Funding a Sound Basic Education in 2020

Educating New York’s children is one of the most important undertakings of State and local government and is enshrined in the New York State Constitution, which confers the right to a sound basic education (SBE). A serious challenge is that despite significant funding increases over the past decade, some districts still do not have the resources to provide an SBE.

The vigorous debate on the amount and distribution of state education aid occurs with each annual budget cycle. In recent years the Governor has proposed substantial increases. Yet the Board of Regents, teachers’ unions, and advocates demand even larger increases, and the adopted budget falls somewhere in between. This year is no different: the Governor has proposed an increase of nearly $1 billion while others advocate for more than $2 billion.

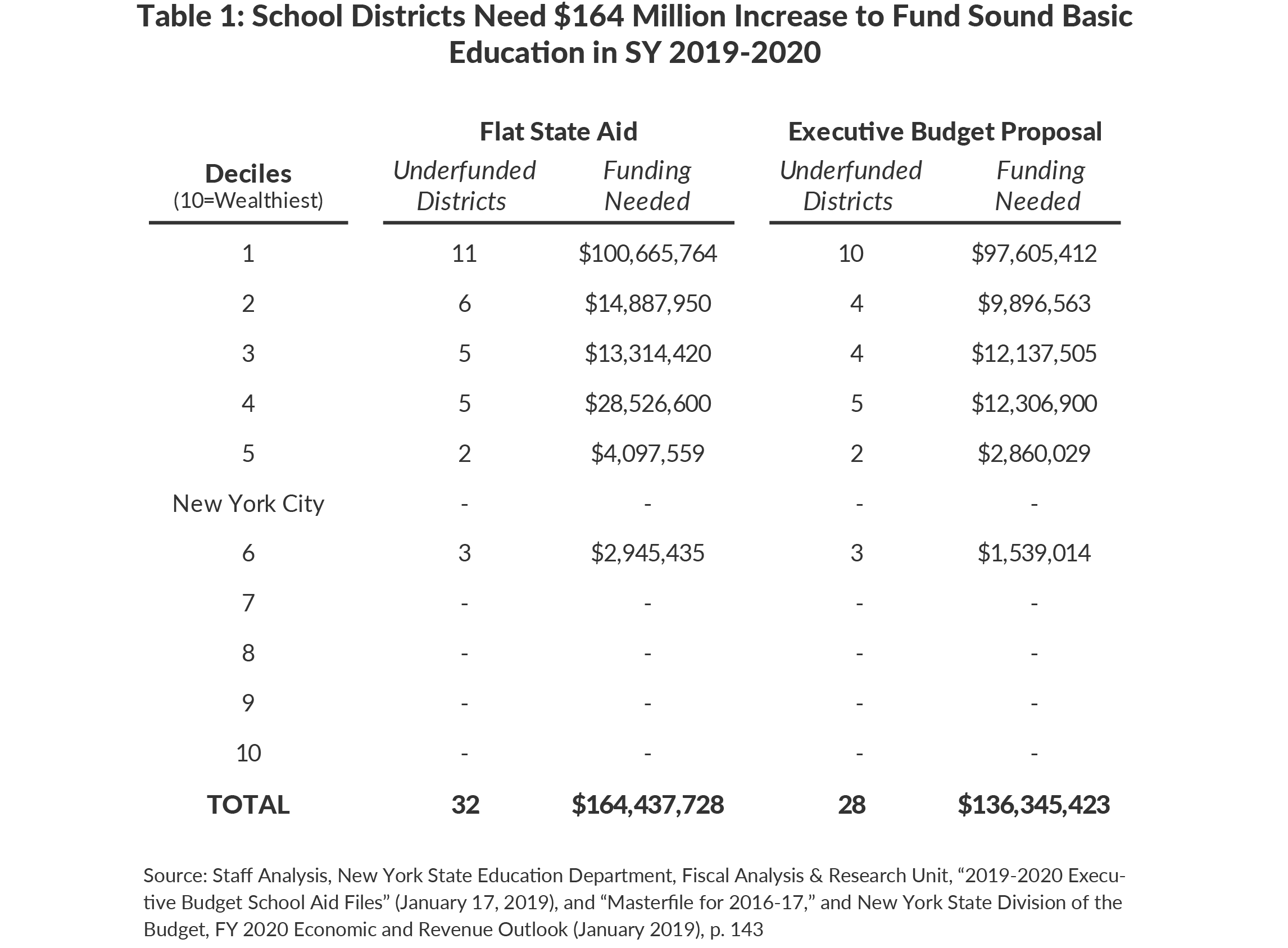

Despite contrary claims, the majority of districts already have sufficient resources to fund an SBE. In fact, due to significant increases in spending over the past decade, the State could ensure all districts have the resources to provide an SBE by increasing aid by $164 million and targeting it to 32 of the state’s 674 districts that are underfunded.

To be clear, providing the financial resources to provide an SBE does not guarantee that all students receive a high-quality education. However, it is an important goal to meet and can be accomplished with less than 20 percent of what the Executive Budget proposed.

State Aid Need Only Increase $164 Million to Fund an SBE

In response to the lawsuit that found the State was failing to provide New York City with the resources needed to provide an SBE, the State created a formula to determine the amount needed for each school district.1 The formula determines the total district resources needed by specifying a base per pupil amount and adjusting it for special student needs in each district along with regional cost differences.

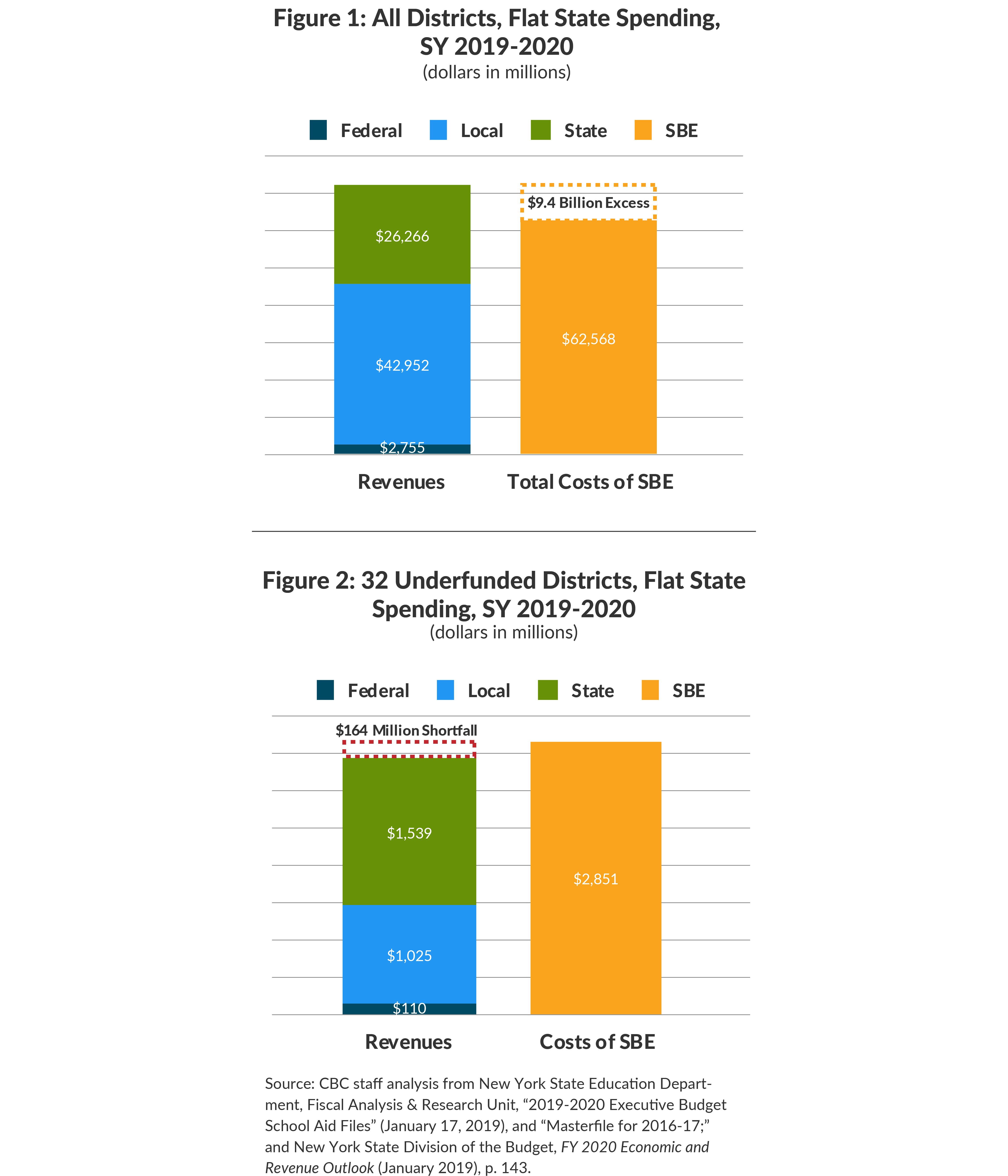

Based on this calculation, $62.6 billion is needed in 2020 to provide an SBE for New York’s students. As Figure 1 shows, school districts will spend an estimated $72.0 billion in 2020—even assuming no increase in State aid from 2019, historical federal funding levels, and local increases commensurate with the property tax cap. This is $9.4 billion more than is necessary to fund an SBE. (See Figure 1 and Appendix.)

While total funding is greater in the aggregate, 32 districts would have $164 million less than needed. Therefore, the goal of providing sufficient funding for an SBE could be achieved statewide with nearly $800 million less than proposed in the Executive Budget. (See Figure 2.)

Executive Budget Would Not Provide All Districts Resources for SBE Despite Nearly $1 Billion Increase

The Governor’s Executive Budget proposes to increase school aid $956 million.2 However, since it is not targeted to districts with the greatest need, 28 districts still would not have the resources needed. Not surprisingly, the underfunded districts are generally low-wealth districts.3 (See Table 1.)

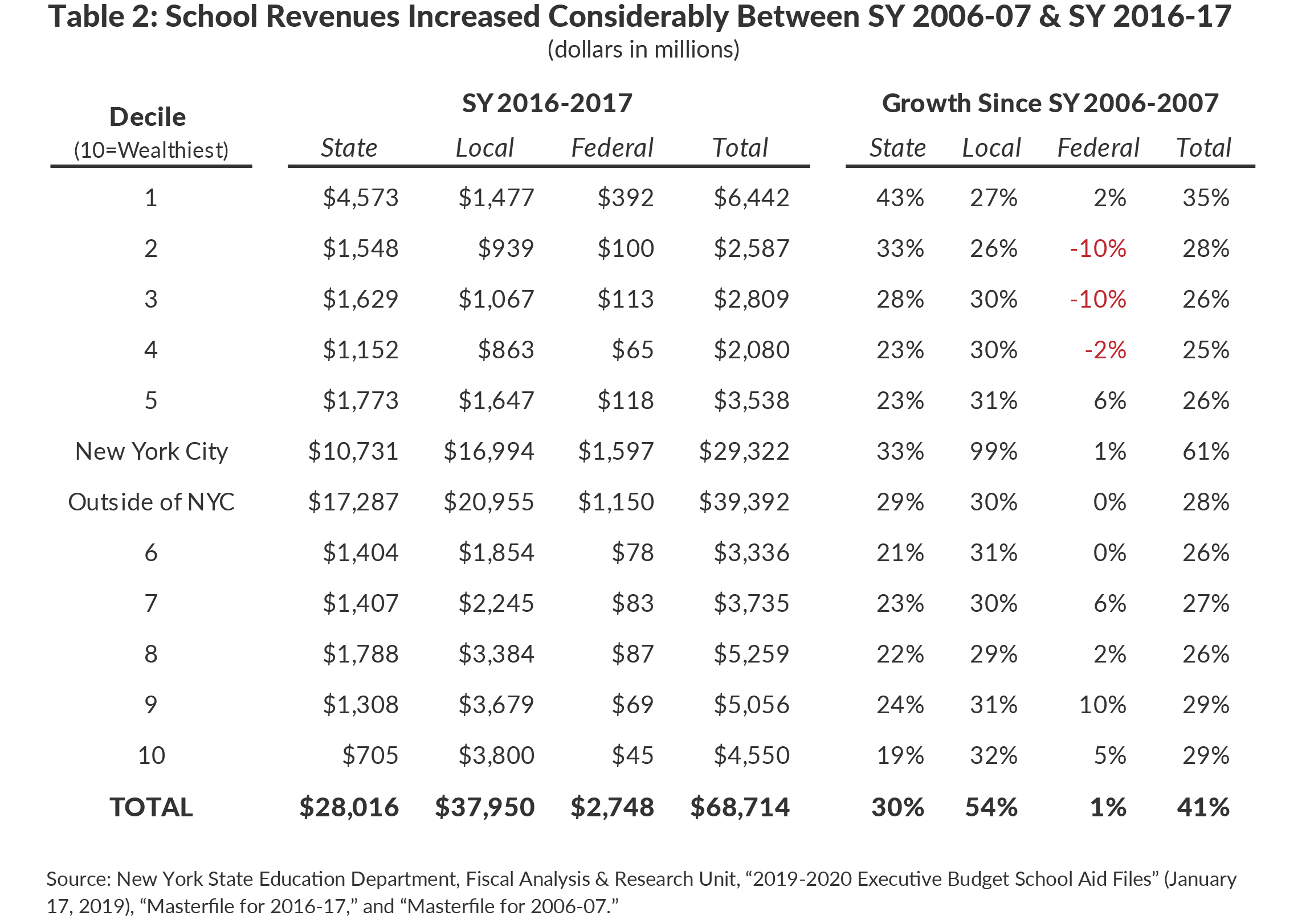

Education Funding Increased 41 Percent Over Past Decade

Education funding has grown significantly over the past decade. Between school year 2006-2007 and school year 2016-2017, school district revenues increased $20 billion, or 41 percent–twice the rate of inflation. State aid increased 30 percent, or $6.5 billion, and local funding increased 54 percent, or $13.3 billion. New York City local revenues increased 99 percent, while the rest of the state local funding increased 30 percent. State aid increases were concentrated in the lower-wealth districts, while local revenues increased somewhat evenly outside of New York City. Federal aid growth was more variable, but it represents a comparatively small share of school district revenues. (See Table 2.)

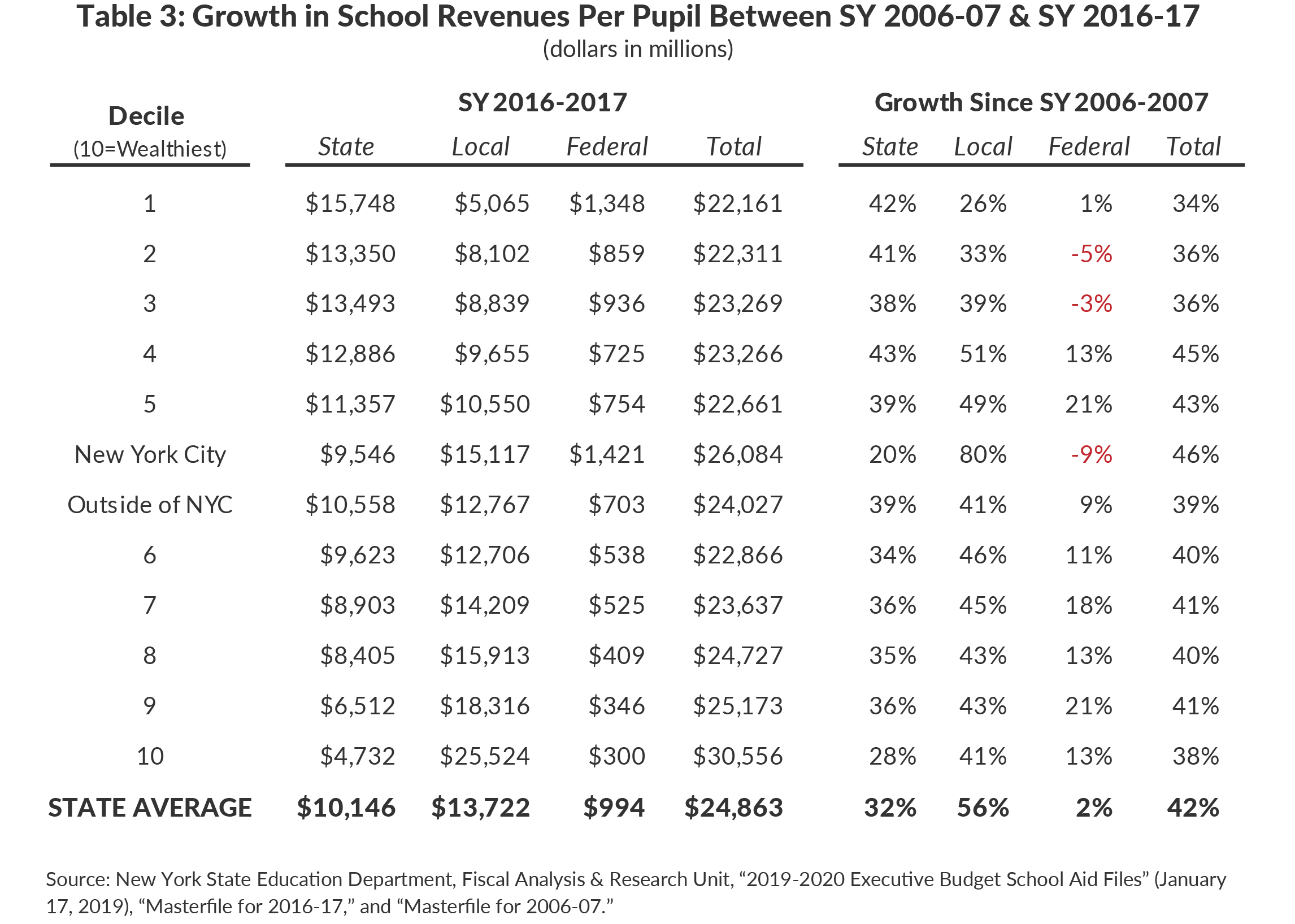

Districts have different per pupil and total revenue growth due to enrollment trends. Per pupil revenue in New York City increased 46 percent, less than the 61 percent increase in total revenue due to enrollment growth. Outside of New York City, aggregate declines in enrollment resulted in a per pupil revenue increase of 39 percent, more than the 28 percent increase in total revenue. Local and State funding increases also reflect this disparity. Per pupil State aid outside New York City increased 39 percent, and local revenues increased 41 percent. However, in New York City per pupil State aid increased 20 percent, which is equal to inflation, while local revenues increased 80 percent. (See Table 3.)

Inaccurately Reflecting Local Spending Results in Overstatement of State Aid Shortfalls

Some claim that State aid is $4 billion less than is needed to support an SBE.4 Like the analysis presented here, this claim is based on the formula that calculates the resources needed for an SBE.5 However, it differs from CBC’s analysis in that it does not reflect actual local funding. Instead, the formula calculates a hypothetical local funding level that is lower than actual local resources provided. It then assumes that the State should make up that gap.

The flaw is exemplified by 179 districts whose actual local funding are already sufficient to provide an SBE; despite this, these districts receive $2 billion in State aid and the flawed Foundation Aid formula concludes these districts need an additional $373 million in state aid to support an SBE.

Conclusion

New York could ensure that all districts have the revenues to provide an SBE by directing $164 million to those districts that currently do not have sufficient combined State, local, and federal funds to provide an SBE. This allocation should be prioritized during budget negotiations and State aid above this amount should be targeted to educational needs and balanced with the State’s fiscal realities.

Addendum - Methodology

The Foundation Aid formula includes the cost of providing an SBE for all students in each district, based on the successful schools model; this is known as the "Foundation Amount."[6] However, this model does not include all costs necessary for a school district to operate. Therefore, other costs (taken from 2016-2017 actuals) are added to the SBE costs to arrive at total costs of providing an SBE. The total costs of an SBE are compared to total revenues to determine if districts have sufficient resources to provide an SBE.

The publicly available successful schools methodology provides general descriptions of what costs are included. A request has been submitted to the New York State Education Department (NYSED) to provide a listing of the exact account codes utilized in the model to provide for a more exact evaluation. However, in order to ensure that all needed expenses are included certain costs may be double counted, which would result in overstating the amount of underfunding.

- Costs for a sound basic education by district are determined by the addition of:

- The Foundation Amount in school year 2019-2020 school aid runs and multiplied by number of total aidable Foundation Aid pupils (TAFPU); plus

- Other necessary costs excluded from the Foundation Amount calculation. This calculation includes: transportation; debt service; transfer to capital funds; operations and maintenance; and high cost public and private school pupils.

- Expenses for transportation; debt service; transfer to capital funds; and operations and maintenance taken directly from the Masterfiles and increased by the State Fiscal Year Composite Consumer Price Index of New York as reported by the New York State Division of the Budget.[7]

- Total costs for high cost public and private school pupils calculated using data provided in school aid runs.

- Revenues available by district include:

- Local revenues:

- For districts other than New York City, school year 2016-2017 local revenues increased by average property tax cap.

- Since New York City is not subject to the property tax cap, figure from The City of New York Executive Budget Fiscal Year 2019.

- Federal aid: Equal to 2016-2017 federal aid; assumes no change in federal revenues.

- State aid:

- Remainder –if any–is the amount of underfunding per district in the coming fiscal year.

- Subtracts State Executive Budget proposed school aid to arrive at current underfunding.

- Based on school year 2018-2019 formula-driven aid from school aid runs in base scenario to determine aid increase needed to fund SBE.

- Local revenues:

Footnotes

- In 1993 an advocacy group, the Campaign for Fiscal Equity (CFE), sued the State of New York contending New York City public schools did not have enough financial resources to provide students with a “sound basic education,” as the courts have specified is required by the State Constitution. In 2003 the Court of Appeals ruled in CFE’s favor, agreeing that the State needed to increase State education aid. State leaders subsequently adopted the State Education Budget and Reform Act of 2007 and pledged to dramatically increase school aid. As part of this legislation, 30 aid programs were consolidated into “Foundation Aid” with the goal of better targeting state aid to school districts lacking sufficient financial resources. One portion of the Foundation Aid formula determines what each district needs in total funds to support an SBE.

- The Executive Budget would also require that certain districts adopt an ‘equity plan’ to ensure that increases in Foundation Aid funding are being targeted to the highest needs schools within the district, subject to New York State Education Department (NYSED) approval. While there may be equity issues within districts, the disparity among districts is clear and pervasive. The Executive Budget also proposed that in school year 2020-2021, 11 expense-based aid categories would be collapsed into one block grant benchmarked to inflation and enrollment. The budget would also modify building aid for new projects, decreasing the minimum reimbursement from 10 percent to 5 percent and prohibit reimbursement for some incidental building costs.

- Wealth deciles are based on the average of a district’s small area income and poverty estimates (U.S. Census), and free and reduced price lunch share and divided by the district’s combined wealth ratio as determined by NYSED. The resulting figure is then indexed to the state average to determine a needs index. New York City is in decile 5, but listed separately. CBC staff analysis of data from U.S. Census Bureau, Small Area Income and Poverty Estimates Program, “SAPIE School District Estimate for 2017” (November 15, 2018), https://www.census.gov/data/datasets/2017/demo/saipe/2017-school-districts.html; and New York State Education Department, Fiscal Analysis & Research Unit, “2019-2020 Executive Budget School Aid Files” email to Citizens Budget Commission staff (January 17, 2019).

- Anna Gronewold, “Is CFE case over? Even Cuomo foes say, 'sort of.'” Politico New York (January 11, 2019), https://www.politico.com/states/new-york/albany/story/2019/01/11/is-cfe-case-over-even-cuomo-foes-say-sort-of-784670.

- The $4 billion figure is calculated in the last step of the Foundation Aid formula, which applies a ‘phase-in’ factor that slows growth in annual Foundation Aid allocations. Citing the impact of the phase-in factor in insolation is misleading since there are a number of other manipulations within the formula, the inaccurate calculation of local share among them.

- New York State Education Department, “Update to the Successful Schools Study” (2012), http://www.oms.nysed.gov/faru/articles.html.

- New York State Division of the Budget, FY 2020 Economic and Revenue Report (January 2019), p. 143, www.budget.ny.gov/pubs/archive/fy20/exec/ero/fy20ero.pdf.