Aligning Crossed Policy Wires Can Help Achieve CLCPA Goals

The report is co-authored by Julie Tighe, President of the New York League of Conservation Voters

The Climate Leadership and Community Protection Act (CLCPA) took effect on January 1, 2020 with goals to reduce New York’s greenhouse gas (GHG) emissions 40 percent by 2030 and 85 percent by 2050 from 1990 levels while also drastically improving energy efficiency, and investing in environmental justice communities. The CLCPA also sets a goal of expanding the share of electric power generated by renewable sources, such as hydro, solar, and wind power, to 70 percent by 2030 and becoming carbon neutral in that sector entirely by 2040.

Meeting these ambitious goals will be easier if State leaders consider them when making future policy and funding decisions.1 The State’s current fiscal crisis increases the importance and benefit of the State ensuring that policy and budget choices do not undermine efforts to achieve GHG emission reduction goals and other priorities laid out in the CLCPA, and that they are not at cross-purposes. Through an $178 billion budget, and billions of off budget capital projects, the State’s funding and spending decisions will influence how quickly agencies, localities, and the private sector change their practices to achieve CLCPA’s goals. State officials also have an opportunity to modify existing and outdated policies that may hinder progress toward a renewable energy, low emissions future. This policy brief offers some examples of tax expenditure and direct spending programs the State could tailor to help meet CLCPA goals. Repealing or better targeting these tax expenditures and curtailing spending choices may also help alleviate the State’s fiscal woes.

Tax Expenditures

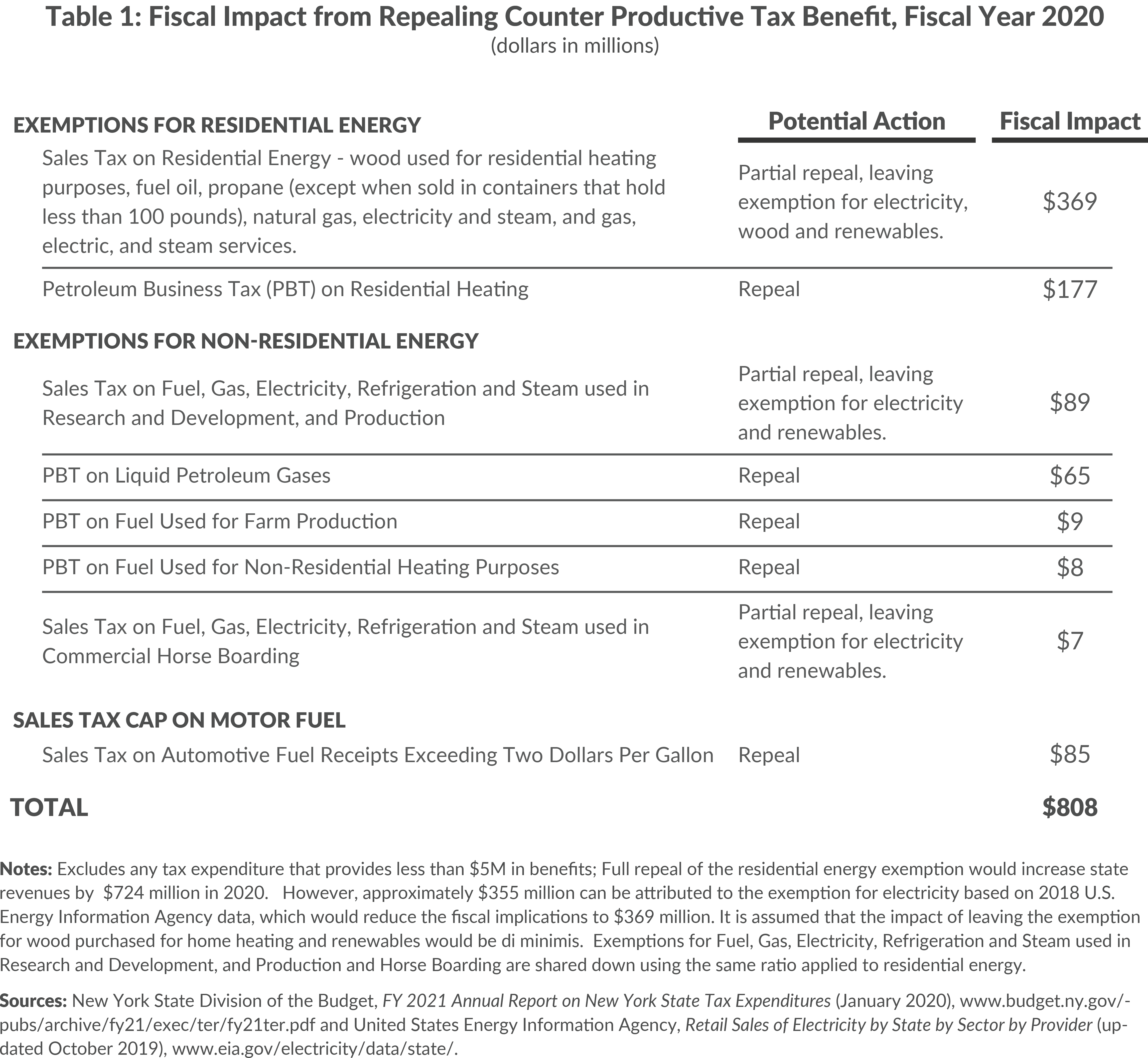

New York State provides more than $800 million in annual tax exemptions that reduce the cost of consuming fossil fuels, thereby encouraging production of GHG emissions. As renewable energy increases as a share of total energy generation, the State could also reconsider tax policies that encourage fossil fuel consumption.2 Examples of policies that could be changed include sales tax exemptions for residential energy; exemptions for non-residential energy; and the sales tax cap on gasoline.

Exemptions for Residential Energy

The largest tax expenditure that could be altered is the residential energy sales tax exemption on wood purchased for residential heat, various fossil fuels, and electricity. (See Table 1.) The State could limit this exemption only to zero emission fuels and renewable energy sources and target benefits to sources that support CLCPA goals. Another is the exemption from the petroleum business tax for residential heating and other types of petroleum products, which subsidizes the cost of using these products and indirectly subsidizes GHG emissions. As renewable sources increase and households and businesses have greater opportunities to choose sources of energy generation, the State could lower, or gradually eliminate, the sales tax exemptions on fossil fuel-based residential energy sources. To avoid creating economic hardship for an essential purchase, the State could consider providing financial support to low-income households to enable them to afford switching to clean heating sources.

Exemptions for Non-Residential Energy

The State also could consider eliminating exemptions for fossil-fuel based energy used for non-residential purposes, such as research and development.

Sales Tax Cap on Motor Fuel

The State provides a sales tax exemption on the cost of gasoline that exceeds $2 per gallon. This exemption was designed to cushion the impact of rising gasoline costs; however, the State could eliminate this exemption, which would increase the price at the pump, reduce consumption, and bring in some of the approximately $85 million in foregone State revenue.3 However, due to the current economic disruption, reduced fuel consumption, and reduced fuel prices, it is likely the near-term fiscal and GHG impact of repealing the sales tax cap on motor fuel may not have the anticipated impact. This may also be true for other tax expenditures listed in table 1.

Tax Expenditure Design

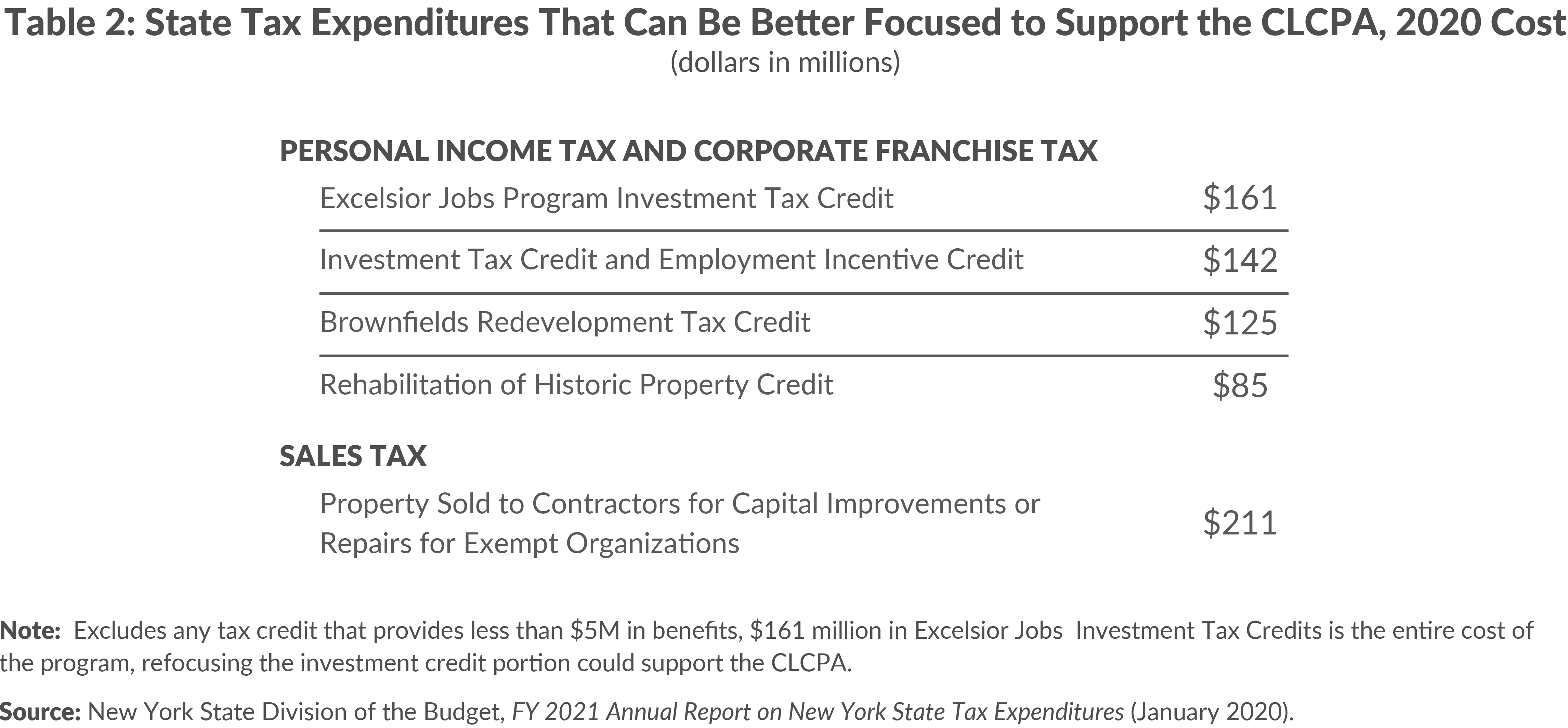

Many of the State’s tax expenditure programs make no distinction between investments that contribute to GHG emissions and those that do not. The State could explore tailoring tax credit programs to create incentives to incorporate renewable energy into program projects. Table 2 offers some examples of tax expenditure programs that could be tailored in this manner. Each of these programs includes credits for energy investments, such as heating systems and energy efficiencies in historic building rehabilitations, that could be reviewed to identify opportunities to incentivize renewable energy use. For example, investment tax credits could exclude heating systems that rely on fossil fuels.4

State Spending

In addition to tax expenditures, both State direct spending and local aid could be modified to support CLCPA goals.5

Direct Spending

State spending on heating, cooling, and providing electricity to public buildings is a major expense; the State spent almost $200 million on utilities in fiscal year 2019.6 When replacing any aging heating systems in existing facilities, the State could transition facilities away from fossil fuels wherever cost-effective and feasible. The State also maintains a significant vehicle fleet of almost 7,000 passenger vehicles and could accelerate the transition to clean fuel vehicles by purchasing electric vehicles and building vehicle charging infrastructure.7 To ensure no negative impact on State finances, additional State investments in clean fuel vehicles and associated infrastructure could be offset by decreasing spending in areas reflecting savings attributed to lower operating and maintenance costs. Many other opportunities likely exist to integrate CLCPA goals into State budget decision-making, and thus avoid actions that undermine achieving CLCPA goals.

Grants and Local Aid

Two areas of local aid could be reconsidered. First, the State provides much of its annual $1.8 billion in economic development grants to companies to subsidize expansion or relocation to New York.8 The State could consider not reimbursing the cost of installing fossil fuel dependent building infrastructure or vehicles.

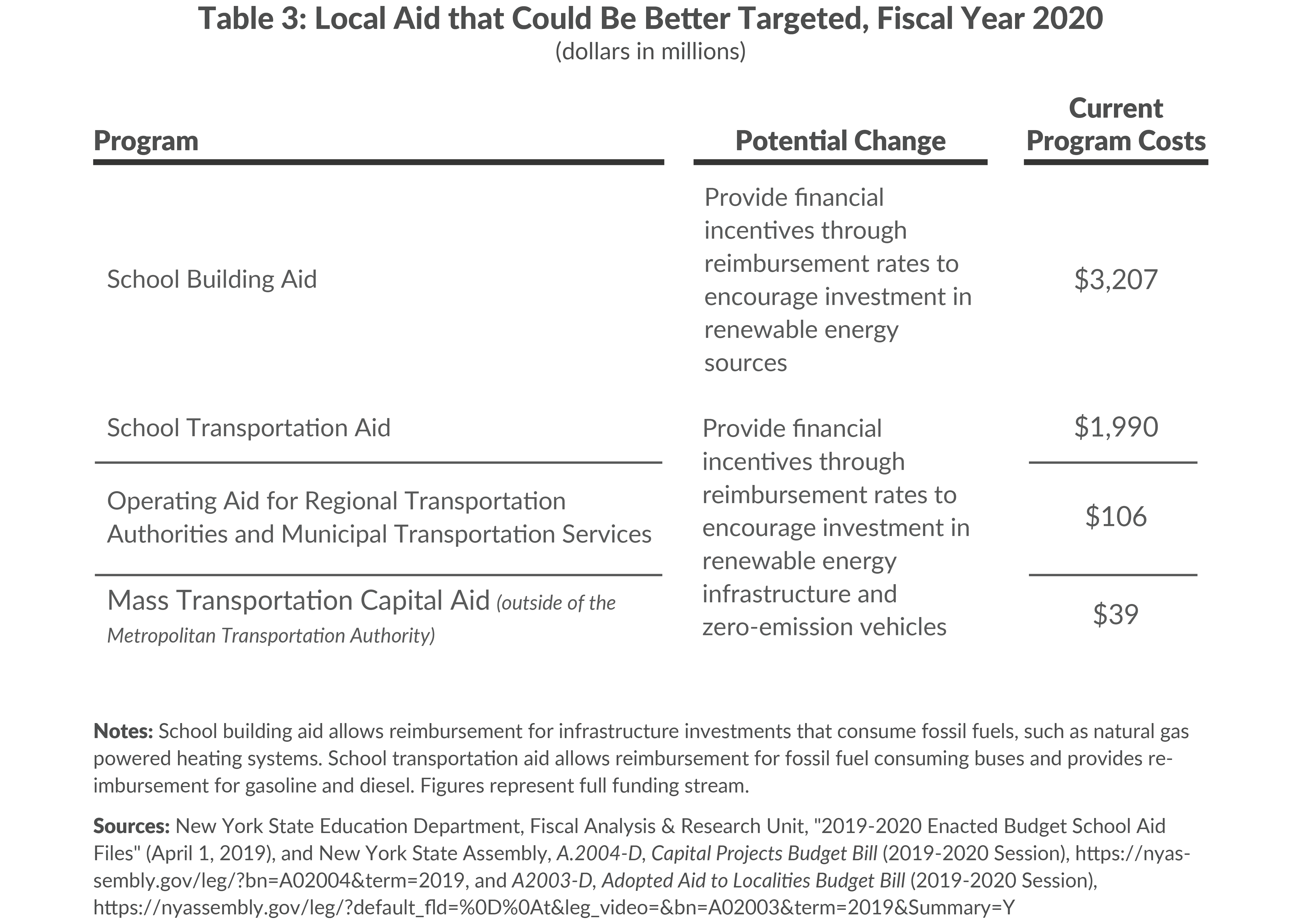

Second, a large portion of the State’s budget is for school aid; of this more than $5 billion is for building aid and transportation aid. Building aid reimburses districts for a share of expenditures for construction of new buildings, and additions, alterations, or modernization of district-owned buildings. Transportation aid reimburses a share of a district’s transportation costs, including vehicle purchases, fueling infrastructure, and fuel purchases. As renewable energy technology gains in market share, the State could use its aid actively to convert schools to renewable energy sources. Likewise, State aid could incentivize school districts to purchase zero-emission school buses and build the needed charging infrastructure.9 Similarly, regional transportation districts receive state aid and grants. Such aid also could be refocused to stop reimbursement of new GHG-emitting investments; instead, aid could be directed towards zero emissions buses, like certain State grants that are specifically for electric buses.10

Conclusion

The current public health, economic, and fiscal crises have not stopped implementation of the CLCPA, which will profoundly affect New York’s energy sector and the State’s economy in the coming decades. As the State implements the CLCPA and adopts various requirements for businesses and residents, State tax and spending policies will play a role supporting or undermining progress toward CLCPA goals. CLCPA’s ambitious GHG emission reduction goals will require fundamental changes in how New Yorkers heat their homes, travel, and get their electricity. The State should undertake a thoughtful and thorough examination of its existing programs and policies, and consider modifications that can assist localities, businesses, school districts, and others to transition to a clean energy future.

Download Report

Aligning Crossed Policy Wires Can Help Achieve CLCPA GoalsFootnotes

- State and local governments should also coordinate GHG emission reduction requirements, such as New York City’s Local Law 97, in order to improve the likelihood of achieving State and local goals.

- A legislative proposal would require the Division of the Budget to provide detailed information on all tax expenditures that subsidize the purchase of fossil fuels, and provides a 5-year expiration for all expenditures that are determined to subsidize fossil fuel consumption. See S.2649-C/A.257-C (2020 session), https://nyassembly.gov/leg/?default_fld=&leg_video=&bn=A00257&term=2019&Summary=Y&Text=Y.

- This analysis does not contemplate repealing the exemption of fuel sold to airlines ($126 million) or bunker fuel ($7 million) used in shipping. See: New York State Division of the Budget, FY 2021 Annual Report on New York State Tax Expenditures (January 2020), www.budget.ny.gov/pubs/archive/fy21/exec/ter/fy21ter.pdf.

- Although current electricity production in New York State emits significant GHGs, if the state achieves its renewable electricity goals by 2040 all electricity production in New York would be GHG neutral.

- In evaluating spending decisions, the State may want to include the social cost of carbon.

- Calculated by CBC staff based on total payments in State fiscal year 2019 to the state’s load-serving entities using data from Office of the State Comptroller, Open Book New York (accessed October 14, 2019), https://wwe2.osc.state.ny.us/transparency/checkbook/checkBookRpt.cfm#chkbk.

- The State Office of General Services does not know how many hybrid or electric vehicles are in state ownership according to New York State Office of General Services, Response to Freedom of Information Request Number 7020 (November 15, 2019).

- Riley Edwards, “10 Billion Reasons to Rethink Economic Development in New York,” Citizens Budget Commission (February 11, 2019), https://cbcny.org/research/10-billion-reasons-rethink-economic-development-new-york.

- Building aid and transportation aid reimburse certain costs over an extended period of time based on amortization schedules.

- New York State Department of Environmental Conservation, “DEC and NYSERDA Announce $24 Million in Volkswagen Settlement Funds to Support All-Electric Transit Buses in Environmental Justice Communities” (press release, March 20, 2020), https://www.dec.ny.gov/press/119918.html.