And State Spending Growth Resumes

Buoyed by Revenue Strength and Federal Aid

Since taking office, Governor Andrew Cuomo has set the benchmark for growth of State Operating Funds (SOF) spending–a subset of the State budget that excludes federal funds and capital spending–at 2 percent. However, at times this has only been ‘achieved’ by shifting funds, delaying payments, and adjusting accounting for some disbursements. After growing 3.7 percent per year on average before the pandemic, SOF spending growth is expected to slow to 1.1 percent in the current fiscal year. However, the Governor’s Fiscal Year 2022 Executive Budget plus reported restorations supported by the Governor would increase SOF spending 5.2 percent ($5.7 billion) in fiscal year 2022 and then an average of 2.7 percent per year over the next three fiscal years; the use of additional aid from the federal American Rescue Plan is expected to drive spending growth even higher.

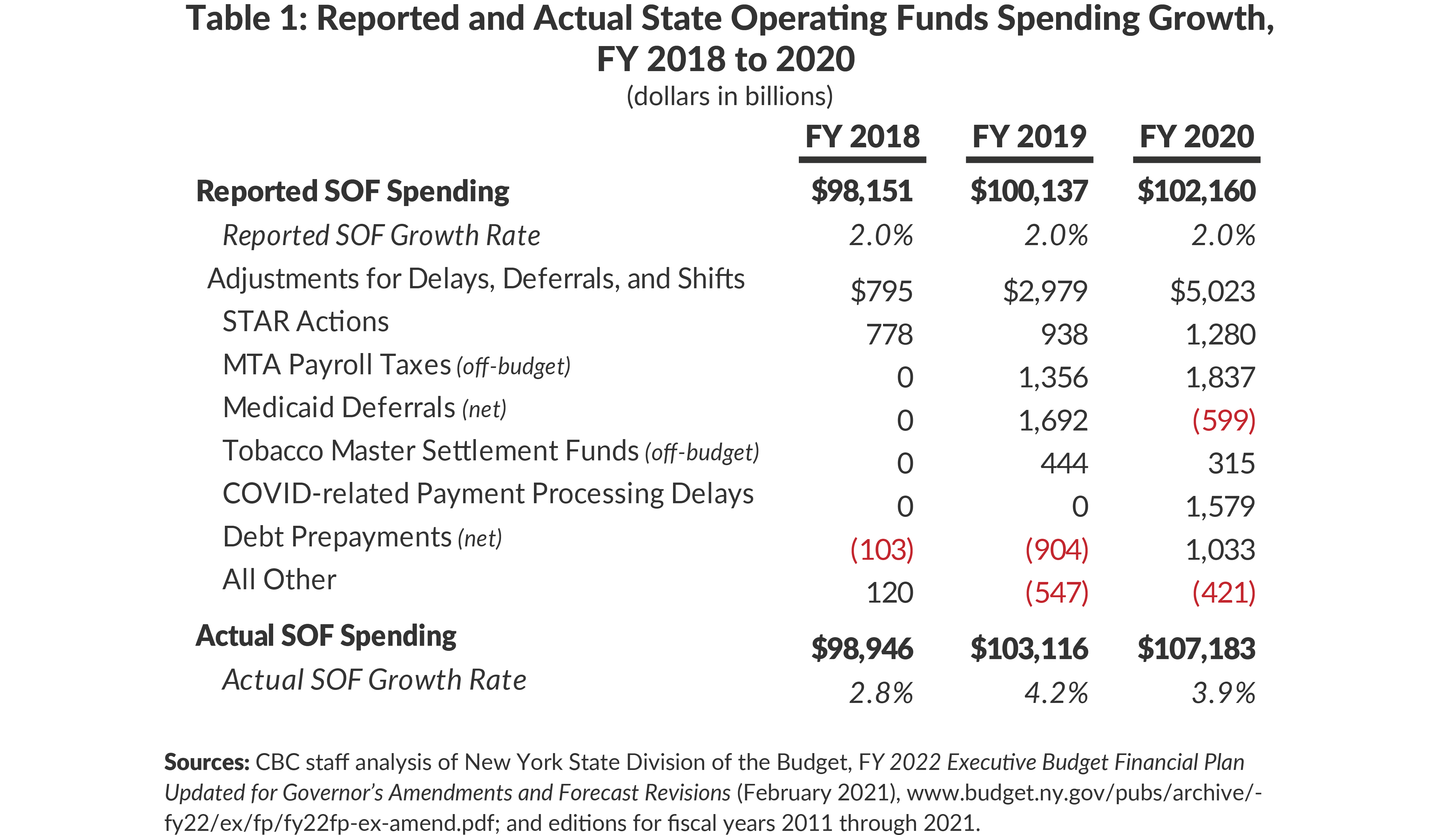

Accounting Shifts and Payments Delays Drive Pre-Pandemic Average Annual Spending Growth to 3.7 Percent

Adjusting for spending maneuvers, SOF spending increased an average annual rate of 3.7 percent over the three years prior to the pandemic. (See Table 1.) To determine the actual SOF spending growth, adjustments to reported spending are made to account for:

-

STAR Actions: STAR benefits were shifted from State-funded local property tax exemptions to personal income tax credits, effectively shifting the costs of STAR off-budget;

-

MTA Payroll Taxes: Receipts of the Metropolitan Commuter Transportation Mobility Tax were shifted off-budget beginning in fiscal year 2019 and additional receipts dedicated to the MTA were shifted off-budget in fiscal year 2020;

-

Medicaid Deferrals: At the conclusion of fiscal year 2019, Medicaid payments totaling $1.7 billion were deferred into fiscal year 2020. The State caught up with a portion of the deferral during fiscal year 2020, but expects again to defer $1.7 billion to close out fiscal year 2021 and in perpetuity;

-

Tobacco Master Settlement Funds: State proceeds from the Tobacco Master Settlement were shifted off-budget and fund a portion of the Medicaid program that was previously on-budget;

-

COVID-related Payment Processing Delays: Payments for some costs incurred during fiscal year 2020 were delayed until fiscal year 2021; and

-

Debt Prepayments: Debt service payments were shifted across fiscal years.

Executive Budget Plus Reported Restorations Would Increase Actual SOF Spending by 5.2 percent in Fiscal Year 2022

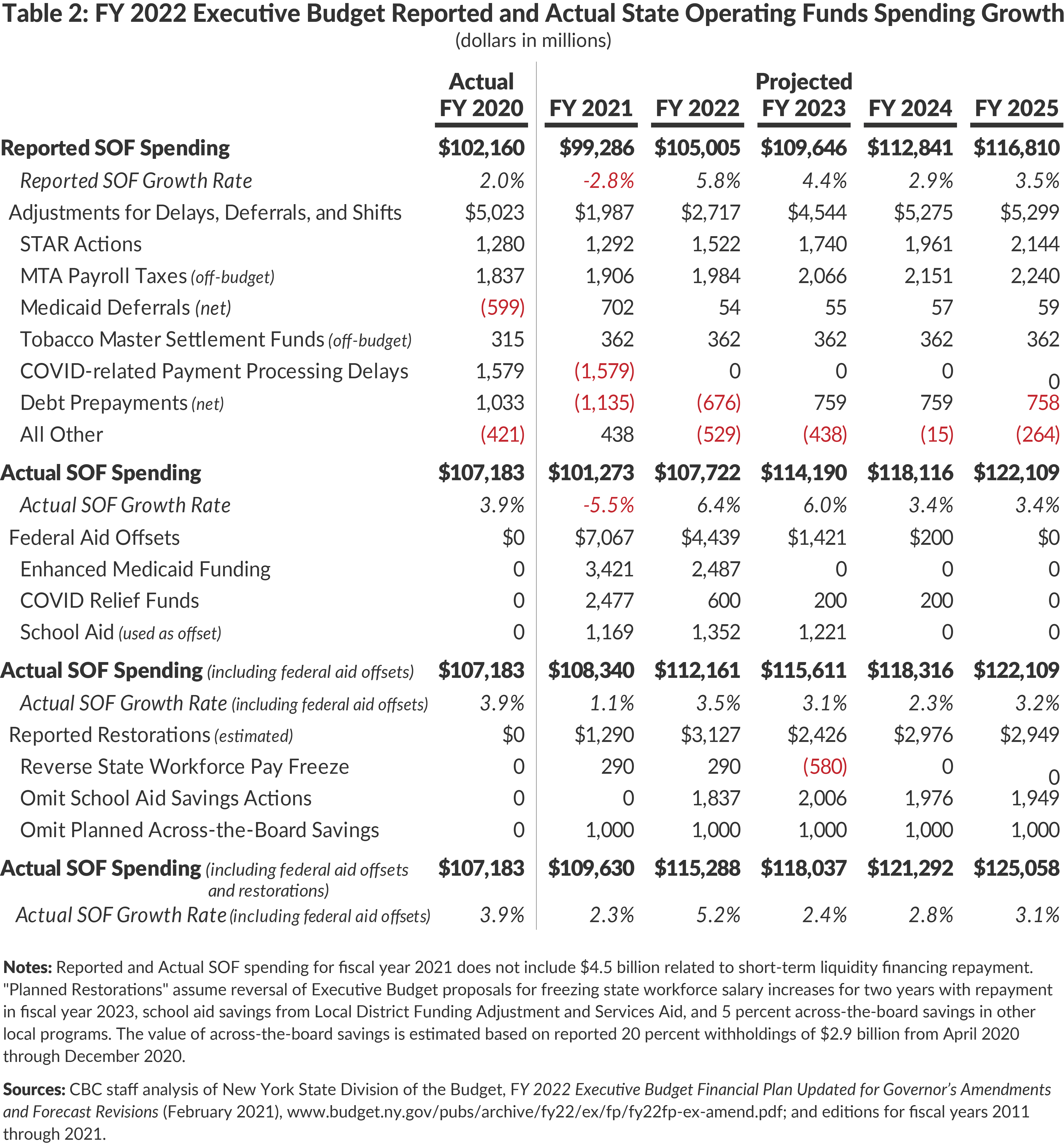

The fiscal year 2021 enacted budget included approximately $8 billion of unspecified recurring spending reductions to partly address projected revenue shortfalls; however, stronger that projected revenues and federal aid ultimately offset much of the expected shortfalls. Thus, the Executive Budget, as modified in February, will increase current year actual SOF spending 1.1 percent. The budget also proposes growth of 3.5 percent in fiscal year 2022 and 2.9 percent average annual growth over the remainder of the financial plan. (See Table 2.) This is supported in part by the assumption that the American Rescue Plan would provide $6 billion in additional federal aid—a “worst case.” Along with the spending maneuvers described above, some federal aid has been used to offset SOF spending. Absent federal aid, actual SOF spending declines 5.5 percent in fiscal year 2021, then grows 6.4 percent in fiscal year 2022, and 4.3 percent annual on average thereafter.

The Governor’s Executive Budget spending plan includes some cuts, but also increases spending for school aid that already is highest in the nation and double the national average, and the Medicaid program that is one of the most expensive in the county.

However, public statements suggest that given stronger revenues and additional federal aid the State will omit some major savings actions proposed in the Executive Budget. These include a temporary freeze of state workforce salary increases for two years to be repaid in fiscal year 2023, recurring reductions in school aid spending, and 5 percent across-the-board savings in other programming.1 Restoration of these Executive Budget savings proposals would add an estimated $1.3 billion in spending in the current year, $3.2 billion in fiscal year 2022, and $2.8 billion on average annually over the following three years. These restorations would increase SOF spending growth to 2.3 percent in the current year, 5.2 percent next year, and 2.7 percent on average in the following three years.

American Rescue Plan Further Improves the Fiscal Landscape

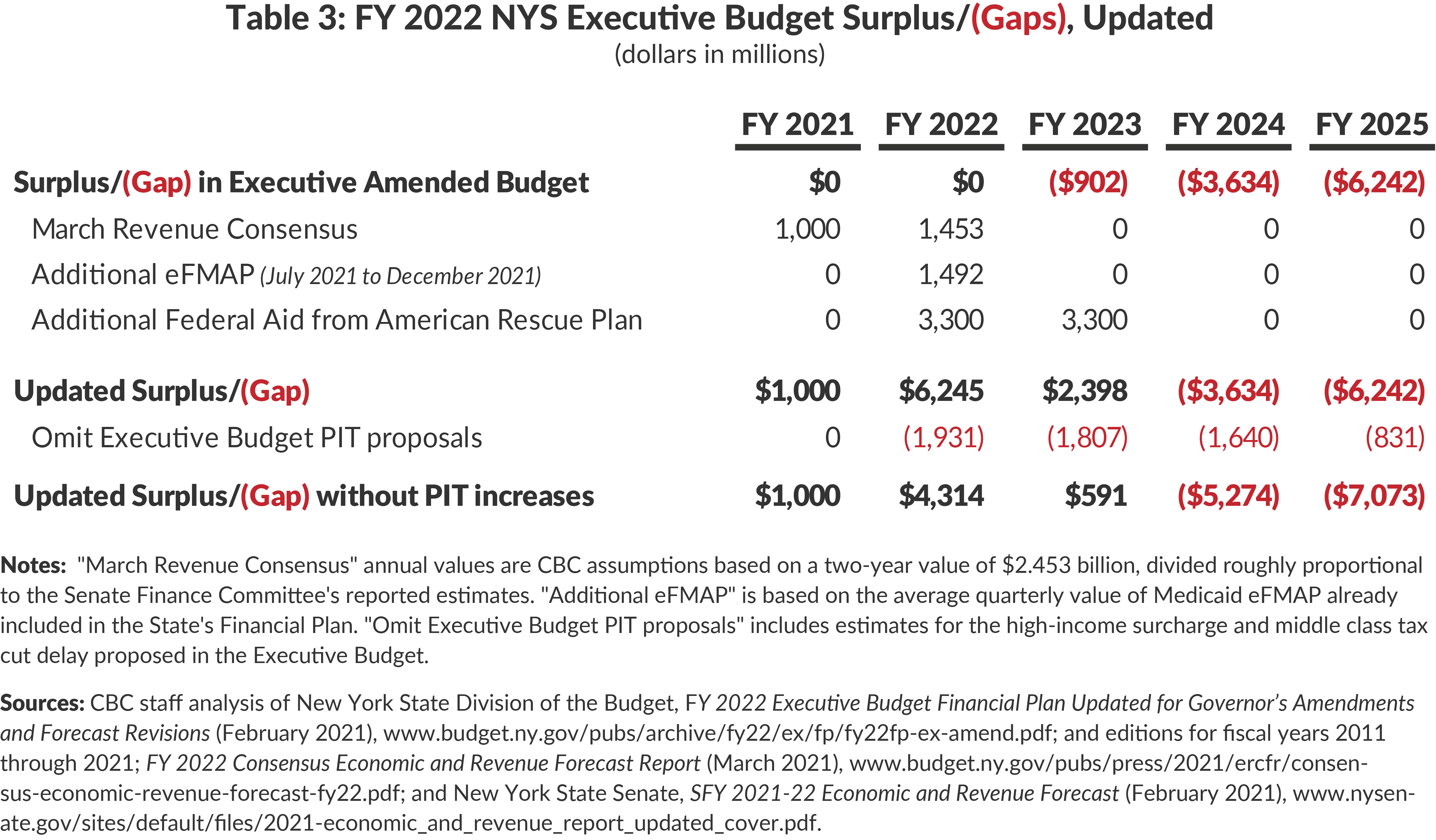

Subsequent to the Governor’s budget proposal, the federal government enacted American Rescue Plan which further improved the State’s revenue picture, with $12.6 billion in direct federal funding to the State, more than was double what the Governor planned for in the Executive Budget. The federal package also includes tens of billions of dollars in other aid for schools, local governments, individuals, and businesses in New York. With the additional direct State aid and the higher revenue “consensus” forecast agreed to with the Legislature, enacting the Governor’s Executive Budget would result in a $9.6 billion surplus over the fiscal years 2021 through 2023.2 This amount is sufficient to omit the proposed personal income tax increases and still leave $5.9 billion to fully reverse the spending reductions proposed by the Governor and to make additional investments. (See Table 3.) Still, budget gaps in fiscal years 2024 and 2025 are significant.

Legislature’s One-House Bills Would Push Fiscal Year 2022 SOF Spending Growth to Over 11 Percent

Both houses of the State Legislature presented their one-house budget proposals shortly after enactment of the American Rescue Plan. Each one-house budget proposed a plan to spend the new federal aid, raise taxes in excess of $7 billion annually, and further increase SOF spending. For example, the Assembly plan added approximately $9 billion in SOF spending in fiscal year 2022, increasing SOF spending growth of 11.8 percent next year.3

Conclusion

Earlier this week, the State Budget Director reported that the State has sufficient revenue to restore once-planned spending reductions and make other investments without significantly raising income taxes.4 The American Rescue Plan provides sufficient direct funding to make these budget restorations and investments possible, and separately provides an additional $9 billion in federal aid for elementary and high schools. Once included in the budget, actual SOF spending growth in fiscal year 2022 will be even higher than reported here. Ultimately, to address the gaps that will exist and grow when the federal funds are depleted, the State should use the next two years to restructure spending to be more sustainable.

Footnotes

- Christopher Robbins, “Cuomo Locates $5 Billion In Budget To Avoid Taxing The Rich” Gothamist (March 24, 2021), https://gothamist.com/news/cuomo-locates-5-billion-budget-avoid-taxing-rich.

- The State’s annual revenue consensus identified $2.5 billion in additional state receipts expected through the end of fiscal year 2022 in excess of projections made by the Division of the Budget in February. See New York State Division of the Budget, FY 2022 Consensus Economic and Revenue Forecast Report (March 2021), https://www.budget.ny.gov/pubs/press/2021/ercfr/consensus-economic-revenue-forecast-fy22.pdf.

- Growth of 11.8 percent in fiscal year 2022 under the Assembly one-house budget is based on net addition of $9 billion in spending relative to the Executive Budget on top of Actual SOF spending calculated in Table 2. See New York State Assembly, Overview of Assembly Budget Proposal State Fiscal Year 2021-22 (March 2021), p. 4, https://nyassembly.gov/Reports/WAM/2021AssemblyBudgetProposal/2021AssemblySummary.pdf

- Nick Reisman, “Cuomo: "Significant" Tax Hikes Not Needed for Budget” Spectrum News (March 22, 2021), https://spectrumlocalnews.com/nys/central-ny/ny-state-of-politics/2021/03/22/cuomo---significant--tax-hikes-not-needed-for-budget.