Balancing Incentives to Maximize Emission Reduction

Recommendations on Local Law 97 Implementation

Executive Summary

Local Law 97 (LL97), New York City’s ambitious greenhouse gas (GHG) emissions reduction law, aims to cut emissions from large buildings 40 percent by 2030 and 80 percent by 2050. Passed in 2019, LL97 sets limits on the annual GHG emissions of most buildings larger than 25,000 square feet. Building emissions limits are based on gross square footage and occupancy group, which categorizes building uses across ten types, including business and permanent residential. Buildings whose GHG emissions are above the established limit will be assessed an annual fine of up to $268 per metric ton. Potential fines will vary based on buildings’ emissions, size, and uses.

The New York City Department of Buildings (DOB) will implement and monitor the new requirements and assign penalties for noncompliance. An advisory board will provide recommendations on key policy elements established but not defined in the law. The law also establishes programs to support building owners to comply, including technical and financial support for building upgrades, alternative compliance paths including the purchase of renewable energy credits (RECs), and adjustments to individual buildings’ emissions limits and penalty mitigation for certain buildings based on building-specific circumstances.

Achieving Local Law 97’s Emissions Goals

Retrofits that upgrade buildings’ systems to reduce energy consumption or switch to an energy source associated with a smaller fossil fuel footprint are owners’ primary way to reduce GHG emissions through improvements to their buildings. However, given the wide variation in buildings’ age, mix of energy sources, efficiency of existing building systems, and tenant energy consumption profiles, there is no standard path to compliance through retrofits. Rather, owners will have to determine each building’s most cost-effective path to reducing emissions. Some owners may be able to comply through relatively minor retrofits like installing thermostatic sensors of heating and cooling systems. In such cases, energy savings may pay for themselves relatively quickly, perhaps in as few as three years. Compliance for other buildings, however, may require significant capital investments, including upgrades to the building envelope or the wholesale replacement of a cooling system. For these buildings, reducing emissions may be a costly, long-term effort, and LL97’s alternative compliance paths and adjustments may play an important role.

How the City implements the law will affect the compliance costs and pathways across building owners, tenants, utilities, and the New York State and City governments. DOB has flexibility, for example, to set future emission limits, adjust incentives and penalties, and provide credits for beneficial electrification. These modifications may create enhanced pathways to reduce emissions in more cost-effective ways. For buildings with lower revenue or higher potential penalties per square foot, complying with LL97 may be more financially challenging and lead to rent increases for both commercial and residential tenants. Further, buildings’ ability to meet LL97 standards depends in large part on actions and public policy outside the control of building owners. As building owners increasingly convert fossil fuel-powered building systems to electric power, the resulting emissions reductions will depend on the mix of energy sources powering the city’s electric grid. Currently in New York City those sources are overwhelmingly fossil fuel-based. However, the State is responsible for increasing the supply of renewable energy. Furthermore, as formerly fossil fuel-powered buildings become electric, substantial investment will be required to increase transmission capacity between downstate and upstate New York, and to improve capacity and resiliency of the grid within New York City. The extent to which DOB’s implementation of the law accounts for these dynamics will affect tenants and utility ratepayers across New York City.

Findings on Current Emissions and Local Law 97 Standards

Building emissions limits take effect in 2024 and become increasingly stringent in 2030 and five-year periods thereafter. CBC’s analysis of the latest available data from 2019 found that:

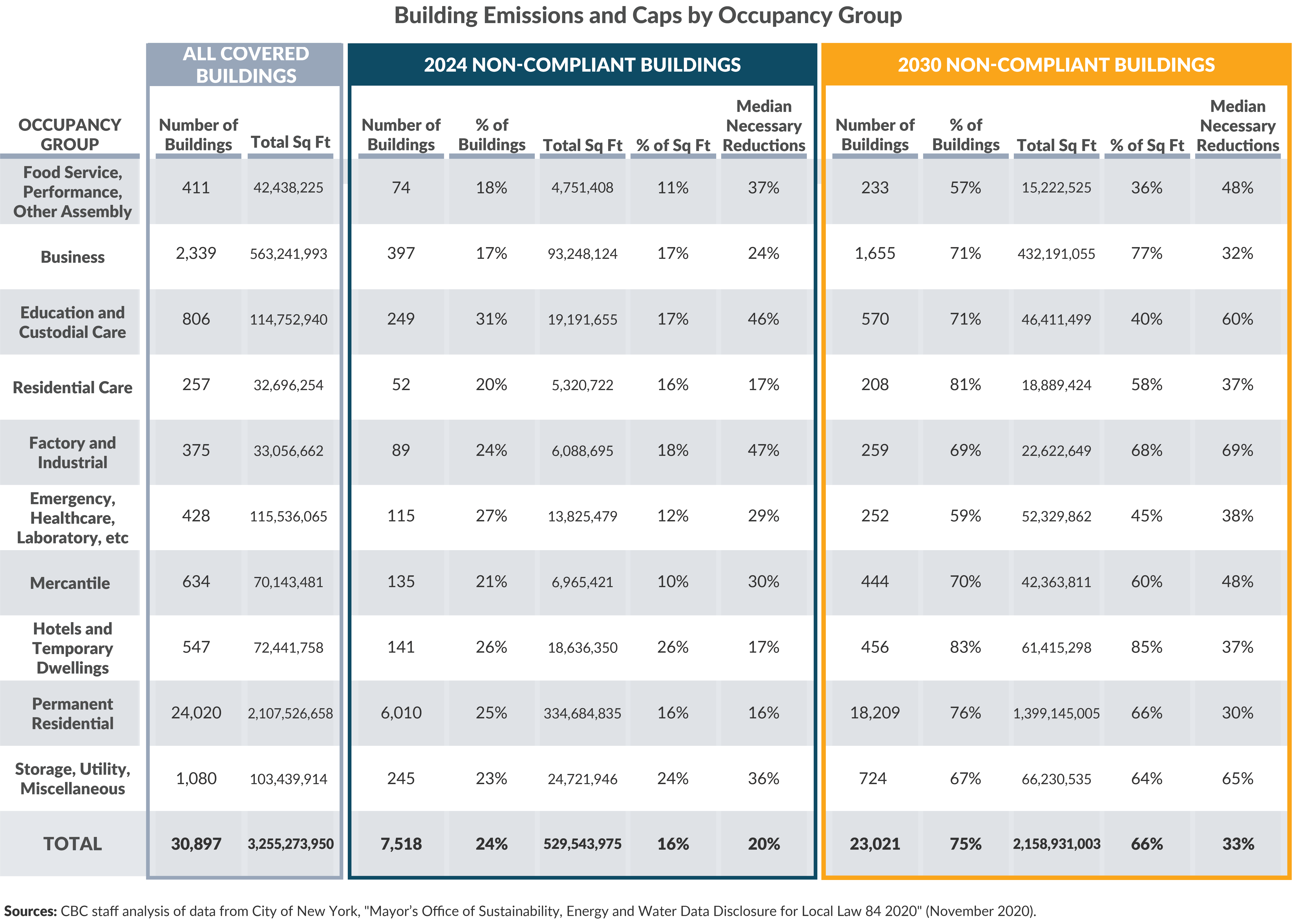

- Fully 24 percent of affected buildings were not compliant with 2024 limits, rising to 75 percent in 2030;

- The median noncompliant building would have to reduce its emissions 20 percent by 2024 and 33 percent by 2030;

- Fully 24 percent of buildings would need to reduce emissions by half or more to comply with 2030 standards;

- In 2030, penalties could average about $1 per square foot per year for the building with noncompliant emissions, and total $218 million per year for all covered buildings; and

- Smaller buildings covered by LL97 may face higher average penalties per square foot than larger buildings, as will buildings outside core Manhattan. Owners of high emission buildings with lower revenue may face high relative costs or penalties that require potentially economically damaging rent increases.

Implementation Challenges

Four challenges hinder LL97’s ability to create incentives for building owners to reduce emissions cost-effectively, and may instead provide incentives to pay penalties or incur high costs that are passed on to tenants:

- Inadequate renewable energy supply: New York City’s electric grid is highly fossil fuel-dependent. If progress of transitioning the grid to renewable energy over the next decade is inadequate due to slower than desired increase in renewable generation or transmission from renewable sources, an owner could electrify a building and still face significant penalties. This possibility reduces owners’ incentives to undertake projects that are vital to the long-run reduction in emissions and the success of LL97;

- Disincentives for density and certain occupancy use types: LL97’s metric of emissions per square foot penalizes densely occupied buildings, disincentivizing building owners from hosting tenants that use space densely. More workers or residents per square foot will consume more energy in that building—and hence emit more GHG—than less-dense uses. However, density can be beneficial on a citywide basis, for example allowing more workers to use New York’s low-emissions transit systems or needing fewer square feet of office space producing lower emissions per worker. Similarly, the law disincentivizes some uses that consume more energy than others within the same occupancy group. While this is appropriate in many cases, certain economically important uses, including data centers and restaurants, should not be disadvantaged;

- Lack of clarity and potential lack of feasibility of alternative compliance paths: DOB will promulgate rules, including adjustments to incentives and penalties, that will substantially affect compliance on an ongoing basis and identify alternative compliance paths through the purchase of RECs or use of distributed energy resources. However, lack of clarity now and likely at important future times hampers building owners’ ability to plan for and implement changes needed to comply. In some cases, especially the buildings in need of the deepest emissions reductions, the process may leave too little time to design, finance, and complete retrofits ahead of the start of compliance in 2024; and

- The COVID-19 pandemic impact on the real estate market: The pandemic’s considerable economic damage to the city’s real estate market may hamper owners’ ability to make the major capital investments required by LL97 in a timely fashion or in an economically viable manner. Retrofit projects also may have been and will be delayed. Furthermore, the pandemic and recession has dramatically altered many buildings’ financial fundamentals in the near, mid, and possibly long terms.

Recommendations: Six Steps to Success

The City can use the substantial discretion LL97 provides DOB through its rulemaking process to overcome these challenges and secure needed emissions reductions. To meet LL97’s emissions reductions goals most cost-effectively, DOB, in consultation with the advisory board, should tailor the policy and compliance rules to provide building owners the most cost-effective compliance paths. This will promote investments in emissions reduction rather than owners simply paying the penalties. The following six steps will help ensure that citywide emissions reduction goals are met in a cost-effective manner:

- Adjust credits appropriately for lack of renewable energy availability to encourage electrification: Mitigating penalties if the greening of the grid is slower than planned, which will incentivize building owners to accelerate the switch to electric building systems. If the grid’s supply of renewable electricity lags the goals for renewable energy generation established by the New York State Climate Leadership and Community Protection Act, the law’s credits for beneficial electrification should be calculated accounting for those missed goals;

- Expand allowable RECs to offshore wind and a phased-down portion of Tier 2 RECs: Provide buildings with flexibility while the New York City electric grid remains fossil fuel-powered by allowing buildings to purchase unlimited amounts of Renewable Energy Certificates (RECs) associated with downstate offshore wind projects and limited amounts of existing RECs from existing generation;

- Specify, expand and continue emission limit adjustments for density and specific uses: Alleviate counterproductive disincentives to density and certain economically vital uses by clearly specifying parameters for the law’s adjustments for high density and energy-intensive uses, providing clear and appropriate adjustments for these uses, including economically important activities disincentivized by classifications, and extending adjustments past the first compliance period;

- Specify and extend need-based building-level adjustments: Set an accelerated, public timeline for rulemaking that includes critical rules governing limit adjustments and penalty mitigation and universal criteria so building owners can determine eligibility and adjusted requirements as-of-right, rather than through individual petitions. This will encourage building owners to begin planning for compliance in good faith. These adjustments should mirror the law’s existing alternative compliance path allowing high-need buildings to comply by meeting percentage point-based emissions reductions. Finally, allow owners of the highest-emitting, financially strained buildings to reach compliance and avoid penalties by substituting a percentage point-based reduction schedule for the second compliance period for an emissions compliance level;

- Allow carbon trading within an owner’s portfolio: Allow owners of multiple buildings to target the most cost-effective emissions reductions across their assets by establishing a carbon trading scheme that allows credits to be traded within a portfolio. Such a scheme should include buildings not otherwise covered by LL97 within such a system, which may help to achieve emissions reductions from less efficient buildings that would not otherwise experience investment; however, taking environmental justice concerns into account and not allowing a localized increase in pollution; and

- Adjust limits and penalties appropriately to the post-pandemic economy: Study whether LL97 emissions limits or alternative compliance paths in the first compliance period should be modified due to permanent shifts in work patterns, delays in retrofit projects or financial strain. Adjust limits as necessary to maintain citywide emissions targets.

Introduction

For more than a decade, New York City has sought to establish itself as a global leader in the fight against climate change. In 2007, PlaNYC established a comprehensive set of strategies for reducing local carbon emissions and bolstering resiliency against the effects of climate change.1 Seven years later, the New York City Council (the Council) committed the City to reducing its greenhouse gas (GHG) emissions 80 percent by 2050, and Mayor Bill de Blasio released plans to reduce emissions from public buildings by 2025.2 In 2019, the Council enacted the Climate Mobilization Act (CMA), a suite of ambitious measures to reduce GHG emissions over the coming decades. The centerpiece of these measures is Local Law 97 (LL97), which sets GHG emission targets for large buildings in New York City and creates processes to ensure that targets are met.

LL97 sets the ambitious targets of reducing GHG emissions from large buildings 40 percent by 2030 and 80 percent by 2050. To reach these targets, the law establishes annual emissions limits for large buildings and financial penalties for failure to bring emissions into line with those limits. While emissions limits take effect in 2024, major elements that will significantly affect how building owners decide to comply are unspecified in the law but may be defined in advance of the deadline. To help define these regulatory details, the law convenes an advisory board to make recommendations on these elements and advise on the law’s implementation. In turn, the New York City Department of Buildings (DOB) is charged with promulgating rules before the law’s implementation.

Given the global threat posed by climate change and buildings’ high share of GHG emissions in New York City, the law’s focus is reasonable. However, the law’s design does not account for important factors that may impede its effectiveness. Compliance mechanisms do not adequately account for buildings’ uses and density, their most efficient paths to compliance, or the supply of renewable energy in New York City. While the law establishes programs to support building owners in reducing emissions, the usefulness and practicability of alternative compliance paths to provide building owners with flexibility as they begin planning emissions reduction strategies, and possible offsets and credits to help bridge the short-term compliance gaps are unclear.

The opacity is compounded by the law’s timeline. DOB already has started to issue regulations, but the majority of rules on key provisions may come as late as one year prior to the start of compliance. This provides too little time for building owners to plan and implement many important emissions-reducing upgrades, which are typically planned over decades as building components become obsolete. The lack of coordination between DOB and building owners may threaten LL97’s ability to realize its targeted emissions reductions, as some building owners may opt for a more cautious initial compliance approach, or simply absorb penalties, while key technical elements are finalized.

As LL97’s ability to achieve its targeted GHG emissions reductions depends on the details of its implementation, so do its costs. By design the costs to comply with LL97 fall primarily on building owners. While owners will be the principal payers of the direct compliance costs, the economic burden of reaching LL97 goals will be borne by the tenants of large residential, commercial, and industrial buildings, the public sector, utilities, and utility ratepayers. The ultimate distribution of costs across these stakeholders depends in part on the final details of LL97’s implementation; how building owners balance upgrades, compliance alternatives, and penalties in their compliance strategies; and the pace of increasing the supply of renewable energy in and to New York City. A well-designed implementation would target the most cost-effective emissions reduction strategies first, aligning compliance cost burdens with responsibility of, and control over, GHG emissions.

LL97’s advisory board and DOB should ensure that the law’s citywide targets are met while minimizing costs to tenants by providing building owners flexibility in their approaches to compliance to ensure that they are both practical and create incentives to achieve the most cost-effective emissions reductions. Providing timely, transparent, and universal guidance and rules will further support building owners in reducing citywide GHG emissions from their properties.

Overview

Under LL97, emissions from buildings larger than 25,000 square feet must collectively fall 40 percent by 2030 and 80 percent by 2050, relative to 2005 levels.3 LL97 covers about 50,000 buildings, which account for 60 percent of the city’s total building square footage.4

Policy Groundwork

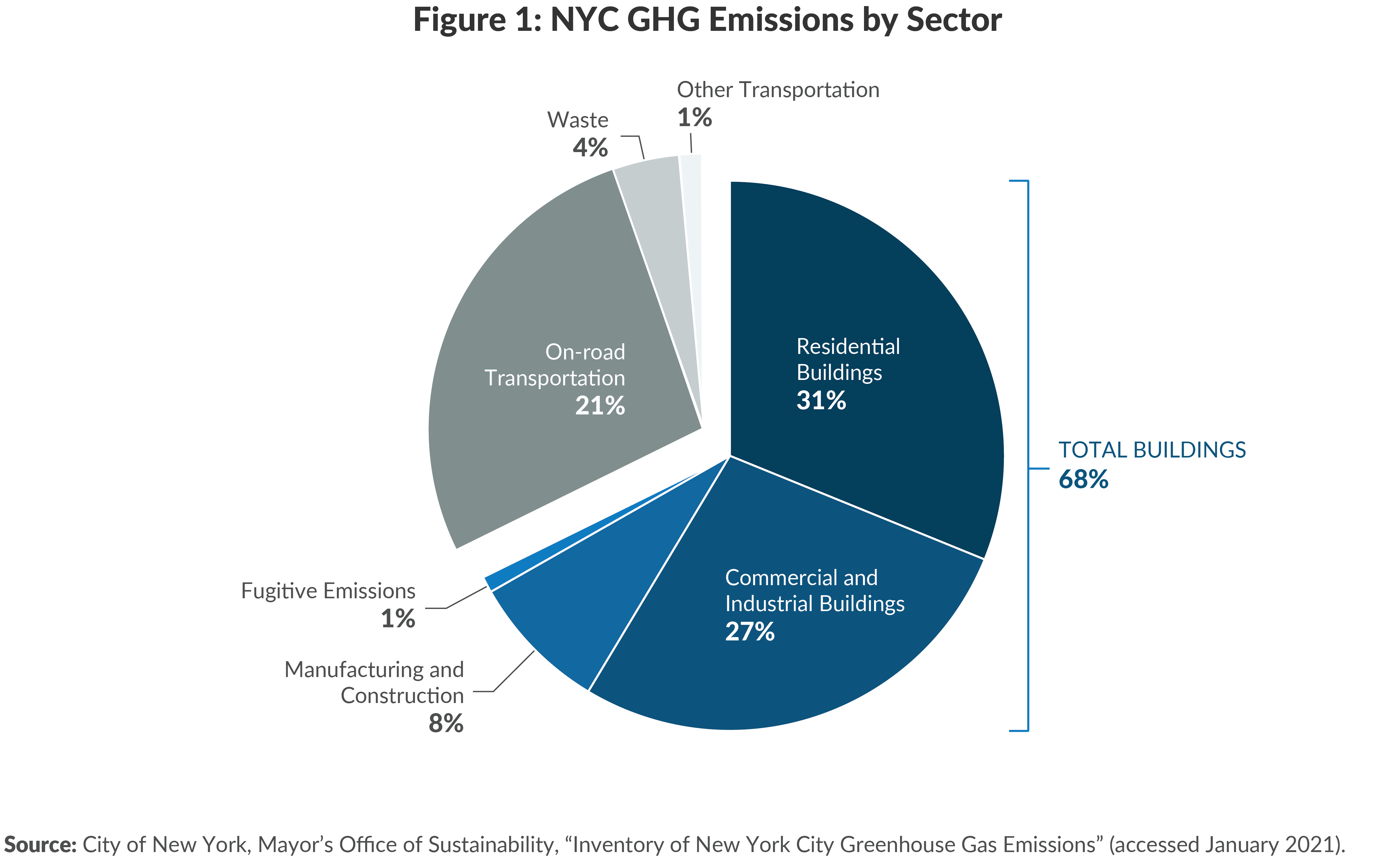

CMA’s primary focus is on building emissions because buildings account for 68 percent of citywide emissions. (See Figure 1.) LL97 builds on Local Laws 84 and 87 of 2009 (LL84 and LL87), which require building owners to submit annual data on their assets’ energy consumption and conduct analyses of energy efficiency every ten years.5 Between 2005 and 2019, building emissions fell slightly more (18 percent) than overall citywide emissions (15 percent).6 Amendments to LL84 have brought the law’s coverage into alignment with LL97—targeting buildings greater than 25,000 square feet, while only buildings larger than 50,000 square feet must undergo LL87’s energy audits. Furthermore, other laws contained in the CMA addressed building emissions: Local Laws 92 and 94 of 2019 require newly constructed buildings and buildings undergoing major roof renovations to build green roofs or install solar panels.7

The CMA is part of a larger movement among state and local governments to curb GHG emissions in response to climate change. Following then President Donald Trump’s 2017 announcement that the US would stop pursuing the GHG emissions reductions embodied in the Paris Agreement and begin the process of formally withdrawing from the agreement, some states individually announced their intention to adhere to the Paris Agreement goals regardless.8

New York is among the states setting ambitious GHG reduction goals. In 2019, the State passed the Climate Leadership and Community Protection Act (CLCPA), which sets targets for statewide GHG emissions, and focuses on the electricity sector as a driver of emissions reductions. Under the CLCPA, the State must reduce greenhouse gas (GHG) emissions 40 percent by 2030 and 85 percent by 2050, relative to 1990 levels, with GHG offsets bringing net emissions to zero. The law aims to have an increasingly clean supply of electricity lead this effort, mandating that the share of electricity coming from renewable sources rises to 70 percent by 2030 and 100 percent by 2040.9

Design and Implementation

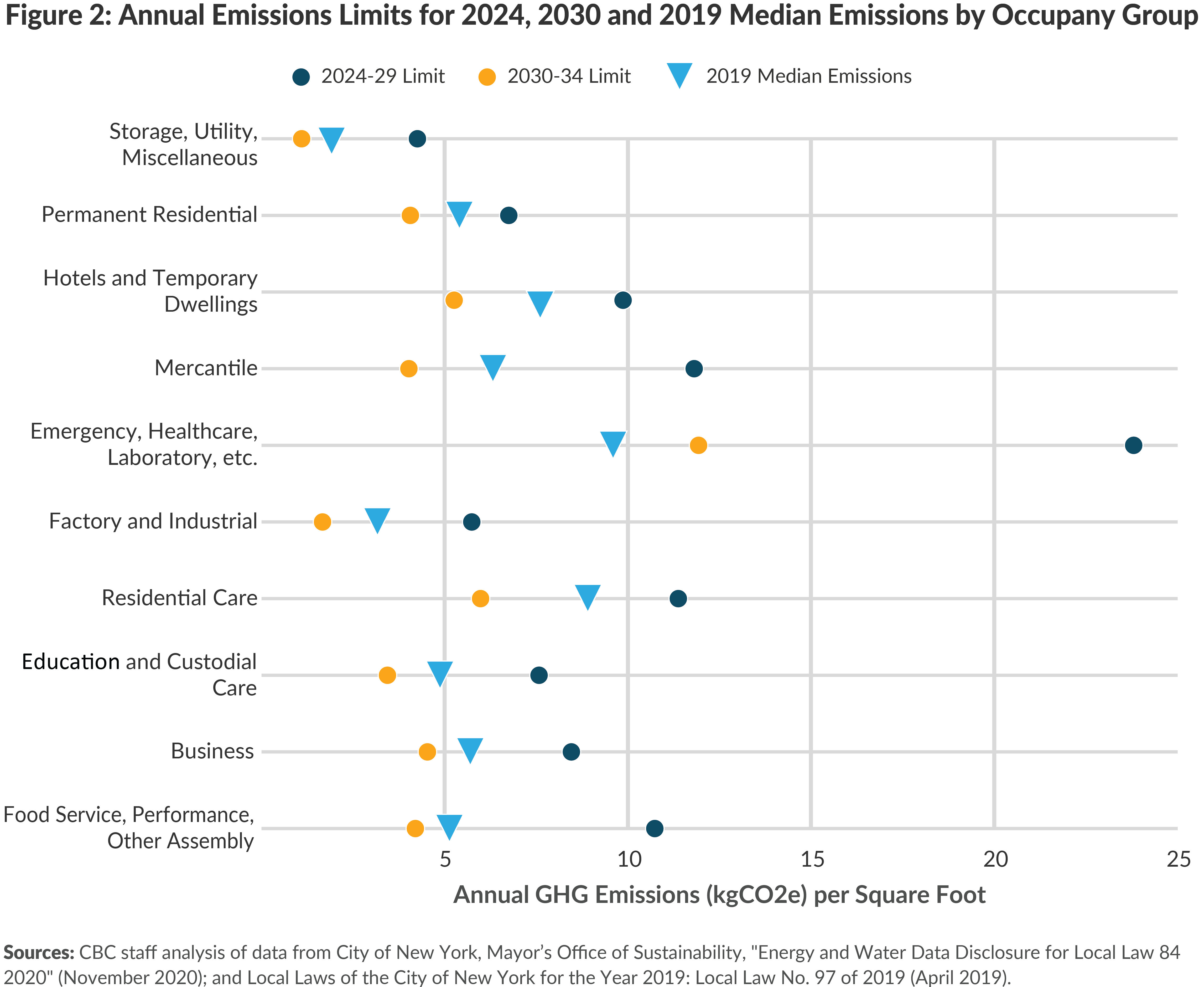

LL97 creates a framework that sets annual emissions limits for each covered building, monitors building-level emissions, imposes penalties for failure to meet targets, and provides alternative pathways to support buildings in complying with the law. Buildings’ annual GHG emissions limits are based on their square footage and the type of uses. Each use type—classified by ten DOB-defined occupancy groups—is limited to a certain level of emissions per square foot. (See Figure 2.) For buildings with multiple occupancy groups, LL97 allows emissions limits to reflect each occupancy group’s footprint in calculating each building’s limits. A building that solely houses office space, for instance, will have an emissions limit of 8.46 kilograms of carbon dioxide equivalent (kg CO2e) per square foot per year when the limits take effect on January 1, 2024. This first set of annual emissions limits remains in effect until the end of 2029, after which the limits are lowered, requiring buildings to achieve deeper emissions reductions. Limits will continue to fall in subsequent five-year periods, although the law does not prescribe limits after 2034.

Buildings’ emissions are calculated by measuring their total consumption of each source of energy, then applying factors that convert each energy source into units of carbon dioxide equivalent (CO2e). As such, a building’s emissions are determined both by the amount of energy it consumes and by the underlying emissions of its mix of energy sources. Thus, while the larger goal includes reducing energy consumption, increases in the proportion of renewable sources powering New York City’s electric grid would reduce an electricity consuming building’s GHG emissions even if its energy consumption profile was unchanged.

While buildings with more than 25,000 gross square feet generally must comply with LL97, buildings owned by City government, New York City Housing Authority (NYCHA), religious institutions, electricity generating industrial facilities, and those in which heating, ventilation, and air conditioning (HVAC) and hot water systems are maintained by individual tenants are exempt from the law.10 The recently enacted Local Law 116 of 2020 amended LL97 to limit exemptions for rent regulated buildings to only those with more than 35 percent regulated units.11 LL97 sets more stringent emissions reductions targets for City government emissions and commits NYCHA to the same reductions as buildings covered by the law but does not subject them to any compliance mechanisms.

Within DOB, a new Office of Building Energy and Emissions Performance (OBEEP) is tasked with overseeing building emissions limits—assessing buildings’ emissions performance, assisting building owners to meet targets, and auditing and penalizing noncompliant buildings. Buildings that fail to meet the annual limits will receive penalties of up to $268 for each metric ton of CO2e emitted over the building's limit. This penalty level is commonly understood to be calculated to approximate the cost of meeting emissions limits through emissions-reducing building upgrades, thereby encouraging building owners to undertake upgrades that have recurring benefits rather than accept ongoing annual penalties. In this sense, the collection of penalties would represent a failure to achieve carbon reductions from buildings.

LL97’s implementation process provides DOB discretion to determine several key policy elements. These policy elements will have substantial bearing on how building owners approach compliance, and include:

- Protocols for monitoring and reporting building emissions;

- Out year emissions limits;

- Adjustments to incentives and penalties that facilitate compliance;

- Credits for electrification and distributed energy resources; and

- Adjustments to buildings’ emissions limits based on owners’ inability to reasonably meet strict compliance because of financial hardship, lack of availability of GHG offsets, and inadequacy or ineligibility of existing public incentive programs to finance compliance.

The law provides further potential adjustments for the first compliance period: allowing for emissions from electric power to be calculated by the time of day (benefiting buildings with 24-hour operations that draw comparatively clean overnight electricity); and providing an alternative requirement that buildings that are more than 40 percent above their 2024 limit can comply by cutting emissions 30 percent relative to 2018 levels based on special circumstances. These special circumstances include high density occupancy, 24-hour operations, or the presence of “energy intensive communications technologies or operations.” In addition to limits adjustments, DOB is empowered to mitigate building penalties based on owners’ “good faith efforts to comply,” lack of access to financing, and other external constraints to compliance.

The law creates an advisory board to support this rulemaking process. The advisory board, which is comprised of members from relevant stakeholder groups, is tasked with conducting ongoing research and making recommendations on these policy elements. The advisory board, whose work is supported by working groups and DOB staff, will deliver recommendations to DOB on an ongoing basis, and must submit final recommendations on matters established by the law by January 1, 2023. In turn, DOB will promulgate rules as it receives recommendations. As of May 12, 2021, DOB had promulgated a rule establishing the process by which nonprofit hospitals can apply for adjustments to their emissions limits.12

Calculating Building GHG Emissions

Under LL97, a building’s GHG emissions are calculated by measuring its total annual consumption of each energy source it uses then applying factors that convert each energy source into units of CO2e. While LL97 sets emissions factors for the first and second compliance periods, the factors will be recalculated in subsequent compliance periods as the GHG emissions associated with the production of energy from each source changes over time. Even though building owners generally cannot control where grid-purchased electricity is sourced, they are responsible for the associated emissions.

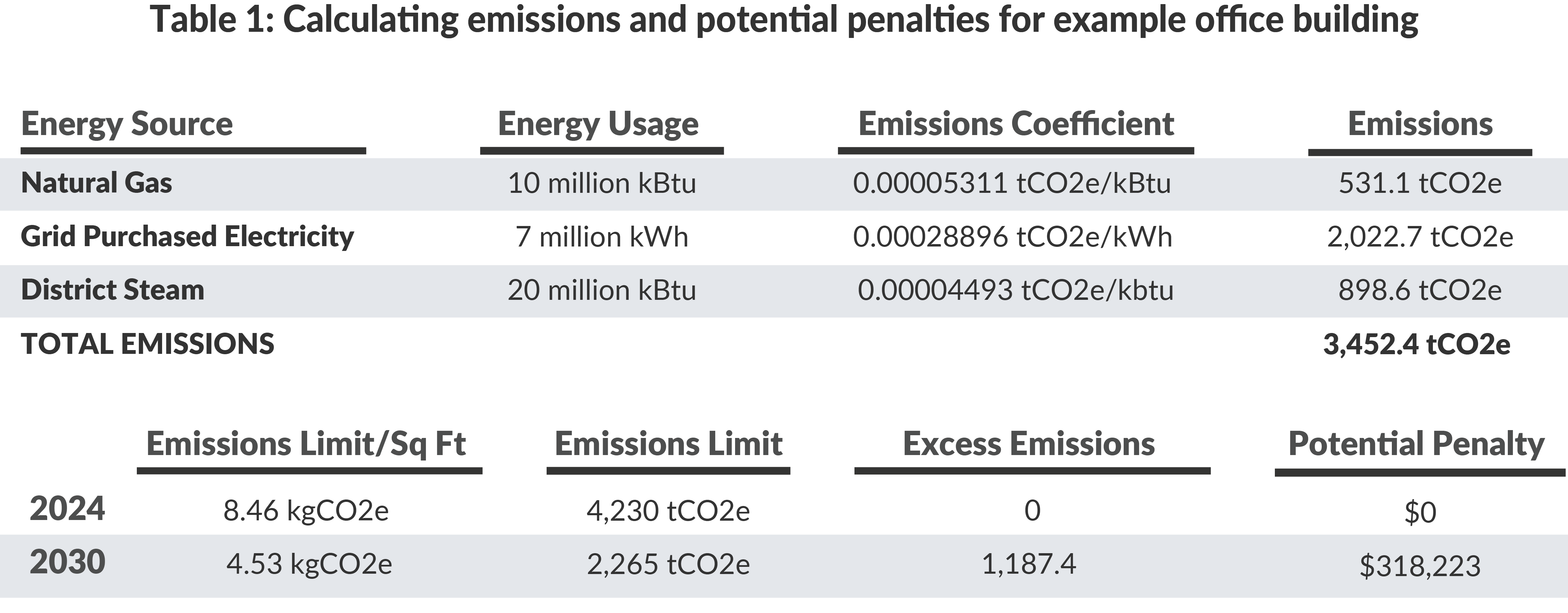

The following example of a representative large office building illustrates how a building’s annual emissions limits and GHG emissions are calculated.

- Office buildings have annual emissions limits of 8.46 kilograms of CO2e (kgCO2e) per square foot from 2024 through 2029 and 4.53 kgCO2e per square foot from 2030 through 2035. As such, the limits for an office building with 500,000 gross square feet are 4,230 metric tons of CO2e (tCO2e) and 2,265 tCO2e for the first and second compliance periods, respectively.

- If the building consumes 10 million kilo-British thermal units (kBtu) of natural gas, 7 million kilowatt hours (kWh) of electricity purchased from the grid, and 20 million kBtus of steam delivered through the district steam system, the table below shows it is estimated to be responsible for annual emissions of about 3,452 tCO2e based on the emissions factors the law establishes for the 2024-29 compliance period.

- This building already would be in compliance for the 2024-2029 period. If emissions factors were held constant for the second compliance period (that is, if no progress was made reducing emissions from the city’s electric grid), the building would need to reduce emissions by about 34 percent from current levels. Were the building’s energy consumption profile to remain constant into 2030, it would face annual noncompliance penalties of about $318,000.

Clean Energy DC: An Alternative Approach to Building Emissions

The climate change mitigation efforts made by New York City and State are part of a national movement to keep the US on pace to meet the goals of the Paris Agreement. Among the local governments specifically targeting the building sector, Washington, DC stands alongside New York City for its far-reaching plan to lower building emissions. Understanding the approaches of other local governments targeting building emissions can help highlight the tradeoffs and decision points in designing such a policy.

In 2018, the Council of the District of Columbia passed the Clean Energy DC act, a comprehensive green energy plan. Clean Energy DC aims to lower GHG emissions 50 percent by 2032, relative to 2006 levels, and achieve carbon neutrality by 2050. The plan also sets the goals of reducing energy consumption 50 percent by 2032, relative to 2012 levels, and increasing the share of energy coming from renewables 50 percent by 2032. To accomplish these targets, the plan focuses on building emissions, energy supply, and transportation.

Unlike LL97, Clean Energy DC’s package of building policies differ for new and existing buildings. New buildings will be subject to an increasingly stringent building code that will require net-zero energy performance for all buildings by 2026. For existing buildings, the plan expands the role of the District of Columbia Sustainable Energy Utility and recommends incentives and financing programs to increase the pace of retrofits, targeting the most cost-effective energy efficiencies and the least-efficient buildings.

By targeting building emissions as part of a comprehensive plan that also targets energy supply, the Clean Energy DC plan is able to outline concrete steps for buildings to take, estimating the GHG mitigation that those steps will achieve when accomplished in conjunction with other elements of the plan.

Complying with Local Law 97

The annual emissions limits established by LL97 will have disparate effects across buildings. The amount by which building owners must reduce emissions—if at all—varies considerably. A building’s emissions, together with the energy efficiency of existing its systems, and its mix of energy sources, will determine owners’ compliance strategies. The strategies owners will employ may include: a) investing in upgrades that improve a building system’s energy efficiency, b) converting its energy source to one associated with lower emissions, c) purchasing GHG offsets, including RECs, and d) pursuing one of LL97’s established alternative compliance paths, including requesting adjustments to emissions limits from DOB based on need. If these options’ costs are too high or extend over a longer timeline than the building owner deems feasible, building owners may choose to pay the penalties. Many building owners will likely employ some combination of these options. Each of these paths has costs, and how they are implemented will determine the law’s economic burden in total and its distribution among building owners, tenants, utilities, and the broader public.

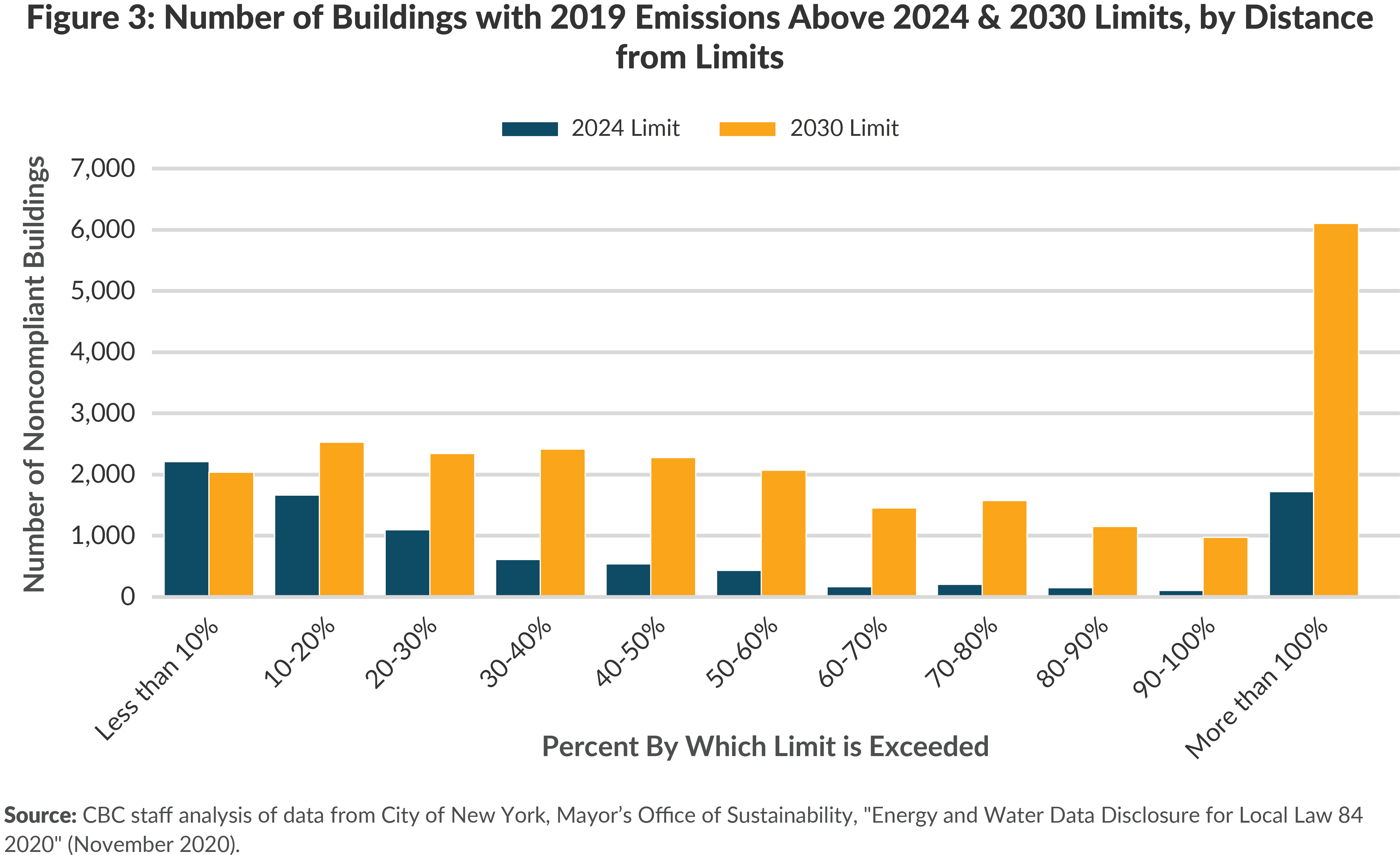

New York City Buildings’ Current Emissions

Annual GHG emissions limits are relatively high for the first compliance period that takes effect on January 1, 2024. Only 24 percent of buildings covered by the law must reduce emissions from their 2019 levels to comply (i.e., they are currently noncompliant).13 (See Figure 3.) Many noncompliant buildings will need to reduce emissions relatively modestly: 25 percent of noncompliant buildings must reduce emissions by less than 10 percent and an additional 19 percent must reduce emissions by less than 20 percent.

The second compliance period substantially lowers emissions limits, requiring three-quarters of covered buildings to take steps to comply by 2030. Because these limits are more stringent, buildings also must generally achieve deeper emissions reductions. Only 18 percent of buildings above their 2030 limits will need to reduce emissions from their 2019 levels by 20 percent or less. In contrast, emissions for nearly a quarter (24 percent) are more than double their 2030 limits, requiring these buildings to cut emissions by half or more.

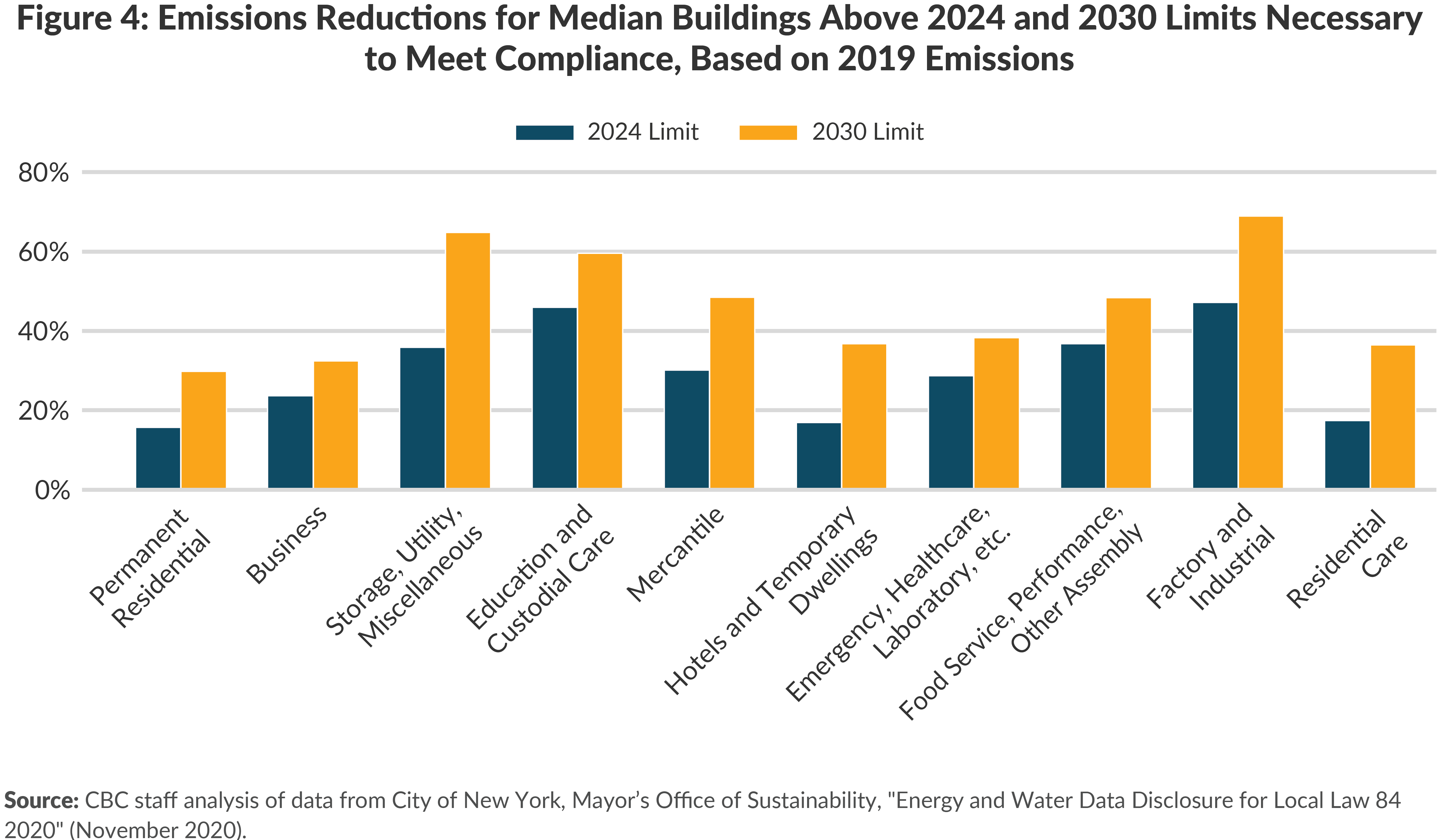

While the share of buildings that need to reduce emissions from 2019 levels for each compliance period do not differ widely across occupancy groups, the extent to which affected buildings need to lower their emissions varies more. (See Figure 4.) The median noncompliant building must lower emissions 20 percent by 2024 and 33 percent by 2030. Necessary emissions reductions for the median Permanent Residential Building, the largest group of covered buildings, are 16 and 30 percent for each period, respectively, closer to compliance than average. The median Business building, which is the second largest group, will require greater than average emissions reductions of 24 percent and 32 percent for each period, respectively.

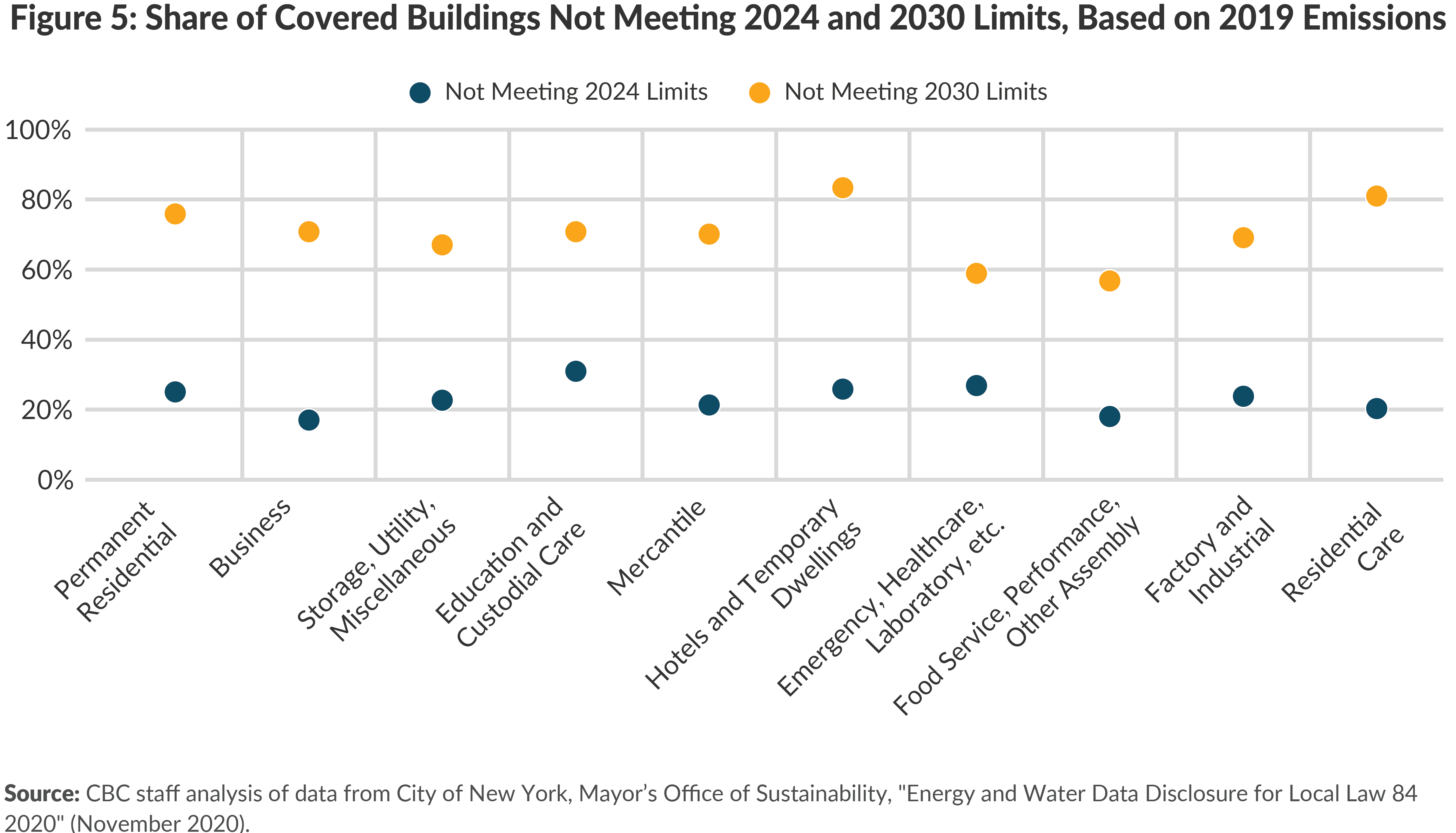

While the median noncompliant residential building is closer to meeting standards than the median commercial building, a greater proportion of residential buildings are above their emissions limits. (See Figure 5.) Residential buildings’ noncompliance rate is similar to the overall rate of covered buildings: 25 percent of permanent residential buildings are above 2024 limits and 76 percent are above 2030 limits. For commercial buildings, the noncompliance rate is 17 percent for 2024 and 71 percent for 2030.

Reducing Building GHG Emissions through Retrofits

Buildings covered by LL97 vary widely by type, age, efficiency of existing buildings systems, and the amount of GHG emissions reduction necessary to comply with the law. As a result, there is no standard path to compliance. Rather, owners must assess their buildings’ emissions goals and opportunities for efficiencies. While these assessments will be informed by energy consumption data and energy efficiency audits required by LL84 and LL87, many owners, especially those with higher GHG emitting assets, will have to study their building systems further to determine cost-effective compliance paths.

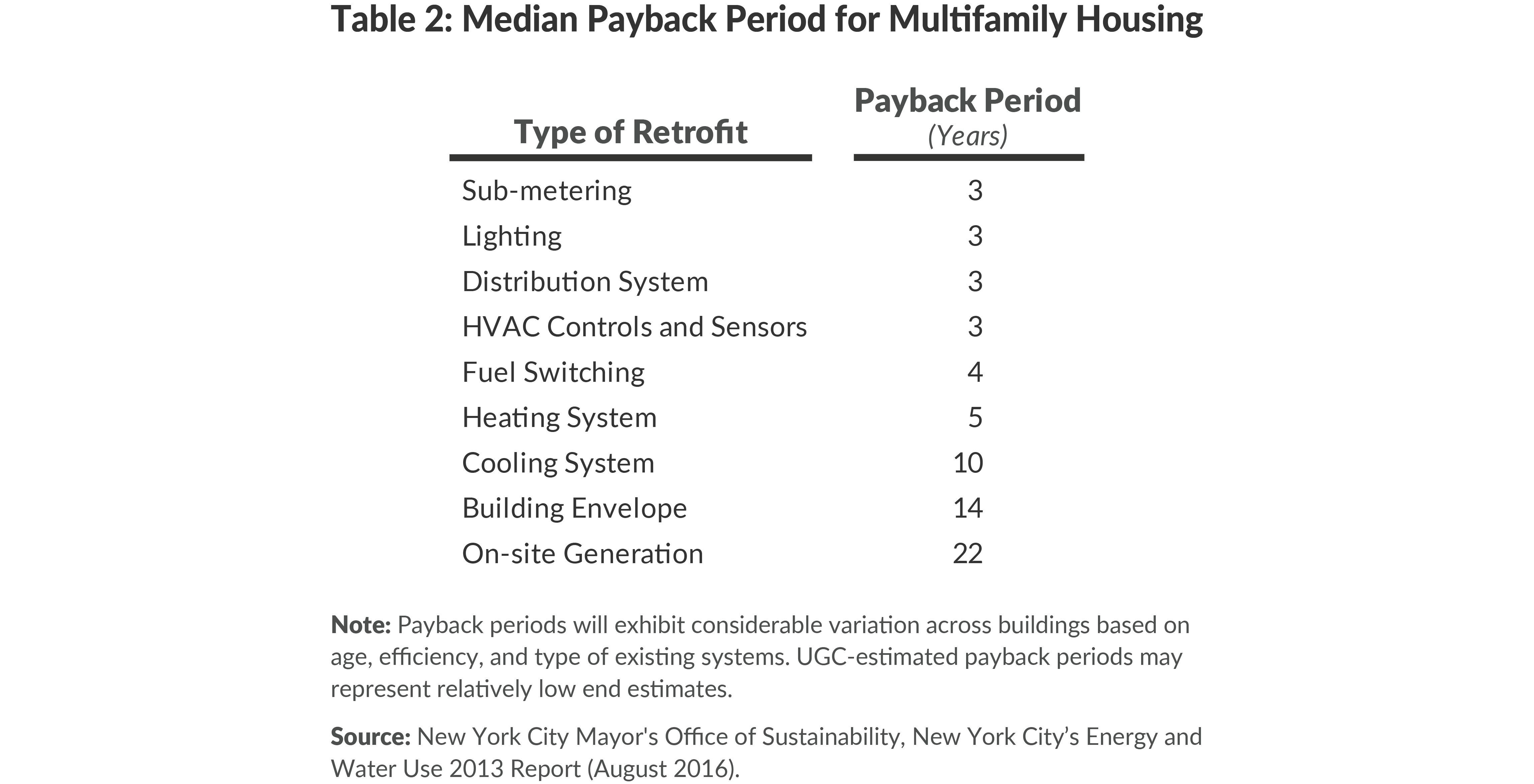

Building owners’ primary methods to lower their assets’ GHG emissions are retrofitting building systems to increase their energy efficiency and changing the source energy consumed. Emissions-reducing retrofits range from the relatively inexpensive (like installing LED lighting) to major capital investments, including structural improvements to better seal buildings’ envelopes and upgrade HVAC systems. While environmental benefits of retrofits are measured in terms of their GHG reductions, financial benefits of retrofits can be measured by projects’ payback periods—the amount of time needed for investments to be fully offset by the subsequent savings in energy bills brought by greater efficiency. Highly cost-effective retrofits, including lighting upgrades or the installation of systems that better regulate a building’s energy use by monitoring and controlling HVAC systems, have payback periods that are estimated to be as short as two or three years. Because of the wide variance in building components’ age, efficiency, and condition, it is difficult to estimate generic payback periods for all buildings. Nevertheless, these estimates provide an opportunity to compare relative payback periods across retrofit types. (See Table 2.) For older buildings that have not undertaken relatively minor upgrades, LL97 may incentivize an economically sound investment.

Owners whose properties are further from their emissions limits and need deeper emissions reductions may have to make more significant investments. Investments with longer payback periods include upgrades to HVAC systems (5 years for heating and 10 years for cooling), replacing the systems that deliver heat or cold air through the building, or switching of fuel sources (such as from high-emitting fuel oils to natural gas, which emits less GHG per unit of energy). Major capital investments to reduce emissions may have the longest payback periods. These improvements include building envelope upgrades (14 years), which entail improving the energy performance of a building’s roof, walls, and windows, and, for larger buildings, the construction or overhaul of on-site energy plants (22 years), which can generate renewable or low-emitting energy and increase building efficiency by capturing heat generated in energy production.14

The retrofits required for deep reductions in building GHG emissions represent major investments, and their payback periods in many cases are longer than building owners typically view as economical. Building system electrification, converting the energy source of heating and cooling systems from fossil fuels to electricity, may not achieve deep short-term emissions reductions. Given that the city’s electric grid remains overwhelmingly powered by fossil fuels, electrification projects are unlikely to yield sufficient emissions reductions. As such, building owners’ incentives to electrify in large part depends on their forecast of how fast the share of the city’s electricity generated by renewable energy resources will increase.

Because LL97 requires building owners to undertake projects that may fall outside their economic interest or economic capacity in many cases, the law creates programs to assist building owners to comply with the law. Another CMA component law established the Property Assessed Clean Energy (PACE) financing program to be administered by the NYC Energy Efficiency Corporation (NYCEEC), which will provide low-interest loans for buildings to undertake retrofits that improve energy efficiency or generate renewable energy.15 The program released final guidance in April 2021 and announced the closing of its first loan on June 16, 2021.16 To facilitate LL97 compliance, the Mayor’s Office of Sustainability is retooling its NYC Accelerator program, which provides building owners with technical assistance to plan emissions reduction strategies and connects them to potential financing options. While the program has been operational since 2012, the Mayor’s Office is expanding it to provide assistance at a scale necessary to facilitate compliance with LL97. Finally, ConEdison, the New York State Energy Research and Development Authority (NYSERDA), and renewable energy incentives available at the federal, state, and city level already provide programs designed to offset the upfront costs associated with deploying energy efficiency improvements and renewable energy generating resources, such as rooftop solar panels.

Building Retrofit Costs and Potential Penalties

Each owner of a building covered by LL97 will have to determine their optimal compliance path. For the average building, complying primarily through emissions-reducing retrofits is likely to be most cost-effective, with amortized compliance costs below potential penalties. However, depending on a building’s current emissions and potential retrofit costs, in some cases penalties may be less costly than compliance. In these situations, owners would not have the incentive to reduce emissions. LL97’s rulemaking process should be used to balance the incentives to promote compliance paths that encourage emissions reductions rather than penalties.

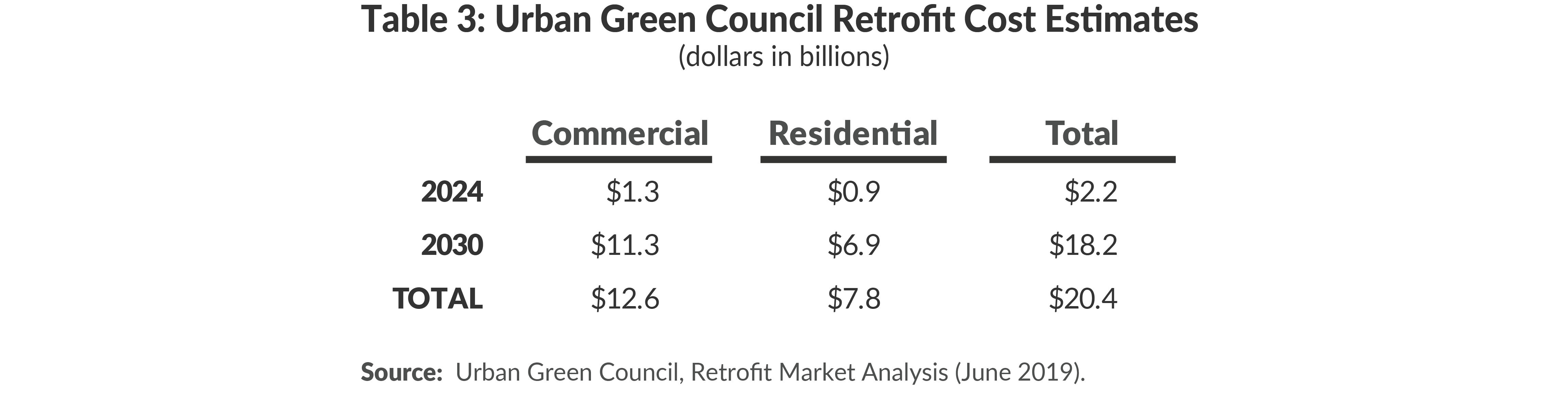

In 2019, the Urban Green Council (UGC) estimated that the total city-wide cost of reaching the emissions limits set in the first and second compliance periods solely through energy efficiency retrofits would be about $20 billion. Because fewer buildings are above their first period limits, and many above their limits are relatively close, compliance costs start low and increase dramatically as more buildings need to achieve deeper reductions by 2030.17 (See Table 3.)

These estimates assume that buildings reach compliance exclusively through retrofits that improve energy efficiency, rather than through emissions offsets, credits or other deductions, external factors like the greening of the electric grid, or noncompliance and penalization. While UGC strongly advocates for GHG reduction and its estimates have not been independently validated, comparing these estimates to potential penalties can help illustrate how LL97’s incentives can work for various buildings.

UGC estimates that the investment needed to sufficiently reduce emissions of the average noncompliant building (relative to 2030 limits) would be about $9.80 per square foot.18 These would be one-time expenditures on building systems upgrades whose benefits would extend for decades. For major retrofits, including building envelope upgrades, newly installed systems’ life cycles may exceed 10 years, driving the annual average compliance cost below $1 per square foot.19 However, these costs vary widely across buildings. Amortized over 10 years as an illustration, 2030 compliance costs for covered commercial buildings would average $1.42 per square foot, while the same figure for residential buildings would be just $0.65.20 These cost estimates are highly dependent on UGC’s cost estimate assumptions, as well as the 10-year timeframe used as an example.

Comparing these figures to the penalties building owners would pay if their assets’ current emissions remained constant through each compliance period can illustrate the extent to which LL97 adequately incentives compliance. These potential penalties represent the upper bound of owners’ possible costs: if building owners expect retrofit costs to exceed penalties, they may opt to simply pay penalties. Under this assumption, and in the absence of external emissions reductions associated with energy generation, buildings with 2019 emissions that are above their 2030 emissions would pay $218 million annually across all covered buildings if 2019 emissions were constant.21 While these penalties appear significantly lower than retrofit costs, they recur annually, while retrofit costs represent long-term investments and carry benefits beyond LL97 compliance, lowering energy bills and potentially increasing buildings’ attractiveness to tenants.

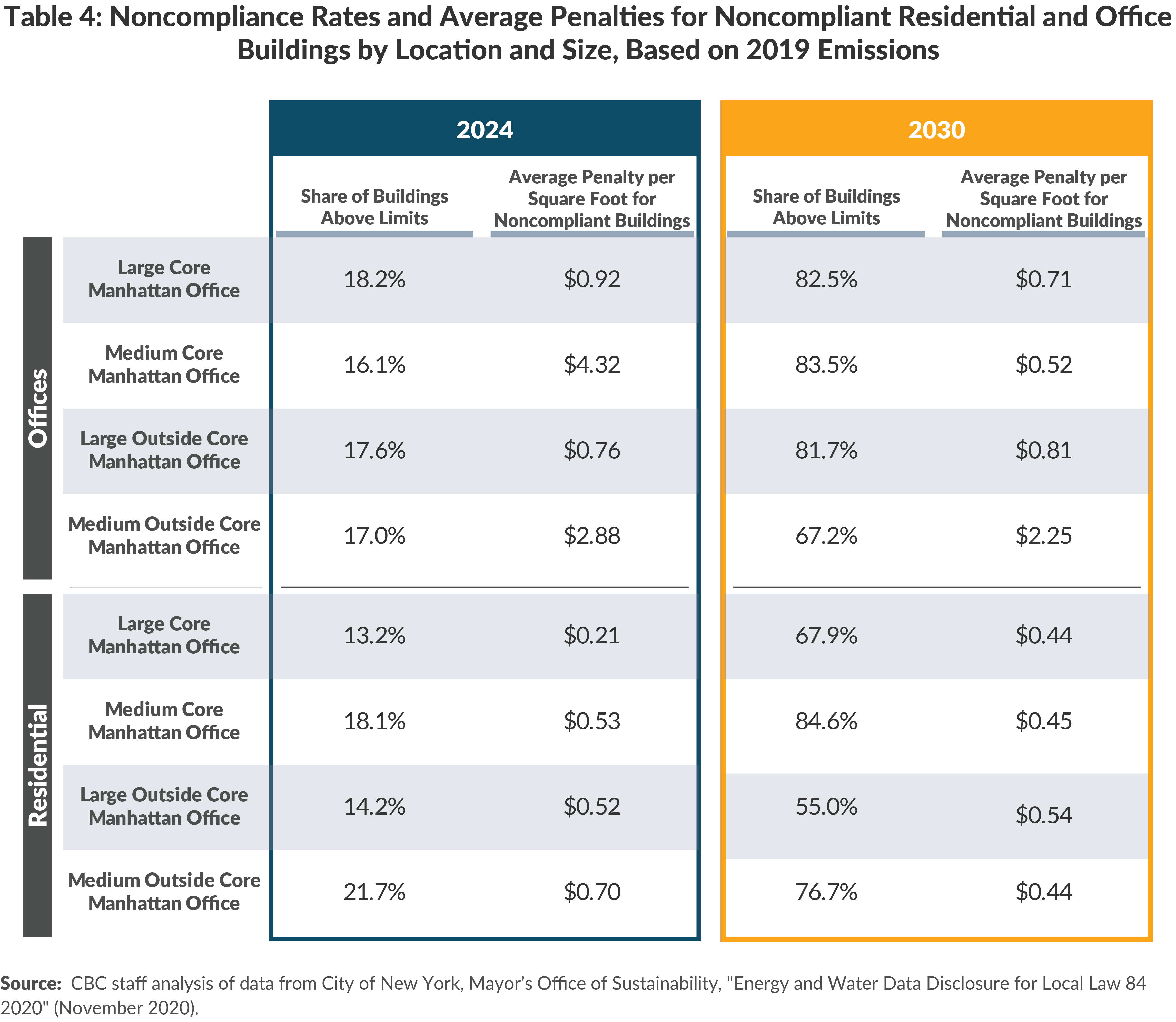

For the average building, potential penalties in 2030 would be $0.97 per square foot each year those limits are in effect.22 These costs will vary widely among market segments and building categories. For commercial buildings, including the business and smaller occupancy groups, the average building above its 2030 limits can expect an average penalty of $1.86 per square foot, based on 2019 emissions. For residential buildings, the same figure is just $0.47. Residential buildings’ lower average penalties may reduce the incentives of their owners to reduce emissions to compliance limits, as paying penalties may be less costly in some cases. (See Appendix for a detailed table of emissions and penalty metrics by occupancy group.)

Because of the wide variation among covered buildings, there is no generic, universal method for building owners to determine the most cost-effective balance of retrofits, other compliance options, and penalties to meet compliance requirements. Rather, building owners will need to integrate LL97 requirements and possible penalties into building capital planning. However, for building owners with relatively low penalties relative to the costs of compliance, noncompliance may be an economical option, especially in the short term. The difficulty of charting an optimal compliance path may pose a greater barrier for smaller and self-managed buildings, which generally do not engage in long-term capital planning and have lower levels of on-staff expertise or ability to retain engineering consultants.

Differential Potential Penalties for Building Types and Tenants

Owners’ abilities to absorb potential costs or penalties and the costs’ effects on buildings’ financial fundamentals depend on a building’s compliance costs and its income, which varies widely across market segments. For some market segments, lower building income may be accompanied by higher-than-average potential penalties. While building owners may pass some portion of LL97 compliance costs—either retrofits or penalties—on to tenants, costs for some buildings and market segments may be higher relative to existing building income and rent, leading to significant rent increases.

Owners’ ability to pass the compliance costs on to tenants depends on real estate market conditions, including the level of competition within the industry. While both the residential and commercial markets remain weak in the fallout from the COVID-19 pandemic, owners may have a more difficult time passing costs to tenants. If real estate markets sufficiently strengthen, when costs associated with compliance increase after 2024, economic evidence indicates that owners may be able to pass costs fully on to tenants as rent increases.23 However, the economic uncertainty in the wake of the pandemic may hinder the commercial real estate market’s ability to return to its pre-pandemic strength.24 The New York City industrial market, which includes manufacturing and warehousing facilities, may not have sustained much damage during 2020, but higher costs for tenants may become a reality as soon as owners begin absorbing compliance costs.25

For commercial buildings at the top of the market, market rents are the highest in the country. As of the fourth quarter of 2020, asking rents for Class A offices in Manhattan’s Midtown South and Midtown averaged $88.33 and $84.12 per square foot, respectively, the highest in the US.26 In Brooklyn—the least expensive New York City market reported—Class A asking rents were $61.55 per square foot. For all office classes, not just Class A, these areas’ rents were $72.70, $77.06, and $49.39, respectively, a 56 percent premium for Midtown over Brooklyn.

The residential rental market exhibits similar price dispersion. Manhattan’s annual average rent was $62.33 per square foot in January 2021.27 In Brooklyn and Northwest Queens, the same figures were $43.89 and $43.64, respectively. These averages represent the high end of residential rental market income. It should be noted that brokerage-provided estimates skew toward higher end of the rental market and often exclude lower-priced market rate rentals, which are less likely to be serviced by professional brokerages.

Potential penalties for office buildings are higher per square foot for smaller buildings across the city, since those tend to be further out of compliance with the emission standards. (See Table 4.) While emissions data do not indicate building class, smaller buildings may be less likely to be Class A offices. For these smaller offices outside core Manhattan, average penalties for buildings currently above their limits would be $2.88 per square foot in the first compliance period and $2.25 in the second.28 Given that below-average-income Brooklyn buildings earn less than $49.39 per square foot, penalties for many of these buildings could total more than 5 percent of annual gross revenue.

For residential buildings, potential penalties outside core Manhattan tend to be higher than similarly sized buildings in Manhattan. With rents also lower, buildings outside core Manhattan may be least able to absorb the new costs. Outside core Manhattan, owners of rental apartments report annual expenses are $14.40 per square foot, including taxes, maintenance, and energy. In these areas, the average medium-sized building that is above 2024 limits faces potential penalties of $0.70 per square foot, approaching or exceeding 5 percent of building operating costs for many currently high-emissions buildings.29

Many buildings with high operating costs relative to income may have less financial cushion and may try to pass a higher share of costs and penalties on to tenants. This may raise rents most for New York City’s relatively less-expensive market rate rental units. Compounding this, less than half of New York City rental apartments (42.9 percent) are private, non-regulated units; the rest are subject to rent stabilization or another form of subsidy or regulation.30 In 2019, New York State reformed its rent regulation system, limiting the extent to which the costs of upgrades to buildings and units can be passed on to rent regulated units.31 As a result, buildings with a mix of rent regulated and market rate units will likely pass nearly all of their compliance costs on to tenants of market rate units, depending on the level competition in the market. In softer markets, owners are likely to bear greater shares of costs.32

As LL97 takes effect, many building owners likely will incorporate more of the costs of compliance into leases. In 2012, New York City launched a campaign to encourage commercial building owners to use energy aligned clauses, which allow the building owner to recoup the savings associated with building improvements that increase energy efficiency. These clauses, together with lease provisions that more accurately price the costs associated with LL97 compliance, are likely to become increasingly common and bring energy efficiency incentives into closer alignment. Major commercial property owners are more likely to have the technical capacity and familiarity with the law to begin this process, but owners in other real estate market segments may be slower and find it more challenging to adapt. Owners with smaller portfolios may have less understanding of LL97 requirements and costs. Further, incentive misalignments may be a greater problem for subsidized housing, where energy use is often not sub-metered and tenants often do not assume costs.33 Even temporary misalignment as leases adjust to the law creates cost burdens that do not effectively lower building GHG emissions. For instance, a building owner that does not have the ability to monitor each tenant’s energy usage or does not have leases that allow the pass through of costs based on actual consumption may raise costs to all tenants equally, providing no incentive for tenants to reduce energy use.

The distribution of cost burdens between building owners and tenants is potentially exacerbated by misaligned incentives in buildings with leased space. The split incentive problem, which has long been documented by analysts of building energy performance, refers to the misalignment between the costs of energy efficiency measures, which are borne by landlords, and the resultant reduced energy bills enjoyed by tenants.34 LL97’s focus on emissions rather than energy efficiency further complicates this dynamic. While building owners are responsible for complying with the law, they do not directly control much of the energy consumed by the buildings. Although the breakdown between building owners’ and tenants’ control over energy varies considerably by building, this problem may be more significant in large commercial buildings with high ratios of electricity use (which is generally tenant controlled) relative to (typically owner controlled) HVAC energy consumption. One major operator of commercial space in New York City estimates that tenants consume 60 to 80 percent of all building energy within their space.35 Taken together, these dynamics may both constrain some building owners’ ability to recoup the savings that result from efficiency-improving upgrades, while leaving them liable for emissions associated with tenants’ energy use.

Alternative Paths to Complying with Local Law 97

For many buildings, especially those currently far out of compliance and those with financial constraints, complying exclusively through retrofits is infeasible. Long building capital cycles and lagging renewable energy production limit building owners’ ability to design, finance, and implement the upgrades necessary to achieve the fast emissions reductions LL97 requires of some buildings. To bridge this gap, the law provides several alternative paths that allow owners to comply in cases where emissions remain above limits.

First, LL97 allows buildings to offset some emissions through the purchase of RECs. RECs are tradable certificates representing units of energy produced by renewable energy resources. In New York, RECs are certified and procured by NYSERDA, which then sells them to utilities required to buy certain quantities under the State’s Clean Energy Standard.36 The process provides an ongoing financing mechanism from ratepayers, through utilities and NYSERDA, to both existing and new renewable energy resources. LL97 allows buildings to deduct emissions by purchasing RECs associated with renewable energy resources located in or delivering energy directly into New York City. While at the time of passage, no mechanism for certifying the location of RECs in New York State existed, NYSERDA currently is in the process of developing Tier 4 RECs that meet LL97’s New York City requirements. NYSERDA expects to award the first round of RECs in the third quarter of 2021.

LL97 also allows owners to offset emissions by deploying distributed energy resources. These are on-site energy generators and typically are limited to large commercial buildings or major institutional facilities that consume enough energy to justify the costs of installation and operation. Cogeneration, a major type of distributed energy resource, uses a natural gas-powered engine to both power the building and provide heat and in some cases cooling. Despite these systems’ use of fossil fuels, they are typically more efficient than other energy sources because cogeneration captures the heat produced by electricity generation for useable building heating. In off-site power plants, that heat often is wasted. Further, distributed energy resources generally avoid the energy loses associated with transmitting energy from off-site plants to buildings.

While LL97 allows buildings with distributed energy resources to receive emissions credits, it does not establish parameters for most of these credits. Rather, it tasks the advisory board with making recommendations on the calculation of such credits and empowers DOB to determine the level of GHG emissions offset by each unit of each type of resource. Separately, the law provides full credits in the first compliance period for energy output from clean distributed energy resources that either generate or store renewable energy on-site; deductions for subsequent periods are to be determined by DOB.

In 2020, the Council passed Local Law 95 (LL95) which altered the LL97 established rules regarding distributed energy credits. LL95 creates favorable treatment for one specific type of distributed energy resource: natural gas-powered fuel cells. Fuel cells provide a continuous load of energy and have lower emissions than other fossil fuel sources; they are powered by hydrogen, which, while derived from natural gas, creates no on-site emissions. This energy is generally far cleaner than grid-purchased energy during midday peak demand when utilities use higher-emitting energy resources.37 Crediting fuel cells with lower emissions by comparing their marginal emissions to that of the electric grid creates an incentive for buildings with sufficiently high energy consumption to adopt them. LL95 limits this treatment to fuel cells installed prior to January 1, 2023, or the promulgation of rules made under the process established by LL97.38

Finally, LL97 requires the Mayor’s Office of Sustainability to study the feasibility of a carbon trading system to help meet LL97 goals. Under such a system, buildings with emissions below their limits would receive and could sell emissions credits to noncompliant buildings to assist compliance and avoid fines. LL97 stipulates that environmental justice considerations must be part of the feasibility study, and that a trading scheme cannot lead to any localized increases in pollution. While the law directs the Mayor’s Office of Sustainability to deliver a report to the Council by January 1, 2021, no report has been made public.

Potential barriers to successful implementation

Successful implementation of LL97 and realization of its ambitious GHG emissions reductions goals will rest on the advisory board’s recommendations and DOB’s rulemaking. DOB’s rules should be based on careful analysis of the barriers that constrain building owners’ ability to deploy the most cost-effective approaches as well as the distribution of direct and indirect costs associated with lowering building emissions and upgrading the New York City electrical grid. Identifying these barriers is critical to ensuring that the final rules of LL97 are workable and effectively reduce building emissions.

CBC has identified four barriers that threaten the successful implementation of the law:

- Inadequate renewable energy supply;

- Disincentives for density and certain occupancy use types;

- Lack of clarity and potential lack of feasibility of alternative compliance paths; and

- The COVID-19 pandemic impact on the real estate market.

Inadequate Renewable Energy Supply

Reducing large buildings’ GHG emissions will require retrofits that increase energy efficiency and buildings converting their systems to electric power. However, electrification can reduce GHG emissions only if the source of electric power is largely renewable. Therefore, the pace at which New York City’s electric grid switches to renewable sources will determine building owners’ ability to comply through electrification.

If building owners electrify systems before the grid becomes significantly greener, buildings’ GHG emissions will not significantly decline. Early adopters of electrification also may face higher costs, as promising technologies that electrify certain building systems are nascent and costly. Building owners may opt for a cautious approach during the early compliance periods, choosing relatively minor retrofits and alternative compliance paths rather than embarking on the large-scale electrification that ultimately will be necessary to reduce emissions to meet LL97’s targets.

While New York State has set an ambitious timeline for increasing statewide renewable energy production, whether the New York City electric grid will meet that timeline is uncertain. As CBC documented in Getting Greener, the renewable energy generated by projects currently in the development pipeline will not be sufficient to meet CLCPA’s goal of generating 70 percent of statewide electric power from renewable energy resources. Given the lengthy process associated with developing renewable resources, sufficient capacity likely will not come on line fast enough to meet CLCPA targets. Renewable energy development has experienced long delays in New York State, and the CLCPA prioritizes offshore wind projects, which take a particularly long time.39

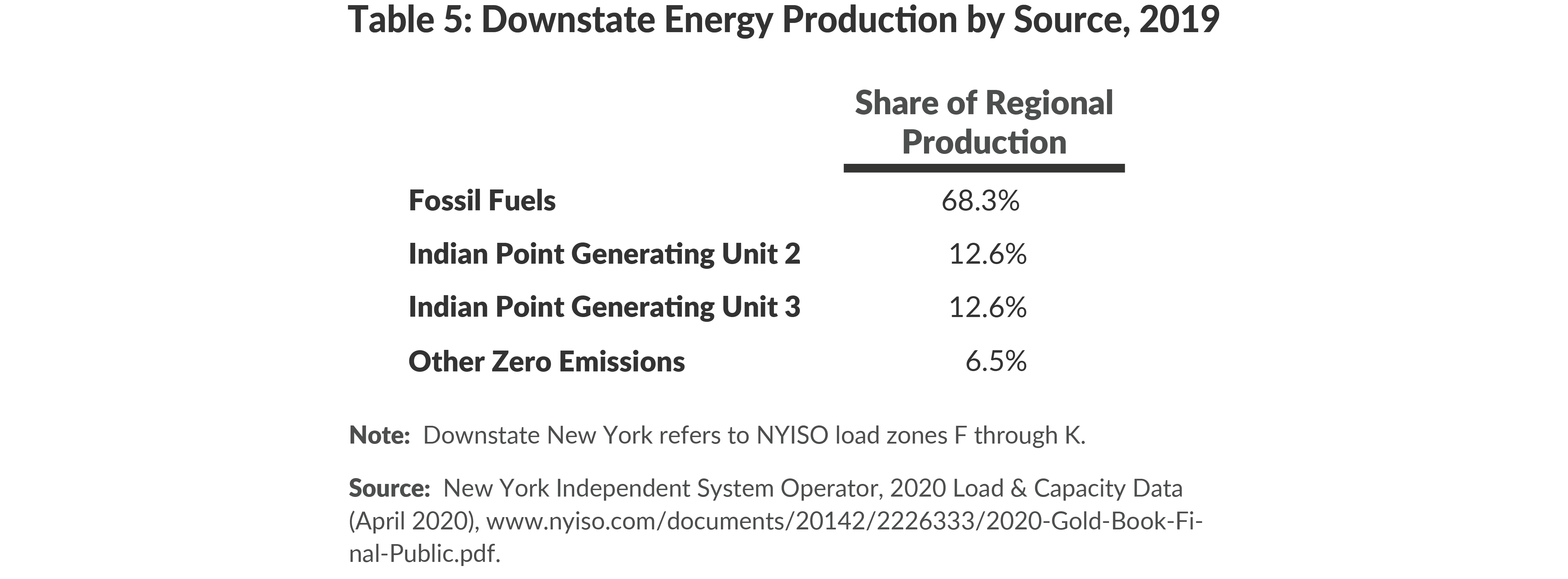

Lagging renewable energy production is especially acute in New York City where currently no utility-scale renewable energy resources are located. Furthermore, New York City’s supply of electricity is becoming less green in the near term. In April 2021, the State decommissioned the final generating unit operating at the Indian Point nuclear power plant, which delivers electricity to New York City. This follows the April 2020 decommissioning of Indian Point’s second operating generating unit. The zero emission energy generated by Indian Point accounted for 25 percent of all electric power produced in downstate New York in 2019, the most recent data available; just 6.5 percent came from other zero emissions resources.40 (See Table 5).

The closure of Indian Point has increased significantly the share of downstate’s electricity generated by fossil fuel-powered plants. Only one utility-scale renewable energy project is currently in development in New York City: the Empire Wind project, which is expected to begin supplying power from offshore wind in December 2024.41 Another major project, the Champlain Hudson transmission line that will deliver hydropower from Quebec to New York City, is expected to begin construction in 2021 after years of delays. The transmission line currently is expected to begin delivering clean energy to New York City in 2025.42 While these projects are crucial steps forward for New York City, they alone are insufficient to bring New York City on pace with CLCPA timelines. Because of this, owners planning strategies to reduce GHG emissions from their buildings may be skeptical that CLCPA targets and resultant lower emissions attributed to grid-delivered electric power will become a reality during the law’s first two compliance periods and opt not to invest in building system electrification. If they do invest, their buildings’ emissions likely would not reduce to the extent needed to comply with LL97.

Phasing out fossil fuel-powered building systems requires not only the installation of electric-powered building systems, but an acceleration of renewable energy production in New York City. Additionally, the city’s electric grid must be upgraded to be able to reliably deliver far more electricity than its current capacity. While core to the success of LL97, accelerating renewable energy production in New York State is largely independent from the actions of building owners.

Finally, readying the electric grid for building electrification will entail further costs to New York City ratepayers. Electrifying building systems that are currently fossil fuel-powered will both increase the demand for electricity and change the profile of the city’s electricity consumption. Grid-straining demand for electricity currently peaks during summer due to electric air conditioner use. Switching heating systems from fossil fuel to electric power will flip the seasonal trend, resulting in potentially grid-straining demand during the winter, increasing the risk of a long-lasting blackout during the winter months that could have devastating consequences. Upgrading the grid to be able to reliably deliver greater electricity will require major capital expenditures over the coming years. If these upgrades are financed by ConEdison alone, the capital costs likely will be passed directly to New York City customers, increasing electricity prices that already are among the highest in the nation.43 This reality increases the necessity for DOB to facilitate the most cost-effective compliance paths using the levers that are under the City’s control.

Disincentives for Density and Certain Occupancy Use Types

Basing LL97’s annual emissions limits on a building’s square footage and occupancy type(s) creates disincentives for density and certain uses that actually may help reduce aggregate citywide GHG emissions. Densely used buildings, which host more workers or residents per square foot, generally use more total energy than less dense buildings. On a citywide basis however, denser uses are more energy efficient. It generally is more energy efficient to have the same number of workers in one building rather than two, since it lowers buildings systems per-capita energy use. Urban density also is more energy efficient in its use of transit systems.

LL97 emissions limits are based on square footage without regard for density of occupancy. Denser uses that result in more energy consumption will face higher penalties than less dense uses even though they are more energy efficient on a per capita basis. While density may bring in more rent to offset this effect, this dynamic may incentivize building owners to prefer leasing to tenants that bring in fewer workers or residents, tilting the field away from firms or housing types that use space more densely.

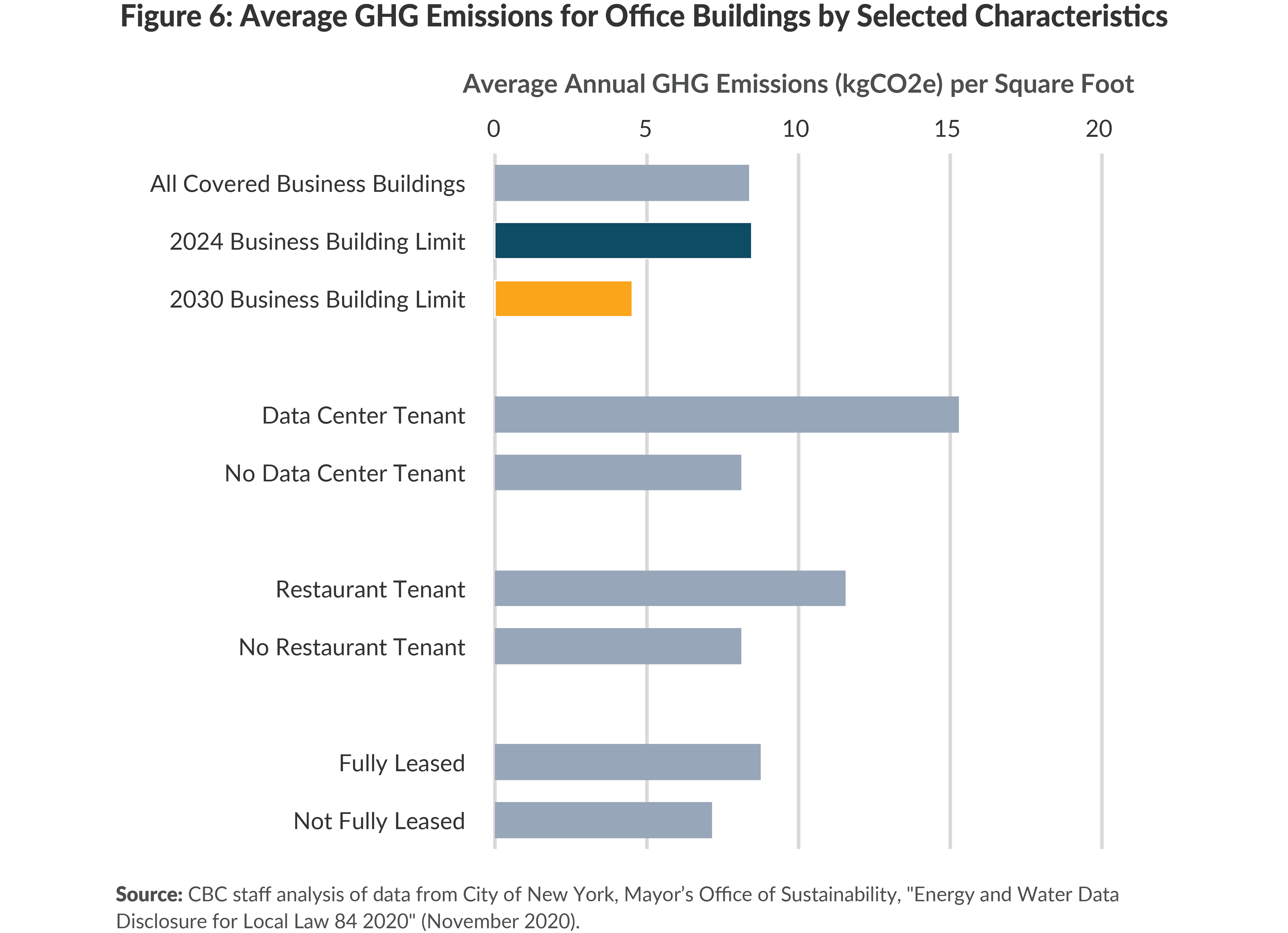

LL97’s occupancy groups create a similar effect. The 10 defined occupancy groups are broad, encompassing wide ranges of uses. For instance, the assembly occupancy group comprises any place of public gathering, from restaurants to places of worship. The emissions associated with these uses can be extremely disparate. Restaurants are far more emissions-intensive than the group’s other uses. Among office buildings covered by LL97, those with restaurants as secondary or tertiary uses have higher emissions than those that do not. The same is true for office buildings hosting data centers, an energy-intensive use without its own separate occupancy group.44 (See Figure 6.) Over time, this dynamic may incentivize landlords to avoid these uses or price compliance costs into leases, raising the relative rents for these types of uses.

Thus, LL97’s broad occupancy groups tilt the field against energy-intensive economic activities, like data centers and restaurants, despite them being vital to the New York City economy. At the same time, the law’s use of gross square feet will encourage uses with fewer workers.

Lack of Clarity and Potential Lack of Feasibility of Alternative Compliance Paths

DOB rules will specify many critical compliance parameters and be promulgated on an ongoing basis. This creates great uncertainty for owners planning compliance strategies. DOB began promulgating rules in early 2021, but has not made public any timeline for rulemaking, leaving building owners without a clear sense of how key provisions might apply to their buildings or when they can expect guidance. DOB could even wait until the start of 2023 when final advisory board recommendations are due before providing guidance.

The timing of the rulemaking process may be impractical for buildings that need to cut emissions ahead of the first compliance period. Building capital investment cycles typically extend over decades, as owners replace components at the end of their useful lives. One year of guidance to plan and implement dramatic emissions reductions may be too little time for many building owners, especially those whose assets are far out of compliance.

The law’s implementation process creates other risks. By not defining precisely how alternative compliance paths, offsets, limits adjustments, and other penalty-mitigating provisions will work, the law creates the risk they are implemented in an ad hoc fashion. Such a system may put buildings with savvier property management operations in a better position to make use of these provisions and implement flexible, cost-effective compliance strategies, while leaving behind owners of single buildings or small portfolios. The implementation process also runs the risk that key provisions are defined in ways that hamper compliance. If provisions are defined too narrowly, or otherwise judged infeasible or impracticable by building owners, they risk going unused. Under this scenario, more building owners may decide to opt for penalties rather than undertaking retrofits, weakening the law’s ability to reduce emissions.

RECs provide buildings with a partial alternative to on-site emissions reductions. LL97 allows for RECs associated with renewable energy resources located in or delivering to New York City (Tier 4 RECs) to be deducted from building emissions. As downstate utility-scale renewable energy resources come on line, NYSERDA will certify those meeting the Tier 4 criteria. However, given the slow progress deploying these resources, the initial Tier 4 REC supply will be limited and unlikely to meet building owners’ demand especially for the first compliance period. This may be compounded by competition from the City of New York, which has pledged to buy all of its energy through the Tier 4 REC program by 2025.45

To bridge this gap between the start of compliance and the availability of Tier 4 RECs, the Fiscal Year 2022 New York State Executive Budget included a proposal to allow New York City building owners to purchase and deduct RECs associated with existing renewable resources (Tier 2) and new offshore wind resources from their building emissions as stipulated under New York City’s LL97. The proposal would have allowed buildings to use these alternatives for the first two compliance period only in the absence of available Tier 4 RECs. Because of the likely short supply of Tier 4 RECs, the proposal would have significantly expanded building owners' ability to comply with LL97 though the purchase of RECs. Ultimately, the proposal was not adopted as part of the state budget.

LL97 also allows carbon trading to be a potential alternative compliance option. This option will depend on a study by the City and the Council’s subsequent decision whether to implement any such system. LL97 requires the Mayor’s Office of Sustainability to submit a report to the Council by the end of 2020. As of April 2021, no report has been made public.

Finally, to ensure that compliance is achievable for buildings facing especially difficult paths to compliance, the law provides both alternative compliance paths and adjustments to compliance requirements based on building-specific factors. Designed well, these alternatives and adjustments could encourage buildings to plan and implementation emissions reductions projects or finance the development of renewable energy resources or deeper GHG emissions reductions elsewhere. However, unclear timelines for rulemaking may undermine this and encourage building owners to wait and see what form the regulations take. As a result, with as little as one year’s lead time, these emissions-intensive buildings may be unable to meet compliance and instead opt to pay penalties. This outcome may involve higher costs for tenants with no emissions reductions for New York City.

The COVID-19 Pandemic Impact on the Real Estate Market

The COVID-19 pandemic wrought havoc on New York City’s real estate market, increasing the challenge for some building owners to comply with LL97. The COVID-19 recession’s initial economic damage hit large cities harder than the rest of the country and those cities have seen employment rebound more slowly.46 Lagging employment, together with remote work, has caused a significant crisis for New York City real estate. Residential rents fell as much as 20 percent during the pandemic and remain 10 percent below pre-pandemic levels by some estimates—drops paralleled only in other high-cost coastal cities.47 Commercial real estate appears to be worse off. Manhattan’s office market vacancy rose to 16.3 percent in first quarter of 2021, a 26-year high. These trends still are exerting downward pressure on rents, which analysts predicted have yet to bottom out and will not recover well into the second half of the decade.48

The extent and timing to which real estate markets return to pre-COVID levels depends on hard-to-predict long-term trends, including the prevalence of remote work, changing attitudes around office space, and high-cost coastal cities’ continued ability to command high rents in exchange for dense social and economic networks. As real estate markets adjust to these trends, individual building owners may need to endure dramatic and unpredictable changes in building value and income. In some cases, these strains may make it difficult for owners to assemble the financial resources necessary to invest in major capital projects. Further, beyond the pandemic’s long run economic impact, it likely derailed the timelines of a number of existing projects, exacerbating the already tight timeline facing some buildings. Without assistance targeted to support these building owners in making investments in reducing emissions, LL97 risks increasing economic strains on hard-hit buildings, making compliance even more challenging.

Recommendations

LL97’s goal of reducing building GHG emissions 80 percent by 2050 is New York City’s most ambitious step toward decarbonization. To realize this goal, the City should provide effective support and the right incentives to encourage and ensure building owners significantly reduce emissions rather than pay penalties for noncompliance. Penalties increase owners’ and likely tenants’ costs without lowering emissions.

LL97 provides DOB the opportunity to promulgate regulations such that emissions limits and alternative compliance paths are appropriately flexible, account for policy and economic circumstances not controlled by owners, and promote energy efficient use of space. To leverage this opportunity to make progress toward LL97’s goals, DOB’s choices should address the identified four barriers to successful implementation. Flexibility should not be too broad or too narrow that they insufficiently encourage changes that reduce emissions. Six recommendations that will best ensure LL97 cost effectively reduces emissions are:

1. Adjust credits appropriately for lack of renewable energy availability to encourage electrification: LL97’s long-run success depends on the conversion of fossil fuel-powered building systems to those powered by renewably-generated electricity. However, because the downstate region’s electric grid is predominantly fossil fuel-powered, owners have inadequate incentive to make these conversions. DOB can eliminate this disincentive by providing credit for electrification even before there is sufficient renewable energy available.

LL97 allows for a “credit for beneficial electrification.” This credit will provide an offset to emissions for buildings that undertake electrification, although LL97 directs the advisory board to make recommendations, and does not provide parameters for such a credit. Well-designed incentives for beneficial electrification, which refers to electrification that reduces GHG emissions, should be forward-looking, encouraging buildings to electrify building systems as systems reach the end of their lifecycles in anticipation of a cleaner downstate electric grid. As such, credits for beneficial electrification should be calculated as if the New York City electric grid was on pace to meet CLCPA targets of 70 percent renewable power by 2030 and 100 percent by 2040. Since progress is likely to lag these targets, these credits would encourage electrification and reap deeper emissions as soon as renewable energy resources begin to come online.

2. Expand allowable RECs to offshore wind and a phased-down portion of Tier 2 RECs: Allowing owners to purchase Tier 4 RECs is beneficial, but too narrow since supply is likely low and broader REC purchases could improve the flow of capital to projects that also benefit the downstate region. DOB should allow owners also to deduct from their buildings’ emissions RECs linked to offshore wind resources in downstate New York. This would both provide financing for these critical projects and increase building owners’ flexibility.

Furthermore, owners should be allowed to purchase existing Tier 2 RECs to offset a limited amount of emissions from their buildings’ total prior to the delivery of Tier 4 RECs. This would provide flexibility while preserving incentives to reduce GHG emissions. This limited approach could entail a two-phase cap—allowing buildings to deduct, for example, as much as 50 percent of the emissions by which they exceed their limits in the first compliance period, and phasing down to 30 percent of emissions above limits in the second compliance period. Further, DOB could require building owners that do use RECs to meet additional minimum standards, such as the prescriptive energy conservation measures LL97 requires buildings with rent regulated units to meet.

3. Specify, expand and continue emission limit adjustments for density and specific uses: For the first compliance period, LL97 provides adjustments for buildings with high-density occupancy, 24-hour operations, and other energy-intensive uses. However, the law does not precisely define the relevant businesses and activities, leaving it unclear how they apply to individual buildings. To improve clarity and ensure that these provisions encourage compliance, DOB should promulgate rules prior to 2023 that define parameters for all buildings, including precise metrics that define high-density occupancy and the energy-intensive uses eligible for adjustments. The latter group should include economically important activities disincentivized by existing occupancy group classifications, including restaurants and data centers. Because these uses are economically beneficial, and, in case of density, may advance citywide climate goals, these rules should continue past the first compliance period.

4. Specify and extend need-based building-level adjustments: LL97 provides compliance alternatives for emissions-intensive buildings with extenuating circumstances that make necessary retrofits cost-prohibitive. These alternative compliance paths include the purchase of offsets, adjustments to buildings’ emissions limits, and mitigation of penalties for noncompliance. While the law outlines general criteria based on financial reasonability, it does not establish clear parameters that define which buildings are eligible and the level of relief provided. This ambiguity together with the law’s aggressive timeline may pose a challenge for the owners of the buildings that need to achieve the deepest emissions reductions.

To encourage owners to begin compliance planning as soon as possible, DOB should set and publish an aggressive rulemaking timeline. Further, for these provisions to effectively support building owners in reducing emissions, DOB should provide clear parameters on eligibility and relief for LL97’s needs-based adjustments and penalty mitigations. Rather than implementing them on an ad-hoc basis or defining them so narrowly that they are not useable for relevant buildings, parameters should be defined universally and transparently with clear criteria and corresponding benefits. Penalty mitigation based on past investments and other efforts to comply should be based on a comprehensive list of eligible emissions reducing projects, each associated with a proportionate level of mitigation. Building owners should be able to determine eligibility for alternatives as-of-right, rather than through individual petitions to DOB.

Limits adjustments for eligible buildings should mirror the percentage-based reduction used by law’s first compliance period adjustments for the special circumstances. In recognition of the challenges financially strained buildings will have reducing emissions, LL97 provides adjustments to individual buildings’ emissions limits, allowing certain resource-strained buildings with emissions more than 40 percent above their limits to comply by reducing emissions to 70 percent of their 2018 levels in the first compliance period.[i] This dispensation encourages emissions-reducing investment and reduces additional financial strain, and should be expanded to LL97’s broader set of building eligible for limits adjustments. These adjustments should be accompanied by that provision’s requirements that building owners receiving relief develop a credible compliance plan and avail themselves of all relevant assistance programs.

Because deep emissions reductions from these high-need buildings will proceed over more than five years for many buildings, this alternative path should be extended to the second compliance period. Second period adjustments should update buildings’ emissions base to their adjusted first compliance period limits. From this base, buildings that are further from their emissions limits should require deeper reductions. For example, buildings with emissions more than 100 percent above first period limits should have to reduce emissions by 50 percent, while buildings that are 50 percent above limits should have to cut emissions 25 percent.

5. Allow carbon trading within an owner’s portfolio: While the fate or design of a carbon emissions trading system under LL97 is unclear, a portfolio-based trading system could be beneficial. This system would allow emissions credits to be traded within an owner’s portfolio of buildings. Building owners would be able to identify the most cost-effective emissions reductions within their portfolios, accelerating the pace of capital projects to achieve the deepest carbon savings and doing so where the cost of emission reductions per dollar invested is the lowest. Such a system could include buildings that are too small to be covered by law, but are in the same ownership portfolio, expanding the universe of possible emissions reductions. A portfolio-based carbon emissions trading system should be designed with environmental justice guardrails that ensure reductions occur across neighborhoods and emissions do not increase in economically marginalized communities.