The Cost of More Cops: A Full Accounting

On July 1 New York City began fiscal year 2016 under the de Blasio Administration’s second budget and four-year financial plan. Expenses this year add to last year’s growth, increasing 12 percent1 in fiscal year 2016 over the Bloomberg administration’s last year in office.2 Some of the growth reflects raises for the City’s workforce under the labor contracts agreed upon over the past year and a half. However, the Mayor’s new programs and initiatives also add considerably to the City’s recurring spending, largely because of the expanded City workforce. As noted in the Citizen Budget Commission’s (CBC) interactive feature, headcount is projected to increase 6 percent, or 17,850 employees, over fiscal year 2014. Their salaries will build $890 million into the City’s recurring spending, plus $270 million for healthcare and other fringe benefits, and $80 million in pension contributions, for a total of $1.2 billion.3 While such additions are affordable this year given stronger than expected revenue gains, budget gaps grow to $2.8 billion by fiscal year 2019, even in the absence of a recession. Reducing the size of the workforce quickly in the event of a downturn can require politically unpopular and managerially complex layoffs, so the recent large headcount increases could pose a risk to future fiscal health and service delivery.

One particularly costly headcount addition was a last-minute commitment to hire 1,297 new police officers and 415 new civilians in the NYPD. Such an increase to recurring spending this late in the budget cycle is unusual; final negotiations between the City Council and the Administration typically focus on Council initiatives for the coming fiscal year, with relatively minor increases to the remainder of the financial plan. Late additions do not allow for the same degree of vetting as proposals introduced earlier in the budget process. This expansion is also noteworthy because police officers have a greater budget impact than most other City employees. Although their initial salary is comparable to other City workers, their salary nearly doubles during their first five years; they also require a higher pension contribution rate than civilian employees, 20.7 percent versus 6.7 percent of payroll. Though policy makers can debate the merits of the community policing and counter-terrorism initiatives these new hires will support, it is clear the increased police force is a significant addition to the City’s long-term recurring spending. Accordingly, it is important to have an accurate accounting of that added cost.

How much will this hiring really cost?

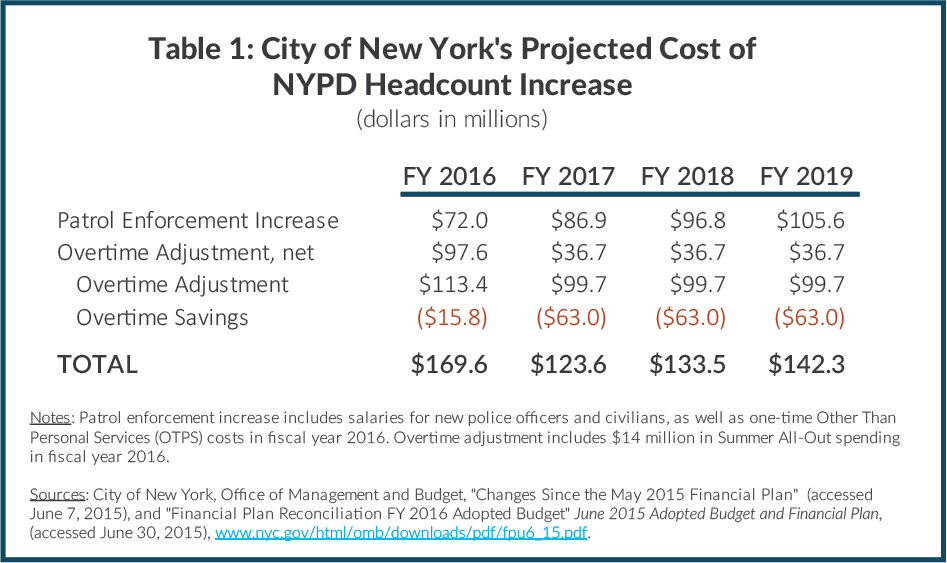

In June the City projected the new police program would increase spending by $170 million in fiscal year 2016, $124 million in fiscal year 2017, $134 million in fiscal year 2018, and $142 million in fiscal year 2019 (Table 1).4 The projections are the sum of two components: Patrol Enforcement and Overtime Adjustments. Patrol Enforcement, which includes officer and civilian salaries and one-time equipment purchases in 2016, grows from $72 million in the first year to $106 million in the final year of the financial plan. Overtime Adjustments include $14 million for the overtime-funded Summer All-Out Initiative in the first year, annual increases of $100 million to reflect more accurately historical overtime patterns, and savings from a new overtime cap of $16 million for the first year, $63 million annually in the rest of the plan years, and $70 million annually when fully phased in. Together, these adjustments make fiscal year 2016 costs appear particularly high, but subsequently reduce total costs despite scheduled salary growth.

The City’s projections do not capture the full budget impact for two reasons. First, new police officers benefit from a succession of raises, the largest of which occur after the last year of financial plan and are not depicted in Table 1.5 Second, the projections exclude the cost of generous fringe benefits, primarily health insurance and pension contributions.6

To present more accurately the new hires’ impact on the City’s recurring spending, CBC estimated their costs from fiscal year 2016 through fiscal year 2022, when the five-year longevity increases for the new hires will have taken place. The estimate includes salaries, fringe benefits including pensions, Federal Insurance Contributions Act taxes (FICA), and Metropolitan Transportation Authority (MTA) payroll taxes. It excludes overtime compensation, assuming the new officers will not add overtime expenses.

The estimated full cost of the new hires will grow from $116 million this fiscal year to $212 million in fiscal year 2022. Much of the growth is driven by the cost of the police officers’ salaries; more than half of the salary increase occurs after the last year in the four-year financial plan.7

Fringe benefits also contribute significantly to the rising costs. The City bears the full cost of health insurance premiums, which are currently $17,700 for a family plan and $7,280 for a single employee. Fringe benefits will add $26.0 million this fiscal year and $39.3 million in fiscal year 2022.

The City budgets for pension fund contributions with a two-year lag and will begin payments for the increase in NYPD personnel in fiscal year 2018. The first payment will be an estimated $14.3 million; as salaries increase the payment will grow to $19.9 million in fiscal year 2022, not including pension contributions associated with any possible overtime compensation.8

Risks

Three risks could further increase the cost of the NYPD hires. The most immediate is the outcome of the binding arbitration proceedings between the City and the police officers’ union, the Patrolmen’s Benevolent Association (PBA). The PBA rejected the 11 percent raise over seven years the City negotiated with most other uniform services unions; if it secures larger raises through arbitration, then the cost of salaries will increase, along with pension costs, FICA, and MTA payroll taxes, which are calculated as a share of salaries.

Pension costs could increase substantially if State legislators approve one of several pension sweetener bills introduced during the 2015 Legislative Session. One such bill, S5596, would enhance disability benefits for police officers and firefighters, increasing NYPD costs $35.7 million in year one, growing to $72.2 million in year five. The de Blasio Administration supported a less expensive bill, A7854A/S5705, that would increase NYPD costs $10.3 million in year one, growing to $22.9 million in year five. If reintroduced and passed, either of these bills would add to the pension costs for all uniformed workers, including the new hires.

The details of the City’s plan to enforce a new overtime cap have yet to be disclosed. If savings fall short, recurring costs could increase up to $70 million annually.

In sum, the City’s tax revenues are benefiting from strong local economic growth and can support new programs; however, the headcount additions require that revenues continue to grow faster than projected to keep the budget balanced. The new police officers are particularly expensive in future years owing to their salary growth and their high pension fund contribution rates. If the Administration expects to maintain these personnel and programs during the next economic downturn, it should seek substantial efficiencies elsewhere in the budget.

Footnotes

- The Bloomberg Administration’s last modification of the fiscal year 2014 budget was in November 2013. Spending for fiscal year 2016, as presented in the June adopted budget this year, increased 10 percent over that modification.

- Expenditures are adjusted for deposits to the Retiree Health Benefit Trust Fund and the surplus roll.

- Assumes average annual salaries of $50,000; average annual health insurance premiums of $13,532 and welfare fund contributions of $1,690; and a 9 percent annual pension contribution rate. Pension contributions for new hires begin after two years; this estimate includes them to show long-term recurring expenses.

- Office of Management and Budget, “Changes Since the May 2015 Financial Plan” (June 7, 2015), www.nyc.gov/html/omb/downloads/pdf/fpu6_15.pdf.

- Under the current salary schedule, total pay for a Police Academy graduate increases 96 percent after five years of service, from $46,288 to $90,829. Total pay includes base pay, uniform allowance, longevity pay, holiday pay, and average night differential. City of New York, Police Department, “Benefits & Salary Overview” (accessed June 26, 2015), www.nypdrecruit.com/benefits-salary/overview.

- The adopted budget reflects these costs but they are lumped in with total fringe and pension benefit costs for all City workers.

- CBC staff analysis, see: City of New York, Police Department, “Benefits & Salary Overview” June 2015 Adopted Budget and Financial Plan, (accessed June 26, 2015), www.nypdrecruit.com/benefits-salary/overview.

- CBC’s estimate does not include the future liability for retirement benefits other than cash pension payments, primarily retiree health insurance benefits, known as Other Post Employment Benefits (OPEB). Unlike pension fund contributions necessary to fund future pension benefits, OPEB costs are not constitutionally guaranteed and therefore not required to be counted as current expenses in the budget and financial plan; however, the actuarial value of these benefits are required to be disclosed and reported.