Federal Aid—Needed, But Unlikely to Solve New York State’s and New York City’s Fiscal Problems

A Look Back at Stimulus Funding During the Great Recession

Optimism about the prospects of federal aid for state and local governments has increased since the presidential election; however, New York State and City have budget gaps so wide and face risks so substantial that even with considerable additional federal aid the State and City still will have to implement significant actions to stabilize their finances in the long run. Together, State and City budget gaps total $73.3 billion over four years. If federal aid ultimately relieves the same portion of these gaps as in the “Great Recession,” the State and City still will have to implement gap closing actions totaling $57 billion. Federal aid may well be greater this time, but is unlikely to solve the whole problem. State and City leaders should act with urgency to develop and implement credible fiscal stability plans.

New York State

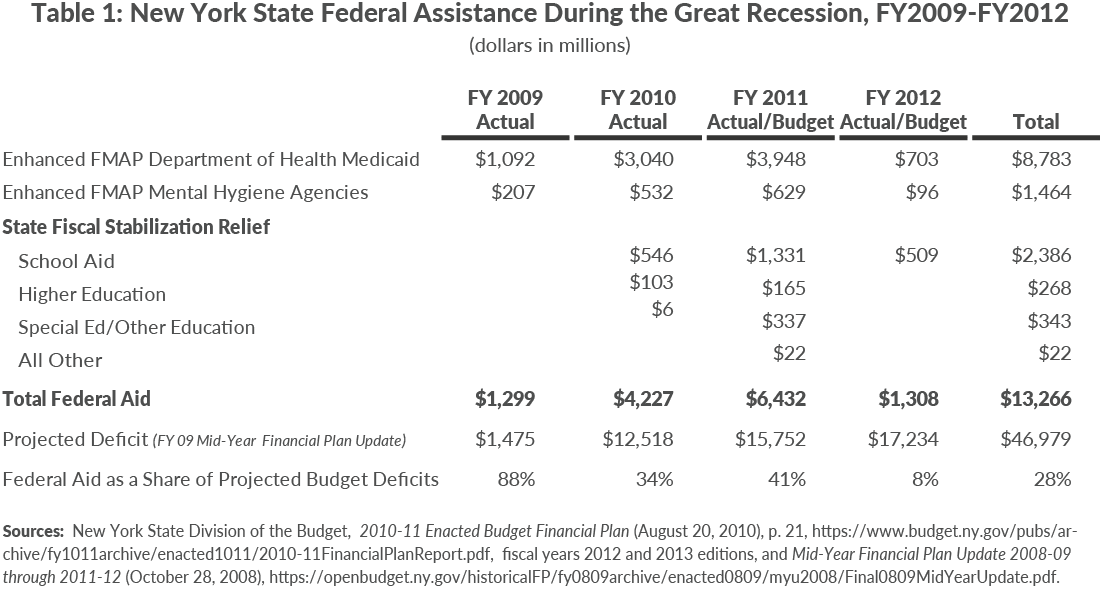

During and following the Great Recession, the federal government provided New York State with approximately $13.3 billion in fiscal relief between fiscal years 2009 and 2012. Two-thirds of this was additional reimbursement for Medicaid that offset State spending. While substantial, federal aid only offset 28 percent of the $47 billion four-year projected cumulative budget gap.1 (See Table 1).

The most recent State financial plan projects a $60.1 billion four-year deficit. This includes approximately $10 billion already provided by the federal government, including $4 billion in fiscal relief (approximately $3 billion in enhanced Medicaid funding and $1 billion in education aid) and $6 billion to support the COVID-19 response, some of which provided fiscal relief as well.

If federal aid provides a similar share of relief as in the Great Recession—which would total $18 billion—the State still would have to implement gap-closing measures totaling $46 billion over the four-year financial plan.2 While federal aid during this recession may be much higher than during the Great Recession, in part due to funding for disaster relief, the shortfall would still likely be significant. Furthermore, the MTA has great needs that will likely add to the State’s fiscal stress if the federal government does not provide it significant aid as well.

New York City

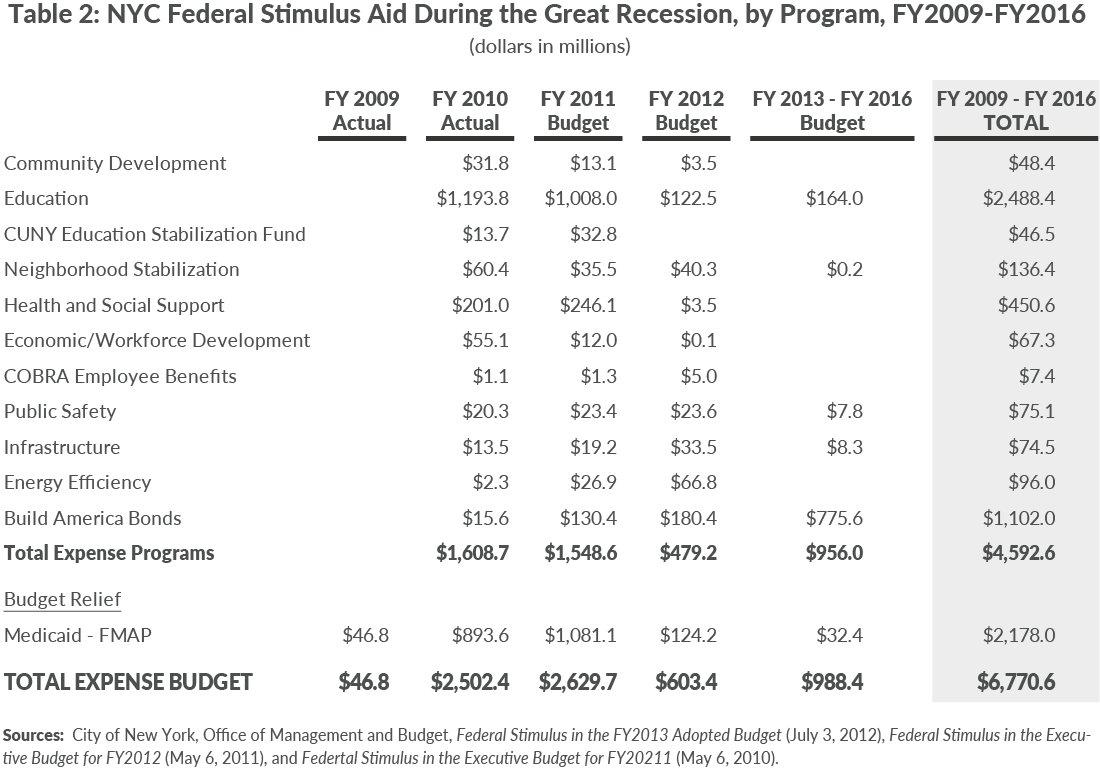

Between fiscal years 2009 and 2012, the federal government provided New York City with an estimated $5.8 billion in federal fiscal relief; an additional $1.0 billion in federal stimulus funding was received between fiscal years 2013 and 2016, bringing total aid to $6.8 billion.3 (See Table 2). The majority of the aid was for education ($2.5 billion) and increased Medicaid reimbursement ($2.2 billion). The subsidy on Build America Bonds was expected to save the City $1.1 billion in interest costs. (An additional $2.1 billion in capital support was also provided between fiscal years 2009 and 2016.) While substantial, federal funds only offset 18 percent of the budget gaps between fiscal year 2009 and 2012. Federal aid during the Great Recession did not include disaster relief funding, which could increase federal support during the pandemic.4

The November 2020 Financial Plan, adjusted for still unspecified labor savings, projects a four-year gap of $13.2 billion; the adjusted gap for fiscal year 2022, which must be closed by the release of the Preliminary Budget in January 2021, is $4.8 billion.5 The City expects to receive approximately $6.6 billion in federal funding in fiscal years 2020 and 2021, including approximately $740 million in enhanced Medicaid funding, $3.1 billion from the Coronavirus Aid, Relief, and Economic Security (CARES) Act, and $2.7 billion in Federal Emergency Management Agency (FEMA) funding to support the COVID-19 response. Of this federal aid, $1.9 billion provided about one-fifth of the resources being to balance fiscal years 2020 and 2021.6

If additional federal aid provides a similar share of relief as the Great Recession – which would total $2.6 billion -- the City still would have to implement $10.6 billion in gap closing measures from now through January 2024.7 The City faces additional fiscal risk of substantial State budget reductions, which could add billions of dollars to the City gaps.

Footnotes

- New York State Division of the Budget, 2010-11 Enacted Budget Financial Plan (August 20, 2010), p. 21, https://www.budget.ny.gov/pubs/archive/fy1011archive/enacted1011/2010-11FinancialPlanReport.pdf, fiscal years 2012 and 2013 editions, and Mid-Year Financial Plan Update 2008-09 through 2011-12 (October 28, 2008), https://openbudget.ny.gov/historicalFP/fy0809archive/enacted0809/myu2008/Final0809MidYearUpdate.pdf.

- This assumed total relief equal to 28 percent of the budget gaps and that $4 billion of that relief has already been received.

- The June 2012 Stimulus Report provided budgeted figures for fiscal year 2011 through 2016. The estimate of federal stimulus funding reported there is 99.5 percent of the stimulus funds expended per the NYC Stimulus Tracker.

- Following Superstorm Sandy on October 12, 2012, the City received about $7.2 billion in Federal Emergency Management Agency (FEMA) Public Assistance funds between fiscal years 2013 and 2016. FEMA aid following the terrorist attack of September 11, 2001 was about $6.0 billion. See: Office of the New York City Comptroller, Comprehensive Annual Finance Reports for the Fiscal Year Ended June 30, 2013 (October 31, 2013), and fiscal years 2014-2016 editions, https://comptroller.nyc.gov/reports/comprehensive-annual-financial-reports/; and Eric Anderson, The Aftermath: Federal Aid 10 Years After the World Trade Center Attack, New York City Independent Budget Office, (August 2011), https://ibo.nyc.ny.us/iboreports/wtc2011.pdf.

- The November 2020 Financial Plan gaps for fiscal years 2022 through 2024 were $9.8 billion. CBC adjusted these to include $3 billion in labor savings in those years that had yet to be specified, and $340 million in unspecified labor savings in fiscal year 2021, bringing the total gaps to $13.2 billion.

- Ana Champeny, “NYC FY2021 Adopted Budget: Short Term Balance, Long-Term Challenge,” Citizens Budget Commission Blog (July 21, 2020), https://cbcny.org/research/nyc-fy2021-adopted-budget.

- This assumed total relief equal to 18 percent of the $13.2 billion in gaps currently faced by the City.