Medicaid Supplemental Payments

The Alphabet Soup of Programs Sustaining Ailing Hospitals Faces Risks and Needs Reform

The national debate over the future of Obamacare highlights the important role Medicaid plays in providing health insurance for low-income Americans. In New York about 6.1 million people—roughly one of every three residents—rely on the program for health coverage. An often ignored element of Medicaid is its “supplemental payments,” money paid to hospitals and other providers not directly in exchange for giving care to Medicaid enrollees, but as institutional support to help deal with fiscal stress arising from care given to the indigent. This policy brief explains four important points about Medicaid supplemental payments in New York State:

- Four separate programs provide $5 billion in supplemental payments annually, comprising about 1 of every 14 Medicaid dollars.

- Supplemental payments are important to the financial health of many hospitals; all of the State’s 179 hospitals receive some payments, and the funds are especially critical for 30 hospitals including New York City’s municipal hospitals, public hospitals affiliated with five counties, SUNY Downstate Medical, and 14 voluntary hospitals for which supplementary payments are at least 5 percent of operating revenues and which still incur operating losses.

- Supplemental payments will shrink in the near future due largely to federal policy, and the impact will be most severe for New York City municipal hospitals; these institutions are slated to bear the brunt of approximately $370 million in net annual cuts in 2018.

- The State can revise the distribution of reduced federal funding for supplemental payments to make the impact of future federal cuts more equitable.

The Alphabet Soup of Programs

The four supplemental payment programs each have an acronym, yielding an alphabet soup of names. The names are: Disproportionate Share Hospital (DSH) program; Upper Payment Limit (UPL) program Vital Access Provider Assurance Program (VAPAP) ; Value-Based Payment Quality Improvement Program (VBP QIP).

The Disproportionate Share Hospital (DSH) Program

DSH is the largest and most complex of the supplemental payment programs, comprising $3.6 billion of the $5 billion in total payments.1 DSH payments are made to hospitals to cover losses incurred for serving uninsured patients and Medicaid patients; hospitals serving large shares of Medicaid patients are financially disadvantaged because Medicaid payments are often less than the cost to deliver services.2

Like most Medicaid payments, DSH payments are made with 50 percent federal funds and 50 percent nonfederal funds. The nonfederal share is funded by either the State or the local government affiliated with a hospital. The amount available for each state is set in federal law, based largely on historical patterns of payment in effect when a federal cap was imposed on the program in 1993. Currently New York State’s allotment is the largest in dollar amount among the 50 states, but it ranks seventh in terms of DSH payments as share of total state Medicaid spending.3

Federal rules give the states substantial discretion in how they may distribute the funds among hospitals. To be eligible a hospital must provide at least 1 percent of its services to Medicaid enrollees and cannot receive payments in excess of its “Medicaid shortfall,” defined as the cost of uncompensated care and the difference between Medicaid payments and the cost of providing care to Medicaid enrollees; hospitals with a high volume of Medicaid use must receive some DSH payment.4 Federal rules also limit the amount of DSH payments to State mental hospitals.5

New York State has designed a complicated method for allocating its federal DSH funds. The system reflects these priorities:6

- First preference is given to institutions run by State government and requiring funding in the State budget. This means the State mental hospitals receive the full amount allowed by federal law, currently $605 million annually. The three State hospitals operated in conjunction with medical schools at the State University system receive the full amounts for which they are eligible, about $340 million annually. Since these DSH payments are funded 50 percent with federal funds and 50 percent with State revenues, this part of the DSH program effectively reduces the State’s share of funding for its mental and university hospitals by about $473 million annually and replaces these funds with federal aid.7

- Second preference is given to voluntary hospitals, which are guaranteed $995 million annually. This sum is divided among the hospitals in proportion to their share of the total Medicaid shortfall, but adjustments have been made in each year to protect individual hospitals from large annual losses. In the aggregate for voluntary hospitals, DSH payments cover 24 percent of their Medicaid shortfall. The nonfederal portion of these DSH payments is funded with a State tax on some hospital revenues; this means the hospitals as a group are funding the nonfederal share, but redistribution occurs among the hospitals based on their role in providing care to the indigent.8

- Third preference is given to county hospitals outside of New York City. These institutions, including large facilities in Nassau, Westchester, and Erie, receive the full amount of their Medicaid shortfall, currently about $300 million annually. However, the nonfederal portion of these payments must be funded locally; thus, the net payment to the hospital is actually only half the Medicaid shortfall.

- Lowest priority is given to the municipal hospitals operated by the NYC Health + Hospitals (H+H). These facilities are allocated the remaining DSH funds, about $1.5 billion. Because New York City supports the nonfederal share of payments for the majority of its DSH payments, the net payment to H+H hospitals is approximately $800 million, or 56 percent of need.9

The Upper Payment Limit (UPL) Program

While the DSH program fully covers the Medicaid shortfall for State university hospitals and county hospitals, voluntary hospitals and H+H hospitals face a remaining shortfall. The UPL program addresses these needs.

Federal law authorizes—but does not require—states to make payments to hospitals to cover the difference between the Medicaid payment for services and the amount the federal Medicare program would pay for those services. The maximum amount a state can spend is set separately for public and private hospitals and for types of services.

In New York State UPL payments are authorized for voluntary hospitals for inpatient services and H+H hospitals for inpatient and outpatient services. The combined authorization for 2016 is estimated at $811 million annually with $247 million for voluntary hospitals and $563 million for H+H hospitals.10 Generally the payments are distributed in proportion to Medicaid service volume. The UPL payments to H+H are financed half by federal funds and half by funds from New York City on behalf of H+H. Thus the net gain to H+H from the UPL payments is $282 million rather than $563 million.

The funding of voluntary UPL payments is more complex due to its links to voluntary DSH payments. The nonfederal portion of the voluntary UPL payments is technically paid from the State General Fund; however, these UPL payments are credited against the $995 million voluntary hospital DSH allocation.11 Using the 2015 figures as an illustration, voluntary hospitals do not receive an additional $247 million due to UPL payments, but those hospitals receive the same total amount of $995 million with $247 million from UPL payments and $748 million in DSH payments. This reduction in voluntary DSH payments is important because more federal funding is made available for other DSH payments as a result. Given the hierarchy of payments in the DSH program, the impact is to make available additional federal funds for H+H DSH payments; but, H+H must fund the nonfederal portion of these DSH payments from its own sources. Using the 2015 illustration, H+H receives an additional $123.5 million in net DSH payments, the federal share of the $247 million.

The Vital Access Provider Assurance Program (VAPAP) and Value-Based Payment Quality Improvement Program (VBP QIP)

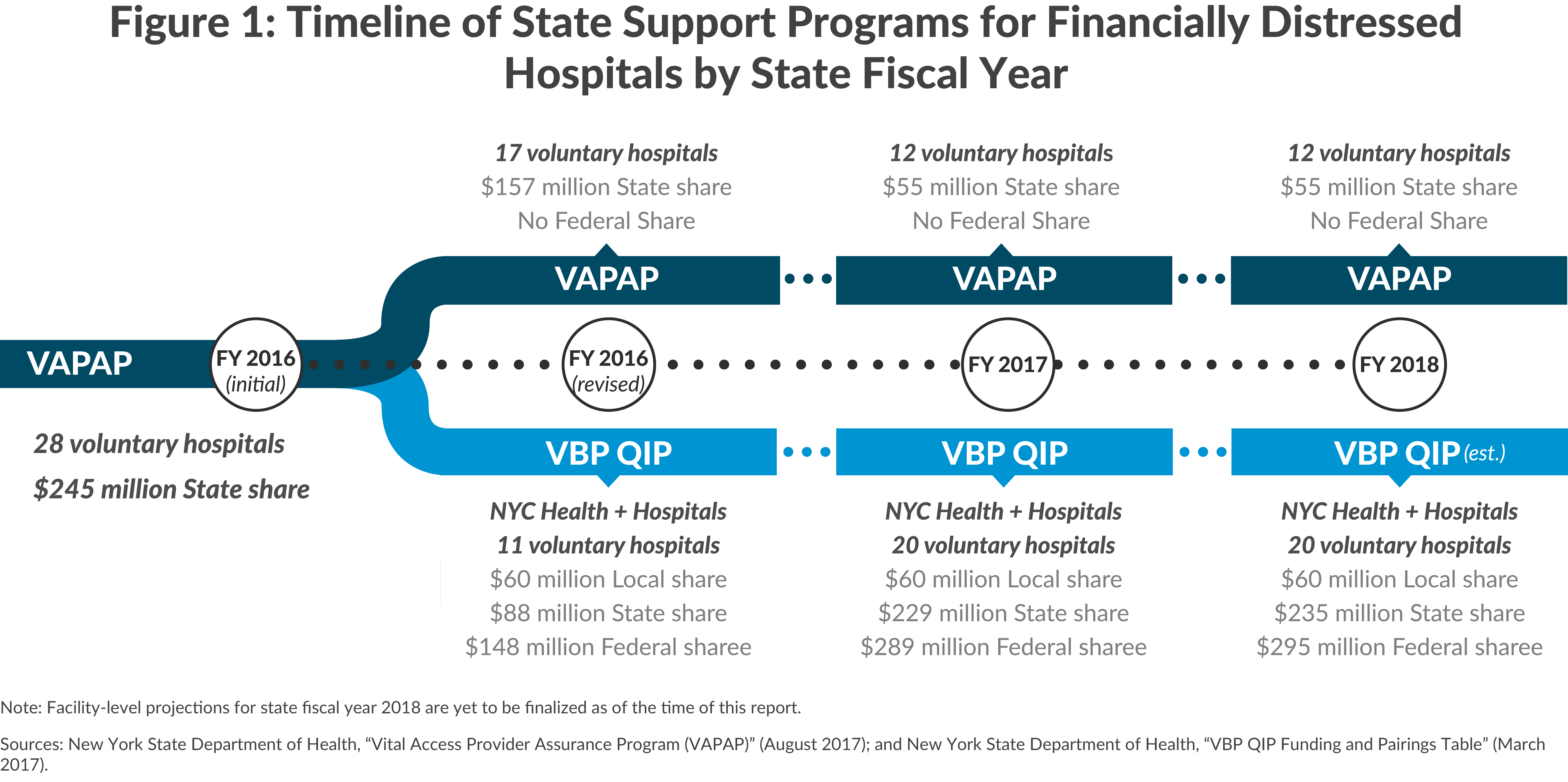

VAPAP was created in March of 2015 as part of the fiscal year 2016 enacted State budget as a program to help financially distressed hospitals. The initial design authorized payments in fiscal year 2016 of up to $245 million for 28 voluntary hospitals deemed in need. The program was funded entirely from the State’s General Fund with no federal financial participation.12 Just two months after VAPAP launched, it was significantly modified in response to two pressures.

First, an effort was made to use the State funds to leverage federal funds. In May 2015, VBP QIP was created, and the largest financially distressed hospitals were shifted from VAPAP to VBP QIP. Payments to these hospitals were made eligible for federal reimbursement under Medicaid by linking the payments to progress toward hospitals using “value-based payments” (VBP).

VBP is a long-term goal of federal and state policy because it improves quality of care by allowing insurers and providers to share in both risk and savings from quality improvements, rather than making payments based solely on volume of service. Because VBP arrangements are between insurers (or managed care organizations) and hospitals, VBP QIP payments are added into the rates the state pays managed care plans. Managed care plans then pass the funding on to hospitals. In this way the payments qualify for federal reimbursement, but also are subject to review by federal officials.

Initially 11 of the 28 hospitals in VAPAP were transferred to VBP QIP, and the roster has since grown to 20 voluntary hospitals. (See Figure 1.) State funding for VBP QIP has grown to $235 million in fiscal year 2018, generating another $235 million in federal funds, providing a total of $470 million for the voluntary hospitals. The State determines how the funds are distributed among qualifying hospitals; about half of the total is allocated to four Brooklyn Hospitals: Brookdale, Interfaith, Kingsbrook, and Wyckoff Heights.13 These four hospitals were recently the subject of a study to determine how best to reform health care delivery in Brooklyn.14

Second, while VAPAP was restricted to voluntary hospitals, H+H hospitals sought additional funds by seeking eligibility under VBP QIP. This was arranged by having H+H provide the nonfederal share of the payments, enabling it to qualify for an additional $60 million in federal funds.

VAPAP remains as a relatively small program serving financially distressed voluntary hospitals that are too small to have arrangements with managed care plans that could qualify for the VBP QIP program. VAPAP has also recently been used as an emergency resource for hospitals that also receive funding through VBP QIP. For example, in February and March of 2017 the State approved $30 million in VAPAP funding to three large hospitals (Interfaith, St. John’s Episcopal, and Wyckoff Heights). Altogether hospitals receive approximately $55 million annually from VAPAP coming exclusively from State funds.15 Combined, VAPAP and VBP QIP will disburse approximately $645 million annually going forward.

For 2016 total supplemental payments reached approximately $5 billion, with $3.6 billion from DSH payments, $811 million from UPL payments, and $535 million from VAPAP and VPB QIP.

Medicaid supplemental payments play an important role is sustaining many hospitals that otherwise would suffer severe financial distress and face possible closure. All of the State’s 179 hospitals receive some supplemental payment.16 Among these hospitals the role of the supplemental payments varies in importance, but for many they are vital.

Critical in their dependence on these payments are the four voluntary hospitals in Brooklyn that have received the most favorable treatment under VBP QIP. Collectively these institutions receive $314 million in supplemental payments including $249 million from VBP QIP, $52 million in DSH payments, and $13 million from the UPL program. The combined payments exceed the cost attributable to uncompensated care and inadequate Medicaid rates, yet all four hospitals are currently reporting operating losses. The unusually generous treatment is justified as a temporary measure to help stabilize the hospitals and assist in a transformation to long-term stability.

H+H hospitals also are heavily reliant on supplementary payments. They receive a total of $2.2 billion, but almost half of that sum is funds provided by New York City so the net gain is a lower $1.1 billion. Nonetheless the smaller sum represents about 76 percent of their costs attributable to uncompensated care and inadequate Medicaid rates. While H+H still incurs an operating loss, the red ink would be far worse without the supplemental payments.

Six county hospitals receive $375 million in supplemental payments, but three large ones are particularly dependent on these funds. Together the Erie, Nassau, and Westchester county facilities account for $344 million. Net of local government funding, this sum covers about 79 percent of the hospitals’ collective costs for uncompensated care and inadequate Medicaid rates; these hospitals still incur net operating losses but would be in far worse shape without supplemental funds.

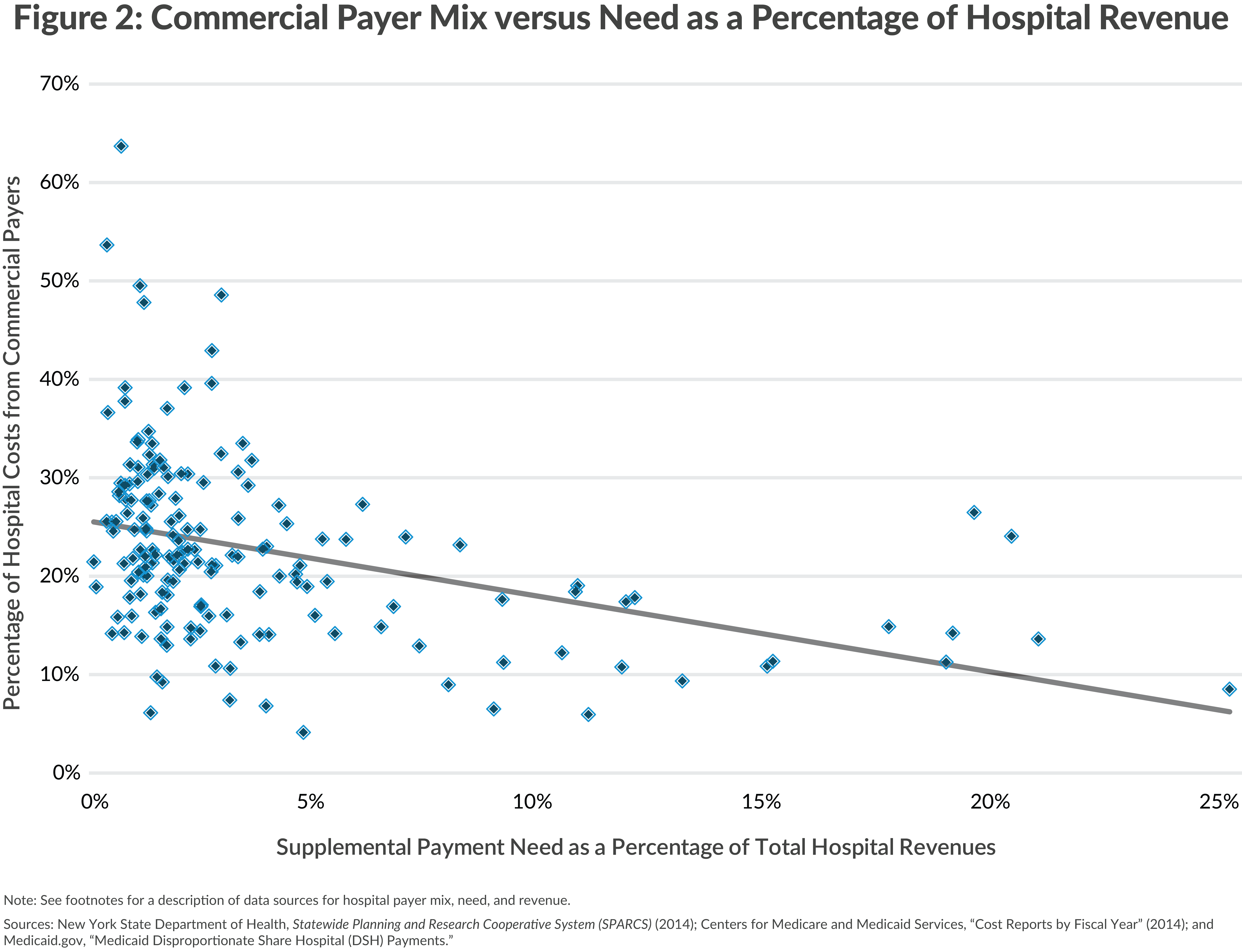

Excluding the four previously noted Brooklyn hospitals, the remaining 167 voluntary institutions receive a total of $1.1 billion in supplementary payments. In the aggregate this represents 41 percent of costs attributed to uncompensated care and inadequate Medicaid rates.17 Many of the voluntary hospitals can offset losses in other ways, notably by negotiating rates with commercial insurance companies that exceed costs and provide a cross-subsidy for uncompensated and Medicaid services.18 However, the hospitals with the greatest need for cross-subsidy have the least potential. As shown in Figure 2, the hospitals with the most need due to uncompensated and Medicaid costs receive the smallest share of their revenue from commercial insurance.19

The voluntary hospitals likely to be most strongly dependent on supplementary payments are those incurring operating losses and relying on supplementary payments for a significant share of operating revenues. Fourteen voluntary hospitals with operating losses (including the four Brooklyn hospitals noted earlier) derive at least 5 percent of their total revenues from supplementary payments.

Looming Reductions in Supplementary Payments Will Jeopardize Some Hospitals

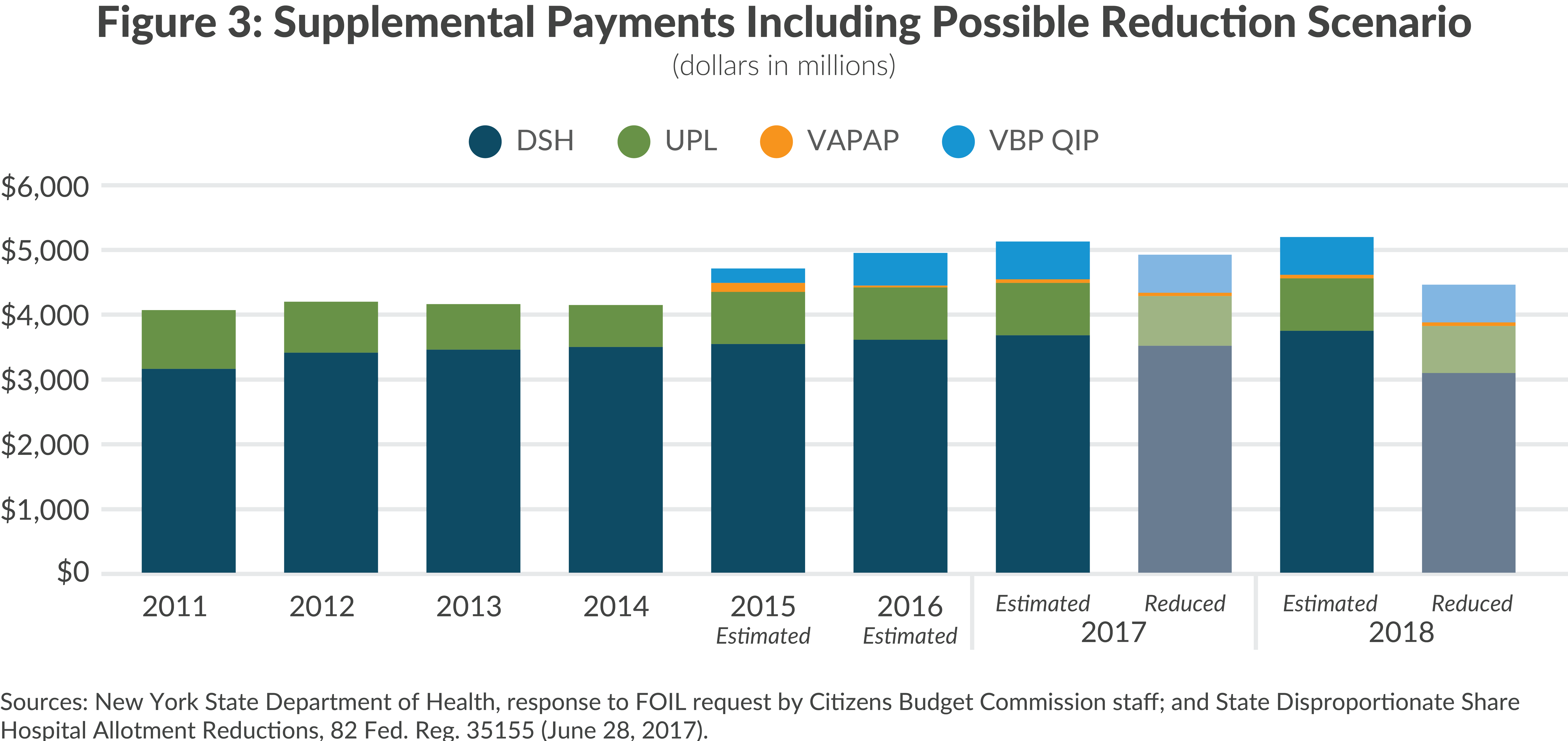

As shown in Figure 3, the recent trend has been an increase in supplemental payments. From 2011 to 2017 total payments increased from $4.1 billion to more than $5 billion, due to slow but steady increases in DSH payments and creation of VAPAP and VBP QIP. The UPL payments fluctuate due to their unpredictable nature; hospitals do not know their volume of Medicaid services in advance and estimated payments are adjusted based on subsequent reviews and audits of previous years. However, the underlying trend is a reduction in UPL payments because fewer Medicaid services are paid on a fee-for-service basis and more through managed care plan arrangements. This means lower volumes of revenue qualify for UPL payments even though total Medicaid services may not be declining. In the 2011 to 2017 period this trend may have been offset somewhat by growing Medicaid enrollment, but the decline in Medicaid fee-for-service payments is likely to be the persistent trend.

Each of the programs may shrink in coming years. The drop in Medicaid fee-for-service payments noted above will reduce the scale of UPL payments. A reasonable projection is 5 percent annual declines, creating a drop of approximately $38 million from $770 million in 2017 to $732 million in 2018.

The Affordable Care Act (ACA) reduced DSH payments because the uninsured population was expected to decrease under that legislation. Initial reductions to DSH payments were to begin in federal fiscal year 2014, but were delayed until federal fiscal year 2018. Nationwide DSH payments are currently scheduled to decrease $2 billion—one-sixth of the nation’s $12 billion federal DSH budget. The projected impact on New York is a loss of approximately $659 million.20

The size of VAPAP and VBP QIP is determined primarily by the State. In the longer term the programs are intended to be transitional, altering the structure of care in Brooklyn and moving the nature of hospital payments toward VBP. But the shorter term prospect is for continued need. The scenario in Figure 3 assumes a steady level of funding for these programs, although they could be cut if the State faces fiscal pressures and seeks to reduce its commitment. Based on steady funding for these programs, a 5 percent reduction in UPL payments, and a $659 million DSH cut, the total reduction in supplemental payments would be $697 million.

This cut would not affect all hospitals equally. Given the State policies for allocating supplemental payments, nearly all of the reduction is likely to be in payments to H+H.

H+H will be affected by the UPL reductions in two ways. First, lower UPL margins at H+H will mean lower UPL direct payments. Second, reductions in UPL payments to voluntary hospitals will lower DSH payments to H+H because of the link between the two programs described earlier. Voluntary hospitals are assured $995 million in combined DSH and UPL payments; a loss in UPL payments will increase their DSH payments and reduce the federal DSH funding available to H+H.

Similarly the reduction in total DSH will fall exclusively on H+H. The State will retain the funds for its mental hospitals and university hospitals; the voluntary institutions are assured their share, and other local public hospitals also have greater priority than H+H. In addition, DSH need at the State University hospitals has been temporarily increasing as losses related to the acquisition of Long Island College Hospital (LICH) are reconciled; the State has increased DSH payments to it, thereby reducing funding available to H+H.21

New Priorities Needed to Promote Equity

The looming cuts in supplementary payments point to a grim outlook for H+H in particular. Its leaders already recognize this; in a 2016 report H+H projected receipts from supplemental payments will fall 36 percent from $2.2 billion in fiscal year 2016 to just $1.4 billion in fiscal year 2020.22 H+H is developing responses to its challenges including greater efficiencies and efforts to secure offsetting intergovernmental revenues, but cuts in services important to New York residents could also be a consequence.

The State should reconsider its priorities in distributing Medicaid supplemental payments. The fixed size of available federal funding means that redirection to H+H comes at the expense of other institutions. Pending cuts should not fall only on H+H, and adjustments, such as reduced payments to voluntary hospitals with limited reliance on supplementary payments, may be needed.

Footnotes

- Numbers in the text and figures may not add up to totals because of rounding.

- See: American Hospital Association, “Table 4.4: Aggregate Hospital Payment-to-Cost Ratios for Private Payers, Medicare and Medicaid, 1994-2014” (accessed May 1, 2017), www.aha.org/research/reports/tw/chartbook/2016/table4-4.pdf; and Kaiser Family Foundation, Understanding Medicaid Hospital Payments and the Impact of Recent Policy Changes (June 2016), http://files.kff.org/attachment/issue-brief-understanding-medicaid-hospital-payments-and-the-impact-of-recent-policy-changes.

- Medicaid and CHIP Payment and Access Commission, Report to Congress on Medicaid Disproportionate Share Hospital Payments (February 2016), Figure 1-1, p. 8 and Table B-1, pp. 61-62. www.macpac.gov/wp-content/uploads/2016/01/Report-to-Congress-on-Medicaid-DSH.pdf

- High volume is defined as at least 25 percent of services or a share at least one standard deviation above the mean for the state.

- This practice is consistent with restrictions on regular Medicaid payments for patients of these hospitals aged 21-64. The limit is 33 percent of the state’s DSH payments or the amount paid to these hospitals in fiscal year 1995.

- DSH allocations flow through three payment channels outlined in State law and the Medicaid State Plan. See: §2807-k of the Public Health Law, §2807-c of the Public Health Law, §211 and §212 of Chapter 474 of the Laws of 1996; and New York State Department of Health, State Plan Under Title XIX of the Social Security Act Medical Assistance Program (accessed August 8, 2017 ), pp. 1,216-1,329, www.hcrapools.org/medicaid_state_plan/DOH_PDF_PROD/nys_medicaid_state_plan.pdf.

- Projected DSH payments for 2016 are used in this analysis. Because DSH payments are initially made and then reconciled following audits, payments for years 2015 through 2018 remain estimates until finalized. Data for hospital need is based on the most recent published estimated DSH caps for each available facility. See: Medicaid.gov, “Medicaid Disproportionate Share Hospital (DSH) Payments” (accessed June 26, 2017), www.medicaid.gov/medicaid/financing-and-reimbursement/dsh/index.html.

- The DSH Indigent Care Pool for voluntary hospitals is funded via Health Care Reform Act (HCRA) assessments. See New York State Division of the Budget, FY 2018 Enacted Budget Financial Plan (May 2017), p. 109, www.budget.ny.gov/pubs/archive/fy18archive/enactedfy18/FY2018EnactedFP.pdf.

- The only State funding contributed for supplemental payments to H+H is through the Indigent Care Pool, a portion of the DSH program which uses funds from HCRA Fund to support the nonfederal share of Indigent Care Pool payments for all hospitals statewide. This represents approximately $50 million annually for H+H.

- Estimate is based on $439 million for H+H Inpatient UPL for 2015, $123 million for H+H Outpatient UPL for 2014, and $274 million for the Voluntary Hospital UPL. Data provided by the New York State Department of Health subject to a Freedom of Information Law request submitted by CBC staff.

- Although the nonfederal share of voluntary UPL payments is technically made from the State General Fund, the reduced nonfederal share of the DSH payments comes from a dedicated tax on some hospital revenues. The reduced amount required from the dedicated tax is transferred to the General Fund. Thus the nonfederal UPL share is, in effect, financed by the dedicated tax rather than other General Fund revenues.

- New York State Department of Health, VAPAP Transformational Plan Training Conference (July 21, 2015), www.totalwebcasting.com/view/?id=nysdoh.

- New York State Department of Health, “VBP QIP Funding and Pairings Tables” (March 2017), www.health.ny.gov/health_care/medicaid/redesign/dsrip/vbp_initiatives/funding-pairings.htm

- The Brooklyn Study will help inform a $700 million transformation project to be undertaken with capital resources provided by New York State. See Northwell Health, The Brooklyn Study: Reshaping the Future of Healthcare (October 2016), www.northwell.edu/sites/northwell/files/20830-Brooklyn-Healthcare-Transformation-Study_0.pdf.

- New York State Department of Health, “Vital Access Provider Assurance Program (VAPAP)” (August 2017), www.health.ny.gov/health_care/medicaid/redesign/dsrip/vapap/.

- Number of hospitals is from New York State Department of Health, “New York State Health Care Reform Act (HCRA)” (updated July 1, 2017), www.health.ny.gov/regulations/hcra/provider/provhosp.htm; and hospital- specific supplemental payment amounts are from data supplied by the New York State Department of Health in response to a Freedom of Information Law request by CBC staff.

- The share of need met from supplemental payments for voluntary hospitals is less than that for H+H hospitals. This may appear to contradict findings in other reports. See: Roosa Tikkanen, Funding Charity Care in New York: An Examination of Indigent Care Pool Allocations (New York State Health Foundation, March 2017), p. 16, http://nyshealthfoundation.org/uploads/resources/examination-of-indigent-care-pool-allocation-march-2017.pdf. The apparent conflict is resolved by the fact that data here cover all supplemental payments; data in the other report covers only DSH payments from the Indigent Care Pool and not the other payments. The Indigent Care Pool comprises only about $1 billion of the $5 billion total.

- See: New York State Health Foundation, Why Are Hospital Prices Different? An Explanation of New York Hospital Reimbursement (December 2016), p. 6, http://nyshealthfoundation.org/uploads/resources/an-examination-of-new-york-hospital-reimbursement-dec-2016.pdf.

- Data on payer mix is from the New York State Department of Health’s Statewide Planning and Research Cooperative System (SPARCS) for 2014. See: New York State Department of Health, “Health Data Query System” (accessed June 26, 2017), https://apps.health.ny.gov/pubdoh/sparcsqry/GetSystemType.do; and data for hospital revenue is from Centers for Medicare and Medicaid Services, “Cost Reports by Fiscal Year” Hospital Report 2552-10, Report Year 2014 (accessed June 26, 2017), www.cms.gov/Research-Statistics-Data-and-Systems/Downloadable-Public-Use-Files/Cost-Reports/Cost-Reports-by-Fiscal-Year.html.

- Medicaid Program: State Disproportionate Share Hospital Allotment Reductions, 82 Fed. Reg. 35155 (June 28, 2017).

- Testimony of Jason Helgerson, Medicaid Director, New York State Department of Health, before the Joint Legislative Public Hearing on 2017-2018 Executive Budget Proposal on Health/Medicaid (February 16, 2017), www.nysenate.gov/calendar/public-hearings/february-16-2017/joint-legislative-public-hearing-2017-2018-executive.

- New York City, One New York – Healthcare for our Neighborhoods (April 26, 2016), p. 26, www1.nyc.gov/assets/home/downloads/pdf/reports/2016/Health-and-Hospitals-Report.pdf.