New York State Budget (Actually) Grows at 2 Percent, Assuming $2.5 Billion in Medicaid Savings Realized

Governor Andrew Cuomo has set a 2 percent spending growth benchmark for State Operating Funds (SOF); however, in the last few years, spending has grown in excess of 2 percent. The Executive Budget for Fiscal Year 2021 does, in fact, hold spending growth below 2 percent; however, it is dependent on $2.5 billion in Medicaid savings that have yet to be identified.1 The Governor has convened the Medicaid Redesign Team to identify plans to reduce spending by this amount, stipulating that the State will make across the board cuts if the target is not met. Absent these savings SOF spending would increase 4.2 percent.

State Operating Funds Spending Trends

SOF spending includes disbursements for state operations, local aid, and debt service supported by State revenues. It excludes federal funds, over which the State has little control, and capital investments, which are separately reported and best evaluated over a longer period of time. Accordingly, it is the best measure of State spending choices and has been the focus of spending control under Governor Cuomo.

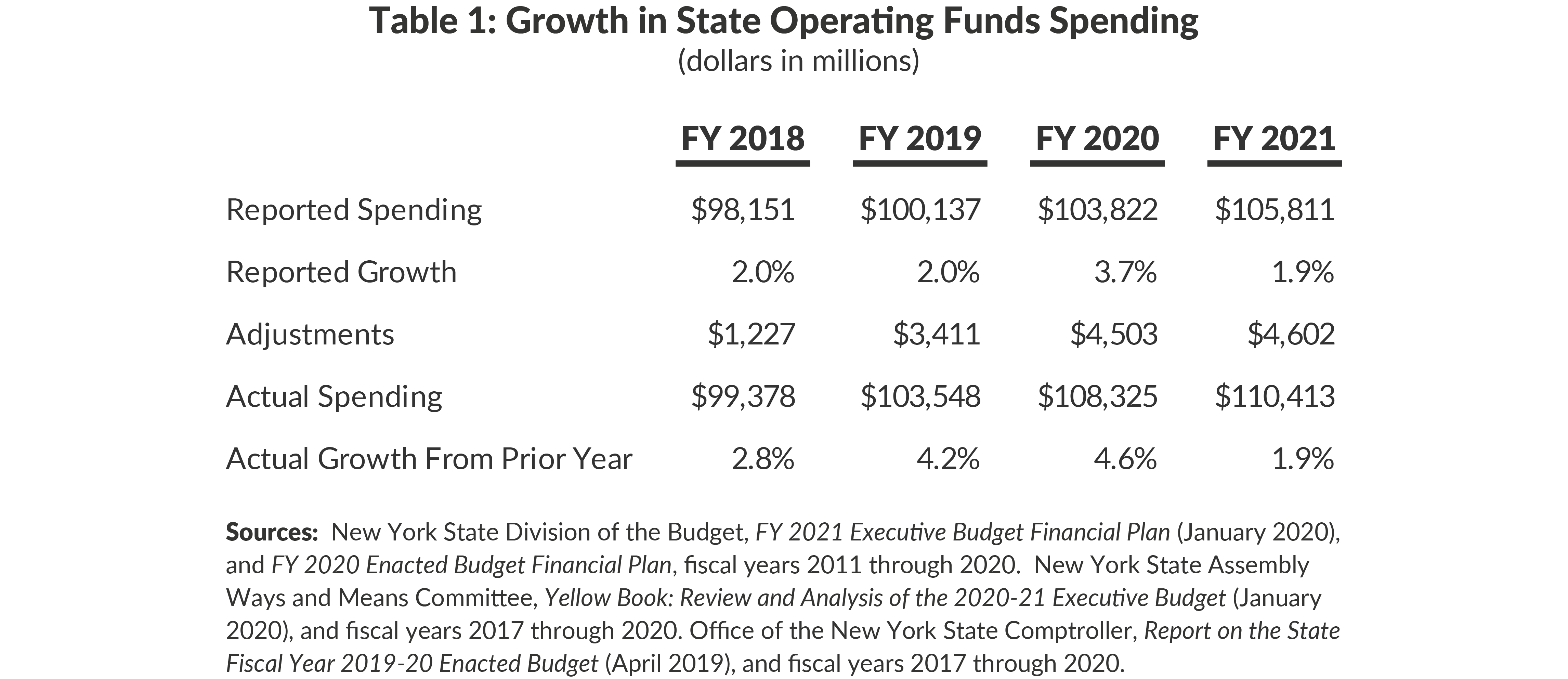

Early in Governor Cuomo’s tenure, New York implemented important spending reforms to Medicaid, public pensions, and employee and retiree health insurance, while keeping agency spending mostly flat. These measures were sufficient to keep SOF growth to 2 percent or less until fiscal year 2018. CBC calculates that SOF spending increased 2.8 percent in fiscal year 2018, 4.2 percent in fiscal year 2019, and 4.6 percent in fiscal year 2020. If the State had actually held spending growth to 2 percent annually since fiscal year 2017, the fiscal year 2021 budget would be $6.2 billion lower. (See Table 1.)

To derive these figures, CBC adjusts spending as reported by the Division of Budget (DOB) to provide a more accurate picture of annual spending by accounting for:

- cash disbursements shifting between fiscal years;

- items previously categorized as state operating spending shifting to off-budget accounts; and

- reclassification of other spending items.

The New York State Division of the Budget (DOB) acknowledges SOF spending includes accounting maneuvers.2 DOB also acknowledges that SOF spending in fiscal year 2020 grew by more than 2 percent, reporting growth of 3.7 percent before accounting for such maneuvers.

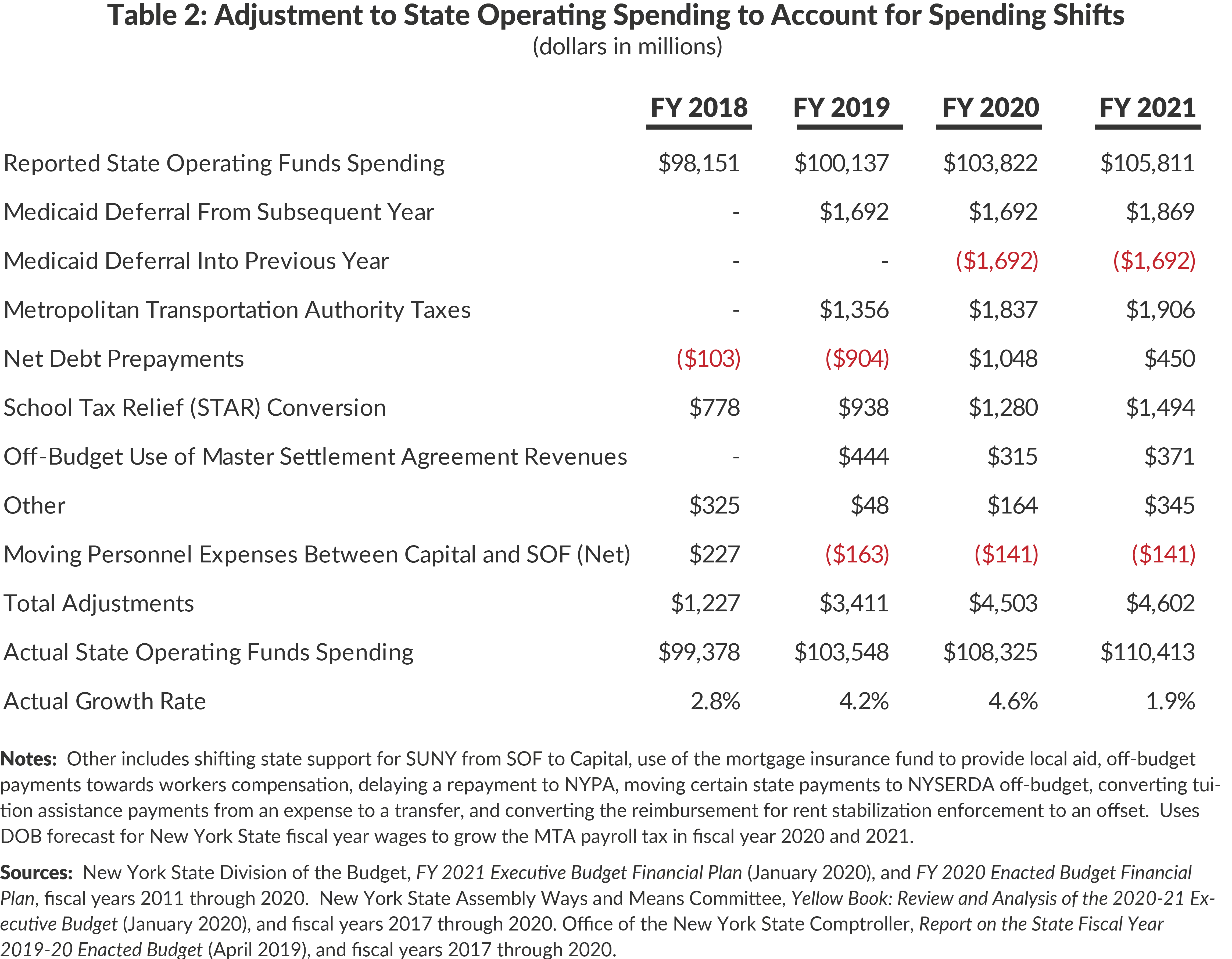

More than $4.5 billion in disbursements are being shifted out of fiscal year 2021 SOF spending. (See Table 2.) The largest shift relates to the deferral of Medicaid payments that is projected to grow to $1.9 billion in fiscal year 2021. The largest re-categorization reflects the continuation of a process that began in fiscal year 2019: the Metropolitan Commuter Transportation Mobility Tax and other taxes collected on behalf of the Metropolitan Transportation Authority (MTA) were shifted off-budget, reducing reported SOF spending by $1.9 billion in fiscal year 2021.3

Similarly, beginning in fiscal year 2017, new School Tax Relief (STAR) recipients receive their benefits as personal income tax credits, instead of as state-funded property tax exemptions.4 In the same year, all New York City personal income tax STAR benefits were reclassified from spending to a state tax credit. Under the Fiscal Year 2020 Budget, all STAR exemption recipients have their benefits frozen at current levels unless they shift to the tax credit program. In addition, the State required that all homeowners with incomes of more than $250,000 receive STAR benefits as an income tax credit. In the Fiscal Year 2021 Executive Budget, the Governor proposed to lower that threshold to $200,000. While residential property owners will continue to receive the same benefits, the reclassification from an expense to a personal income tax credit results in a reduction of $1.5 billion in SOF spending.

Reported fiscal year 2021 SOF spending also appears lower because Master Settlement Agreement revenues (tobacco settlement related funds) are used to pay certain Medicaid expenses off-budget.5 In fiscal year 2020 this totals $315 million and in fiscal year 2021 and thereafter $371 million.

Continuing past practice $450 million in debt service payments for fiscal year 2021 will be prepaid in fiscal year 2020. Fiscal year 2020 disbursements increased by $1.0 billion—the net result of $1.5 billion in fiscal year 2020 debt service payments made in fiscal year 2019 and $450 million in fiscal year 2021 debt service payments made in fiscal year 2020.

Other actions decreased reported SOF spending by $345 million in fiscal year 2021, including shifting State support for the State University of New York (SUNY) from SOF to capital funds, delaying a repayment to the New York Power Authority (NYPA), shifting certain costs of the New York State Energy Research and Development Authority (NYSERDA) off-budget, converting tuition assistance payments from an expense to a transfer, and converting the reimbursement for rent stabilization enforcement in New York City to an offset against revenues dispersed to the City.

Finally, beginning in fiscal year 2018, DOB began shifting personnel expenses between capital funds and SOF. The net result is a reported $141 million increase in SOF spending in fiscal year 2021.

Taken together, these shifts and reclassifications will decrease reported SOF spending in fiscal year 2020 by $4.5 billion and decrease fiscal year 2021 SOF spending by $4.6 billion. Total proposed SOF spending in fiscal year 2021 is $110.4 billion, higher than reported; however, SOF growth is 1.9 percent.

Conclusion

These shifts and reclassifications undermine transparency and make year-to-year comparisons challenging. While spending reform measures were sufficient to keep SOF growth to 2 percent early in Governor Cuomo’s tenure, significant spending increases, most notably in education and Medicaid, drove spending beyond 2 percent in the last three years. In fiscal year 2021 proposed spending growth is under 2 percent, but is dependent on $2.5 billion of unspecified Medicaid cuts. As the Legislature considers the budget and its wish list, it should be mindful that spending already is larger than it appears.

Footnotes

- This analysis accounts for past changes that continue to impact Executive Budget growth rates, including changes that occurred in past years that would artificially deflate fiscal year 2020 spending. The New York State Comptroller reported that the Fiscal Year 2021 Executive Budget grows by 3.1 percent after adjusting for timing-related and other budgetary actions; however, the Comptroller’s office does not account for past changes that would impact fiscal year 2021 spending growth. See: Office of the State Comptroller, Report on the State Fiscal Year 2020-21 Executive Budget (February 14, 2020), p. 2, http://www.osc.state.ny.us/reports/budget/2020/executive-budget-report-2020-21.pdf.

- The Division of Budget writes: “The Financial Plan also includes actions that affect spending reported on a State Operating Funds basis, including accounting and reporting changes. If these and other transactions are not implemented or reported as planned, annual spending growth in State Operating Funds would increase above current estimates.” See: New York State Division of the Budget, FY 2021 Executive Budget Financial Plan (January 2020), p. 40, https://www.budget.ny.gov/pubs/archive/fy21/exec/fp/fy21fp-ex.pdf.

- Previously, the State would collect these taxes and appropriate the funding to the MTA. Now the State collects these funds on behalf of the MTA and simply transfers the funds without an appropriation so it no longer counts as spending.

- The previous method requires expenditure of funds to compensate impacted school districts as opposed to the new method which reduces revenues instead.

- New York State Division of the Budget, FY 2021 Executive Budget Financial Plan (January 2020), p. 98, https://www.budget.ny.gov/pubs/archive/fy21/exec/fp/fy21fp-ex.pdf