Reconsidering Rent Regulation Reforms

Rent regulation laws applicable to New York City are due to sunset in June 2019, and their renewal will be a top priority in the legislative session. New York is a city of renters, and rent regulated units account for nearly half of the city’s rental housing stock.

The Governor’s budget message includes a proposal to extend rent regulation, contingent on reforms intended to strengthen protections against increasing rents and the loss of units. Legislators and some stakeholders have proposed additional reforms that would expand the scope of rent regulation and address other provisions that affect rent increases. However, these proposals would exacerbate many of rent regulation’s flaws and will not make a meaningful impact on the affordability of rental housing in New York City. Instead, they will further benefit upper-income renters without providing relief to the low-income households most likely to be rent burdened. Moreover, the reforms will do little to address concerns about the relatively poor physical condition and maintenance of rent-stabilized buildings and may aggravate these problems.

Any reforms included with the renewal of rent regulation should focus on better targeting its protections to the most rent burdened. One way to serve this goal would be to eliminate rent stabilization for upper-income households who earn more than $200,000 per year, restoring as many as 28,000 units to market-rate status, which would boost property values, increase property tax revenue, and give the City additional resources to invest in better-targeted housing programs. Any reforms to capital improvement allowances should provide some incentive for owners of stabilized buildings to maintain the condition of their units.

Background

Rent regulation is one tool with which New York State and New York City support housing affordability. Rent regulation is permissible when the citywide rental vacancy rate is below 5 percent; such a “housing emergency” has been in effect in New York City since 1960, when the U.S. Census Bureau began tracking vacancy rates in the New York City Housing and Vacancy Survey (HVS).

Rent regulation applies to rental units in buildings of six or more units built before January 1, 1974, as well as units that are subject to regulatory agreements with the City or State.1 In 2017, 988,192 apartments were subject to rent regulation, including 966,441 rent-stabilized units and 21,751 rent controlled units. Together rent-stabilized and controlled units make up 45 percent of the city’s rental housing stock.2 (See Figure 1 and the methodological note below.)

While rent regulation has existed in some form in New York State since as early as 1920, the current rent stabilization era dates to the passage of the Rent Stabilization Law of 1969. In response to falling vacancies, rising rents, and a wave of deregulation, New York City Mayor John Lindsay appointed the first Rent Guidelines Board in 1969, whose recommendations formed the basis of the City’s rent stabilization system. The State Legislature responded with a series of bills to limit the City’s rent regulation powers before ultimately passing the Emergency Tenant Protection Act of 1974 (ETPA), which established the basic framework of the City’s current rent regulation system. Today, the rent stabilized housing stock includes both units that were grandfathered into the rent regulation system upon the passage of the ETPA as well as units built after 1974 that are stabilized pursuant to regulatory agreements. Units that were built after January 1, 1974 are not subject to rent regulation unless property owners enter into a voluntary agreement with the City or State. The latter category includes units that receive property tax reductions through the 421-a or J-51 housing programs. The analysis in this report focuses on rent stabilized units that were built prior to 1974 in order to exclude units that are regulated due to regulatory agreements. It also excludes rent controlled units. Focusing on pre-1974 stabilized units is important because these units will likely remain in the rent regulation system until their legal rents exceed the decontrol threshold. By contrast, units that are regulated pursuant to a regulatory agreement will exit the stabilization system when their tax benefits expire or their agreement ends. According to the HVS 876,465 of the city’s 966,441 rent stabilized units (91 percent) were built prior to 1974. While some units built prior to 1974 are rent stabilized through a regulatory agreement, the HVS does not distinguish how units came to be regulated.

State law provides rent regulated tenants with the right to renew their leases with rent increases capped at rates determined by the Rent Guidelines Board (RGB).3 If a tenant’s current rent is less than the maximum amount an owner is permitted to charge, known as a “preferential rent,” increases are not strictly capped but cannot rise to a level that exceeds the maximum legal rent, which continues to increase based on the RGB guidelines.

Property owners also are permitted to increase an apartment’s legal rent to reflect the cost of buildingwide capital improvements and upgrades to individual apartments, called Major Capital Improvements (MCIs) and Individual Apartment Improvements (IAIs), respectively. When a rent-stabilized unit is vacated, the property owner also may increase the legal rent with a one-time “vacancy allowance” of up to 20 percent.

Units may be deregulated under certain conditions. The most common method, known as high-rent vacancy decontrol, allows owners to deregulate a unit if its legal rent, including allowable increases, exceeds a statutorily set threshold, currently $2,774.76, upon vacancy. This provision was added in 1993, and the threshold has been changed periodically; in 2015, the Legislature increased the threshold to $2,700 and indexed it to annual one-year RGB increases as part of the renewal of rent regulation. Other less frequently used ways that units can be decontrolled include conversions to condominiums or cooperatives (co-ops) and high-income/high-rent decontrol, which affects households who earn at least $200,000 for two consecutive years and have a legal rent that exceeds the decontrol threshold.4

Why the proposed reforms would exacerbate rent regulation’s shortcomings

Governor Cuomo and several State legislators have announced support for changes to rent regulation statutes that would limit the ability to increase rents beyond the annual increases authorized by the RGB and curtail the ability to remove units from the rent regulation system. Two proposals included in the Governor’s Executive Budget are ending high-rent vacancy decontrol and placing unspecified limitations on the MCI and IAI capital improvement allowances.

The goal of these proposals is to maintain the number of units under rent regulation; however, they would not address the limitations of the City’s rent regulation system and would make it less effective in three ways.

1. The benefits of rent regulation are not well targeted; ending high-rent vacancy decontrol will disproportionately benefit upper-income households.

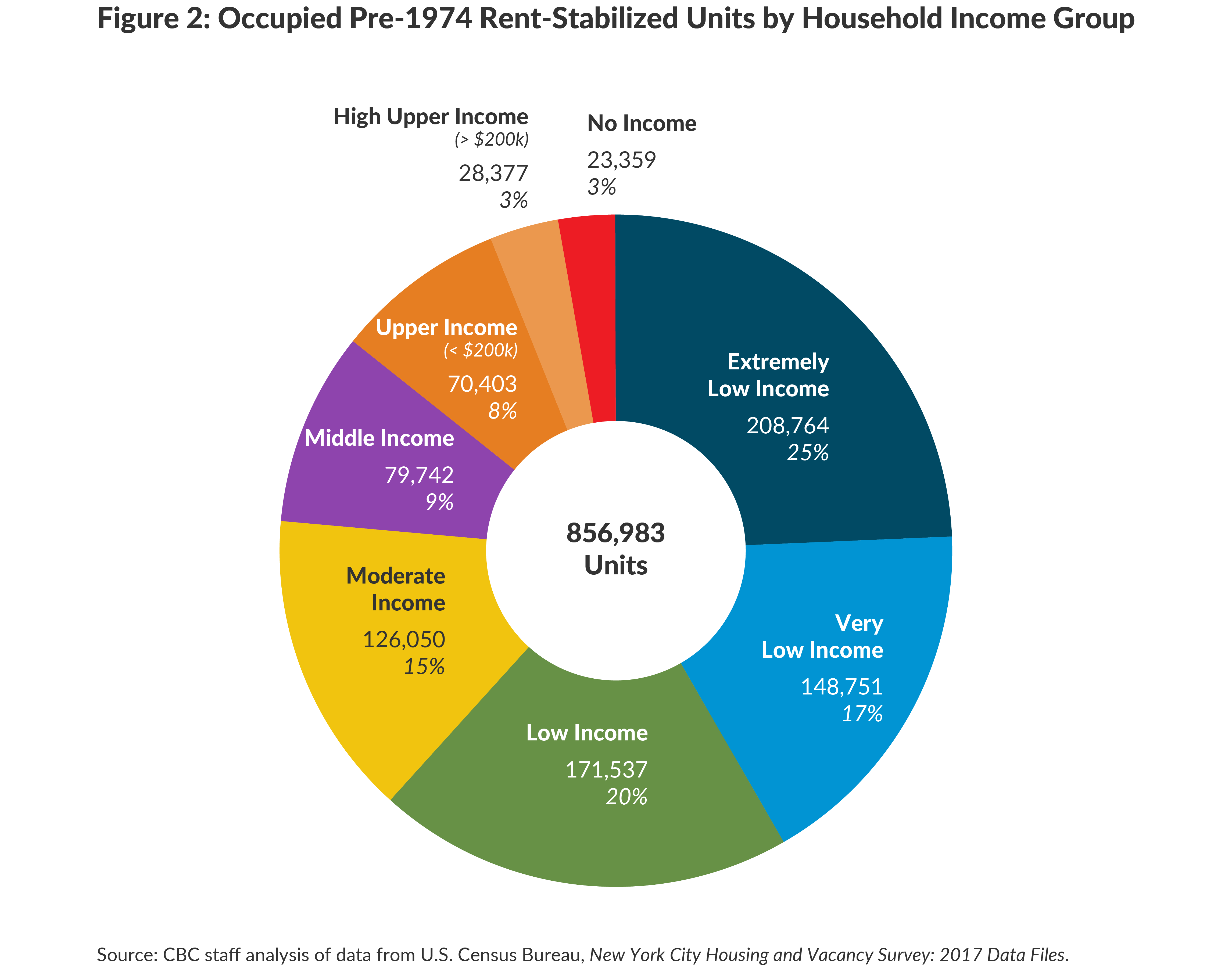

In 2017 upper-income households occupied 12 percent of pre-1974 rent-stabilized units, or 98,780 units. (Upper-income households earn more than 165 percent of Area Median Income (AMI). See Figure 2 for the distribution of rent-stabilized households by income group and the Appendix for the definitions of income groups used in this report. The analysis is based on the income limits in place at the time of the 2017 HVS.)

Of these upper-income stabilized households, 28,377 households earn more than $200,000 per year, which is the threshold for high-income/high-rent decontrol.5 For households earning $200,000 per year, rents up to $5,000 per month are considered affordable based on the standard that rent should be no more than 30 percent of a tenant’s income.

Rent-stabilized households who earn more than $200,000 and live in below market-rate units pay a total of $271 million less annually than the average cost of an unregulated unit of the same size in a similarly priced neighborhood, an average savings of $13,764 per household per year.6

Ending high-rent vacancy decontrol will disproportionately benefit higher-income households. Upon vacancy these units will continue to be stabilized and most likely will be rented by households of similar economic status. Over the last three years, middle- and upper- income households have accounted for 60 percent of households who moved into stabilized units with rents of $2,000 or more per month. Meanwhile, current high-income tenants in regulated units will realize even greater savings in future years if market rents continue to grow faster than RGB increases.

2. Ending high-rent vacancy decontrol will not increase the number of affordable units.

Apartments that rent at the current decontrol threshold are considered affordable for households earning at least $111,000 annually.Maintaining units at those rent levels will not provide affordable housing for low-income households, who disproportionately suffer from severe housing burdens. For a unit to be affordable to low-income households of three, defined as 80 percent of AMI or less, the rent must be below $1,600, a level that is far below the decontrol threshold of $2,774.76.7

Most stabilized units are unaffordable to the lowest-income households without additional assistance. In 2017 more than 75 percent of rent regulated tenants who earn less than 80 percent of AMI and did not receive Section 8 vouchers or another form of housing assistance were rent burdened–approximately the same rate as similar tenants in market-rate units. (See Figures 3 and 4.) Section 8 vouchers, funded by the federal government and administered by local housing agencies, cap tenant responsibility for rent at 30 percent of income.

Keeping high-rent units regulated will continue to provide benefits to the higher-income households who can afford to pay higher rents while doing little to address the rent burdens faced by the lowest-income households. Furthermore, eliminating high-rent vacancy decontrol while leaving other decontrol provisions in place may encourage property owners to pursue other paths toward deregulation. Before high-rent vacancy decontrol was established in 1993, the most common method for removing units from rent regulation was to convert them to co-ops and condominiums. Co-op/condo conversions have fallen out of favor in recent years but could see a resurgence if high-rent vacancy decontrol is repealed.

3. Restricting the capital improvement allowances will not improve the physical condition of rent-stabilized units.

The current proposals fail to address and may exacerbate the comparatively poorer condition of stabilized units. Rent-stabilized units report 80 percent more maintenance deficiencies on average than market-rate units (See Figure 5). Rent regulated tenants also report broken plaster, peeling paint, cracks in ceilings and walls, and heating breakdowns at higher rates than tenants in unregulated properties (See Figure 6). This maintenance gap between stabilized and nonstabilized units persists despite continued improvement in the overall quality of the city’s housing stock.

The MCI and IAI provisions were intended to encourage property owners to maintain buildings and invest in needed capital improvements. Lessening that incentive could result in less investment by landlords in the quality of their buildings. Critics contend that owners use MCIs and IAIs to increase legal rents toward the decontrol threshold instead of for their intended purpose. Limiting the usefulness of the capital improvement allowances, however, could exacerbate the existing gap in quality between stabilized and market-rate rental units.

Conclusion

At best rent regulation is only one component of an affordable housing strategy. Lower-income households benefit from availability of units that rent for less than market rates, which often help lessen otherwise severe rent burdens. The right to lease renewals offers security of tenure and promotes housing stability. Rent-stabilized units also make up a disproportionate share of units that meet the eligibility rules of local and federal rental housing voucher programs. For low-income households, however, most rent-stabilized units are only affordable with additional assistance.

Many of the reforms likely to be introduced this session would exacerbate the shortcomings of rent regulation. Ending high-rent vacancy decontrol would lock in below-market rents for upper-income households, while limiting capital improvement allowances could discourage property owners from reinvesting in rent-stabilized buildings.

At a minimum, any reform measures should not exacerbate current problems. Ideally, reform measures should make rent regulation better targeted to lower-income, rent-burdened households. One way to achieve this would be to eliminate rent stabilization for upper-income households who earn more than $200,000 per year. This may restore more than 28,000 units to market-rate status, which would boost property values, increase property tax revenue, and give the City additional resources to invest in better-targeted housing programs.8 Reforms to capital improvement allowances also should provide an incentive for owners of stabilized buildings to maintain their portfolios.

Download Report

Reconsidering Rent Regulation ReformsFootnotes

- Units that are stabilized pursuant to a regulatory agreement are most commonly stabilized a result of their participation in tax incentive programs, including 421-a; J-51; 420-c; or Articles 11, 14, and 15 of the Private Housing Finance Law. Units can also enter stabilization when cooperatives revert to rental status, when in rem buildings are returned to private ownership, when owners of Mitchell-Lama rental buildings opt out of the program, when the Loft Board approves conversions of commercial lofts to residential units; or when rent controlled units are vacated. See: Timothy L. Collins, “An Introduction to the New York City Rent Guidelines Board and the Rent Stabilization System” (New York City Rent Guidelines Board, April 2018), https://www1.nyc.gov/assets/rentguidelinesboard/pdf/history/intro.pdf.

- CBC staff analysis of data from U.S. Census Bureau, New York City Housing and Vacancy Survey: 2017 Microdata (accessed August 9, 2018), https://www.census.gov/data/datasets/2017/demo/nychvs/microdata.html.

- In New York City the Rent Guidelines Board, comprised of nine members appointed by the Mayor, sets annual increases for one-year and two-year leases.

- The income threshold for high-income/high-rent decontrol is based on federal adjusted gross income. Property owners can also deregulate units if they replace at least 75 percent of buildingwide and apartment systems (substantial rehabilitation); if they convert a unit to commercial uses; or because of condemnation, demolition, the combination of vacant units, or abandonment.

- Under current law, units occupied by high-income households can be deregulated under the high-rent-high-income decontrol provision. High-rent-high income decontrol has a two prong test: a tenant’s rent must exceed the decontrol threshold (currently $2,744); and 2) their federal adjusted gross income must exceed $200,000 for two consecutive years. The vast majority of stabilized households who earn over $200,000 per year do not meet the rent prong of the test. The average rent of households earning over $200,000 is $2,121 per month, well below the decontrol threshold. Since the decontrol threshold now grows at the rate of annual RGB increases, this means that fewer high-income households are affected by high-rent/high-income decontrol each year. In 2017, only 107 units were deregulated through high-rent/high-income decontrol, the lowest number since high-rent/high-income decontrol was first passed.

- Approximately 70 percent of the 28,377 rent-stabilized households earning at least $200,000 per year have below market-rate rents.

- The low income category includes households earning up to 80 percent of the AMI, which is $65,250 for a family of three. An affordable rent for a household at that income level is $1,631.25.

- Some below-market stabilized units occupied by upper-income households may be rent stabilized pursuant to a regulatory agreement. In those cases, the unit would likely remain rent stabilized according to the terms of the agreement.