The Record on Reserves

New York City Fiscal Year 2023 Preliminary Budget Reserves

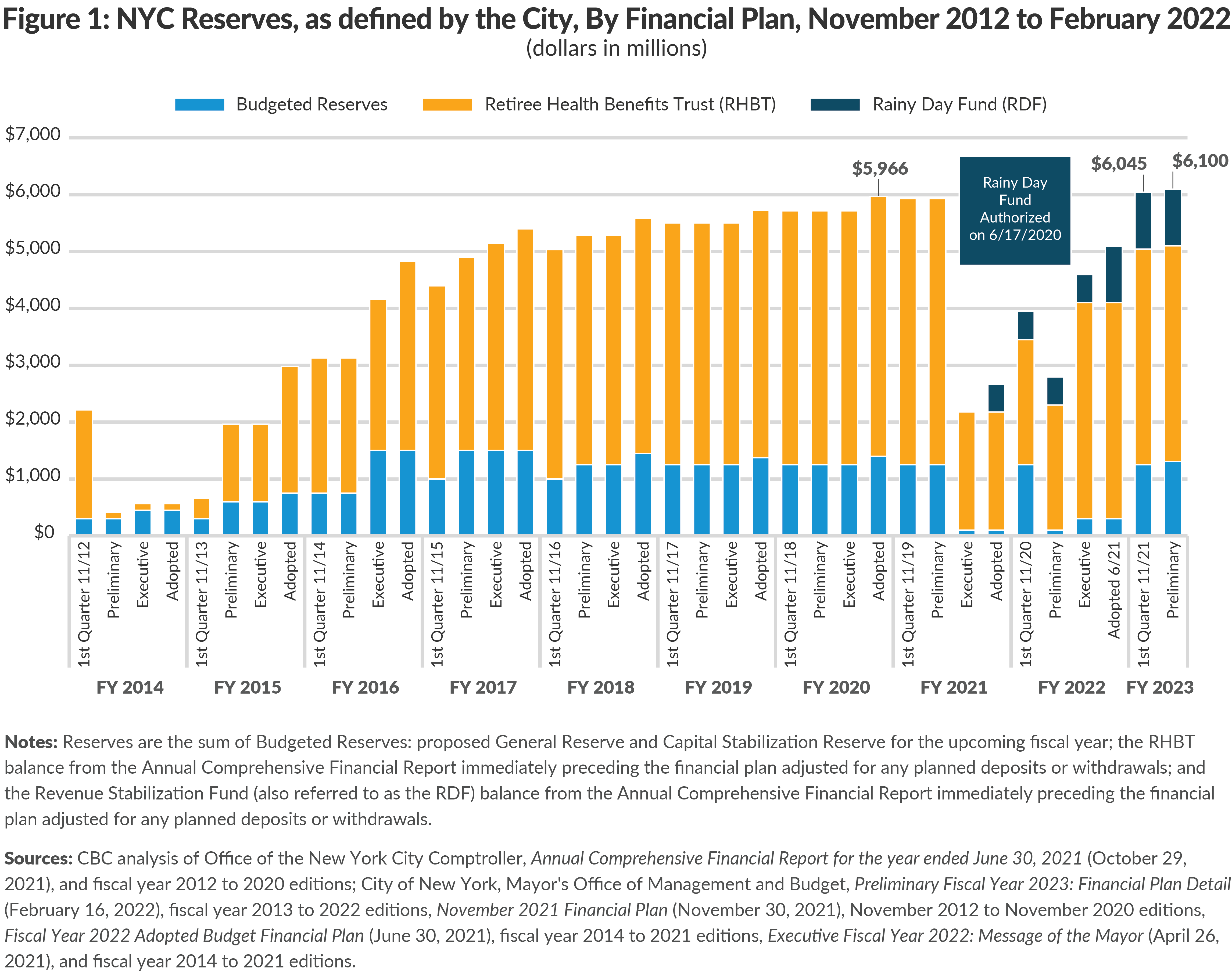

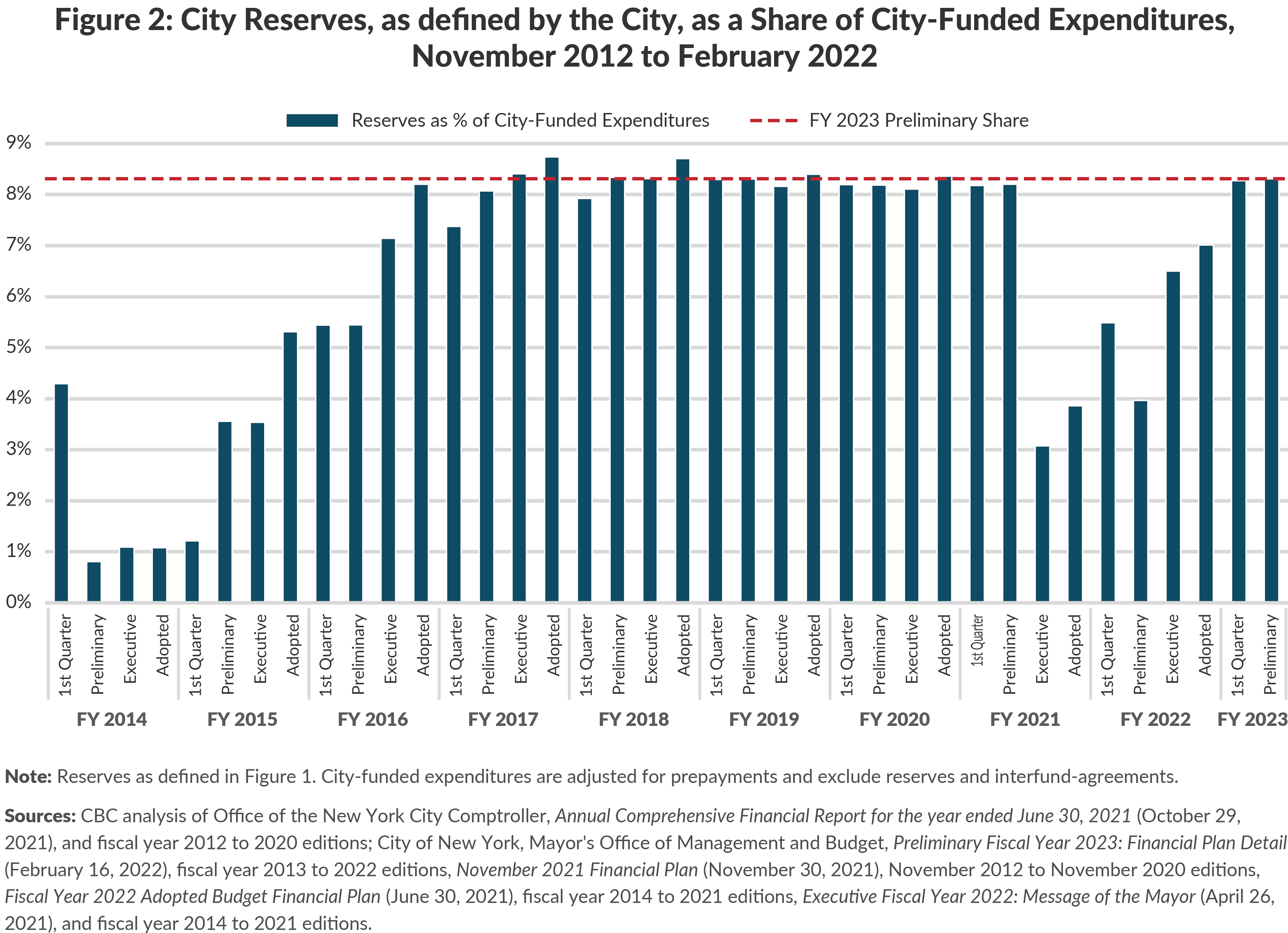

Mayor Eric Adams touted the City’s record level of ‘reserves’—$6.1 billion—in his Fiscal Year 2023 Preliminary Budget. While this is a record in dollars, it is not a record as a percent of the City-funded budget—a better measure of the reserves’ ability to mitigate the impacts of a recession or severe emergency. (See Figures 1 and 2.) CBC’s historical review of these funds and prior research found that:

- The budget increased these reserves 0.9 percent ($55 million) from the November 2021 financial plan;

- They total 8.3 percent of City-funded spending in the Preliminary Fiscal Year 2023 Budget, which is lower than 8.7 percent in both June 2016 and June 2017;

- They appropriately include over $480 million in reserves unlocked by the establishment of the Rainy Day Fund (RDF) and the $500 million RDF deposit in fiscal year 2022 that was approved in the June 2021 Adopted Budget;

- They include balances in the Retiree Health Benefits Trust (RHBT), which CBC does not consider a reserve fund and generally should not be used to address a recession or severe emergency;

- To address the revenue loss of an average recession, the amount in the City’s RDF should equal 17.2 percent of the budget’s pre-recession tax revenues, or $11 billion to $12 billion; and

- The wise strategy to prepare for the next recession or emergency is to include annual deposits to the RDF in the Executive and Adopted budgets.1

A Peak Depending on Perspective

Figure 1 shows the history of these reserves including the Preliminary Budget’s $6.100 billion and the prior peak of $5.966 billion in June 2019. Following a decrease in reserves due to the Great Recession, these reserves increased from $1.963 billion for fiscal year 2015 (based on the February 2014 financial plan) to $5.966 billion for fiscal year 2020 (as of the June 2019 Adopted Budget). These reserves were over $5.900 billion through the January 2020 financial plan.

The City planned to tap $2.600 billion in reserves to address the COVID-19 pandemic and recession, reducing their projected balance to $2.179 billion in April 2020. The reserves increased when the RDF was established, unlocking nearly half a billion in new resources (see below). Following the passage of the American Rescue Plan, the City began to rebuild reserves by cancelling a planned withdrawal from the RHBT, increasing budgetary reserves, and budgeting a deposit of $500 million to the RDF. Reserve levels increased from $2.794 billion in January 2021 to $6.045 billion in November 2021, before this budget added $55 million to bring these reserves to $6.100 billion.

As the City budget grows, the same absolute level of reserves becomes less adequate. To consider how well a level of reserves will address a crisis, it is better to measure reserves relative to the size of the budget—City-funded expenditures or revenues.2 Figure 2 shows that—except during the peak of COVID and the recession—these reserves stayed relatively constant for the past five years. Furthermore, the Preliminary Budget’s reserves are 8.31 percent of City-funded expenditures, which is lower than the 8.74 percent and 8.70 in the Adopted Budgets for fiscal years 2017 and 2018, respectively (June 2016 and June 2017).3

Not All These Funds are Appropriate to Use for a Rainy Day

Not all these funds are appropriate to consider as a buffer for a recession or severe emergency. The Preliminary Budget’s $6.1 billion aggregates budgetary reserves included in the operating budget (the General Reserve and the Capital Stabilization Reserve), the RHBT, and the recently established RDF.

The General and Capital Stabilization Reserves can be a hedge in times of revenue shortfall, but they generally are reallocated within a fiscal year to pay for higher than expected spending, new programs or rolled into the subsequent year. Depending on the severity and speed of any shortfall or spending need, these funds may or may not be available. Still, they are reasonable to include for this purpose and the high budgeted level is a fiscally prudent choice.

While both the Bloomberg and de Blasio Administrations used funds from the RHBT to address budget shortfalls, the CBC considers this inappropriate since this fund is intended to accrue resources to address the City’s obligation to pay $122 billion for retirees’ other postemployment benefits (OPEB).

The City’s RDF has only existed since June 2020, when it was authorized by the State following voter approval of a Charter Amendment in November 2019. The RDF had a $488 million balance when created because the legislation allowed the City to unlock these previously unavailable funds amassed over decades. State legislation generally limits the use of the RDF to a recession or emergency, making it the most secure of the City’s reserve funds. That legislation, however, has exceptions that should be closed either by State or City legislation to ensure the Fund is not used for other purposes.

The Reserve Level Should Be Built to Weather the Next Storm

The important focus going forward should be to build the City’s reserves so they may be adequate to weather the next recession or severe emergency. CBC recommends the City have rainy day reserves equal to 17.2 of tax revenues ($11.3 billion).4 This would be adequate to address a three-year revenue shortfall while allowing small increases in spending. The Government Finance Officers Association recommends 16.7 percent of general fund revenues or expenditures ($12.3 billion based on City-funded expenditures).5 While rebuilt quickly following the recession, the City’s current level remains insufficient. The City should commit to annual deposits to the RDF to build the City’s reserves to increase its capacity to address future economic or other shocks and preserve its ability to take care of New Yorkers, particularly those most in need.

Footnotes

- Reserves are the sum of Budgeted Reserves: proposed General Reserve and Capital Stabilization Reserve for the upcoming fiscal year; the RHBT balance from the Annual Comprehensive Financial Report immediately preceding the financial plan adjusted for any planned deposits or withdrawals; and the Revenue Stabilization Fund (also referred to as the RDF) balance from the Annual Comprehensive Financial Report immediately preceding the financial plan adjusted for any planned deposits or withdrawals. Source: CBC analysis of Office of the New York City Comptroller, Annual Comprehensive Financial Report for the year ended June 30, 2021 (October 29, 2021), and fiscal year 2012 to 2020 editions, https://comptroller.nyc.gov/reports/annual-comprehensive-financial-reports/; City of New York, Mayor's Office of Management and Budget, Preliminary Fiscal Year 2023: Financial Plan Detail (February 16, 2022), fiscal year 2013 to 2022 editions, https://www1.nyc.gov/site/omb/publications/budget-reports.page?report=Fin%20Plan%20Detail, November 2021 Financial Plan (November 30, 2021), November 2012 to November 2020 editions, https://www1.nyc.gov/site/omb/publications/budget-reports.page?report=Financial%20Plan, Fiscal Year 2022 Adopted Budget Financial Plan (June 30, 2021), fiscal year 2014 to 2021 editions, https://www1.nyc.gov/site/omb/publications/budget-reports.page?report=Financial%20Plan, Executive Fiscal Year 2022: Message of the Mayor (April 26, 2021), and fiscal year 2014 to 2021 editions, https://www1.nyc.gov/site/omb/publications/budget-reports.page?report=Mayor%27s%20Message.

- City-funded expenditures exclude planned reserve deposits, interfund agreements, and adjust for pre-payments.

- Compared to recent Preliminary Financial plans, this is the second highest level of reserves as a share of City-funded expenditures. Reserves were 8.34 percent in January 2017, compared to 8.31 percent in February 2018 and February 2022.

- Charles Brecher, Thad Calabrese, and Ana Champeny, To Weather a Storm: Create an NYC Rainy Day Fund (Citizens Budget Commission, April 18, 2019), https://cbcny.org/research/weather-storm.

- Government Finance Officers Association, Fund Balance Guidelines for the General Fund (accessed February 24, 2022), www.gfoa.org/fund-balance-guidelines-general-fund.