The State Budget Cap Has Lost Its Meaning

Keeping with Albany tradition, the state's leaders adopted the budget on the final day of last fiscal year in the wee hours of the morning with little debate and no transparency, once again proclaiming the budget complies with a 2 percent growth cap.1 After adjusting for shifts of certain types of spending out of state operating funds or across fiscal years, the budget actually increases 4.5 percent from fiscal year 2018. This marks the second consecutive year that spending exceeds the self-imposed cap.2

State Operating Funds Spending

State operating funds (SOF) spending is an encompassing measure of state expenditures that includes spending from the general fund and other funds that the State controls. It excludes federal funds, over which the State has little control, and capital investments which are best evaluated over a longer period of time. Therefore, SOF spending is the best measure of state spending choices and a logical focus of spending control. The Governor claims this is the eighth straight year SOF spending growth has been held to 2 percent or less. However, as noted after the release of the Executive Budget: (1) items previously categorized as state operating spending have been shifted to “off-budget” accounts; (2) cash disbursements have been shifted between fiscal years; and (3) other spending items have been reclassified.3

Despite the pronouncements of elected officials, the State’s Division of the Budget (DOB) takes a more nuanced approach, noting in the FY 2019 Enacted Budget Financial Plan that certain “actions have affected, or are intended to affect, the amount of annual spending accounted for in the State Operating Funds basis of reporting” and that absent these actions “annual spending growth in State Operating Funds would be higher than current projections.”4

Actions Impacting State Operating Funds Spending

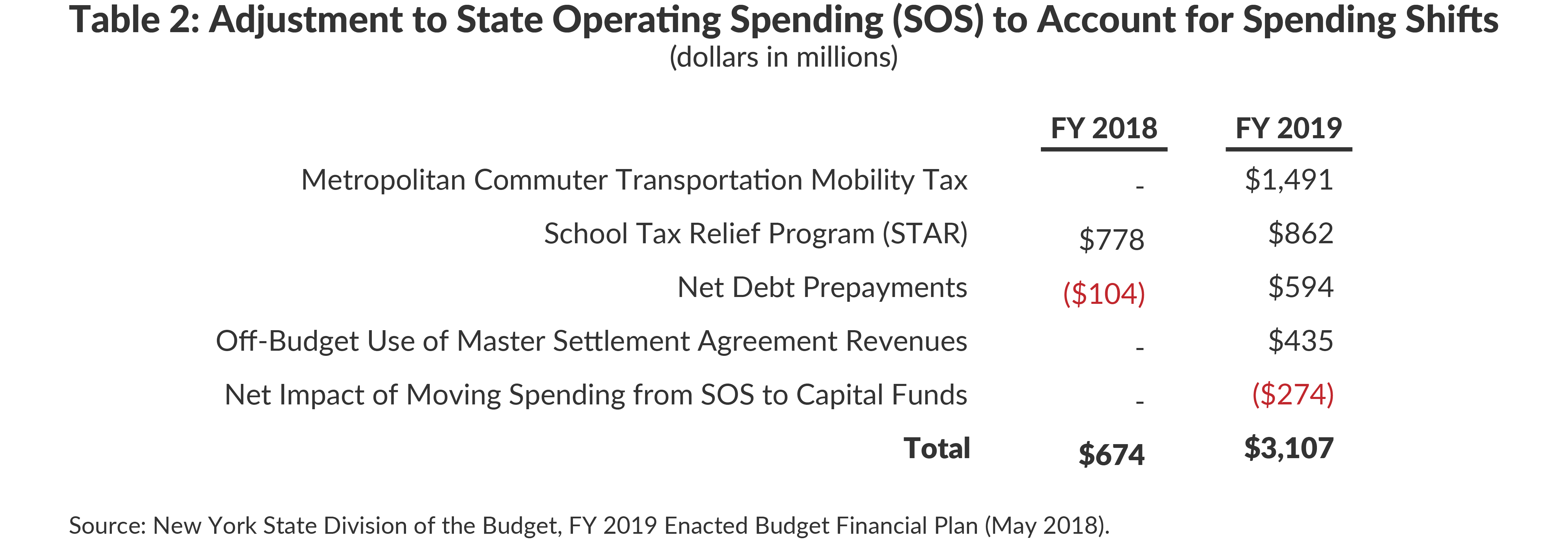

More than $3.1 billion is being shifted out of fiscal year 2019 SOF spending. The largest shift reflects a change in the administration of the Metropolitan Commuter Transportation Mobility Tax. Previously, the $1.5 billion tax was collected by the State and appropriated to the Metropolitan Transportation Authority (MTA). The fiscal year 2019 budget provides that these funds go directly to the MTA, a change the State indicates is intended to improve the credit quality of MTA bonds. By making this simple administrative shift, SOF spending decreases by $1.5 billion from fiscal year 2018 to fiscal year 2019.

Continuing the process that began in fiscal year 2017, new School Tax Relief (STAR) recipients will receive their benefits as a personal income tax benefit, instead of as a property tax exemption. This will reduce SOF spending by $862 million in fiscal year 2019, which is $84 million more than the prior year. Residential property owners will continue to receive the same benefits, while ‘spending’ decreases.

Continuing past practice DOB also chose to prepay certain debt service costs. Fiscal year 2018 spending is increased by $104 million—the net result of $490 million in fiscal year 2018 debt service payments made in fiscal year 2017 and $594 million in fiscal year 2019 debt service payments made in fiscal year 2018.

Fiscal year 2019 SOF spending is further decreased by using Master Settlement Agreement revenues to pay certain Medicaid expenses off-budget.5 Originally announced in last year’s Executive budget, this was expected to decrease SOF spending by approximately $100 million in fiscal year 2018 and almost $350 million in fiscal year 2019. However, the Executive decided to use the full $435 million to reduce fiscal year 2019 SOF spending.

Lastly, DOB shifted $116 million in agency costs from SOF to capital funds while moving $390 million in other expenses from capital funds to SOF. The net impact increases SOF spending by $274 million.6

Taken together, these shifts and reclassifications will decrease SOF spending in fiscal year 2018 by $674 million and decrease fiscal year 2019 SOF spending by $3.107 billion. (See Table 2.)

Conclusion

Under the Governor’s leadership the State took many prudent fiscal measures to help recover from the Great Recession—including public employee benefit reforms and Medicaid redesign–the benefits of which continue to accrue. However, growth in Medicaid spending and education aid in excess of 2 percent have not been offset by enough fiscal control in other areas to allow the State to abide by the self-imposed 2 percent spending growth cap. Instead, the State has used reclassifications and budgetary shifts to justify claims of fiscal restraint at the expense of transparency.

Footnotes

- New York State Senate Majority Press Office, “Senate Completes Passage of 2018-19 State Budget That Rejects $1 Billion in New Taxes, Protects Existing Tax Cuts, Provides Record Funding For Schools and Opioid Abuse Prevention” (press release, March 30, 2018) https://www.nysenate.gov/newsroom/articles/senate-completes-passage-2018-19-state-budget-rejects-1-billion-new-taxes-protects; and New York State Division of the Budget, “Governor Cuomo Announces Highlights of the FY 2019 State Budget” (press release, March 30, 2018), https://www.budget.ny.gov/pubs/press/2018/pr-enactfy19.html.

- David Friedfel, “When 2 Percent Isn't 2 Percent,” Citizens Budget Commission Blog (May 30, 2017), https://cbcny.org/research/when-2-percent-isnt-2-percent.

- David Friedfel, “Twice as Much as Advertised,” Citizens Budget Commission Blog (February 6, 2018), https://cbcny.org/research/twice-much-advertised.

- New York State Division of the Budget, FY 2019 Enacted Budget Financial Plan (May 2018), pp. 2-3, https://www.budget.ny.gov/pubs/archive/fy19/enac/fy19enacFP.pdf.

- The Master Settlement Agreement is a $10 billion settlement between various governments and the five largest tobacco companies related to the impact of tobacco use on public health. The state is using these funds to pay state costs associated with freezing the local share of Medicaid.

- The $174 million shift from SOF to capital includes $79 million for support of State University of New York Hospitals, $23 million in Department of Environmental Conservation costs, and $14 million in Office of General Service costs. The $390 million shift from capital to SOF includes operating costs related to snow and ice removal; bus, truck, and rail inspection; and DMV regulatory activities currently accounted for in the Dedicated Highway and Bridge Trust Fund.