Three Strikes Against the Governor’s Proposed Conversion Revenue

The New York State Executive Budget and Financial Plan for fiscal year 2019 proposed by Governor Andrew Cuomo includes $3 billion–$750 million annually in each of the next four years–from the proceeds of conversions of health insurers from nonprofit to for-profit status.1 Counting on this revenue is not prudent because:

- The transactions are speculative and may not occur;

- The value of any such transactions that may occur is likely overestimated; and

- The proposed use of most of any revenue that does materialize is inappropriate for such nonrecurring resources.

The Precedent and the Uncertainty

During the 1990s and early 2000s, conversions of health insurers from nonprofit to for-profit status became common. Some nonprofit insurers converted to raise capital and to compete more effectively in health insurance markets. The ability of for-profit insurers to issue stock grants a comparative advantage to expand infrastructure and information technology systems. For-profit insurers also have greater flexibility in pursuing joint ventures and can offer executives greater financial incentives to increase the company’s market share and profitability.2 In other cases, nonprofit insurers were acquired by for-profit entities because the nonprofits had established significant market shares and strong relationships with providers.3

Nonprofit insurers accrue financial benefits from tax exemptions in exchange for the community benefits they provide, such as helping to insure low-income individuals.4 When a nonprofit insurer converts to for-profit status or is acquired by a for-profit entity, State governments generally receive the value of the assets the nonprofit has accrued. Typically the States transfer the new found wealth to charitable foundations or fund public health programs.5

The most notable conversion in New York was that of Empire Blue Cross Blue Shield (Empire), a process that began in 1995.6 Empire initially planned to endow a charitable foundation upon conversion.7 After years of negotiations among Empire, Governor George Pataki, the Legislature, and labor unions, New York State in January 2002 enacted a law to authorize and regulate the conversion.8 Under these provisions of the State Insurance Law, the State must be provided the full market value of the entity as approved by the Department of Financial Services (DFS) and the funds must be divided as follows:9

- 90 percent is considered a “public asset,” which is transferred to the State’s Health Care Reform Act (HCRA) special revenue fund to be spent for public health purposes.10

- 10 percent is considered a “charitable asset” and is transferred to the New York State Health Foundation (NYSHealth), which was created in 2002 to receive conversion proceeds. The composition of the NYSHealth’s board and its mission are set in the Insurance Law.11

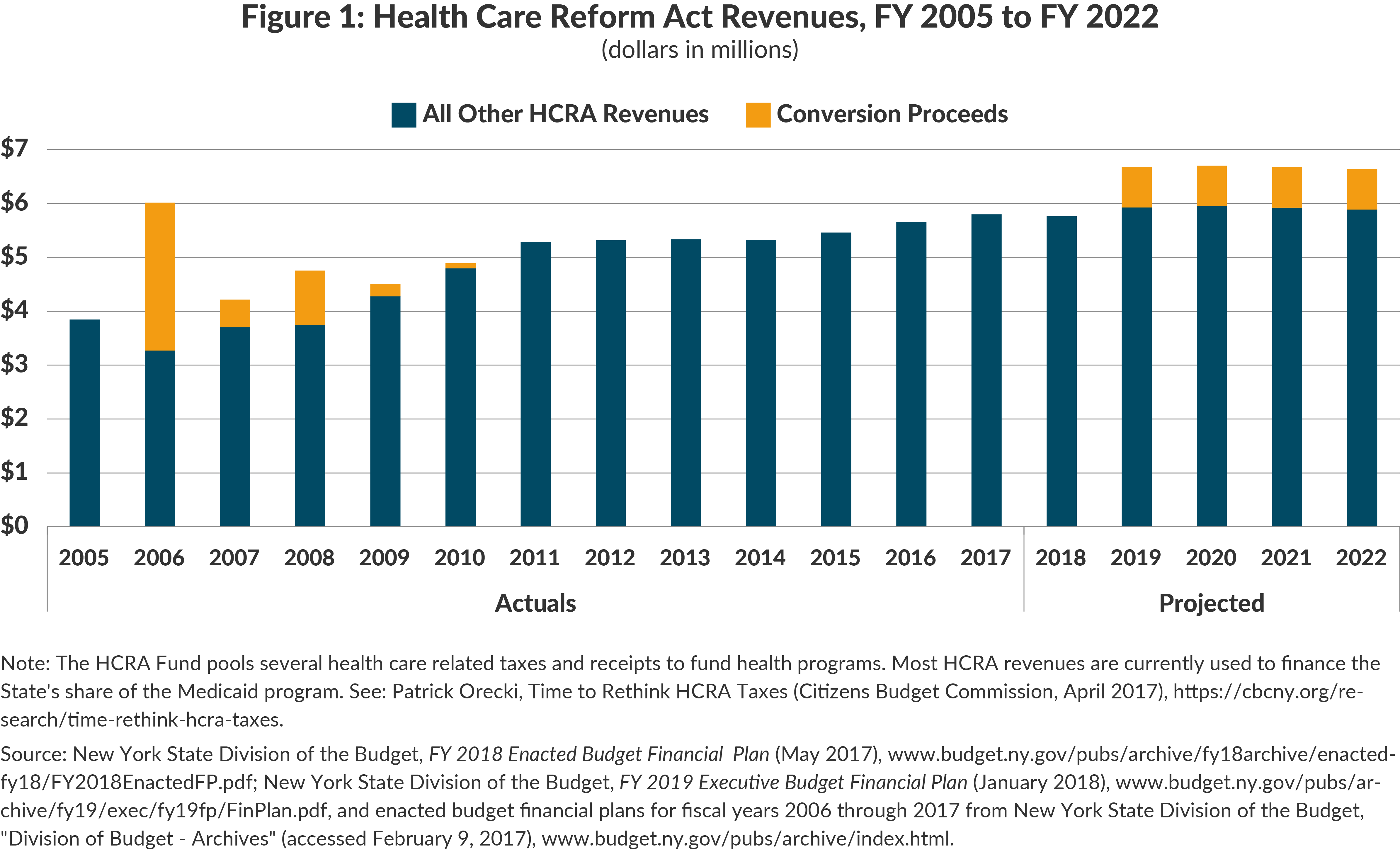

DFS approved the conversion of Empire in October 2002.12 The State’s initial receipt of conversion proceeds was delayed by litigation and other transactional issues until fiscal year 2006. Transactions related to the Empire conversion eventually generated $4.6 billion for the State from fiscal year 2006 to fiscal year 2010. (See Figure 1.)13 The history of the Empire conversion and the basis for conversions reflect that the State’s Financial Plan should not rely on these revenues. Although conversion proceeds were a boon to the State’s health care revenues a decade ago, the revenues are irregular, finite, and inappropriate for supporting recurring spending.

Strike 1: Revenues from Conversion Proceeds are Uncertain

The revenues from the Empire conversion did not materialize as expected, nor have conversion proceeds been a steady and consistent source of HCRA funding. The fiscal year 2005 enacted budget projected $1.2 billion would be received from the Empire conversion, yet the State did not receive any proceeds until fiscal year 2006.14 The fiscal year 2009 enacted budget projected the State would receive $2.4 billion in conversion proceeds from fiscal year 2009 to fiscal year 2012, but it received only $95 million.15

Although the Empire conversion did not occur as initially planned, it did eventually materialize. This is a contrast to the anticipated, but unrealized, EmblemHealth (Emblem) conversion. Following the merger of Group Health Incorporated (GHI) and the Health Insurance Plan of Greater New York (HIP) under the name Emblem, Emblem submitted a plan of conversion in April 2007 and resubmitted the plan in December 2007. The State held public hearings related to the proposed conversion in January 2008.16 Later that year Emblem halted proceedings to convert, requesting its submitted plan be suspended prior to a final ruling by the State.17 Emblem’s leadership later made clear the insurer had scrapped plans to convert.18 The expectation of Emblem conversion revenues was the basis in part for the State’s projection of billions from conversion proceeds in the fiscal year 2009 Financial Plan, but the revenues were never realized.

The Governor’s budget proposal does not identify a specific transaction to yield the $3 billion, but the context is a September 2017 announcement of negotiations between for-profit Centene, the nation’s largest Medicaid managed care organization, to acquire nonprofit Fidelis for a publicized price of $3.75 billion. Fidelis is the largest Medicaid managed care insurer in New York and operates in all 62 counties within the State. The companies expected the deal to close early in 2018.19 If DFS approves the fair market value at $3.75 billion, it would yield $3.375 billion for the State and $375 million for the NYSHealth.20 The proposed budget includes no new statutory changes and assumes the existing language in insurance law will capture this transaction. However, the Fidelis acquisition differs from the Empire conversion in that it is a purchase rather than a conversion, and Fidelis is licensed under Public Health Law, not State Insurance Law.21 Fidelis–the New York State Catholic Health Plan–plans to use the conversion proceeds to fund a charitable foundation to promote health and health care in the State.22 Following release of the Executive Budget, the Catholic Church called the state’s plan “unprecedented” and “alarming,” and said the State did not have legal authority to claim the conversion proceeds.23 A lengthy negotiation and potential litigation makes an assumption of revenues from this transaction in the coming fiscal year risky.

Strike 2: The Revenue Estimate May Be Too High

The revenue assumptions from nonprofit conversions may also be optimistic in terms of the likely amounts. Despite the price tag publicized for the Fidelis acquisition, such high figures may be unrealistic. Sale values are rooted in the net assets and potential income of the acquired firm. Table 1 presents the net assets and net income in recent years of the large nonprofit managed care plans serving the New York Medicaid market. Fidelis is clearly the largest and most valuable of these entities. It has a Medicaid enrollment of nearly 1.3 million, net assets of nearly $1.2 billion, and net income of more than $250 million. But even these impressive figures appear to justify a $3.75 billion price only if rapid and significant growth continues; that price is more than double the recent net assets and about 15 times the latest net income. The actual price for the entity, if acquired, might prove less than publicized. Furthermore the market value for other nonprofit insurers that may convert likely would be substantially less than that of Fidelis.

Strike 3: The State’s Use of the Proceeds is Inappropriate

The Governor’s Financial Plan indicates the anticipated revenue of $750 million annually will be used in two ways. First, $500 million annually ($2 billion cumulatively over four years) will be used to help pay for the Medicaid program; the use of these speculative, nonrecurring windfall revenues to pay for ongoing activities is imprudent. Such revenue cannot be counted on to continue to support State operations and likely will create or increase future budget gaps. Additionally, the State’s capture of these “public assets” is based on the reasoning that the community benefits provided by a nonprofit insurer should be retained in the community. But the State is not investing the money in programmatic enhancements; it is offloading the funding to reduce planned Medicaid spending in the State’s General Fund.24

The remaining $250 million annually ($1 billion cumulatively over four years) will be put into a reserve to offset future federal cuts in health programs. The latter use is appropriate because it is a reserve to cushion future revenue losses and to help implement longer term adjustments that may be necessary. As the Citizens Budget Commission has previously recommended, nonrecurring resources are best used to repay debt, support capital investments, increase reserves, or make possible other desirable one-time expenses.25

Conclusion

More than a decade ago, receipts from conversions of insurers from nonprofit to for-profit status peaked at $2.7 billion in a single year. The lone known insurance acquisition currently being negotiated is likely to experience delays, and whether or not and how much of the proceeds go to the State is not clear. The State budget and financial plan should not depend on $2 billion from this precarious source. Furthermore, any proceeds earned by the State should not be used for multiyear budget balancing. These revenues are episodic and finite and should be used to bolster reserves or fund one-time costs after proceeds are received by the State.

Footnotes

- This revenue is one large piece of a broader reliance of the Executive Budget and Financial Plan on one-time resources and spending shifts. See: Carol Kellermann, “Statement on NYS Executive Budget for FY2019” (Citizens Budget Commission, January 2018), https://cbcny.org/advocacy/statement-nys-executive-budget-fy2019.

- Society of Actuaries, “Conversion of Health Organizations from Not-for-Profit to For-Profit,” The Record, vol. 22, no. 2 (June 1996), p. 4, www.soa.org/library/proceedings/record-of-the-society-of-actuaries/1990-99/1996/january/rsa96v22n271pd.pdf.

- J. Needleman, “Nonprofit to for-profit conversions by hospitals, health insurers, and health plans,” Public Health Reports, vol. 114, no. 2 (March/April 1999), pp. 111-112, www.ncbi.nlm.nih.gov/pmc/articles/PMC1308449/.

- Nonprofit insurers were created in most states during the 1930s to provide coverage for low-income individuals, which had the added advantage of increasing financial certainty for hospitals. Some of the community benefits of not-for-profit insurers have been eroded by expansion of insurance options, including by Medicaid and the Children’s Health Insurance Program (CHIP). See: J. Needleman, “Nonprofit to for-profit conversions by hospitals, health insurers, and health plans,” Public Health Reports, vol. 114, no. 2 (March/April 1999), www.ncbi.nlm.nih.gov/pmc/articles/PMC1308449/.

- See: Nancy M. Kane, “Some Guidelines for Managing Charitable Assets from Conversions,” Health Affairs, vol. 16, no. 2 (March/April 1997), www.healthaffairs.org/doi/full/10.1377/hlthaff.16.2.229.

- The conversion, according to the sponsor’s memo in support of the provisions authorizing such conversions, would allow Empire “the ability to raise capital needed to compete effectively in the current health market.” See: New York State Senate, memo in support of Chapter 1 of the Laws of 2002 (January 15, 2002).

- James C. Robinson, “The Curious Conversion Of Empire Blue Cross,” Health Affairs, vol. 22, no. 4 (July/August 2003), p. 107, https://pdfs.semanticscholar.org/b4a6/5a05d4e1b41acee0beab97f28bb1fa2bd703.pdf.

- James C. Robinson, “The Curious Conversion Of Empire Blue Cross,” Health Affairs, vol. 22, no. 4 (July/August 2003), p. 101, https://pdfs.semanticscholar.org/b4a6/5a05d4e1b41acee0beab97f28bb1fa2bd703.pdf.

- The Department of Financial Services was created in 2011 to combine the Department of Banking and the Department of Insurance. Prior to 2011, the Department of Insurance had oversight responsibility for conversions. See §4301 of the State Insurance Law and §7317 of the State Insurance Law.

- See §4301(j) of the State Insurance Law. Funds can also be held in reserve and invested while held in trust by the Office of the State Comptroller. See: Office of the New York State Comptroller, Fund Classification Manual (January 2018), p. 349, www.osc.state.ny.us/agencies/fcm/fund-classification-manual-jan2018.pdf.

- The Health Foundation’s mission is to promote health insurance coverage, expand public health programs, and to educate the public on health issues. The Foundation has a nine member board with three board members selected by each of the Governor, the Senate, and the Assembly. See: §4301(j) of the State Insurance Law and §7317(k) of the State Insurance Law.

- New York State Department of Financial Services, “Approval in the matter of the amended plan of conversion” (October 8, 2002), www.dfs.ny.gov/insurance/r_other/rfempcrt.pdf.

- As part of the conversion, Empire Blue Cross Blue Shield also merged with the Empire health maintenance organization (HMO) under the umbrella of WellChoice. WellChoice then merged with WellPoint, a separate insurer, in 2005. The WellPoint/WellChoice merger yielded more than $2 billion in conversion proceeds for the State. WellPoint changed its corporate name to Anthem in 2014. See: New York State Department of Financial Services, “Market Conduct Report on Examination of Empire HealthChoice Assurance, Inc. and Empire HealthChoice HMO, Inc. as of December 31, 2006” (November 4, 2010), p. 4, www.dfs.ny.gov/insurance/exam_rpt/55093m06.pdf; Anthem Insurance Companies, Inc., “Company History” (accessed February 12, 2018), www.antheminc.com/AboutAnthemInc/CompanyHistory/index.htm and “WellPoint and WellChoice to Merge” (press release, September 27, 2005), http://ir.antheminc.com/phoenix.zhtml?c=130104&p=irol-newsArticle&ID=761487.

- New York State Division of the Budget, FY 2005 Enacted Budget Report (September 14, 2004), p. 44, www.budget.ny.gov/pubs/archive/fy0405archive/enactedBudgetReport0405.pdf and FY 2006 Enacted Budget Report (April 18, 2005), p. 40, www.budget.ny.gov/pubs/archive/fy0506archive/enacted/FinalEnactedBudget.pdf.

- New York State Division of the Budget, FY 2009 Enacted Budget Report (May 1, 2008), p. 59, www.budget.ny.gov/pubs/archive/fy0809archive/enacted0809/2008-09EBReportFinal.pdf.

- The City of New York formally opposed the conversion plan in May 2008. See: City of New York, memorandum to the Honorable Eric R. Dinallo, Superintendent, New York State Insurance Department, in Opposition to the Plan of Conversion of HIP/GHI (May 6, 2008), www.nyc.gov/html/om/pdf/2008/pr164-08_memorandum.pdf.

- State Insurance Law was amended by Chapter 58 of the Laws of 2007 to expressly allow for the Emblem conversion. See: New York State Department of Financial Services, 152nd Annual Report of the Superintendent (May 2011), p. 98, www.dfs.ny.gov/reportpub/insurance/annrpt_2010.pdf.

- Barbara Benson, “Former DC lobbyist hired to rescue ailing health insurer,” Crain’s New York Business (September 28, 2015), www.crainsnewyork.com/article/20150928/HEALTH_CARE/150929890/after-shocking-washington-with-her-departure-from-americas-health-insurance-plans-karen-ignagni-sits-down-for-a-source-meeting-to-talk-about-working-to-rescue-emblemhealths-ailing-assets.

- Bertha Coombs, “Centene in a $3.75 billion Deal for New York Medicaid leader Fidelis Care,” CNBC (September 12, 2017), www.cnbc.com/2017/09/12/centene-in-a-3-point-75-billion-deal-for-new-york-medicaid-leader-fidelis-care.html.

- Fair market value is determined by either the value of stock from the converting entity’s initial public offering (IPO), or by an independent evaluation of market value when an IPO is not planned. The sale price is not necessarily indicative of the fair market value. See §7317(l) of the State Insurance Law.

- Questions have been raised over the legal authority related to conversion proceeds. Fidelis is authorized under Article 44 of the Public Health Law. Provisions governing insurance conversion proceeds cover not-for-profit insurers licensed under Article 43 of the Insurance Law and subsidiary Article 44 plans. It is unclear whether existing provisions cover the Centene-Fidelis deal. See: Bill Hammond, Cuomo’s Health Care Piggy Bank (Empire Center for Public Policy, January 2018), www.empirecenter.org/publications/cuomos-health-care-piggy-bank/.

- Dan Goldberg and Nick Niedzwiadek, “Cuomo’s health care shortfall fund,” Politico New York (January 17, 2018), www.politico.com/states/new-york/newsletters/politico-new-york-health-care/2018/01/17/cuomos-health-care-shortfall-fund-024827.

- Dan Goldberg, “Bishop assails Cuomo’s health care proposal,” Politico New York (February 12, 2018), www.politico.com/states/new-york/albany/story/2018/02/12/bishop-assails-cuomos-health-care-proposal-249624.

- Excess health care revenues in HCRA are used as an offload to pay for the State’s share of the Medicaid program which would otherwise be paid for from the General Fund.

- See: Carol Kellermann, “Statement on NYS Executive Budget for FY2019” (Citizens Budget Commission, January 2018), https://cbcny.org/advocacy/statement-nys-executive-budget-fy2019.