On Time, Off-budget

State 2020 Budget Grows 4.9 Percent

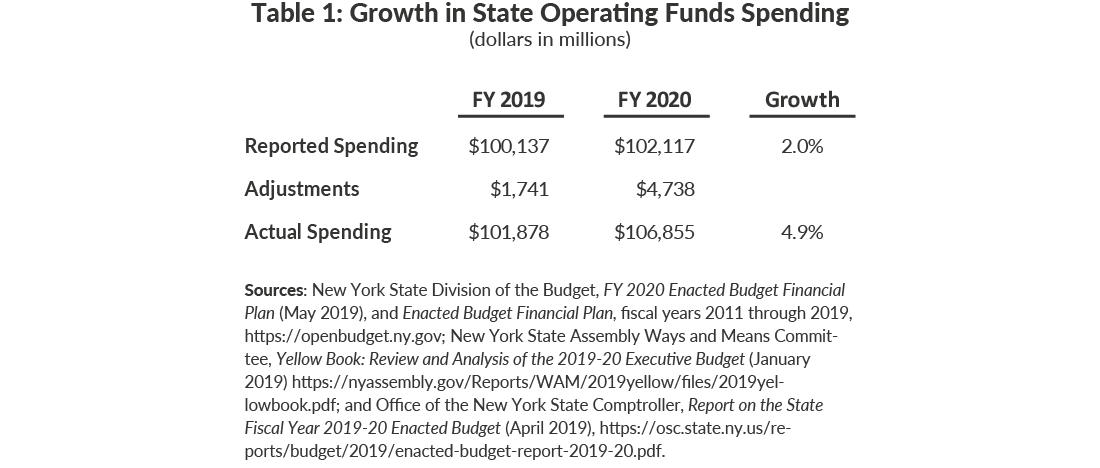

When announcing the fiscal year 2020 budget agreement, New York State’s leaders again reported holding State Operating Funds (SOF) spending growth to below the 2 percent benchmark Governor Andrew Cuomo set after taking office.1 However, accounting for prepayments, reclassifications, and other spending adjustments between fiscal years reveals SOF spending is projected to grow 4.9 percent in fiscal year 2020, more than double the benchmark.

Governor Cuomo has implemented important spending reforms to Medicaid, public pensions, and employee and retiree health insurance, and has kept agency spending mostly flat during his tenure. While these measures were sufficient to keep SOF growth to 2 percent early on, significant increases in other areas, most notably education and Medicaid, have pushed spending growth above 2 percent in the last three years.

State Operating Funds Spending

SOF spending includes disbursements for operations and debt service supported by State revenues. It excludes federal funds, over which the State has little control, and capital investments, which are best evaluated over a longer period. Accordingly, it is the best measure of annual State spending choices and has been Governor Cuomo’s focus for spending control.

The Governor claims this is the ninth straight year SOF spending growth has been held to 2 percent or less; however, growth is higher once adjusting for a series of accounting maneuvers that include:

- Items previously categorized as SOF spending shifting to off-budget accounts;

- Cash disbursements shifting between fiscal years; and

- Reclassification of other spending items.

The New York State Division of the Budget (DOB) acknowledges SOF spending growth would exceed the 2 percent reported when adjusting for such maneuvers.2

More than $4.7 billion is being shifted out of fiscal year 2020 SOF spending. (See Table 2.) The largest shift reflects the continuation of a process that began in fiscal year 2019: The Metropolitan Commuter Transportation Mobility Tax was shifted off-budget, reducing reported SOF spending by $1.4 billion in fiscal year 2019.3 In addition approximately $292 million in other taxes and fees collected on behalf of the Metropolitan Transportation Authority will be shifted off-budget in fiscal year 2020.4

Continuing past practice, debt service payments for fiscal year 2020 will be prepaid in fiscal year 2019. However, fiscal year 2020 shows a marked increase in prepayments compared to past years with $1.5 billion in debt prepayments shifted into the prior year; the largest previous shift under the Cuomo administration was less than $1 billion. Fiscal year 2019 spending increased $904 million—the net result of $594 million in fiscal year 2019 debt service payments made in fiscal year 2018 and $1.5 billion in fiscal year 2020 debt service payments made in fiscal year 2019—double the amount estimated at the 30-day amendments. The financial plan also expects $200 million in fiscal year 2021 debt service to be paid in fiscal year 2020. These payment accelerations do not save any interest costs.

Similarly, beginning in fiscal year 2017 new School Tax Relief (STAR) recipients receive their benefits as a personal income tax (PIT) credit, instead of as a State-funded property tax exemption. In the same year, all New York City personal income tax STAR benefits were reclassified from spending to a state tax credit. Starting this fiscal year, all homeowners with incomes greater than $250,000 will receive STAR benefits as an income tax credit. The budget also provides that recipients with incomes of less than $250,000 who do not switch to the PIT credit will have their STAR benefits frozen while other recipients will receive a 2 percent annual increase in the value of their STAR benefits. Residential property owners will continue to receive the same or greater benefits, but the reclassification results in SOF spending appearing $1.24 billion lower.

Reported fiscal year 2020 SOF spending also appears lower because tobacco Master Settlement Agreement revenues are used to pay certain Medicaid expenses off-budget.5 This totals $444 million in fiscal year 2019 and $315 million in fiscal year 2020.

Other actions are forecast to decrease reported SOF spending by $186 million in fiscal year 2020; shifting State support for the State University of New York from SOF to capital; using the mortgage insurance fund to provide local aid; delaying a repayment to the New York Power Authority; and shifting certain costs of the New York State Energy Research and Development Authority off-budget.

Finally, beginning in fiscal year 2018, the State began shifting personnel expenses between capital funds and SOF. The net result is a reported $141 million increase in SOF spending in fiscal year 2020.

Taken together, these shifts and reclassifications decrease reported SOF spending $1.7 billion in fiscal year 2019 and $4.7 billion in fiscal year 2020. Adding this spending back to each fiscal year demonstrates that SOF growth is actually 4.9 percent in fiscal year 2020, which builds on growth of 2.5 percent in fiscal year 2019 and 2.8 percent in fiscal year 2018. (See Table 2.)

Conclusion

These shifts and reclassifications undermine transparency and make year-to-year comparisons challenging. While spending reform measures were sufficient to keep SOF growth to 2 percent early in Governor Cuomo’s tenure, significant spending increases, most notably in education and Medicaid, have driven spending beyond 2 percent in the last three years.

Download Blog

On Time, Off-budget: State 2020 Budget Grows 4.9 PercentFootnotes

- New York State Office of the Governor, “Governor Cuomo and Legislative Leaders Announce Agreement On FY 2020 Budget” (press release, March 31, 2019), https://www.governor.ny.gov/news/governor-cuomo-and-legislative-leaders-announce-agreement-fy-2020-budget.

- “The Financial Plan also includes actions that affect spending reported on a State Operating Funds basis, including accounting and reporting changes. If these and other transactions are not implemented or reported as planned, annual spending growth in State Operating Funds would increase above current estimates.” New York State Division of the Budget, FY 2020 Enacted Budget Financial Plan (May 2019), p. 36, https://www.budget.ny.gov/pubs/archive/fy20/enac/fy20fp-en.pdf.

- Since the State has shifted this tax off-budget, collections are no longer reported by DOB. Therefore, in order to account for the fiscal year 2020 impact of this shift, the 2019 levels were increased by the State’s most recent forecast for wage growth. See: New York State Division of the Budget, FY 2020 Enacted Budget Financial Plan (May 2019), p.74, https://www.budget.ny.gov/pubs/archive/fy20/enac/fy20fp-en.pdf.

- New York State Assembly Ways and Means Committee, Yellow Book; Review and Analysis of the 2019-20 Executive Budget (January 22, 2019), p. 91, https://nyassembly.gov/Reports/WAM/2019yellow/.

- The Master Settlement Agreement is a $10 billion settlement between various governments and the five largest tobacco companies related to the impact of tobacco use on public health. The State is using these funds to pay costs associated with freezing the local share of Medicaid off-budget. Previously, these expenses were on-budget.