Slumping Sales

Pandemic Continues to Batter City Economy

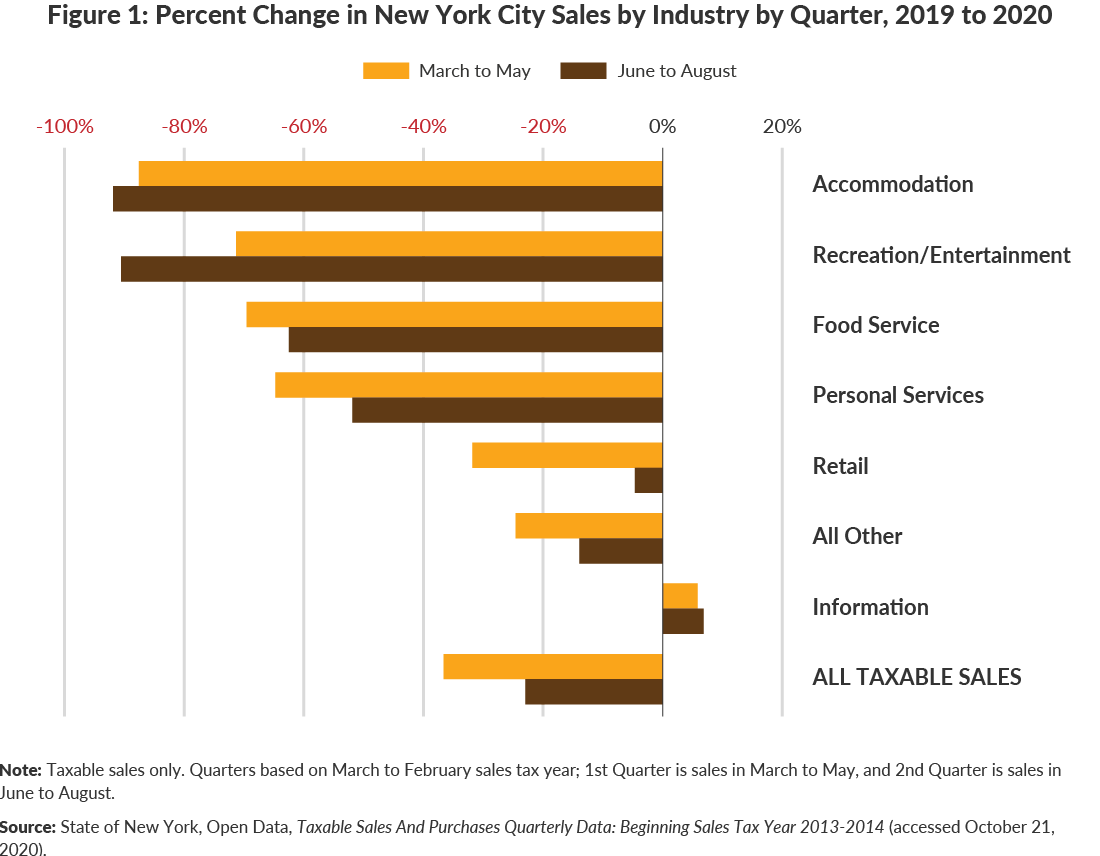

Recently released sales tax data show the COVID-19 pandemic and recession continue to batter New York City. In contrast to the rest of the state, where aggregate taxable sales have rebounded to 2019 levels, New York City taxable sales declined 23 percent to $34.2 billion in June to August 2020 as compared to the same quarter in 2019.1 Fortunately the decline was less severe than in the preceding quarter; from March to May 2020 New York City taxable sales declined 37 percent compared to the prior year. (See Figure 1.)

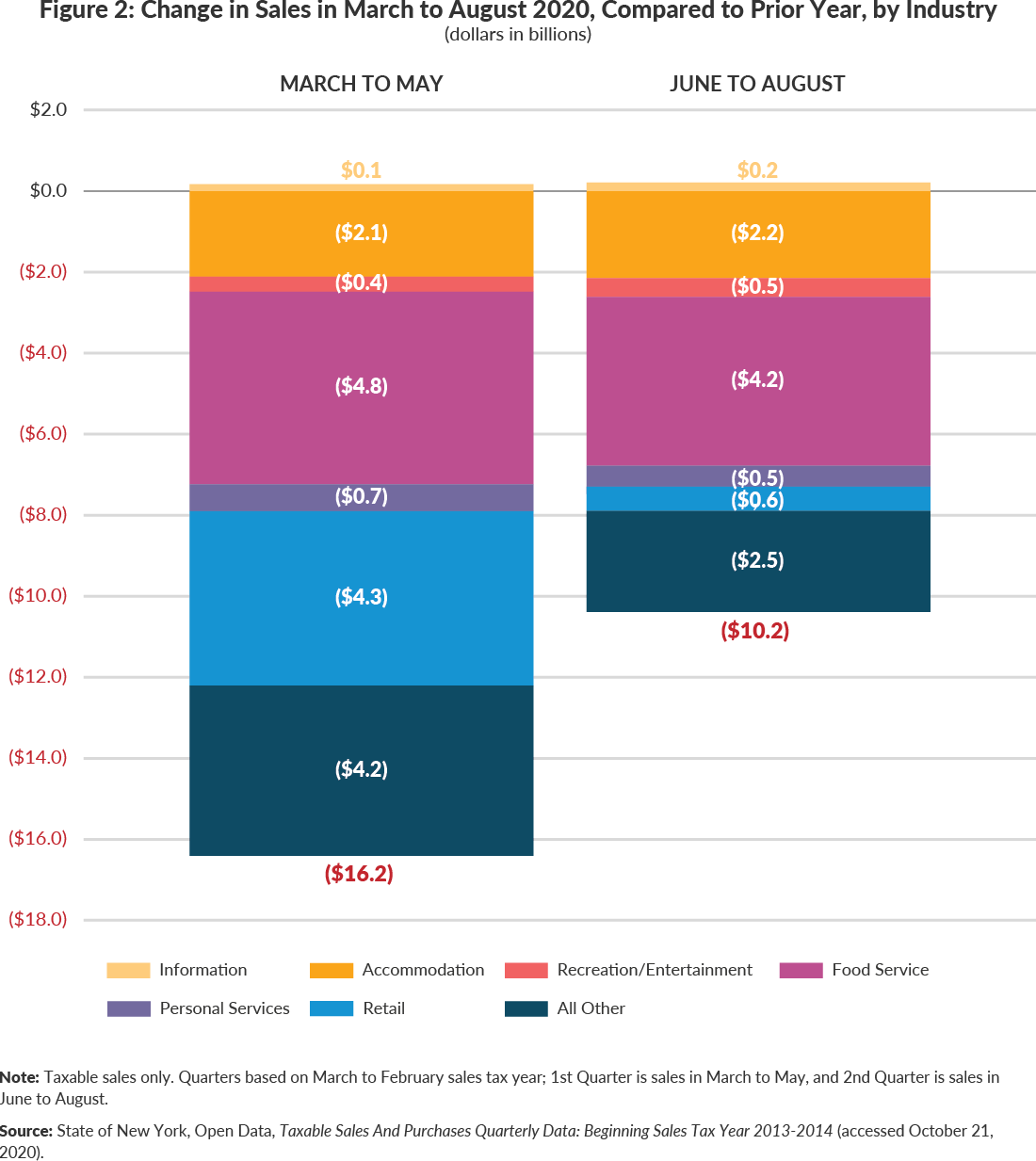

The pandemic’s impact in New York City varies significantly by industry. (See Figures 1 and 2.)

- The largest dollar decline was at restaurants, where sales were down $9.0 billion from March to August 2020 (34 percent of the total decline). Outdoor dining, which resumed in June, only modestly helped restaurants. 2 Taxable food service sector sales were down 62 percent in June to August, a very modest improvement over the 70 percent decline in the prior quarter.

- Tourism and business travel suffered the greatest proportional decline; the accommodation sector’s taxable sales declined more than 90 percent ($2.2 billion) in June to August 2020 compared to the prior year. The prior quarter, March to May, saw a similar decline of 88 percent, equal to $2.1 billion less in sales.

- Declining tourism, pandemic-related business closures, and New Yorkers staying home or leaving the City reduced recreation/entertainment sector taxable sales by more than 90 percent in June to August 2020, which is even greater than the prior quarter’s 71 percent decline. Personal services also were down by more than half. The combined reduction in taxable sales for these two sectors was about $1 billion in each quarter.

- Retail shopping has recovered substantially. Taxable retail sales were down 5 percent in June to August 2020, a major improvement from the 32 percent decline in prior quarter. From March to May 2020, taxable retail sales were $4.3 billion lower than the prior year; the decline was $600 million in June to August 2020. During the pandemic, electronic retailers comprised 21.5 percent of retail taxable sales, up from 8.5 percent the prior year.

- Taxable sales increased in only one sector: information. However, this sector is a small share of taxable sales and the increase was $200 million. Notably, this does not reflect streaming and digital goods, which are not subject to the sales tax.

In sum, the impact of these changes is City sales tax revenue declined 23 percent to $1.5 billion in June to August 2020 compared to $2 billion in same period last year.

Footnotes

- Taxable sales were greater in 38 counties and lower in 19 counties in June to August 2020 as compared to the same time period in 2019.

- Taxable food service sector sales were $2,079 million in March to May 2020 and $2,503 million in June to August 2020.