CBC Releases "Top of the Charts"

With Albany and New York City facing steep challenges and hard choices in upcoming budget discussions, it’s important to know where we stand in comparison to other states and their localities on the taxing and spending charts. A new CBC analysis shows the stark reality: Based on the most recent available national data, New York and its localities are at the top of the chart in taxes and are #2 in spending.

Specifically, the analysis found:

- New York State and its localities spent 50 percent more per capita than the national average—higher than all other States except Alaska;

- Higher than California (7%), Massachusetts (24%), New Jersey (55%), Texas (71%), Connecticut (77%), and Florida (101%);

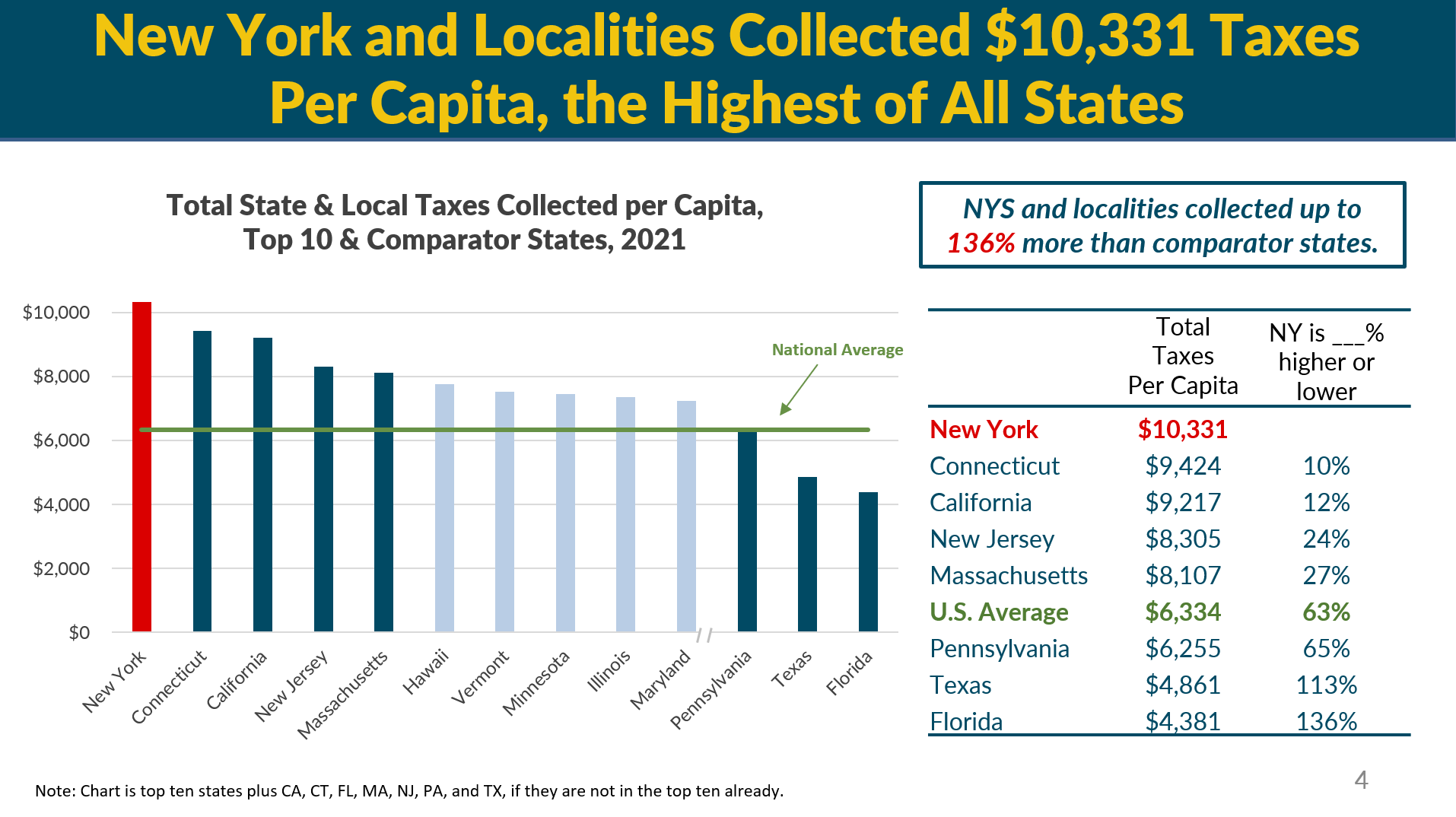

- New York State and its localities led in taxes, collecting the most per person (63 percent more than the national average) and the most per $1,000 personal income (36 percent more than the national average); and

- New York State and its localities collected more revenue from many types of taxes—property, personal income, corporate, and sales—than most other States and their localities.

The rankings are based on 2021 data—the most recent available. Since then, New York State and New York City have both substantially increased spending, and the State has increased taxes, likely maintaining New York’s chart-topping status.

High taxes and spending are not inherently bad. New York has long chosen to levy high taxes to fund an extensive array and level of services that are relatively high cost. Are we getting our money’s worth? What’s the tax-and-spend impact on drawing and keeping residents and businesses? Public officials should consider how we stack up to our competitors in terms of the State’s job growth and attractiveness to residents and businesses. They also should consider whether New York’s governments should be able to provide needed services at a lower cost.

Given the need to compete, increasing taxes in New York would risk the State’s economic wellbeing. New York should focus on identifying critical services and delivering them as efficiently as possible.