10 Billion Reasons to Rethink Economic Development in New York

This policy brief updates the Citizens Budget Commission’s two previous analyses of the cost of New York’s state and local economic development programs. This brief finds that between 2016 and 2018 state and local economic development costs continued to increase, state spending shifted toward discretionary grants and away from as-of-right tax breaks, and transparency has not meaningfully improved. These continue the trends found in the September 2016 policy brief Increasing Without Evidence that examined changes between 2014 and 2016.

A positive development is a gubernatorial proposal to improve transparency through a “database of deals” and procurement reform. It would be best to codify these commitments in law. Other reforms are still needed, including establishment of a forward-looking unified economic development budget, standardized metrics across programs, and improved program design.

Highlights:

- New York spent $9.9 billion on state and local economic development efforts in 2018, up $1.4 billion and 17 percent from $8.5 billion in 2016. (See Table 1.)

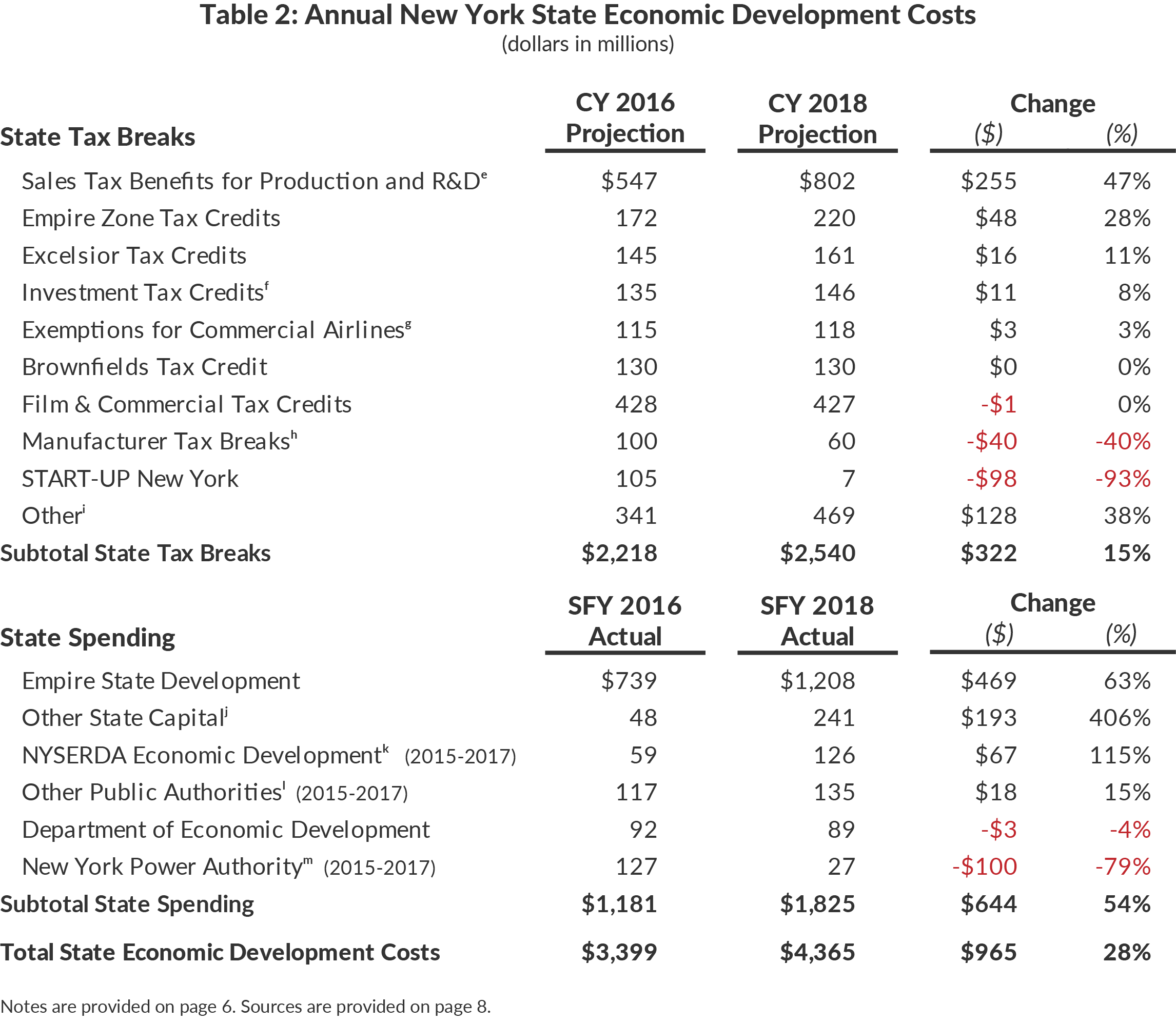

- State costs were $4.4 billion in 2018, an increase of $965 million over the 2016 total. State tax expenditures grew $322 million to $2.5 billion, while discretionary state spending grew $644 million to $1.8 billion. (See Table 2.)

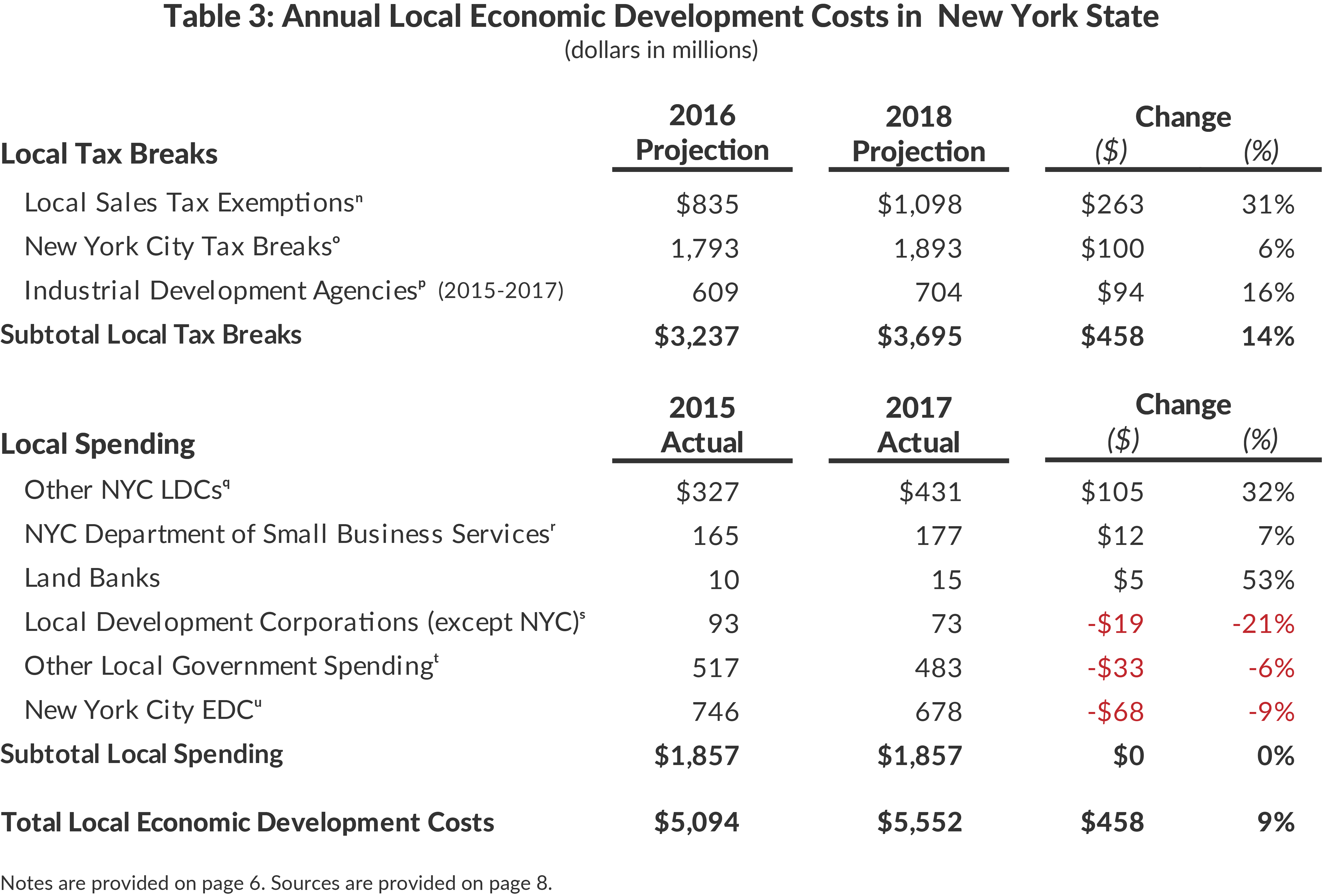

- Local costs, including tax expenditures and other spending, were $5.6 billion and 56 percent of the total 2018 cost. Local tax expenditures increased $458 million to $3.7 billion and local spending stayed flat at $1.9 billion. (See Table 3.)

Programs Growing Considerably During this Period

Sales Tax Benefits for Production and Research and Development

These tax expenditures increased 47 percent from $547 million in 2016 to $802 million in 2018.1 The growth was driven by an increase in the projected value of the sales tax benefit for machinery and equipment used in production, which rose from $330 million in 2016 to $607 million in 2018.

Empire State Development Spending

Spending by the State’s main economic development agency, the Empire State Development Corporation (ESD), grew 63 percent from $739 million in 2016 to $1.2 billion in 2018. During this period, the legislature made several large appropriations for major new projects under ESD’s jurisdiction, including the construction of Moynihan Station in Manhattan ($700 million), a second phase of investment in the Buffalo Billion ($400 million), and a Life Sciences Initiative and new laboratory ($1.1 billion). In addition, appropriations were made creating two new sources of funds without specified projects: the Strategic Projects Program ($208 million) and High Technology Innovation and Economic Development Infrastructure Program ($300 million). Spending under these appropriations will occur over several years. ESD also continued spending on existing programs such as the Regional Economic Development Council initiative.

Other State Capital Spending

This category includes several different sources of capital funding for economic development: the Special Infrastructure Account, the Economic Development Capital Program, the Strategic Investment Program, the Regional Economic Development Program, the High Technology and Development Program, and the Economic Development Program – New York State. The Special Infrastructure Account (SIA) is funded by settlements paid to the State by large financial institutions. Economic development spending through the SIA grew significantly in 2018, with $164 million disbursed for the expansion of the Javits Center and $28 million to expand the availability and capacity of the state’s broadband networks.

Programs Shrinking During this Period

START-UP NY

This program, which allows for ten years of tax-free operation for new and expanding businesses that locate in designated areas on or near college campuses, has been smaller than anticipated. The decrease in the projected value from $105 million in 2016 to $7 million in 2018 reflects this gap.

New York Power Authority (NYPA)

Market rates for electricity have fallen faster than the rates NYPA offers through its ReCharge NY program, so there has been no effective cost of selling power through this program in 2015 and 2017 (the years for which data are available). Other aspects of NYPA’s economic development costs decreased over this period. The value of NYPA’s hydropower programs, which also offer power at a discounted rate, have fallen due to the decrease in market prices. In 2015, NYPA made a $67 transfer to ESD, which was not listed as revenue in ESD’s financial statements. A similar payment was not made in 2017.

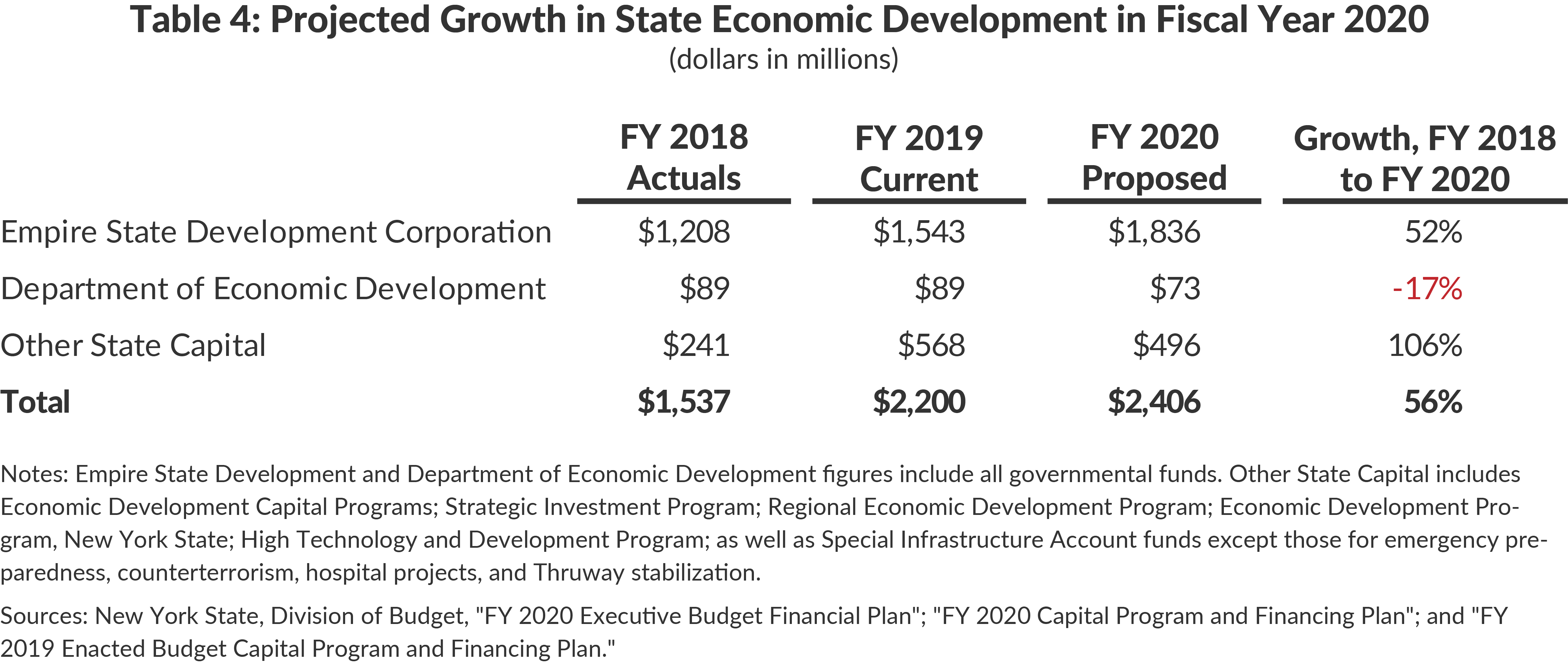

Continued Growth in New York State 2020 Executive Budget with Some Reforms

The Fiscal Year 2020 Executive Budget Financial Plan projects continued growth in state economic development spending, including 52 percent growth in ESD spending and 106 percent growth in Other State Capital, predominantly due to increased spending on the Javits Center expansion, broadband initiative, and economic development projects on Long Island. (See Table 4.)

Although spending growth continues, important reforms to improve transparency and accountability have not been made.2 In the 2018 session, the State Senate passed three bills to create a database of economic development deals, establish a unified economic development budget, and reform procurement by restoring the State Comptroller’s oversight of contracts made by the State University of New York, City University of New York, or the state’s Office of General Services, which previously had been eliminated.

Both a database of deals and procurement reform were included in the Governor’s book of proposals released with the State of the State, and the Executive Budget includes an appropriation to fund the creation of a database.3 However, these proposals are not included in the Article VII bills accompanying the Executive Budget, so they would not have the strength of law. These reforms should be codified in statute and passed by the legislature in this session. In addition, further reforms are needed: a unified economic development budget that includes information on the costs of all economic development programs for the coming fiscal year; standardization of metrics across programs to allow for comparability of results; and program design improvements so that benefits follow private sector investment, eligibility is standardized, and results are evaluated regularly.4

Download Report

10 Billion Reasons to Rethink Economic Development in New YorkNotes to Tables

Totals may not add due to rounding.

Some figures for tax expenditures are projections or estimates rather than actuals. These are calculated by the New York State Department of Taxation and Finance, New York State Division of the Budget, and New York City Department of Finance based on available data.

[a] Data are projections for calendar years 2016 and 2018.

[b] Data are actuals for state fiscal years 2015-2016 and 2017-2018, except where actuals for 2018 are not available. For New York Power Authority (NYPA), New York State Energy Research and Development Authority (NYSERDA), and other state authorities, data are actuals for fiscal years ending in 2015 and 2017.

[c] Includes data for local sales tax exemptions estimated using projections for calendar years 2016 and 2018; data for New York City tax expenditures for fiscal years 2016 and 2018 where available, and most recent data otherwise; and data for actual net tax exemptions granted by Industrial Development Agencies for fiscal years ending in 2015 and 2017.

[d] Data are actuals for fiscal years ending in 2015 and 2017, except for data for the Department of Small Business Services, which are for fiscal years 2016 and 2018.

[e] Includes tax breaks for research and development property; services to machinery and equipment used in production; machinery and equipment used in production; fuel, gas, electricity, refrigeration and steam used in research and development and production.

[f] Includes investment credit and investment credit for financial services industry.

[g] Includes tax breaks for Commercial Aircraft, Food Sold to Airlines, and Fuel Sold to Airlines.

[h] Includes real property tax relief credit for manufacturing. Does not include the $193 million value of the elimination of net income tax on corporate manufacturers in 2016, because the impact of this change is not reported for subsequent years.

[i] Includes alcoholic beverage production credit; biofuel production credit; clean heating fuel credit; commercial buses; computer systems hardware; economic transformation and facility redevelopment program tax credit; Empire State apprenticeship tax credit; farm production and commercial horse breeding; farmers' school property tax credit; fuel, gas, electricity, refrigeration and steam used in farming and commercial horse breeding; green building credit; industrial development agencies sales tax exemption; Lower Manhattan commercial office space; NY Works youth job credit; musical and theatrical production credit; qualified emerging technology company credits; rehabilitation of historic properties; tractor-trailer combinations; and training and maintaining race horses.

[j] Includes Economic Development Capital Programs; Strategic Investment Program; Regional Economic Development Program; Economic Development Program--New York State; High Technology and Development Program; as well as Special Infrastructure Account funds except those for emergency preparedness, counterterrorism, hospital projects, and Thruway stabilization.

[k] Includes expenditures on NYSERDA's Technology and Market Development Program, Saratoga Technology and Energy Park, Energy Research & Development, and Market Development/Innovation & Research. The Technology and Market Development Program expired in 2016 and is included in "Other" in the 2017-2018 financial statements, so it is not included in the 2018 total.

[l] Total expenses, excluding depreciation costs and transfer of excess revenues; includes Agriculture & New York State Horse Breeding Development Fund, Development Authority of the North Country, Hudson River Park Trust, Olympic Regional Development Authority, and New York State Thoroughbred Breeding and Development Fund.

[m] Data are for calendar years 2015 and 2017. Includes estimated benefit to ReCharge NY participants; Industrial Incentive Awards paid; deposits to Western New York Economic Development Fund; deposits to Northern New York Economic Development Fund (established in 2014); legacy rebate payments made to Power For Jobs program participants; payments to Transitional Electricity Discount recipients; and transfers to Empire State Development (ESD). ESD's financial reports do not list this transfer as revenue.

[n] Estimated as equal to statewide sales tax expenditures on economic development-related items.

[o] Includes NYC Industrial and Commercial Incentive Program, Industrial and Commercial Abatement Program, Commercial Expansion Program, Trust for Cultural Resources, Insurance Company Non- Taxation, Commercial Revitalization Program, Relocation and Employment Assistance Program, Energy Cost Savings Program, Biotechnology Credit, Economic Development Corporation exemptions net of PILOTs, and Industrial Development Agency exemptions net of PILOTS .

[p] Net exemptions. Does not include New York City Industrial Development Agency.

[q] Total expenses; includes Apple Industrial Development Corporation, Brooklyn Bridge Park Corporation, Brooklyn Navy Yard Development Corporation, Build NYC Resource Corporation, Community Fund for Manhattan, Governors Island Corporation, Hudson Yards Development Corporation, Hudson Yards Infrastructure Corporation, NYC Business Assistance Corporation, NYC Capital Resource Corporation, NYC Energy Efficiency Corporation, NYC Land Development Corporation, NYC Neighborhood Capital Corporation, Queens Economic Development Council, The Mayor's Fund to Advance New York City, Theater Subdistrict Council Local Development Corporation, and West Brighton Community Local Development Corporation.

[r] Actual Expenditures and Transfers for City Fiscal Years 2016 and 2018, net of Economic Development Corporation.

[s] Total expenses; excludes tobacco asset securitization corporations, STARC, and others with non- economic development purposes.

[t] Expenditures; Includes cities, counties, towns, villages, and special purpose units.

[u] Total expenses.

Sources to Tables

- Agriculture and New York State Horse Breeding Development Fund, “Management’s Discussion and Analysis and Financial Statements” (December 31, 2017), www.abo.ny.gov/annualreports/PARISAuditReports/FYE2017/State/AgricultureandNewYorkStateHorseBreedingDevelopmentFund2017.pdf, and 2015 edition, www.abo.ny.gov/annualreports/PARISAuditReports/FYE2015/State/Agriculture&NYSHorseBreedingDevelopmentFund2015.pdf.

- City of New York, Department of Finance, “Annual Report on Tax Expenditures: Fiscal Year 2018” (February 2018), https://www1.nyc.gov/assets/finance/downloads/pdf/reports/reports-tax-expenditure/ter_2018_final.pdf, and Fiscal Year 2016 edition, https://www1.nyc.gov/assets/ finance/downloads/pdf/reports/reports-tax-expenditure/ter_2016_final.pdf.

- Development Authority of the North Country, “Financial Statements as of March 31, 2018” (March 31, 2018), www.abo.ny.gov/annualreports/PARISAuditReports/FYE2018/State/DevelopmentAuthorityoftheNorthCountry2018.pdf, and 2016 edition, www.abo.ny.gov/annualreports/PARISAuditReports/FYE2016/State/DevelopmentAuthorityoftheNorthCountry2016.pdf.

- Hudson River Park Trust, “Management’s Discussion and Analysis, Financial Statements and Supplemental Information” (March 31, 2018), www.abo.ny.gov/annualreports/PARISAuditReports/FYE2018/State/HudsonRiverParkTrust2018.pdf, and 2016 edition, www.abo.ny.gov/annualreports/PARISAuditReports/FYE2016/State/HudsonRiverParkTrust2016.pdf.

- New York Independent System Operator, “Energy Market and Operational Data: Zonal Day- Ahead Market Location Based Marginal Price,” www.nyiso.com/energy-market-operational-data.

- New York State Authorities Budget Office, “Industrial Development Agencies’ Project Data,” https://data.ny.gov/Transparency/Industrial-Development-Agencies-Project-Data/9rtk-3fkw; “Summary Financial Information for Local Development Corporations,” https://data.ny.gov/ Transparency/Summary-Financial-Information-for-Local-Developmen/wgry-y5zd.

- New York State Division of the Budget, “FY 2019 Annual Report on New York State Tax Expenditures” (February 2018), www.budget.ny.gov/pubs/archive/fy19/exec/fy19ter/taxexpendfy19.pdf, and FY 2017 edition, www.budget.ny.gov/pubs/archive/fy17archive/eBudget1617/fy1617ter/TaxExpenditure2016-17.pdf; “FY 2019 Enacted Budget Capital Program and Financing Plan,” (May 2018), www.budget.ny.gov/pubs/archive/fy19/enac/fy19enacCP.pdf, and Fiscal Year 2017 edition, www.budget.ny.gov/pubs/archive/fy17archive/ enactedfy17/FY2017CPFP.pdf; “FY 2019 Enacted Budget Financial Plan,” p. T-155 (May 2018), www.budget.ny.gov/pubs/archive/fy19/enac/fy19enacFP.pdf, and Fiscal Year 2017 edition, p. T-155, www.budget.ny.gov/pubs/archive/fy17archive/enactedfy17/FY2017FP.pdf.

- New York State Energy Research and Development Authority, “Financial Statements” (March 31, 2018), www.abo.ny.gov/annualreports/PARISAuditReports/FYE2018/State/NewYorkStateEnergyResearchandDevelopmentAuthority2018.pdf, and Fiscal Year 2016 edition, www.abo.ny.gov/annualreports/PARISAuditReports/FYE2016/State/NYSERDA2016.pdf.

- New York State Olympic Regional Development Authority, “Financial Statements as of March 31, 2018 and 2017” (March 31, 2018), www.abo.ny.gov/annualreports/PARISAuditReports/FYE2018/State/NewYorkStateOlympicRegionalDevelopmentAuthority2018.pdf, and 2016 edition, www.abo.ny.gov/annualreports/PARISAuditReports/FYE2016/State/NYSOlympicRegionalDevelopmentAuthority2016.pdf.

- New York State Thoroughbred Breeding and Development Fund Corporation, “Financial Report” (December 31, 2017), www.abo.ny.gov/annualreports/PARISAuditReports/FYE2017/State/NewYorkStateThoroughbredBreedingDevelopmentFund2017.pdf, and 2015 edition, www.abo.ny.gov/annualreports/PARISAuditReports/FYE2015/State/NYSThoroughbredBreedingDevelopmentFund2015.pdf.

- Office of the New York City Comptroller, “Comprehensive Annual Financial Report of the Comptroller For the Fiscal Year Ended June 30, 2018,” p. 302, https://comptroller.nyc.gov/wp-content/uploads/documents/CAFR2018.pdf, and Fiscal Year 2016 edition, p. 302, https://comptroller.nyc.gov/wp-content/uploads/documents/CAFR2016.pdf.

- Office of the New York State Comptroller, “Financial Data for Local Governments,” www.osc.state.ny.us/localgov/datanstat/findata/index_choice.htm.

- Power Authority of the State of New York, “2015 Annual Report” (March 2016), p. 41, www.nypa.gov/NYPA-2015-AnnualReport.pdf; “2017 Report to the Governor and Legislative Leaders on Power Programs for Economic Development” (April 2018), p. 3, 7-8, www.nypa.gov/-/media/nypa/documents/document-library/governance/2017govrpt.pdf, and 2015 edition, p. 3, 9-10; “Electric Supply Rates - Business Customers: Beginning 2012,” https://data.ny.gov/Energy-Environment/New-York-Power-Authority-NYPA-Electric-Supply-Rate/2x8p-pewm; “Financial Report, December 31, 2017 and 2016” (March 2018), pp. 17-18, www.nypa.gov/-/media/nypa/documents/document-library/financials/2017-finance-report.pdf.

Footnotes

- This category includes tax breaks for research and development property; services to machinery and equipment used in production; machinery and equipment used in production; fuel, gas, electricity, refrigeration and steam used in research and development and production.

- New York State Senate, S6613B, S3354, S3984A.

- New York State, Office of the Governor, “2019 Justice Agenda” (January 15, 2019), pp. 249-251, www.governor.ny.gov/sites/governor.ny.gov/files/atoms/files/2019StateoftheStateBook.pdf.

- Riley Edwards, A Blueprint for Economic Development Reform (March 13, 2017), Citizens Budget Commission, https://cbcny.org/research/blueprint-economic-development-reform.