Christmas Bonuses

Many New Yorkers feeling the effects of the recession will be tightening their belts and shortening their gift-giving lists this holiday season; but, they might find an unexpected entry on their lists. Tomorrow, thousands of retired police and firefighters will be receiving $12,000 Christmas bonuses courtesy of the City's taxpayers.

These Christmas bonuses are officially called Variable Supplement Fund (VSF) payments and they are in addition to the regular pension checks retirees receive. They require no additional employee contributions and are paid to police and fire employees who retire with service (but not disability) pensions.

The State Legislature established the VSFs in 1968. These accounts are technically separate from the pension system, but were established with a transfer from the pension funds when the City changed the way it invested the funds; the idea was to share exceptional investment earnings with retirees. Each year, transfers – and related payments to retirees – were determined by the strength of investment earnings; in time, however, the variable supplements were converted to fixed payments. By 1993, eligible police officers, police superiors, firemen and fire officers were receiving payments set by statute to rise every year until reaching $12,000 in 2007. Based on available public data, CBC estimates that the VSF raises annual pensions for recent police and fire retirees on service retirements from $54,300 and $63,400 to $66,300 and $75,400, respectively.

And it's not just retirees who receive the benefit. Starting in 2002, police officers and firefighters who are eligible to retire after twenty years of service but who choose to remain on the job receive VSF payments, as well. The payments are "banked" for them until their date of retirement, when they receive the funds that have been accrued as a lump-sum payment.

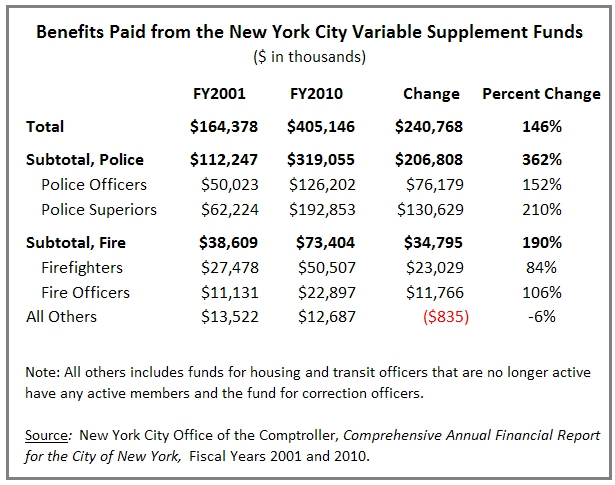

Each year, the benefits paid from VSFs are significant: in fiscal year 2010, they totaled $405 million. This is 150 percent greater than the benefits paid in fiscal year 2001, $164 million.

VSFs are managed as separate funds with their own assets, but any shortfall the funds experience must be covered by a transfer from the City's pension systems. In fiscal year 2010, the VSFs had over $1.7 billion in assets; however, assets have been halved from their 2007 levels due to investment losses. This raises the possibility of a transfer from the pension funds, which would effectively lower the already reduced investment return on the pension funds and prompt an increased contribution by the City to fund pension benefits. Unlike other pension benefits, VSFs are not constitutionally protected. Since they are not considered a part of the pension system, they can be reduced, mitigated or eliminated - but only by the State Legislature.

By Maria Doulis