The Cost of Affordable Housing

A number of elected officials and housing advocates have criticized aspects of the Mayor’s Housing New York Plan as insufficiently focused on creating housing units for the lowest income households. They argue that the Plan’s definition of “affordable” housing is too broad and that developers should be required to provide more affordable units in exchange for the zoning and/or tax benefits to be conferred. In order to assess these concerns it is necessary to understand the economics of housing construction in New York City: How much does it cost to build residential units and what level of rent is needed to generate sufficient revenue to cover those costs?

If certain tenants cannot afford the necessary rents, then other tenants must have their rent set high enough and/or there must be government subsidies to cover the shortfall. But there is a limit to how high rents can be set and still attract tenants, and there is a limit to how much city government can afford to provide in construction or rent subsidies.

Cost of Construction

A large share of total rent charged to tenants in newly constructed rental housing goes toward paying the cost of constructing the unit. The costs of construction can be divided into three types: 1) land prices, 2) “hard costs” including the price of labor and materials, and 3) “soft costs” including insurance, permitting, architectural, legal and financing costs. These costs are sometimes expressed on a “buildable per square foot” basis, a measure used in real estate development based on building size and units permitted on a lot by zoning regulations.

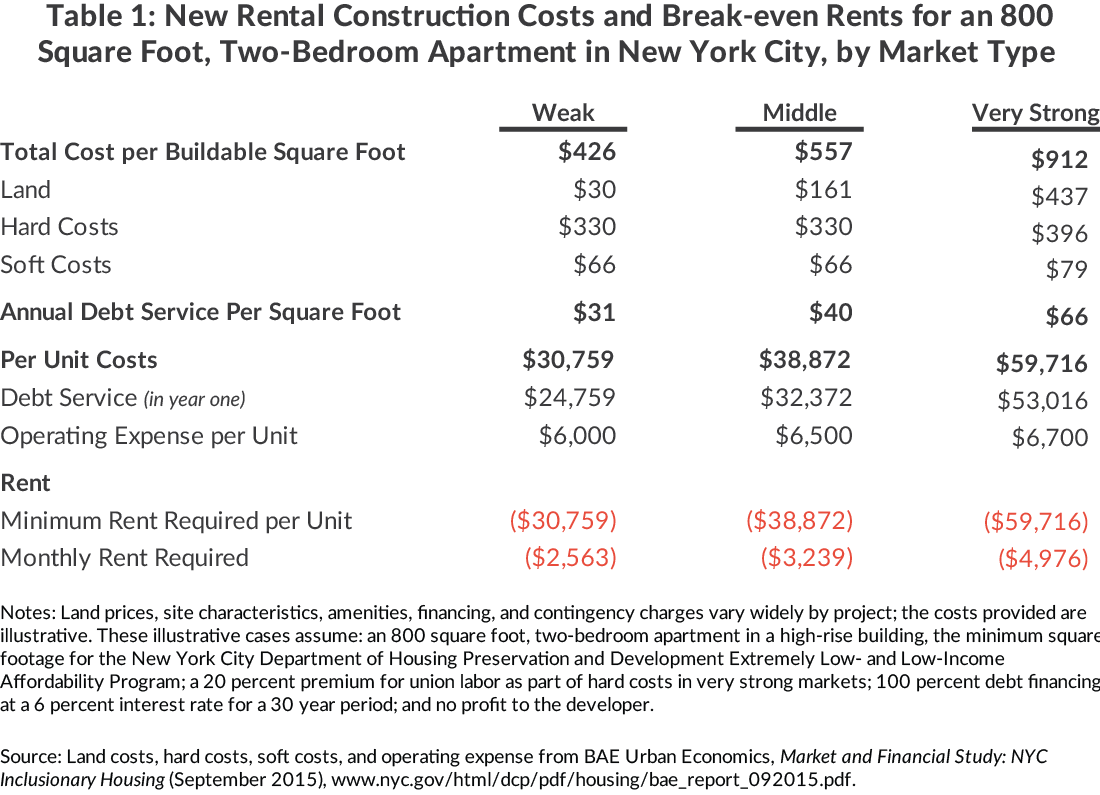

Land prices range widely across New York City neighborhoods. The average price per square foot in weak markets (for example East Tremont and Morrisania in the Bronx) is approximately $30, while in very strong markets the average is $437.1 Hard costs vary based on the type of labor used and the materials and finishes selected. Union labor in New York City, often used in very strong markets, increases labor costs 20 to 30 percent.2 Soft costs are estimated as 20 percent of hard costs.3

In a recent study completed for the New York City Housing Development Corporation, each of these construction cost components was estimated for different types of neighborhood housing markets, from weak to very strong. Table 1 shows the rent required for a hypothetical 800-square foot two-bedroom apartment in a 100-unit high-rise building to cover the costs of construction ranges from nearly $31,000 to $60,000 per year. Even in the weakest housing markets, where land and construction costs are lowest, the rent required to cover construction costs is more than $2,500 per month. It should be noted that these estimates do not account for any profit for the developer and reflect average costs on projects without any site complications.

Who can afford these rents?

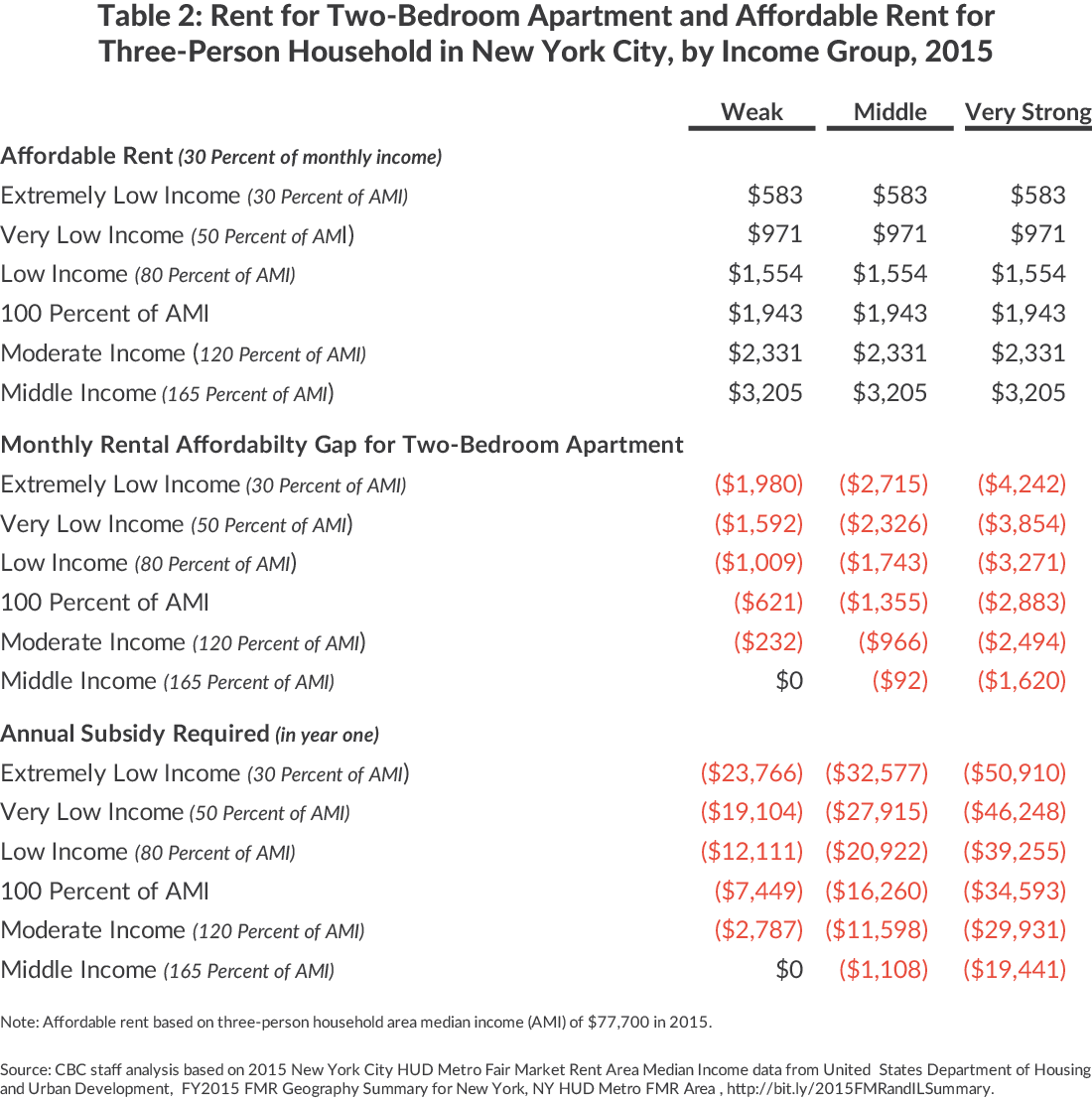

Using the generally accepted standard that an “affordable rent” should not exceed 30 percent of household income, Table 2 shows what amount of rent is affordable for three-person families of different income levels in different neighborhoods. For example an extremely low-income three-person household with an annual income of $23,310 can afford to pay $583 per month in rent. Even in a weak housing market, this household would be $1,980 per month short of the amount required to cover the cost of constructing a new unit. To make it possible for this family to occupy the unit, other tenants, government subsidies, or some combination thereof, would be required to provide an annual subsidy of $23,766. In contrast, a middle-income household earning $128,205 per year, could afford to rent that same apartment without a subsidy, or to rent the same apartment in a very strong market with a subsidy of $1,620 per month, or $19,441 per year.

What would it cost to require more affordable units?

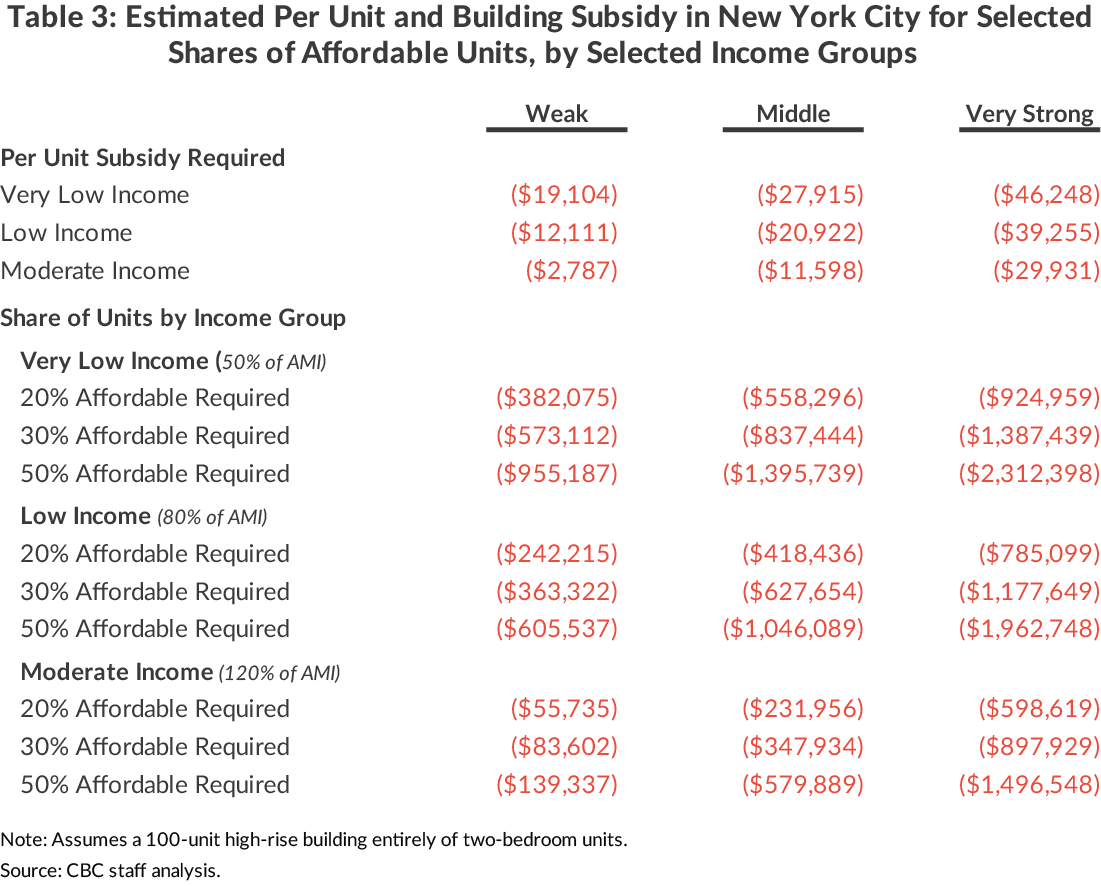

Table 3 shows how the subsidy required for a 100-unit building would change based on the income level and share of affordable units required. For instance, in weak markets, 50 units can be occupied by very low-income households at an annual cost of $955,000. In contrast, providing 20 units to very low income households in very strong markets would require an annual subsidy of $925,000. Generally, increasing housing supply in weaker markets can provide more housing, at a lower cost per unit.

Additionally, subsidies will need to increase over time when operating and maintenance costs exceed rent increases allowed by the Rent Guidelines Board. Thus, the more affordable housing units required, and the lower the income levels specified, the more costly the subsidies will be, the more difficult it will be for developers to structure projects that recover construction costs, and the smaller the total number of affordable units that the City will be able to incentivize and support.

Conclusion

This analysis shows how the high cost of housing development forces trade-offs between income levels, affordable shares, and location. It is challenging to simultaneously lower the income level required for affordable units while increasing their share of the total, spreading the units geographically, and keeping the costs manageable. Options for increasing the efficient use of land, reducing construction costs, and effectively using cross-subsidies should be explored to maximize the amount of affordable housing that can be produced.

Footnotes

- New York City Housing Development Corporation, Market and Financial Study: NYC Inclusionary Housing (September 2015), www.nyc.gov/html/dcp/pdf/housing/bae_report_092015.pdf.

- Regional Plan Association, Construction Costs in New York City: A Moment of Opportunity (June 9, 2011), www.rpa.org/pdf/RPA-CUI-Construction-Costs.pdf.

- This share assumes some level of public financing support, such as Housing Development Corporation construction financing. Private developers face notably higher financing costs.