Myths and Facts

NYC Adopted Budget for Fiscal Year 2025

Throughout the budget debate, public discussion was sometimes hampered by misunderstanding by various stakeholders. This chartbook fact checks and corrects five relatively common, inaccurate perceptions about the budget.

Contents

MYTH: The Budget Cuts Were Not Necessary

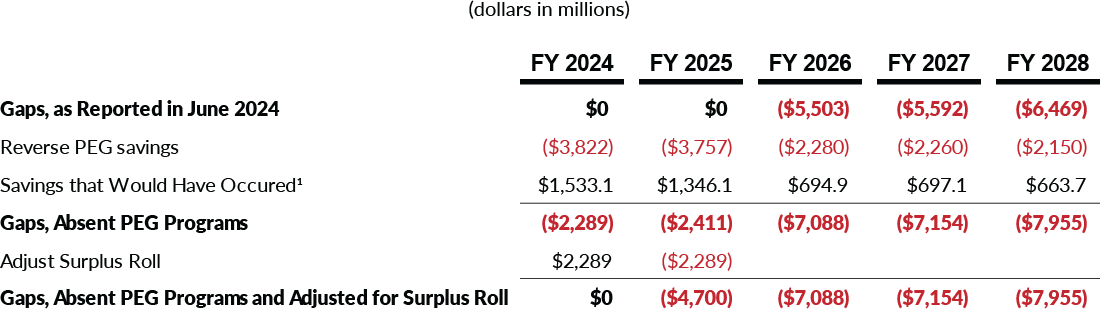

FACT: Absent the PEGs, FY 2025 Would Have a $4.7 Billion Gap

- Program to Eliminate the Gap (PEG) savings—approximately $3.8 billion annually in fiscal years 2024 and 2025 alone—were essential to balance the fiscal year 2025 budget;

- Absent the PEGs, out-year gaps would be $1.5 billion larger; and

- Some of the savings likely would have happened even without the PEGs as the City managed its budget over the course of the year, including all of debt service savings, and a portion of the spending re-estimates, underspending, vacancy savings, funding shifts, and revenues.

CBC Estimate of NYC Budget Gaps in the Absence of PEGs

¹ Based on past City practice, CBC estimates this would have included 100 percent of debt service savings; 50 percent of re-estimates, underspending, and vacancy savings; and 25 percent of funding shifts and revenue PEGs, based on CBC’s categorization.

City of New York, Mayor’s Office of Management and Budget, Fiscal Year 2025 Executive Budget: Program to Eliminate the Gap (April 24, 2024), Fiscal Year 2025 Adopted Budget: Financial Plan (June 30, 2024), and Fiscal Year 2025 Adopted Budget: Reconciliation (July 1, 2024).

MYTH: Most of the Budget Cuts Were Restored

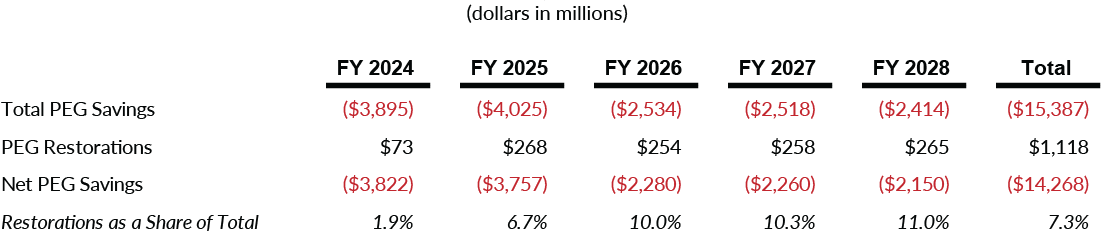

FACT: Just 7.3 Percent of the PEGs Were Restored

- Restorations over five years total $1.1 billion—just 7.3 percent of the $15.4 billion original PEG savings;

- Only 8.4 percent of the remaining PEGs affect program services;

- Only 6.7 percent of fiscal year 2025 PEGs were restored—$268 million, including NYPD Academy classes ($115 million), the Job Training Programs at the parks and sanitation departments ($33 million), and the public libraries ($22 million); and

- $29 million were one-year restorations in fiscal year 2025, including $19 million for Summer Rising and $6 million in sanitation department services, which are still slated to take effect in fiscal year 2026.

PEG Savings and Restorations, November 2023 to June 2024

City of New York, Mayor’s Office of Management and Budget, Fiscal Year 2025 Executive Budget: Program to Eliminate the Gap (April 24, 2024), Fiscal Year 2025 Adopted Budget: Financial Plan (June 30, 2024), and Fiscal Year 2025 Adopted Budget: Reconciliation (July 1, 2024).

MYTH: The Budget Includes Enough Money to Pay for Current Service Levels

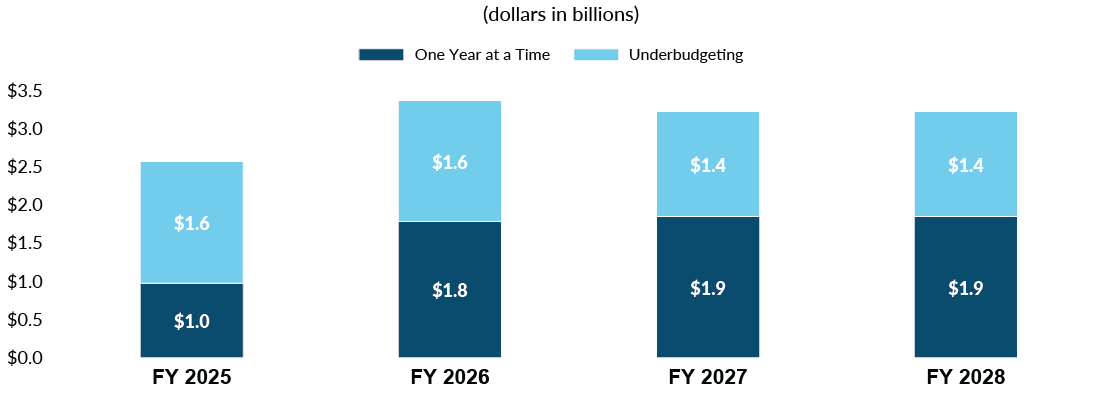

FACT: The Budget Is Short $2.6 Billion This Year and $3.3 Billion in Each Future Year to Support Current Services

- The City both underbudgets the cost of certain ongoing programs and funds others only for one year;

- Underbudgeting in fiscal year 2025 includes overtime ($758 million), public assistance ($468 million), and Carter cases (tuition reimbursement for special education students in private schools, $420 million); and

- Programs funded only for fiscal year 2025 include early childhood education expansion ($167 million); Promise NYC ($25 million); and the Shelter to Housing Action Plan ($10 million).

NYC FY 2025 Adopted Budget Underbudgeting

Ana Champeny and Julia Nagle, Don’t Step off the Cliff: Fiscal Cliffs in New York City’s Fiscal Year 2025 Preliminary Budget (February 8, 2024), City of New York, Mayor’s Office of Management and Budget, Fiscal Year 2025 Executive Budget: Reconciliation (April 24, 2024), Fiscal Year 2025 Adopted Budget: Reconciliation (July 1, 2024), Office of the New York State Comptroller, Review of the Financial Plan of the City of New York (Report 19-2024, February 2024), and Identifying Fiscal Cliffs in New York City’s Financial Plan (Updated May 28, 2024, accessed July 9, 2024); and Office of the New York City Comptroller, Comments on New York City’s Preliminary Budget for Fiscal Year 2025 and Financial Plan for Fiscal Years 2024 – 2028 (March 4, 2024).

MYTH: Out-Year Budget Gaps Are Relatively Easy to Manage

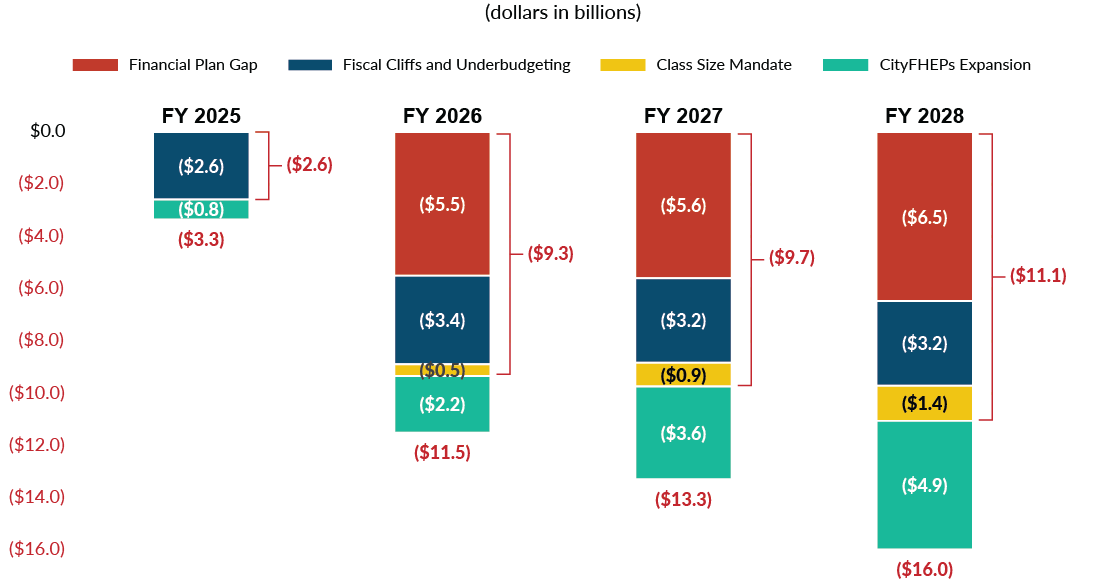

FACT: Reported Gaps Are Understated and Likely Exceed $9 Billion a Year

- The reported budget gaps in fiscal years 2026 to 2028 are significantly understated, and, at 6.4 percent to 7.3 percent of City funds, larger than adopted budget gaps in fiscal years 2013 to 2023;

- In addition to $3.3 billion of annual underbudgeting discussed above, the budget does not include the expected cost to implement the State’s Class Size Reduction mandate, which is projected to grow to $1.4 billion annually;

- CBC projects expected spending increases gaps to $9.3 billion, $9.7 billion, and $11.1 billion in fiscal years 2026, 2027, and 2028; and

- Implementing the eligibility expansion for CityFHEPS—the City-funded housing voucher program—may increase these gaps to $11.5 billion in fiscal year 2026, and $16.0 billion in fiscal year 2028.

CBC Projected Budget Gaps, FY 2025 - FY 2028

Figures may not add due to rounding.

City of New York, Mayor’s Office of Management and Budget, Fiscal Year 2025 Executive Budget: Program to Eliminate the Gap (April 24, 2024), Fiscal Year 2025 Adopted Budget: Financial Plan (June 30, 2024), and Fiscal Year 2025 Adopted Budget: Reconciliation (July 1, 2024); Office of the New York State Comptroller, Review of the Financial Plan of the City of New York (Report 19-2024, February 2024); and Office of the New York City Comptroller, Comments on New York City’s Preliminary Budget for Fiscal Year 2025 and Financial Plan for Fiscal Years 2024 – 2028 (March 4, 2024).

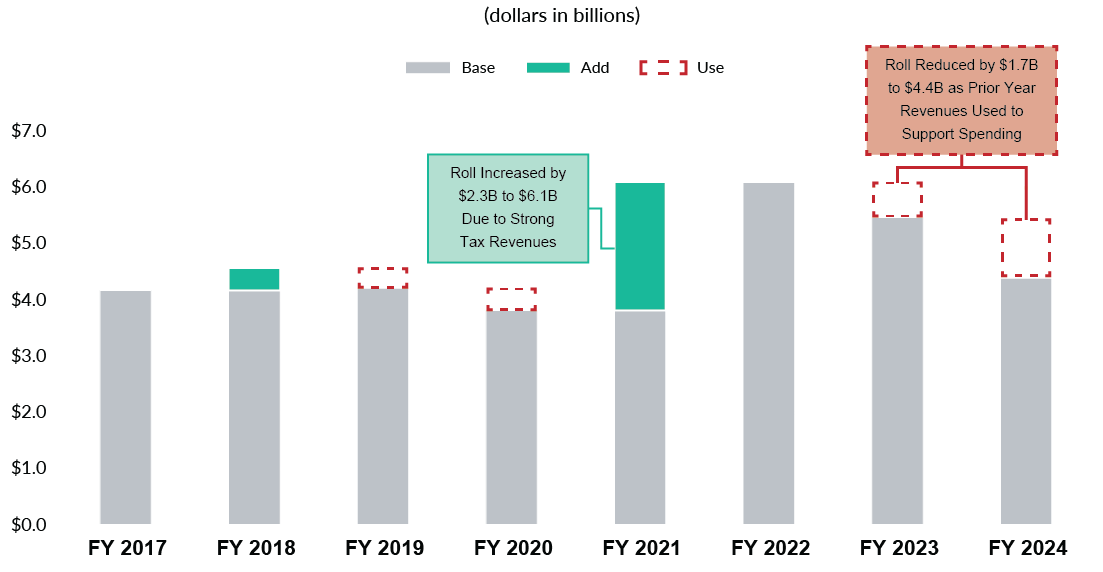

MYTH: FY 2024 Ran a $4.4 Billion Surplus

FACT: FY 2024 Needed $1.1 Billion in Prior-Year Revenues to Cover its Obligations

- For the last two years, the City has propped up unaffordable spending levels with strong fiscal year 2021 revenues that were rolled forward;

- Prepaying $4.4 billion of fiscal year 2025 bills early, in fiscal year 2024, may sound like a surplus, but it wasn’t because the City actually prepaid $5.5 billion of fiscal year 2024 bills in fiscal year 2023; and

- Put simply, the City had $5.5 billion to roll on June 30, 2023 and a year later, on June 30, 2024, the City had $4.4 billion to roll—it had spent down $1.1 billion in fiscal year 2024 of what it had built up previously.

Annual Prepayment of the Following Year’s Expenses (aka “The Surplus Roll”)

City of New York, Mayor’s Office of Management and Budget, Fiscal Year 2025 Adopted Budget: Financial Plan (June 30, 2024); and Office of the New York City Comptroller, Annual Comprehensive Financial Report for the Fiscal Year Ended June 30, 2023, and fiscal year 2017 to 2022 editions.

Methodology

-

PEGs are categorized by CBC based on the description provided in budget documents as one of the following: re-estimate, underspending, vacancy reduction, funding shift, debt service, revenue, efficiency, and program reduction. See Unpacking the PEG for more details.

-

Some PEG savings would have been realized even absent a formal PEG program as the City managed the budget during the year. To estimate the size of budget gaps if the Administration had not done the PEGs in fiscal year 2024, CBC assumed that a portion of the savings related to underspending, re-estimates, vacant positions, funding shifts, debt service and revenue would have occurred anyway.

-

Underbudgeting for current services is calculated based on the Office of the State Comptroller’s (OSC) "Identifying Fiscal Cliffs" tool, which is reconciled against the most recent budget documents to recognize funding that has been added to the budget. CBC estimates additional underbudgeting for overtime, Carter Cases, and the MTA subsidies based on budget data and fiscal monitor reports. This estimate is then reduced by 15 percent to allow for year-to-year variation in spending and limited details in budget documents. See Don’t Step Off the Cliff for more details.

-

The estimate for implementing the Class Size Reduction mandate is based on estimates by OSC and the City Comptroller; the CityFHEPs expansion estimate is based on OSC estimates. See Real Numbers, Real Choices for more details.