New York: A Model of Progressive Taxation?

The Institute on Taxation and Economic Policy (ITEP) recently released an update of its January 2003 report, Who Pays? A Distributional Analysis of the Tax Systems in All 50 States. The report analyzes the progressivity of the tax system of each state and the District of Columbia by measuring the state and local taxes paid by different income groups as a share of household income. Using ITEP's index, New York has the 6th most progressive system in the nation - behind California, the District of Columbia, Vermont, Delaware and Montana. (For an explanation of the ITEP measure, see the Notes at the end.)

New York's personal income taxes - including the New York City and Yonkers personal income tax - drive the progressiveness of New York's total tax system. However, as explained below, New York's system is progressive only in the sense that middle- and high-income residents pay a higher share of their income to taxes than the poorest residents. A comparison of middle-income and high-income residents shows that taxpayers in the middle of the income spectrum bear a proportionately larger burden than the wealthiest residents.

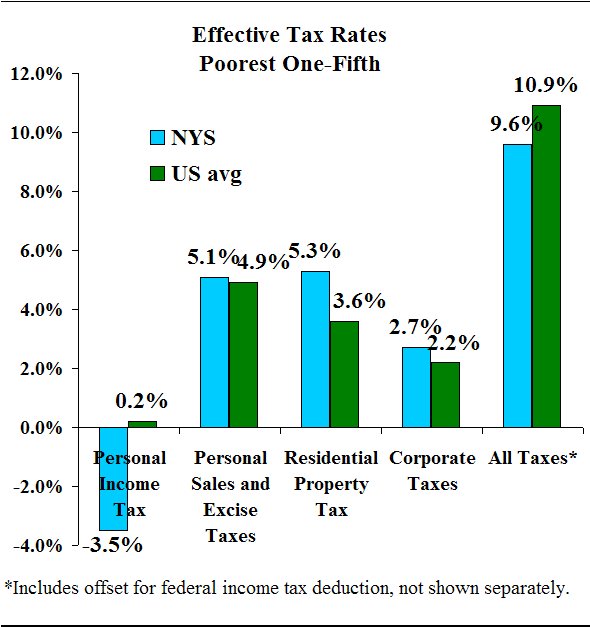

Low-Income New Yorkers

As shown below, the poorest fifth of New Yorkers pay 9.6 percent of their income for state and local taxes, lower than the national average of 10.9 percent and ranking 29th among the states. On average, New Yorkers whose family incomes fall in the lowest fifth do not pay any state and local personal income taxes. In fact, these households receive a refund equal to 3.5 percent of their income; in contrast, the average American in the poorest fifth pays 0.2 percent of income to state and local personal income taxes. The negative personal income tax liability in New York is largely due to the refundable Earned Income Tax Credit (EITC). A family earning less than $42,000 can receive a maximum State EITC of $1,447. Families in New York City are also eligible for a City EITC of up to $241. Starting in 2006, low- and middle-income families in New York can receive the Empire State Child Tax Credit (CTC), which provides a tax refund equal to $100 per child. Low-income New York City residents are also eligible for a child care credit of up to $1,733. According to the Center on Budget and Policy Priorities, New York is one of 24 states with a state EITC and one of 14 states in which the State EITC is large enough to provide families living in poverty with a cash refund from the state.

While New York's income taxes treat the poor relatively well, its property taxes consume a comparatively large chunk of income for the poorest residents. On average, New Yorkers in the poorest fifth pay 5.3 percent of income to property taxes, compared to 3.6 percent nationally. According to the Tax Foundation, New York is home to all 10 of the top 10 counties with the highest property taxes as a percent of home values. While only 25 percent of New Yorkers with less than $20,000 in annual income are home owners, the others pay property taxes indirectly through their monthly rent. The ITEP analysis assumes that renters bear the burden of 50 percent of the property taxes on the unit, with owners paying the other half.

Similar to other states, in New York sales taxes eat up about 5 percent of the income of the poorest residents. Another 2.7 percent of their income pays indirectly for taxes on business, including corporate income taxes and commercial property taxes. (See the Notes at end for the assumptions ITEP uses in allocating business taxes to households.)

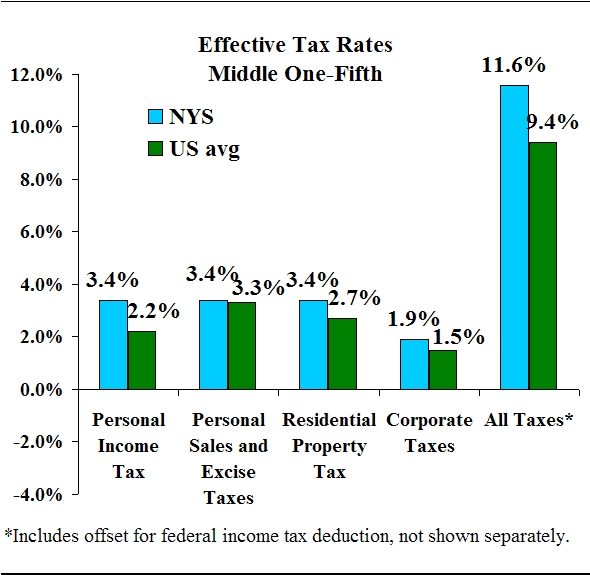

Middle-Income New Yorkers

Among all income groups, middle-income families in New York pay the highest state and local taxes as a share of their income. The middle quintile of New York families pay 11.6 percent of their income to state and local taxes, well above the national average of 9.4 percent and second only to Arkansas' 11.7 percent. While the New York State and City personal income tax systems are generous to the least well-off, income taxes rise quickly as residents move up the income scale. Excluding the temporary surcharge on wealthy New Yorkers, individual New York State taxpayers reach the top personal income tax rate at $20,000 of annual income. Individual New York City taxpayers reach the top personal income tax rate at $50,000 of annual income.

Personal sales and excise taxes and property taxes combined consume 6.8 percent of income for New Yorkers in the middle of the income scale, compared to 6.0 percent nationally. This group devotes another 1.9 percent of their income to corporate taxes.

High-Income New Yorkers

The top 1 percent of earners in New York, whose incomes exceed $633,000 annually, pay 7.2 percent of their income for state and local taxes, a higher share than the national average of 5.2 percent but proportionately much less than middle-income New Yorkers' 11.6 percent. The high rate compared to other jurisdictions is largely due to the personal income tax. The top 1 percent in New York pay 6.7 percent of their income to state and local personal income taxes; the national average for this group is 3.9 percent. For the 2009, 2010 and 2011 tax years, wealthy New Yorkers will contribute even more of their income to the personal income tax. The ITEP analysis does not include a temporary surcharge that will increase the top state tax rate for individual New Yorkers with taxable income greater than $200,000 and $500,000 to 7.85 percent and 8.97 percent, respectively. After 2011, the top rate will go back to its pre-2009 level of 6.85 percent.

For these New Yorkers, sales taxes, property taxes and corporate taxes consume a small share of income. Combined, these three categories of taxes amount to 2.7 percent of income for the wealthiest 1 percent in New York.

Conclusions

New York scores well on the ITEP's measure of tax progressivity, but it can do more to make the system more progressive throughout the range of household incomes. New York is already relatively successful in easing the burden for families with the least ability to pay, and New York already taxes its wealthy at a relatively high level. To complete the model of progressivity, New York needs to focus on lowering the tax burden on households with moderate incomes.

Notes on ITEP Methodology

The ITEP analysis is based on a model derived from a sample of about 365,000 federal tax returns and other data. The analysis assumes that the full incidence of personal income taxes, sales taxes and homeowner property taxes are borne by the individual. Business taxes on income, capital and property are allocated to households according to ownership of capital. This allocation is based on the geographic distribution of national capital income, assumptions for resident and non-resident ownership of capital, and tax return data on income from interest, dividends, capital gains and pensions. For detailed information, see: http://www.ctj.org/itep/model.htm.

The November 2009 ITEP report is based on 2007 income levels and 2007 tax law, updated to reflect permanent changes in law enacted through October 2009. The 2009 report does not include temporary changes that are currently in effect, such as the temporary tax surcharge on high-income earners in New York. The analysis excludes elderly taxpayers. The total tax rate for all taxes includes the net impact of the deduction for state and local taxes against federal income taxes.

ITEP's measure of progressivity (the Tax Inequality Index) equals 1 minus the average of the following ratios: the ratio of after-tax income to pre-tax income (ATI:PTI) for the top 20 percent to the ATI:PTI for the bottom 40 percent, the ATI:PTI for the top 1 percent to the ATI:PTI for the middle 60 percent, and the ATI:PTI for the top 1 percent to the ATI:PTI for the bottom 20 percent.

By Tammy Pels