NY Retirement Systems: Still Out of Line

Today, the U.S. Census Bureau released new figures on public retirement systems.[1] A quick look at the data underscores why New York’s pension system is costly, how it is out of line with others and why reform is needed.

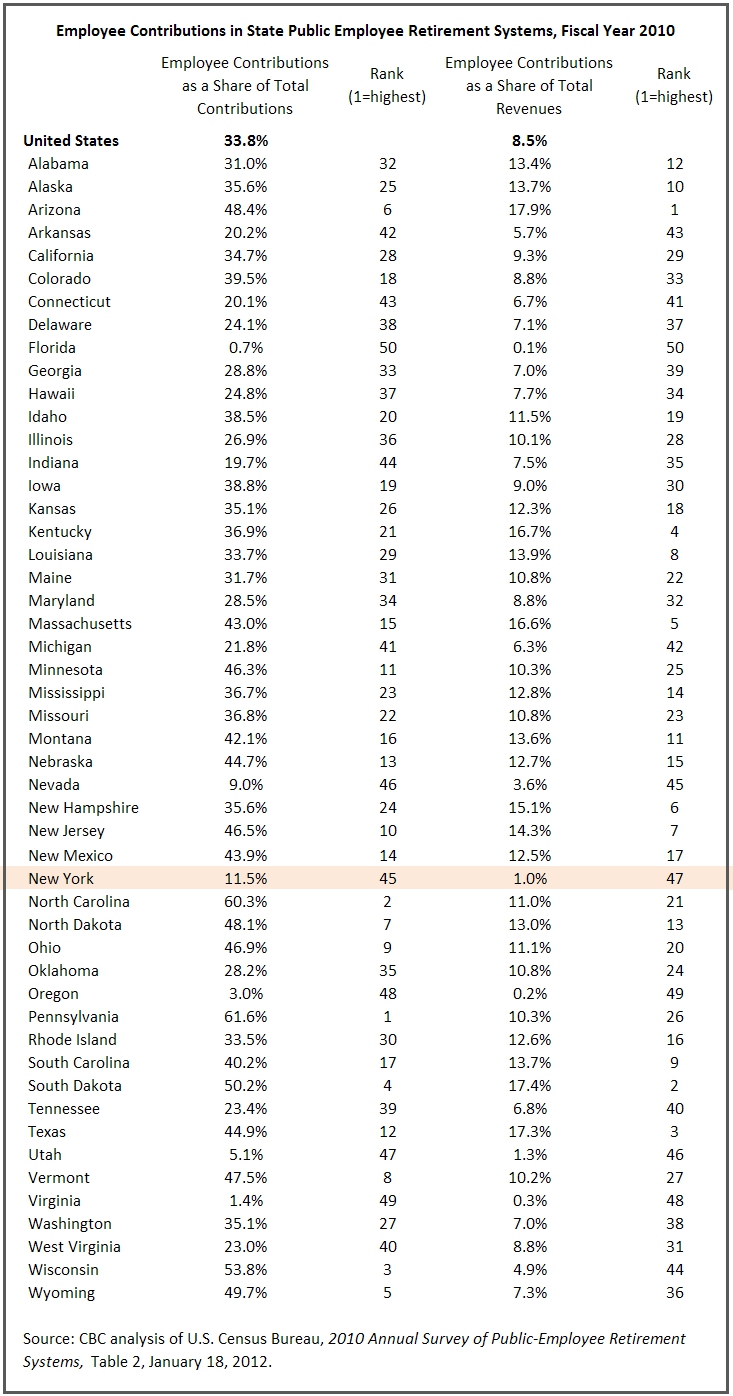

The data show that employee contributions make up 11.5 percent of combined employee and employer contributions to New York State’s pension systems – compared to a U.S. average of 33 percent. As a share of total revenues (contributions plus investment earnings) in 2010, public employee contributions comprised only 1 percent of all revenues to New York’s State’s pension systems. The U.S. average is 8.5 percent, with New York’s systems ranking 47th among states. The low rates of contribution mean that the State largely shoulders the cost of providing pensions, which has grown sharply over the last decade.[2]

The Governor has a proposal to modernize the system that would increase the contributions required of public employees, who would be required to contribute between 3 to 6 percent, rising according to salary, toward the cost of their pensions. The proposal also includes a “risk/reward” provision that would reduce employee contributions if investment earnings are flush and increase the required contributions if the level of contribution required by employers exceeds a certain rate. The change would bring New York’s revenues closer to that of other state pension systems and is an important part of the pension reform proposal.

Footnotes

- U.S. Census Bureau, 2010 Annual Survey of Public-Employee Retirement Systems, Table 2, January 18, 2012

- Citizens Budget Commission, “The First Priority in the New Year – Pension Reform,” January 2012.