School Districts Savings by Following State Practices for Employee Health Insurance

Governor Andrew Cuomo’s proposals to cap property taxes and reduce education aid mean that New York State’s 676 school districts will need to manage with fewer resources; their biggest challenge is to reduce spending without hurting services for the more than 2.7 million public school children. One way to help accomplish this is to change the way taxpayers and school employees share the cost of health insurance premiums.

School districts in New York State, including New York City, spent $4.7 billion on health insurance for employees and retirees in 2009.[1] These costs have been rising rapidly and will likely continue to do so; over the past decade expenditures for health insurance increased an average of 10 percent annually.[2] Negotiating increases in premium sharing with school employee unions would provide immediate savings and reduce future costs. Specifically, districts should bring their widely divergent premium-sharing policies into line with those established by New York State for its employees; they pay 10 percent of the premium for single policies and 25 percent for family policies.[3]

School Districts’ Current Premium Sharing Arrangements

The CBC staff constructed a database of health insurance premium sharing arrangements by examining teacher contracts for 2009-10 for 517 school districts. These contracts are made available online at SeeThroughNY, a project of The Empire Center for New York State Policy. The school districts are grouped into the ten regions established by the New York State Department of Labor — Capital; Western New York; Southern Tier; Central New York; North Country, Mid-Hudson; Finger Lakes, Mohawk Valley; Long Island; and New York City — to reflect regional labor markets. Teachers are typically the most numerous employees of a school district. The contracts often have separate premium sharing arrangements for newly hired (or non-tenured) teachers and for more senior teachers; often separate arrangements also exist for retired teachers.

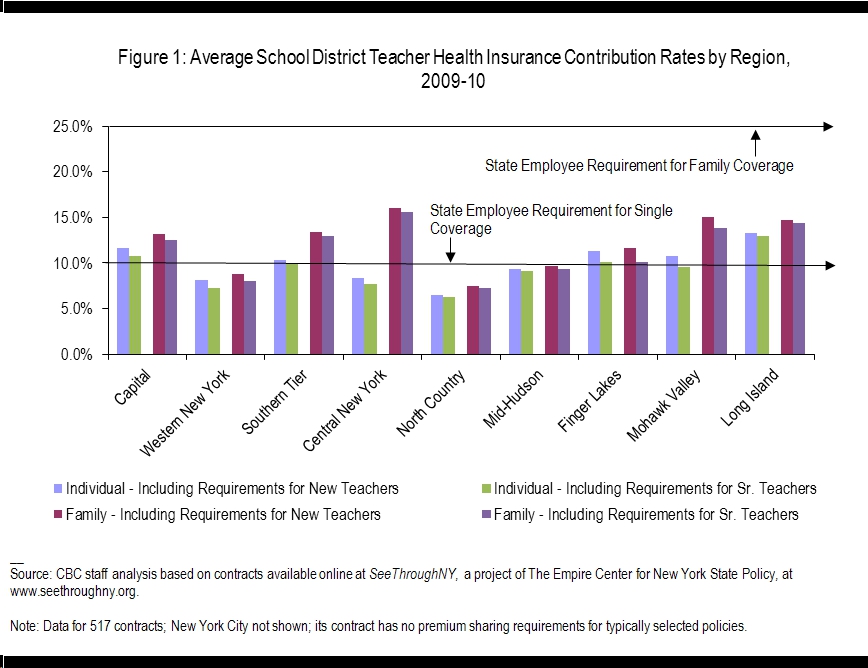

The premium sharing arrangements vary widely among regions and among districts within the same region. Districts in some regions on average have premium sharing requirements for single coverage that equal or exceed State employee requirements, but the school districts in all regions are on average well below State requirements for family coverage. (See Figure 1.)

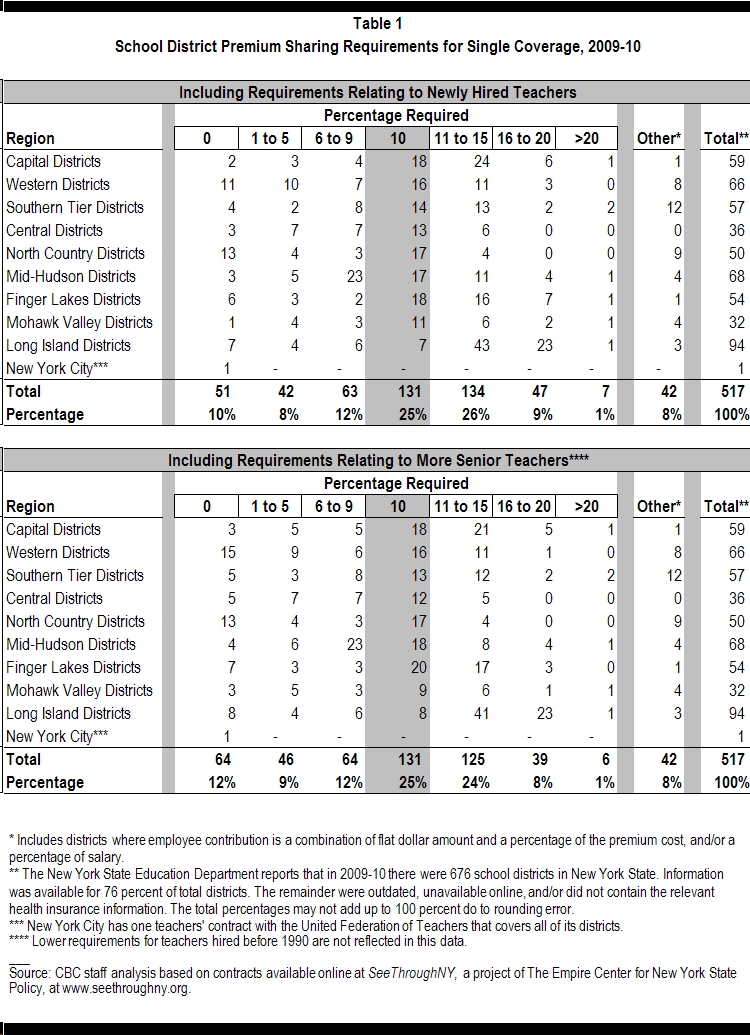

Statewide, for single coverage for the newly-hired teachers, 30 percent of districts are sharing less than 10 percent of the premium with teachers, 25 percent are sharing 10 percent, and the rest share more than 10 percent. (See Table 1.) Some districts have more favorable arrangements for more experienced senior teachers; including senior teachers increases the percent of districts that share less than 10 percent of premium costs for single policies from 30 to 33 percent. About 8 percent of districts have other types of arrangements such as fixed dollar or income-based requirements.

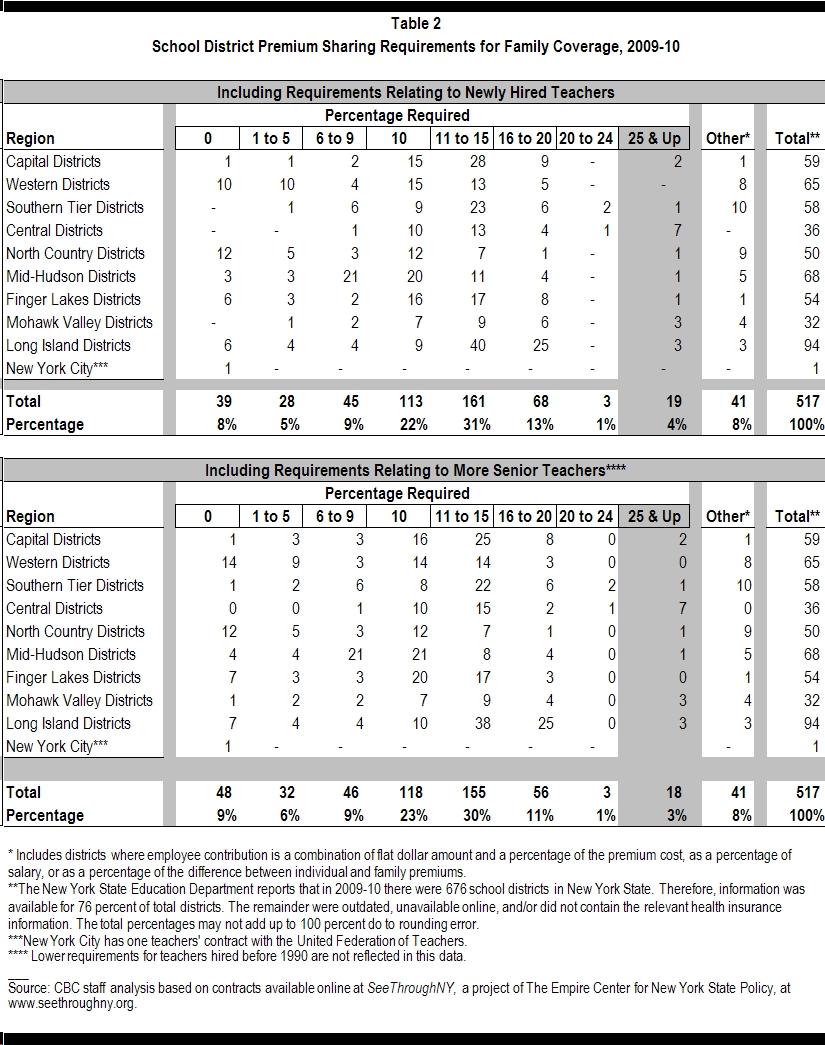

Statewide, the distribution among districts of premium sharing arrangements for family policies is similar to that for single policies. About 22 percent of districts share less than 10 percent, 22 percent require 10 percent, 45 percent require more than 10 percent, and 8 percent have other types of arrangements. (See Table 2.) However, the vast majority, 88 percent, of districts share a smaller percent of premium costs than the State’s 25 percent. Only 19, or 4 percent, of the 517 districts required premium sharing of 25 percent or more for family coverage.

About 50 districts have premium sharing arrangements for family policies that are more generous for senior teachers. The arrangements in these districts lower the extent of cost sharing among all districts. When those provisions are included in the analysis, 24 percent of districts overall require less than 10 percent premium sharing, compared to 22 percent of districts with this limited sharing for newer hires. A slightly higher percentage (89 versus 88) of all districts share less than the 25 percent required of State employees with more senior teachers’ contract provisions included.

Estimated Savings from New Premium Sharing Arrangements

If New York City and school districts across the State changed their health insurance premium sharing arrangements to match those of the State of New York and its employees, the annual savings would exceed $500 million annually including $310 million for the New York City Department of Education (DOE) and at least $220 million for school districts in the rest of the state. For New York City a reasonable estimate of the taxpayers’ annual health insurance premium costs for DOE employees under current arrangements is $1,083 million; retirees cost another $488 million.[4] If the City imposed cost-sharing arrangements for current workers parallel to those established by the State, then the estimated savings for current employees would be $214 million; a similar arrangement for retirees would save $96 million annually for a total of $310 million.[5]

For school districts in the rest of the state, the estimated savings for current employees from new premium sharing arrangements is between $221 million and $246 million annually.[6] Savings from new arrangements for retirees in these districts cannot be estimated accurately because data on current cost-sharing among this group was not collected as part of the CBC staff analysis of contracts. However, it is likely that current school district arrangements for retirees are more generous than the State’s current arrangements (which are the same as for current employees), and substantial additional savings likely are available to school districts by applying the State’s practice to retirees.

School districts in New York State are paying more for employee health insurance than other public sector employers because they are not sharing enough of the costs with their employees and retirees, particularly for family coverage. New York State government employees are required to pay 10 percent and 25 percent for single and family policies, respectively, and the standards are similar for other state and local government employees around the U.S. At this time of fiscal hardship and school aid cuts it is reasonable to seek the same cost sharing for school district employees and retirees as preferable to reducing public school services.

Footnotes

- Data from New York State Department of Education, Fiscal Analysis and Research Unit, School District Fiscal Profiles, school year 2008-09. http://www.oms.nysed.gov/faru/Profiles/profiles_cover.html.

- Ibid, school years 1998-99 to 2008-09.

- The State of New York’s requirements are close to the norm for state and local employees; nationally, state and local government workers pay an average of 11 percent of single policy premiums and 27 percent of family policy premiums according to U.S. Bureau of Labor Statistics, Economic Releases, “Medical plans: Share of premiums paid by employer and employee for family coverage,” National Compensation Survey, March 2010, Table 3 and Table 4, http://www.bls.gov/news.release/ebs2.nr0.htm (accessed December 21, 2010). Greater contributions are typically required of federal employees. The Federal Employee Health Program requires that 25 to 28 percent of the premium be paid for both single and family coverage. Federal data from U.S. Office of Personnel Management, “The 2011 Guide To Federal Benefits for Federal Civilian Employees,” November 2010, Appendix A, p. 29, http://www.opm.gov/insure/health/planinfo/2011/guides/70-1.pdf (accessed December 21, 2010).

- Estimated using unpublished data supplied by the New York City Office of Management and Budget for City fiscal year 2010. In that year, health insurance costs for active employees totaled $2,707 million and health insurance costs for retirees totaled $1,221 million. Also in that year pedagogical employees in the Department of Education accounted for 40 percent of full-time municipal employees. The 40 percent share was used to estimate the share of total health insurance costs for New York City teachers: $1,083 million for active employees and $488 million for retirees.

- New York City employees currently do not make any contributions toward the health insurance premiums for the most commonly selected plans. According to unpublished data from the New York City Office of Management and Budget approximately 35 percent are enrolled in individual plans and 65 percent have family plans. Based on these data and the current arrangements for State employees of 10 percent and 25 percent cost-sharing, a blended contribution rate of 19.75 percent was used to calculate savings from health insurance premium sharing for New York City teachers.

- According to the New York State Education Department districts outside New York City spent $3.4 billion on health insurance for school district employees and retirees in 2008-09. Using the average annual growth rate for school district health insurance costs from 2007-08 to 2008-09, or 6 percent, to estimate costs for 2009-10 results in a total estimated cost of $3.6 billion. (Data for 2007-08 and 2008-09 health insurance costs from New York State Department of Education, Fiscal Analysis and Research Unit, School District Fiscal Profiles, http://www.oms.nysed.gov/faru/Profiles/profiles_cover.html.) Applying the share of the members in the Teacher’s Retirement System that are active—two-thirds—results in the estimate for the health insurance cost for active employees of $2.4 billion. (Data for the share of active employees from New York State Teachers’ Retirement System, 2009 Comprehensive Annual Report, Fiscal Year Ended June 30, 2009, http://www.nystrs.org/main/library/AnnualReport/2009CAFR.pdf.) As described, each district shares the costs with employees through a variety of premium sharing arrangements. Regional averages were calculated using contract data (see source notes in Table 1) and weighted according to the New York State Insurance Program’s (NYSHIP) local government employee experience for single versus family enrollment. Based on unpublished data from the New York State Department of Civil Service, in NYSHIP 60 percent of local government participants subscribe to family coverage and 40 percent to single coverage resulting in a blended premium rate of 18.9 percent. Under current average premium sharing rates school district employees pay an estimated $295 million, or about 11 percent, of their health insurance costs. At the higher premium sharing rate of 18.9 percent, employees and retirees would pay about $515 million, an increase of $221 million. If the single/family enrollment experience for school districts is closer to New York City’s 19.8 percent due to heavier subscription in family coverage the new amount paid by employees increases to $540 million for an additional savings of $24 million.