The State and Local Pension Stretch

In contrast to the dubious fiscal practices in many areas of its budget, New York's pension system for public employees has been a bright spot. Among the 50 states, New York stands out for consistently setting aside adequate funds to make its employee pension systems fiscally sound. In contrast, many states fail to set aside sufficient funds, with the most egregious cases being California and Illinois, which each owe their employees' pension funds more than $50 billion.[1] Unfortunately, New York's political leaders are now seriously considering heading down the path blazed by California and Illinois; it is a slippery slope that should be avoided.

The temptation is easy to understand. The contribution required from taxpayers to support the pensions of New York State employees increases 85 percent from $1.7 billion in fiscal year 2010-11 to $3.2 billion in fiscal year 2013-14. A similar jump is projected in required taxpayer support for pensions of county, school district and other local government workers across the State. This explosive growth is likely to trigger local tax hikes and place increased pressure on an already troubled State budget.

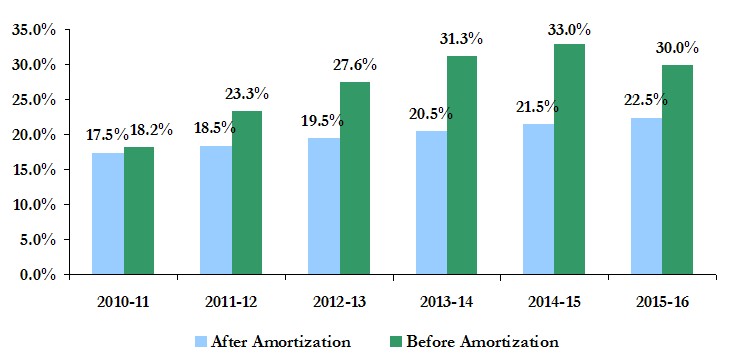

Rather than pay the full amount currently required, State leaders propose to "stretch" out the payments, providing less than needed for the six fiscal years from 2010-11 to 2015-16. Specifically, the stretch proposal would cap pension contributions at 9.5 percent of salaries for the New York State and Local Employees Retirement System (ERS) (see Figure 1) and 17.5 percent for the New York State and Local Police and Fire Retirement System (PFRS) in fiscal year 2010-11 (see Figure 2); after that, the caps would rise by 1 percentage point annually. The contributions required for the Police and Fire Retirement System are higher because the pension benefits for uniformed employees are considerably more costly. For example, in fiscal year 2013-14 the cap under the legislation would be set at 20.5 percent and expected pension contributions as a percent of salary is 31.3 percent. The unpaid amounts would be treated like a loan (that is, amortized) to be repaid over 10 years at an interest rate equivalent to the return on a fixed rate investment portfolio.

Like most fiscal gimmicks, this stretch proposal provides some budgetary savings in the short-term, but has high costs in the long run. It would lower the State's required pension fund contribution by $217 million in fiscal year 2010-11 and that reduction escalates to $856 in fiscal 2013-14. Over the six-year period the cumulative reductions in pension fund contributions are estimated to be $4.5 billion. However, these short-run "savings" are essentially a loan from the pension funds; the cost to repay this loan is an estimated $5.8 billion.[2] For local governments and school districts, who are given the same option as the State, long-term costs could be several billion more, depending on how many choose to participate. Additionally, under an assumed 8 percent annual rate of return on investments, the amortization plan will cost the State pension funds $1.5 billion in fewer total assets by fiscal year 2025-26.

This $5.8 billion could be just the beginning of a ballooning long-term cost from going down this slippery slope. This form of hidden debt has a tendency to grow, as Illinois and California demonstrate.

Figure 1: Current and Proposed Pension Contribution Requirements for the New York State and Local Employees Retirement System, Fiscal Years 2011-2016

(percent of salaries)

Source: New York State Division of Budget

Figure 2: Current and Proposed Pension Contribution Requirements for the New York State and Local Police and Fire Retirement System, Fiscal Years 2011-2016

(percent of salaries)

Source: New York State Division of Budget

Amazingly, at the same time State leaders are trying to provide short-term relief from required pension contributions, the Legislature continues its long-standing practice of adding "sweeteners" to public employee fringe benefits. An initial review of the legislation introduced this session reveals over 50 both-house bills that would enhance pension and health insurance benefits (not including 17 bills benefiting individuals). The CBC will be monitoring and reporting on the progress of such sweetener legislation with its annual scorecard to be released next week.

At a time when the State and local governments face daunting budget gaps, State leaders are proposing to add to future costs in two ways: by putting off current payments and by enriching benefits. Pushing costs onto future taxpayers is irresponsible. Efforts to please the labor unions with sweeteners should be foresworn and more aggressive plans to provide permanent, long run savings should be developed.

By Elizabeth Lynam

[1] The Public Fund Survey, 2008 Public Fund Survey, http://www.publicfundsurvey.org, accessed June 16, 2010.↑

[2] The estimated aggregate cost to "pay back" the deferred pension contributions is based on savings enumerated in the Governor's proposed financial plan. The savings grow from $217 million in fiscal year 2010-11 to $856 million in fiscal year 2013-14. The New York State Division of Budget estimates that the savings would be about $248 million in fiscal year 2015-16. The State would be required to begin paying off the deferred amount in the year following the deferral. The payments will be in equal amounts over ten years. All annual savings estimates are net of required repayments. The Governor's proposed legislation states that the interest rate would "approximate a market rate of return on taxable fixed rate securities with similar terms issued by comparable issuers." Based on this language, CBC assumes that the State would be charged a fixed interest rate of 5 percent. For further information, see New York State Division of the Budget, 2010-11 Executive Budget, Five-Year Financial Plan, January 19, 2010.↑