Late Addition

$1.6 billion in Capital Pork Served Up

Introduction

New York State’s fiscal year 2023 budget negotiations were extraordinary in several ways: the State entered negotiations with an unprecedented, multi-year budget balance; constantly rising tax receipts provided ample cash to accelerate spending growth; and negotiations passed the deadline, requiring an “extender” bill to make payroll. The additional cash and pressure to achieve a budget deal also resulted in the late addition of $1.6 billion for capital projects that were not included in the Executive’s or Legislative budget proposals. These were comprised of $920 million appropriated in a few lump sums and $656 million for specific projects.

These late additions and lump sums represent failures in budgeting, where over a billion dollars of public resources were allocated not based on rigorous analysis of needs and providing time for public consideration of the associated benefits, but seemingly based on political considerations. Late additions deny the public sufficient time to evaluate proposals. Lump sums provide broad and often unilateral spending authority to the Executive to choose any program it wants, perhaps within broad parameters, now or possibly for years to come. The practices overlay the State’s incomplete planning for its capital needs. The State should move to a holistic capital planning process for all capital projects spending that: identifies needs and project benefits, allocates funds to projects that meet the greatest needs and deliver value; reasonably specifies projects in appropriations; and provides transparency on the spending of previously appropriated lump sums.

Capital Pork: Enacted Budget Includes $1.6 Billion in Newly Identified Capital Funding

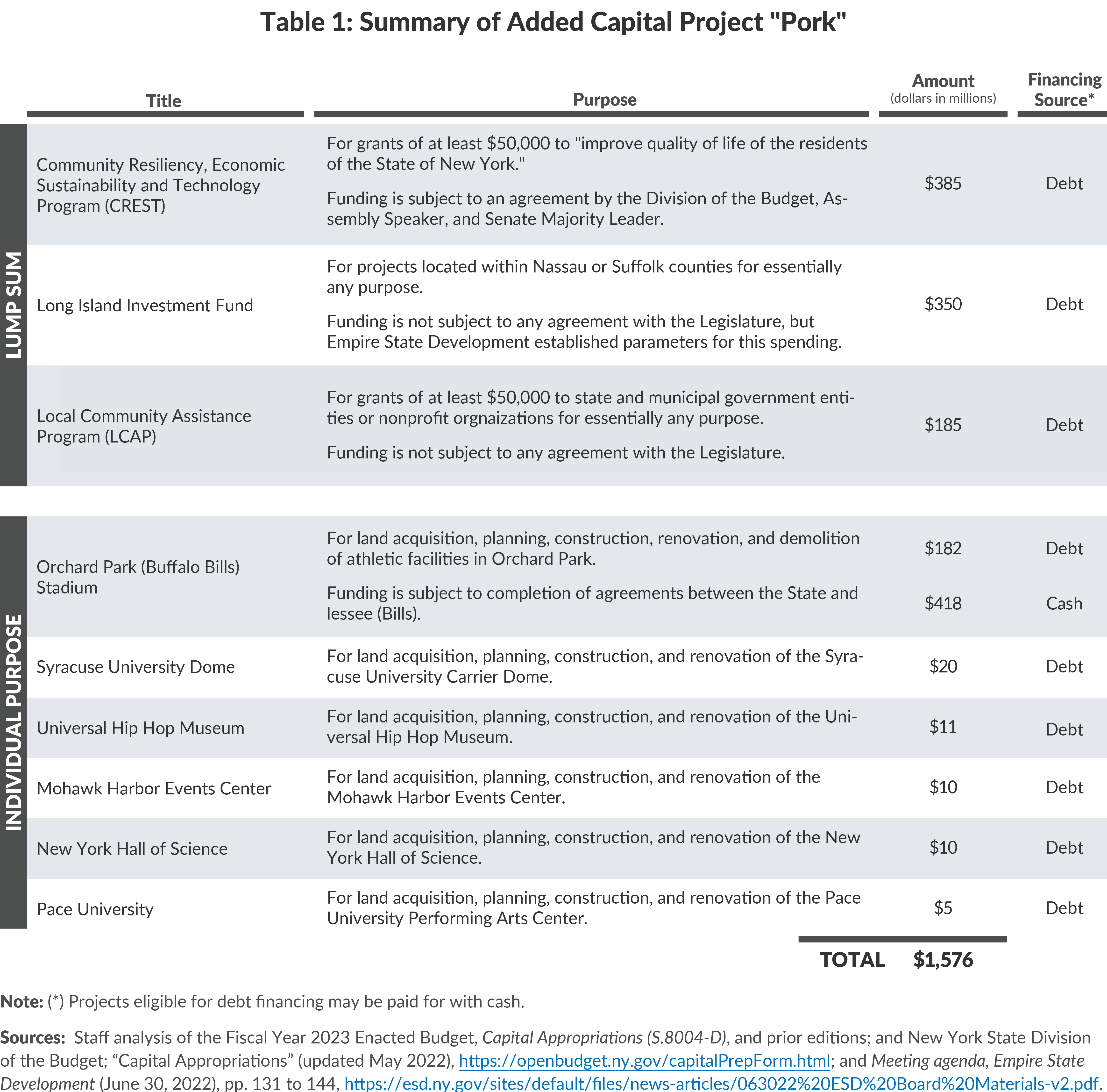

Fiscal year 2023 enacted budget bills and supporting documentation (released in May 2022) reveal that $1.6 billion of capital appropriations were added to the enacted budget. (See Table 1.) These were not appropriated in prior years’ budgets, nor included in the fiscal year 2023 budget proposals of the Governor, Senate, or Assembly. While not included in official documents, some, such as the Buffalo Bills Stadium and the Long Island Investment Fund, were discussed and reported on during negotiations.

Many of these capital projects are eligible to be financed with long-term bonds that provide cash up front and are repaid over many years, but could be financed on a pay-as-you-go (cash) basis. Only $418 million, 70 percent of the funding for the Buffalo Bills Stadium, will certainly be paid for with current money, reportedly with receipts from a settlement related to gaming proceeds.1

What’s Wrong with Capital Pork and Lump Sum Appropriations

Capital pork and lump sum appropriations are concerning for three reasons:

- Breakdown in Sound Budgeting. Budgeting should be conducted by identifying priorities and allocating available resources among them to maximize the value delivered to the public. The capital pork outlined above does not follow this process; its inclusion is not justified by rigorous evaluation of the State’s most urgent needs and maximum benefits. None of these capital appropriations were included in the three negotiators’ budget proposals. The last-minute nature of these adds—which will direct funding across the State without time and information to assess their efficacy—suggests that their inclusion is based on political considerations including geographic spreading, rather than capital prioritization.

- Lump Sum Appropriations Have Few Requirements and Transparency. The $920 million in lump sum adds will go to projects and purposes that primarily will be identified behind closed doors over the coming months and years. As such, they are ripe for political allocation rather than a distribution based on sound, holistic capital planning that addresses critical infrastructure needs. Furthermore, only the Community Resiliency, Economic Sustainability and Technology Program lump sum requires agreement between the Executive and Legislature. The Long Island Investment Fund and Local Community Assistance Program may now be spent unilaterally by the Executive. The Executive has taken some positive steps to provide greater transparency on capital grants and lump sum appropriations. Last year, the Division of the Budget’s (DOB’s) transparency plan, required by Governor Kathy Hochul, identified lump sum spending reporting as a goal.2 Since then, DOB has published a new database of spending from non-capital “Discretionary Lump Sums”, and maintains disclosures of lump sum capital spending by the Dormitory Authority of New York State (DASNY) and Empire State Development (ESD).3 These disclosures are retrospective, and outline the amount, date, and recipient of grants from existing lump sum pots.

- Projects are Supported by Long-Term Borrowing. As much as $1.2 billion of these projects may be financed through bonds, and will consume State debt capacity. This crowds out financing authority and diminishes the ability to finance future critical state of good repair capital projects. Given that the State is projecting to exhaust its available debt capacity by fiscal year 2027, assuming continued growth in personal income, these appropriations deserve a particularly critical review.4

Recommendations

The State should stop these misguided budgeting practices. Instead, to improve its capital planning and budgeting processes and allocate precious resources to New York’s greatest needs, the State should:

- Utilize a comprehensive capital planning process. A sound capital planning process follows five general steps of strategic planning, needs assessment, resource identification, plan development, and implementation. This process requires that the State prioritize critical projects and invest capital spending in maintenance of existing assets and necessary expansions or funding for new projects, and should be utilized for all capital spending. The capital budgeting status quo—including hundreds of millions of dollars added apparently for political expediency rather than rigorous planning—is wasteful.

- Stop using lump sum appropriations. Unfortunately, lump sum appropriations are playing an increasingly large role in the State budget and pose a fiscal risk for the State, as flagged by watchdogs and good government groups. In the case of capital spending, this analysis highlights three lump sum pots of capital funding that evince the same risk—ad hoc spending on just about any purpose with limited oversight or input outside the Executive branch. Going forward, the Governor and Legislature should not authorize these types of lump sum appropriations for capital projects or otherwise.

- Provide transparency on disbursements of existing lump sum pots. Billions of dollars in lump sum appropriations have already been authorized in the State budget, including the $920 million described above. The Executive should report details of spending from these appropriations, including the timing, amount, recipient, and purpose of awards from these pots. It is important that the Executive follow through on the commitment made last year to publicly report on lump sum and capital spending, especially those appropriations that never received public consideration during budget negotiations. The existing lump sum capital disclosures from DASNY and ESD–the entities which will finance and/or administer the funds–are likely to cover much of the spending from the $920 million pots over the coming months and years. This retrospective transparency is already a step forward. But all of the programs should also have clear criteria for their awards, and prospectively report on planned grants for new capital projects.

Conclusion

As part of the concluding stages of State budget negotiations, $1.6 billion in new capital spending was enacted that had not previously been proposed or rigorously evaluated. These authorizations are not sound budgeting; they are enacted without adequate consideration, often without appropriate detail, and some serve simply as a means to strike bargains that end budget negotiations. There is no assessment of whether they are the best use of limited public dollars, and they lack sufficient guardrails to maximize their positive impacts. Going forward, the State should improve capital planning and stop pork and lump sum spending.

Finally, these appropriations are opaque in the immediate wake of budget enactment. The necessary open data, financial plans, and capital programs are only released weeks after the budget is enacted. It is incumbent on the Executive to provide retrospective transparency on the use of these funds when they are spent, as promised just last year.

Download Blog

Late Addition: $1.6 billion in Capital Pork Served UpFootnotes

- See Jerry Zremski, “Hochul ties Seneca payment of nearly $565 million to Bills stadium deal,” The Buffalo News (March 29, 2022), https://buffalonews.com/news/local/hochul-ties-seneca-payment-of-nearly-565-million-to-bills-stadium-deal/article_b1b37682-af90-11ec-ba2e-6bc82b7dd0f0.html.

- See Executive Chamber of New York State, Executive Chamber Transparency Implementation Plan (November 2021), p. 2, www.governor.ny.gov/sites/default/files/2021-12/Executive_Chamber_Transparency_Plan.pdf?mc_cid=3dfaf66e5a&mc_eid=UNIQID; New York State Division of the Budget, Division of the Budget Transparency Plan (October 2021), p. 14, www.governor.ny.gov/sites/default/files/2021-10/Budget_TransparencyPlan.pdf?mc_cid=3dfaf66e5a&mc_eid=UNIQID ; and Reinvent Albany, Opening New York 2022: Rating 70 State Agency Transparency Plans (March 2022), https://reinventalbany.org/wp-content/uploads/2022/03/Opening-NY-2022_Rating-70-State-Agency-Transparency-Plans-March-2022.pdf?mc_cid=65587e94e2&mc_eid=UNIQID.

- See New York State Division of the Budget, “Discretionary Lump Sums” (accessed July 18, 2022), https://openbudget.ny.gov/discretionary.html.

- The State’s cap on outstanding debt is calculated based on growth in Statewide personal income. New York State Division of the Budget, FY 2023 Enacted Capital Program and Financing Plan (May 2022), p. 24, www.budget.ny.gov/pubs/archive/fy23/en/fy23en-cp.pdf.