Adopted Budget Continues Unequal Access to a Sound Basic Education

According to the New York State Education Department (NYSED) Foundation Aid formula, it will cost school districts in New York State approximately $62.6 billion to provide a sound basic education (SBE) to all students in school year 2020.1 In the aggregate, districts are on track to spend more than $70 billion; yet several districts still will not have enough funding to provide an SBE to their students.

The map below identifies 29 school districts that will not have sufficient funding to provide an SBE despite the last decade’s historic State aid increases and an enacted Fiscal Year 2020 Budget that increased total formula-based school aid $961 million. Collectively these 29 districts are underfunded by almost $83 million: If state aid remained flat the shortfall would have only been $23 million larger.2

How Does This Happen?

State aid increases have been significant but poorly targeted. The four wealthiest deciles will receive $4.0 billion of $27.3 billion in formula-based aid and $169 million of the nearly $1 billion growth in school year 2019-2020.

Foundation Aid is the largest component of State education aid—$18.4 billion of a total $27.3 billion in school year 2019-2020—and was created to ensure that all school districts have the resources to provide an SBE after accounting for local wealth and student need. However, the Foundation Aid formula uses outdated poverty measures and does not account adequately for actual local funding; as a result, it overestimates the need for state aid to wealthy districts and results in a warped distribution of aid increases.3 Over time these problems have been exacerbated by a prohibition against decreases—even in cases of declining enrollment—and an artificial limitation on aid growth regardless of change in enrollment or need. Districts that are shortchanged have struggled to catch up while “overfunded” districts continue to get more funding.4 The target amount needed to fund an SBE, which is used in the Foundation Aid formula, is calculated with some of the same limitations.

Other forms of school aid—Library, Textbook, and Software Aids—total $240 million annually and do not take account of district wealth, thereby increasing State aid without regard to ensuring an SBE. In fact, High Tax Aid specifically targets $223 million in additional State aid to wealthy districts.5

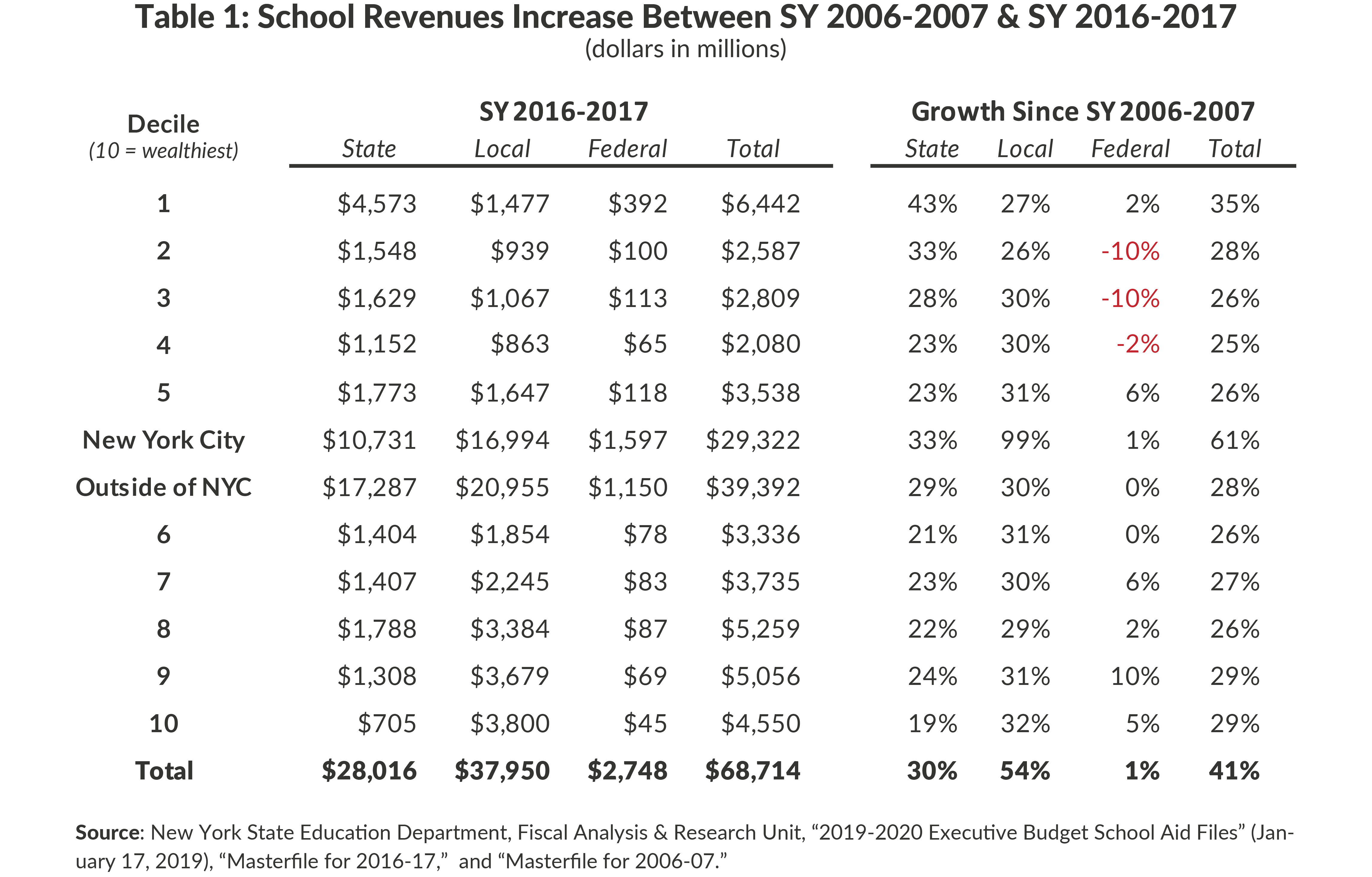

Education funding has grown significantly over the past decade. Between school year 2006-2007 and school year 2016-2017, school district revenues increased $20 billion, or 41 percent–twice the rate of inflation. State aid increased 30 percent, or $6.5 billion, and local funding increased 54 percent, or $13.3 billion. New York City local revenues increased 99 percent, while the local funding in the rest of the state increased 30 percent. State aid increases were concentrated in the lower-wealth districts, while local revenues increased somewhat evenly outside of New York City. Federal aid growth was more variable, but it represents a comparatively small share of school district revenues. (See Table 1 and the map above.)

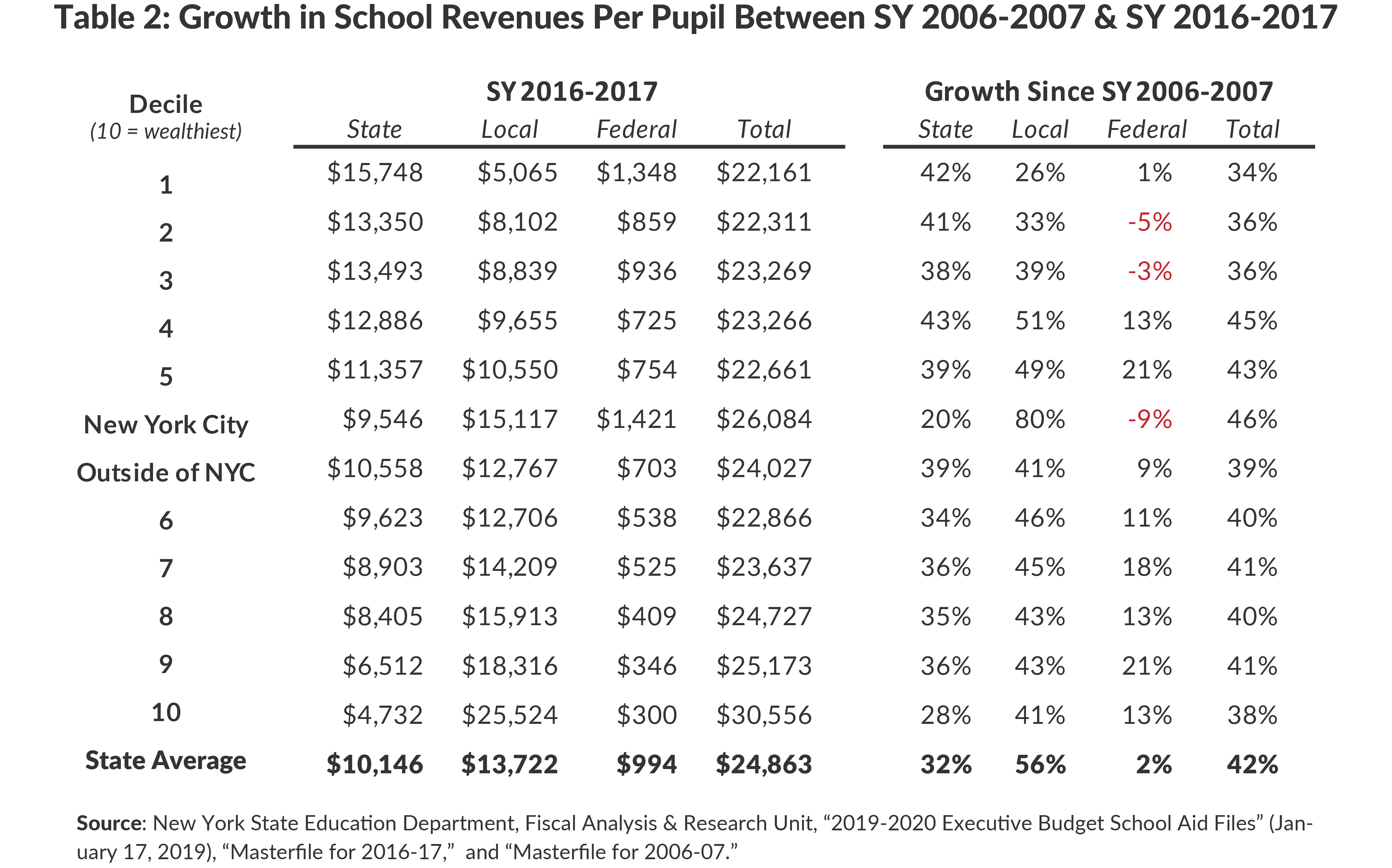

Districts have different per pupil and total revenue growth due to enrollment trends. Per pupil revenue in New York City increased 46 percent; due to enrollment growth, this is less than the 61 percent increase in total revenue. Throughout the rest of the state, aggregate declines in enrollment resulted in a per pupil revenue increase of 39 percent, more than the 28 percent increase in total revenue. Local and State funding increases also reflect this disparity. Per pupil State aid outside New York City increased 39 percent, and local revenues increased 41 percent. However, in New York City per pupil State aid increased 20 percent, which is equal to inflation, while local revenues increased 80 percent. (See Table 2 and the map above.)

Next Steps

Poorly targeted forms of school aid, including High Tax, Library, Textbok, and Software Aids, should be folded into a reformed Foundation Aid formula that uses current data—including actual local funding and student enrollment. The arbitrary floors, ceilings, phase-ins and add-ons to the Foundation Aid formula should be eliminated. Adopting these changes will increase aid to some districts while decreasing aid to others; however, until reforms are implemented, the State will continue failing to provide adequate resources to fund an SBE to thousands of students.

Addendum - Methodology

The Foundation Aid formula includes the cost of providing an SBE for all students in each district based on the successful schools model; this is known as the "Foundation Amount."[6] However, this model does not include all costs necessary for a school district to operate. Therefore, other costs (taken from school year 2016-2017 actuals) are added to the SBE costs to arrive at total costs of providing an SBE. The total costs of an SBE are compared to total revenues to determine if districts have sufficient resources to provide an SBE.

Costs for a sound basic education by district are determined by the addition of:

The Foundation Amount in school year 2019-2020 school aid runs and multiplied by number of Total Aidable Foundation Pupil Units (TAFPU); plus

All school district costs that are not for general education, special education, administration, and instructional support (core costs, salaries, and fringe benefits for each general area).[7] These costs were then increased by the State Fiscal Year Composite Consumer Price Index of New York as reported by the New York State Division of the Budget.[8]

Revenues available by district include:

Local revenues:

- For districts other than New York City, school year 2016-2017 local revenues increased by average property tax cap.

- Since New York City is not subject to the property tax cap, figure from The City of New York Executive Budget Fiscal Year 2019.

- Federal aid: Equal to school year 2016-2017 federal aid; assumes no change in federal revenues.

State aid:

- Subtracts State Enacted Budget school aid to arrive at current underfunding.

- Based on school year 2018-2019 formula-driven aid from school aid runs in base scenario to determine aid increase needed to fund SBE.

Remainder –if any–is the amount of underfunding per district in the coming fiscal year.

Footnotes

- David Friedfel, “Funding a Sound Basic Education in 2020,” Citizens Budget Commission Blog (March 7, 2019), https://cbcny.org/research/funding-sound-basic-education-2020.

- The cost of a sound basic education is generated from the 2019-2020 adopted budget school aid run, which calculates how much is needed to provide a sound basic education for every school district in the state as part of the Foundation Aid formula. The shortfall figures differ slightly from previous calculations provided in David Friedfel, “Funding a Sound Basic Education in 2020,” Citizens Budget Commission Blog (March 7, 2019), https://cbcny.org/research/funding-sound-basic-education-2020. The amounts provided in this analysis were calculated using information from NYSED in response to a freedom of information law request. Specifically, NYSED provided the successful school general education calculation methodology and fiscal supplement methodology.

- There are 165 districts that collected enough revenues from just local sources to fund an SBE. However, these districts will still receive $2.68 billion of State aid in school year 2019-2020. These districts are identified in the map labeled SBE.

- David Friedfel, A Better Foundation Aid Formula (Citizens Budget Commission, December 12, 2016), https://cbcny.org/research/better-foundation-aid-formula.

- David Friedfel, “Ripe for Reform,” Citizens Budget Commission Blog (January 2, 2018), https://cbcny.org/research/ripe-reform.

- New York State Education Department, “Update to the Successful Schools Study” (2012), http://www.oms.nysed.gov/faru/articles.html

- New York State Education Department, “Annual Finance Report (Form ST-3) for New York State Public Schools , ST-3 Data for Year Ending June, 2017” (accessed April 2019), https://stateaid.nysed.gov/st3/st3data.htm, and “Fiscal Supplement Methodology with Account Codes” provided on March 7, 2019 in response to a freedom of information law request.

- New York State Division of the Budget, FY 2020 Economic and Revenue Report (January 2019), p. 143, www.budget.ny.gov/pubs/archive/fy20/exec/ero/fy20ero.pdf.